Abstract

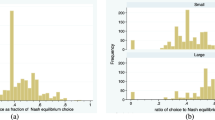

Both mainstream economics and its critics have focused on models of individual rational agents even though most important decisions are made by small groups. Little systematic work has been done to study the behavior of small groups as decision-making agents in markets and other strategic games. This may limit the relevance of both economics and its critics to the objective of developing an understanding of how most important decisions are made. In order to gain some insight into this issue, this paper compares group and individual economic behavior. The objective of the research is to learn whether there are systematic differences between decisions made by groups and individual agents in market environments characterized by risky outcomes. A quantitative measure of deviation from minimally-rational decisions is used to compare group and individual behavior in common value auctions.

Similar content being viewed by others

References

Alderson, M. J., & Betker, B. L. (1999). Assessing Postbankruptcy Performance: an Analysis of Reorganized Firms’ Cash Flows. Financial Management, 28(2), 68–82

Bazerman, M., & Samuelson, W. (1983a). The winner’s curse: an Empirical Investigation. In Reinhard Tietz (Ed.), Aspiration-Oriented Decision Making

Bazerman, M., & Samuelson, W. (1983b). I Won the Auction But Don’t Want the Prize. Journal of Conflict Resolution, 27, 618–634

Blinder, A. S., & Morgan, J. (2005). Are Two Heads Better than One? An Experimental Analysis of Group vs. Individual Decision Making. Journal of Money Credit and Banking, 37, 789–811

Bornstein, G. (1992). The Free Rider Problem in Intergroup Conflicts Over Step-level and Continuous Public Goods. Journal of Personality and Social Psychology, 62, 597–606

Bornstein, G., & Yaniv, I. (1998). Individual and Group Behavior in the Ultimatum Game: are Groups More “Rational” Players?. Experimental Economics, 1, 101–108

Capen, E., Clapp, R., & Campbell, W. (1971). Competitive Bidding in High-Risk Situations. Journal of Petroleum Technology, 23, 641–653

Cason, T. N., & Mui, V.-L. (1997). A Laboratory Study of Group Polarization in the Team Dictator Game. Economic Journal, 107, 1465–1483

Cooper, D. J., & Kagel, J. (forthcoming). Are Two Heads Better than One? Team versus Individual Play in Signaling Games. American Economic Review, in press

Cox, J., Dinkin, S., & Swarthout, J. (2001). Endogenous Entry and Exit in Common Value Auctions. Experimental Economics, 4, 163–181

Cox, J., & Isaac, R. (1984). In Search of the Winner’s Curse. Economic Inquiry, 22, 579–592

Cox, J., & Isaac, R. (1986). In Search of the Winner’s Curse: Reply. Economic Inquiry, 24, 517–520

Davis, J. H. (1992). Some Compelling Intuitions about Group Consensus Decisions: Theoretical and Empirical Research, and Interpersonal Aggregation Phenomena: Selected examples, 1950–1990. Organizational Behavior and Human Decision Processes, 52, 3–38

Dyer, D., & Kagel, J. H. (1996). Bidding in Common Value Auctions: how the Commercial Construction Industry Corrects for the Winner’s Curse. Management Science, 42(10), 1463–1475

Eberhart, A., Altman, E., & Aggarwal, R. (1999). The Equity Performance of Firms Emerging from Bankruptcy. Journal of Finance, 54(5), 1855–1868

Gigone, D., & Hastie, R. (1993). The common knowledge effect: Information sharing and group judgment. Journal of Personality and Social Psychology, 65, 959–974

Hoffman, E., Marsden, J., & Saidi, R. (1991). Are Joint Bidding and Competitive Common Value Auction Markets compatible? — Some Evidence from Offshore Oil Auctions. Journal of Environmental Economics and Management, 20, 99–112

Hogarth, R., & Reder, M. (1987). Rational choice: The Contrast between Economics and Psychology. Chicago. University of Chicago Press

Holt, C., & Sherman, R. (1994). The loser’s curse. American Economic Review, 84(3), 642

Hotchkiss, E. (1995). The Post-emergence Performance of Firms Emerging from Chapter 11. Journal of Finance, 50, 3–21

Isenberg, D. J. (1986). Group polarization: a Critical Review and Meta Analysis. Journal of Personality and Social Psychology, 50(6), 1141–1151

Kagel, J., & Levin, D. (1986). The winner’s Curse and Public Information in Common Value Auctions. American Economic Review, 76(5), 894–920

Kagel, J., Levin, D., Battalio, R., & Meyer, D. (1989). First-Price Common Value Auctions: bidder Behavior and the “winner’s curse”. Economic Inquiry, 27, 241–248

Kerr, L. N., MacCoun, R. J., & Kramer, G. P. (1996). Bias in judgment: comparing Individuals and Groups. Psychological Review, 103, 687–719

Laughlin, P. R. (1980). Social Combination Process of Cooperative Problem-Solving Groups at Verbal Intellective Tasks. In M. Fishbein (Ed.), Progress in Social Psychology, (vol. 1, pp. 127–155). Hillsdale, NJ: Erlbaum

Laughlin, P. R., & Ellis, A. L. (1986). Demonstrability and Social Combination Processes on Mathematical Intellective Tasks. Journal of Experimental Social Psychology, 22, 170–189

Laughlin, P. R., Kerr, N. L., Munch, M., & Haggerty, C. A. (1976). Social Decision Schemes of the Same Four-person Groups on Two Different Intellective Tasks. Journal of Personality and Social Psychology, 33, 80–88

Lind, B., & Plott, C. (1991). The Winner’s Curse: experiments with Buyers and with Sellers. American Economic Review, 81, 335–346

McGrath, J. E. (1984). Groups: Interaction and Performance. Englewood, NJ: Prentice-Hall

Thaler, R. H. (1988). Anomalies: The Winner’s Curse. Journal of Economic Perspectives, 2, 191–202

Thaler, R. H. (1992). The Winner’s Curse. In R. H. Thaler (Ed.), The Winner’s Curse. New Jersey: Princeton University Press

Thiel, S. (1975). Some Evidence on the Winner’s Curse. International Journal of Game Theory, 4(1), 25–55

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification D44, C91, C92

Rights and permissions

About this article

Cite this article

Cox, J.C., Hayne, S.C. Barking up the right tree: Are small groups rational agents?. Exp Econ 9, 209–222 (2006). https://doi.org/10.1007/s10683-006-9123-3

Received:

Revised:

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/s10683-006-9123-3