Abstract

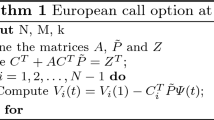

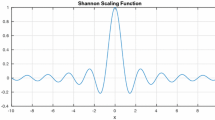

We present a robust and highly efficient dimension reduction Shannon-wavelet method for computing European option prices and hedging parameters under a general jump-diffusion model with square-root stochastic variance and multi-factor Gaussian interest rates. Within a dimension reduction framework, the option price can be expressed as a two-dimensional integral that involves only (i) the value of the variance at the terminal time, and (ii) the time-integrated variance process conditional on this value. A Shannon wavelet inverse Fourier technique is developed to approximate the conditional density of the time-integrated variance process. Furthermore, thanks to the excellent approximation properties of Shannon wavelets, the overall pricing procedure is reduced to the evaluation of just a single integral that involves only the density of the terminal variance value. This single integral can be accurately evaluated, since the density of the variance at the terminal time is known in closed-form. We develop sharp approximation error bounds for the option price and hedging parameters. Numerical experiments confirm the robustness and impressive efficiency of the method.

Similar content being viewed by others

Notes

A stochastic factor is usually understood as a source of randomness which is typically modelled by a Brownian motion.

Having a non-trivial correlation between the underlying asset price and its variance is important for capturing the skewness in the underlying asset price.

References

Ahlip, R., Rutkowski, M.: Pricing of foreign exchange options under the Heston stochastic volatility model and CIR interest rates. Quant. Finance 13, 955–966 (2013)

Alizadeh, S., Brandt, M., Diebold, F.: Range-based estimation of stochastic volatility models. J. Finance 57, 1047–1091 (2002)

Andersen, L., Piterbarg, V.: Moment explosions in stochastic volatility models. Finance Stoch 11, 29–50 (2007)

Andersen, T.G., Benzoni, L., Lund, J.: An empirical investigation of continuous-time equity return models. J. Finance 57, 1239–1284 (2002)

Bakshi, G., Cao, C., Zhiwu, C.: Empirical performance of alternativee option pricing models. J. Finance 52, 2003–2049 (1997)

Bates, D.: Jumps and stochastic volatility: exchange rate process implicit in Deutsche Mark options. Rev. Financ. Stud. 9(1), 69–107 (1996)

Berthe, E., Dang, D.M., Ortiz-Gracia, L.: A Shannon wavelet method for pricing foreign exchange options under the Heston multi-factor CIR model. Working paper, School of Mathematics and Physics, University of Queensland (2017)

Brigo, D., Mercurio, F.: Interest Rate Models—Theory and Practice, 2nd edn. Springer, Berlin (2006)

Broadie, M., Kaya, O.: Exact simulation of stochastic volatility and other affine jump difusion processes. Oper. Res. 54, 217–231 (2006)

Cattani, C.: Shannon wavelets theory. Mathe. Probl. Eng. Article ID 164808 (2008)

Cont, R., Tankov, P.: Financial Modelling with Jump Processes. Chapman and Hall, London (2004)

Cox, J., Ingersoll, J., Ross, S.: A theory of the term structure of interest rates. Econometrica 53, 385–407 (1985a)

Cox, J.C., Ingersoll, J.E., Ross, S.A.: A theory of the term structure of interest rates. Econometrica 53, 385–407 (1985b)

Cozma, A., Reisinger, C.: A mixed Monte Carlo and PDE variance reduction method for foreign exchange options under the Heston-CIR model. J. Comput. Finance 20, 109–149 (2017)

Dang, D.M.: A multi-level dimension reduction Monte-Carlo method for jump-diffusion models. J. Comput. Appl. Math. 324, 49–71 (2017)

Dang, D.M., Christara, C., Jackson, K.: GPU pricing of exotic cross-currency interest rate derivatives with a foreign exchange volatility skew model. J. Concurr. Comput. Pract. Exp. 26, 1609–1625 (2014)

Dang, D.M., Christara, C., Jackson, K., Lakhany, A.: An efficient numerical PDE approach for pricing foreign exchange interest rate hybrid derivatives. J. Comput. Finance 18(4), 1–55 (2015a)

Dang, D.M., Jackson, K.R., Mohammadi, M.: Dimension and variance reduction for Monte-Carlo methods for high-dimensional models in finance. Appl. Math. Finance 22(6), 522–552 (2015)

Dang, D.M., Jackson, K.R., Sues, S.: A dimension and variance reduction Monte-Carlo method for option pricing under jump-diffusion models. Appl. Math. Finance 24(3), 175–215 (2017). doi:10.1080/1350486X.2017.1358646

Delbaen, F., Schachermayer, W.: A general version of the fundamental theorem of asset pricing. Math. Ann. 300, 463–520 (1994)

