Abstract

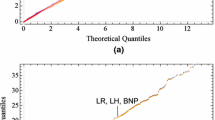

We examine the asymptotic behavior of the number of vertices of the convex hull spanned by n consecutive pairs from a time series model. We consider data from three models, the moving average (MA) process with regularly varying noise, the stochastic volatility (SV) process with regularly varying noise and the GARCH process. The latter two processes are commonly used for modeling returns of financial assets. If \(N_n\) denotes the number of vertices of the convex hull of n consecutive pairs of observations, we show that for a SV model, \(N_n \stackrel {P}{\rightarrow } 4 \) as \(n \rightarrow \infty\), whereas for a GARCH model, \(N_n \geq 5\) with positive probability. This provides another measure that distinguishes the behavior of the extremes for SV and GARCH models. Geometrically the extreme GARCH pairs fall in butterfly-like shapes away from the axes, while the SV pairs suitably scaled drift towards the coordinate axes with increasing n. MA pairs show a similar flavor as the SV pairs except that their convex hull vertices produce segments of extreme pairs that no longer align themselves exclusively along the axes, but are also distributed along other directions, determined solely by the MA coefficients. We show that the non-degenerate limiting distribution of \( N_n \) as \(n \rightarrow \infty \) depends on the model parameters and limiting law of the ratio of the maximal and minimal observations.

Similar content being viewed by others

References

Aldous, D.J., Fristedt, J., Griffin, P.S., Pruitt, W.E.: The number of extreme points in the convex hull of a random sample. J. Appl. Prob. 28, 287–304 (1991)

Basrak, B., Davis, R.A., Mikosch, T.: A characterization of multivariate regular variation. Ann. Appl. Probab. 3, 908–920 (2002a)

Basrak, B., Davis, R.A., Mikosch, T.: Regular variation of GARCH processes. Stoch. Proc. Appl. 99, 95–115 (2002b)

Bollerslev, T.: Generalized autoregressive conditional heteroskedasticity. J. Econom. 31, 307–327 (1986)

Bougerol, P., Picard, N.: Stationarity of GARCH processes and of some nonnegative time series. J. Econom. 52, 115–127 (1992)

Breiman, L.: On some limit theorems similar to the arc-sin law. Theory Probab. Appl. 10, 323–331 (1965)

Carnal, H.: Die konvexe Hülle von n rotationssymmetrisch verteilten Punkten. Z. Wahrscheinlichkeitsth. 15, 168–176 (1970)

Davis, R.A., Mikosch, T.: The sample autocorrelations of heavy-tailed processes with applications to ARCH. Ann. Statist. 26, 2049–2080 (1998)

Davis, R.A., Mikosch, T.: Point process convergence of stochastic volatility processes with application to sample autocorrelation. Probability, statistics and seismology. J. Appl. Probab. 38, 93–104 (2001)

Davis, R.A., Mikosch, T.: Extreme value theory for GARCH processes. In: Andersen, T.G., Davis, R.A., Kreiss, J.-P., Mikosch, T. (eds.) Handbook of Financial Time Series, pp. 187–200. Springer, New York (2009)

Davis, R.A., Mulrow, E., Resnick, S.I.: Almost sure limit sets of random samples in \( \textbf{R}^d\). Adv. Appl. Probab. 20, 573–599 (1988)

Engle, R.F.: Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50, 987–1007 (1982)

Resnick, S.I.: Heavy-Tail Phenomena Probabilistic and Statistical Modeling. Springer Verlag, New York (2007)

Author information

Authors and Affiliations

Corresponding author

Additional information

This research is partially supported by NSF grant DMS-1107031.

Rights and permissions

About this article

Cite this article

Davis, R.A., Hueter, I. The convex hull of consecutive pairs of observations from some time series models. Extremes 16, 487–505 (2013). https://doi.org/10.1007/s10687-013-0169-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10687-013-0169-2