Abstract

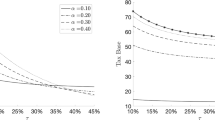

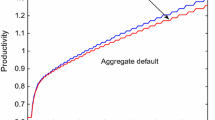

This paper uses a dynamic general equilibrium model to study the economic effects of bank account debits (BAD) taxation. Australia and various Latin American countries have levied or levy BAD taxes. Aspects such as financial disintermediation, market illiquidity, and impacts on dividend and interest rates are considered. Part of the BAD tax revenue may be fictitious, due to increased interest payments on government debt. The Brazilian BAD tax (CPMF) experience is evaluated. The empirical analysis confirms some theoretical predictions. Incidence base over GDP appears to be sensitive to the tax rate, possibly engendering a Laffer curve. The tax may also cause real interest rates to increase. Furthermore, the deadweight losses are relatively large, even if revenues are small. The theoretical and empirical results suggest that the BAD tax is not adequate for revenue collection.

Similar content being viewed by others

References

Albuquerque, P. H. (2002). Os Impactos Econômicos da CPMF: Teoria e Evidência, in Finanças Públicas: VI Prêmio Tesouro Nacional—2001. Brasília: STN.

Albuquerque, P. H., & Gouvea, S. (2005). Canaries and Vultures: A Quantitative History of Monetary Mismanagement in Brazil. Mimeo, Texas A&M International University, Laredo.

Banerjee, A., Lumsdaine, R. L., & Stock, J. H. (1992). Recursive and Sequential Tests of the Unit-Root and Trend-Break Hypotheses: Theory and International Evidence. Journal of Business & Economic Statistics, 10, 271–287.

Coelho, I., Ebrill, L. and Summers, V. (2001). Bank Debit Taxes in Latin America: An Analysis of Recent Trends. IMF Working Paper 01/67.

Colabella, P. R., & Coppinger, R. J. (1999). The Withdrawals Tax, St. John's University Global Institute for Taxation Papers. Jamaica, NY: St. John's University.

Diamond, P. A., & Mirrlees, J. A. (1971). Optimal Taxation and Public Production I: Production Efficiency. American Economic Review, 61, 8–27.

Eichengreen, B., Tobin, J., & Wyplosz, C. (1995). Two Cases for Sand in the Wheels of International Finance. Economic Journal, 105, 162–172.

Feige, E. L. (2000). Taxation for the 21st Century: The Automated Payment Transaction (APT) Tax. Economic Policy, 31, 473–511.

Frankel, J. A. (1996). How Well Do Foreign Exchange Markets Function: Might a Tobin Tax Help? In M. ul Haq, I. Kaul, and I. Grunberg (Eds.), The Tobin tax: Coping with Financial Volatility (pp. 41–81). Oxford: Oxford, University Press.

Garber, P., & Taylor, M.P. (1995). Sand in the Wheels of Foreign Exchange Markets: A Sceptical Note. Economic Journal, 105, 173–180.

Habermeier, K., & Kirilenko, A. (2003). Securities Transaction Taxes and Financial Markets. In P. Honohan (Ed.), Taxation of Financial Intermediation: Theory and Practice for Emerging Economies (pp. 325–343). Oxford: Oxford University Press.

Hakkio, C. S. (1994). Should We Throw Sand in the Gears of Financial Markets? Federal Reserve Bank of Kansas City Economic Review, 79, 17–30.

Jones, C. M., & Seguin, P. J. (1997). Transaction Costs and Price Volatility: Evidence from Commission Deregulation. American Economic Review, 87, 728–737.

Kirilenko, A., & Perry, V. (2004). On the Financial Disintermediation of Bank Transaction Taxes. Mimeo, International Monetary Fund, Washington.

Keynes, J. M. (1936). The General Theory of Employment, Interest, and Money. Cambridge: Cambridge University Press.

Lastrapes, W. D., & Selgin, G. (1997). The Check Tax: Fiscal Folly and the Great Monetary Contraction, Journal of Economic History, 57, 859–878.

Schwert, G. W. (1989). Tests for Unit Roots: A Monte Carlo Investigation. Journal of Business & Economic Statistics, 7, 147–159.

Shome, P., & Stotsky, J. G. (1995). Financial transactions Taxes. IMF Working Paper 95/77.

Stiglitz, J. E. (1989). Using Tax Policy to Curb Speculative Short-Term Trading. Journal of Financial Services Research, 3, 101–115.

Summers, L. H., & Summers, V. P. (1989). When Financial Markets Work Too Well: A Cautious Case for a Securities Transaction Tax. Journal of Financial Services Research, 3, 261–286.

Tanzi, V. (2003). Taxation Reform in Latin America in the Last Decade. In J. A. González (Ed.), Latin American macroeconomic reforms: The second stage (pp. 327–355), Chicago: University of Chicago Press.

Tobin, J. (1978). A Proposal for International Monetary Reform. Eastern Economic Journal, 4, 153–159.

Umlauf, S. R. (1993). Transaction Taxes and the Behavior of the Swedish Stock Market. Journal of Financial Economics, 33, 227–240.

West, K. D. (1990). The Sources of Fluctuations in Aggregate Inventories and GNP. The Quarterly Journal of Economics, 105, 939–971.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Code E62 · H20

Rights and permissions

About this article

Cite this article

Albuquerque, P.H. BAD taxation: Disintermediation and illiquidity in a bank account debits tax model. Int Tax Public Finan 13, 601–624 (2006). https://doi.org/10.1007/s10797-006-6004-9

Issue Date:

DOI: https://doi.org/10.1007/s10797-006-6004-9