Abstract

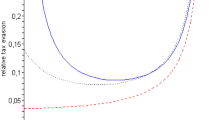

This paper studies optimal taxation in a Dixit–Stiglitz model of monopolistic competition. In this setting, taxes may be used as an instrument to offset distortions caused by producer markups. Since markups tend to be higher in industries where firms face less elastic demand, tax rates will be pushed lower in these industries. This tends to work against the familiar inverse elasticities intuition associated with the Ramsey tax rule. However, a key feature of the model is that the Ramsey rule responds to the industry demand curve (Chamberlin’s DD) while the monopolistic markup is a response to the demand curve faced by firms (Chamberlin’s dd). Hence, the elasticities of both these curves influence the optimal tax rate, but in opposite directions.

Similar content being viewed by others

References

Auerbach, A. J., & Hines, J. R. Jr. (2002). Taxation and economic efficiency. In A. J. Auerbach & M. Feldstein (Eds.), Handbook of public economics (Vol. 3). Amsterdam: Elsevier. Chap. 21.

Besley, T., & Jewitt, I. (1995). Uniform taxation and consumer preferences. Journal of Public Economics, 58, 73–84.

Deaton, A. (1979). The distance function in consumer behaviour with applications to index numbers and optimal taxation. Review of Economic Studies, 46, 391–405.

Deaton, A., & Muellbauer, J. (1980). Economics and consumer behavior. Cambridge: Cambridge University Press.

Dixit, A. K., & Stiglitz, J. E. (1977). Monopolistic competition and optimum product diversity. The American Economic Review, 67, 297–308.

Myles, G. D. (1989). Ramsey tax rules for economies with imperfect competition. Journal of Public Economics, 38, 95–115.

Myles, G. D. (1995). Public economics. Cambridge: Cambridge University Press.

Samuelson, P. A. (1986). Theory of optimal taxation. Journal of Public Economics, 30, 137–143.

Spence, A. M. (1976). Product selection, fixed costs, and monopolistic competition. Review of Economic Studies, 43, 217–235.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Reinhorn, L.J. Optimal taxation with monopolistic competition. Int Tax Public Finance 19, 216–236 (2012). https://doi.org/10.1007/s10797-011-9182-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-011-9182-z