Duffie, D., Pan, J., Singleton, K.: Transform analysis and asset pricing for affine jump-diffusions. Econometrica 68, 1343–1376 (2000)

Fang, F., Oosterlee, C.W.: A novel pricing method for European options based on Fourier-Cosine series expansions. SIAM J. Sci. Comput. 31, 826–848 (2008)

Fang, F., Oosterlee, C.W.: A Fourier-based valuation method for Bermudan and barrier options under Heston’s model. SIAM J. Financ. Math. 2, 439–463 (2011)

Gatheral, J.: The Volatility Surface: A Practitioner\(^{\prime }\)s Guide. Wiley Finance, New York (2006)

Gearhart, W.B., Shultz, H.S.: The function \(\sin (x)/x\). Coll. Math. J. 21, 90–99 (1990)

Giles, M.B.: Multi-level Monte Carlo path simulation. Oper. Res. 56, 607–617 (2008)

Grzelak, L.A., Oosterlee, C.W.: The affine Heston model with correlated Gaussian interest rates for pricing hybrid derivatives. Quant. Finance 11, 1647–1663 (2011)

Grzelak, L.A., Oosterlee, C.W.: On cross-currency models with stochastic volatility and correlated interest rates. Appl. Math. Finance 19, 1–35 (2012)

Grzelak, L.A., Oosterlee, C.W.: On the Heston model with stochastic interest rates. SIAM J. Fianan. Math. 2, 255–286 (2012)

Haastrecht, A.V., Lord, R., Pelsseri, A., Schrager, D.: Generic pricing of FX, inflation and stock options under stochastic interest rates and stochastic. Insur. Math. Econ. 45, 436–448 (2009)

Haastrecht, A.V., Pelsser, A.: Generic pricing of FX, inflation and stock options under stochastic interest rates and stochastic volatility. Quant. Finance 11, 665–691 (2011)

Haentjens, T., In’t Hout, K.J.: Alternating direction implicit finite difference schemes for the Heston-Hull-White partial differential equation. J. Comput. Finance 16(1), 83–110 (2012)

Heston, S.: A closed form solution for options with stochastic volatility with applications to bond and currency options. Rev. Finan. Stud. 6, 327–343 (1993)

Hull, J., White, A.: One factor interest rate models and the valuation of interest rate derivative securities. J. Financ. Quant. Anal. 28(2), 235–254 (1993)

Jamshidian, F., Zhu, Y.: Scenario simulation: theory and methodology. Finance Stoch. 13, 4367 (1997)

Kou, S.G.: A jump diffusion model for option pricing. Manag. Sci. 48, 1086–1101 (2002)

Maree, S.C., Ortiz-Gracia, L., Oosterlee, C.W.: Pricing early-exercise and discrete barrier options by Shannon wavelet expansions. Numer. Math. 136 (4), 1035–1070 (2017)

Merton, R.: Option pricing when underlying stock returns are discontinuous. J. Financ. Econ. 3, 125–144 (1976)

Neuenkirch, A., Szpruch, L.: First order strong approximations of scalar SDEs with values in a domain. Numer. Math. 128, 103–136 (2014)

Ortiz-Gracia, L., Oosterlee, C.W.: A highly efficient Shannon wavelet inverse Fourier technique for pricing European options. SIAM J. Sci. Comput. 38(1), B118–B143 (2016)

Pillay, E., O’Hara, J.: FFT based option pricing under a mean reverting process with stochastic volatility and jumps. J. Comput. Appl. Math. 235, 3378–3384 (2011)

Piterbarg, V.: Smiling hybrids. Risk Mag. 19(5), 66–70 (2006)

Rebonato, R.: Interest Rate Option Models, 2nd edn. Wiley, New York (1998)

Sippel, J., Ohkoshi, S.: All power to PRDC notes. Risk Mag. 15(11), 1–3 (2002)

Stenger, F.: Handbook of Sinc Numerical Methods. CRC Press, Boca Raton (2011)

Zhang, S., Wang, L.: Fast Fourier transform option pricing with stochastic interest rate, stochastic volatility and double jumps. Appl. Math. Comput. 219, 10928–10933 (2013)

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported in part by a University of Queensland Early Career Researcher (ECR) Grant (Grant No. 1006301-01-298-21-609775), and by the Agència de Gestió i d’Ajuts Universitaris i de Recerca (Grant No. 2014SGR-1307).

Rights and permissions

About this article

Cite this article

Dang, DM., Ortiz-Gracia, L. A Dimension Reduction Shannon-Wavelet Based Method for Option Pricing. J Sci Comput 75, 733–761 (2018). https://doi.org/10.1007/s10915-017-0556-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10915-017-0556-y