Abstract

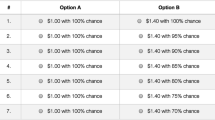

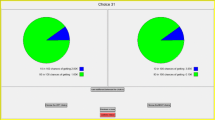

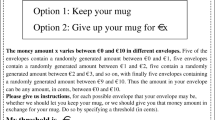

We examine the properties of a popular method for eliciting choices and values from experimental subjects, the multiple price list format. The main advantage of this format is that it is relatively transparent to subjects and provides simple incentives for truthful revelation. The main disadvantages are that it only elicits interval responses, and could be susceptible to framing effects. We consider extensions to address and evaluate these concerns. We conclude that although there are framing effects, they can be controlled for with a design that allows for them. We also find that the elicitation of risk attitudes is sensitive to procedures, subject pools, and the format of the multiple price list table, but that the qualitative findings that participants are generally risk averse is robust. The elicitation of discount rates appear less sensitive to details of the experimental design.

Similar content being viewed by others

References

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2005a). Valuation using multiple price lists. Working Paper 05–07, Department of Economics, College of Business Administration, University of Central Florida. Applied Economics, forthcoming.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2005b). Eliciting risk and time preferences. Working Paper 05–24, Department of Economics, College of Business Administration, University of Central Florida.

Beck, J. H. (1994). An experimental test of preferences for the distribution of income and individual risk aversion. Eastern Economic Journal, 20(2), 131–145.

Binswanger, H. P. (1980). Attitudes toward risk: Experimental measurement in rural India. American Journal of Agricultural Economics, 62, 395–407.

Binswanger, H. P. (1981). Attitudes toward risk: Theoretical implications of an experiment in rural India. Economic Journal, 91, 867–890.

Botelho, A., Harrison, G. W., Hirsch, Marc, A., & Rutström, E. E. (2005). Bargaining behavior, demographics and nationality: What can the experimental evidence show? In J. Carpenter, G.W. Harrison and J.A. List (Eds.), Field Experiments in Economics. (Greenwich, CT: JAI Press, Research in Experimental Economics, Volume 10).

Coller, M., Harrison, G. W., & Rutström, E. E. (2003). Are discount rates constant? Reconciling Theory and Observation. Working Paper 3–31. Department of Economics, College of Business Administration, University of Central Florida.

Coller, M., & Williams, M. B. (1999). Eliciting individual discount rates. Experimental Economics, 2, 107–127.

Cox, J. C., & Sadiraj, V. (2005). Implications of small- and large-stakes risk aversion for decision theory. Games & Economic Behavior, 53(2), forthcoming.

Eckel, C. C., & Grossman, P. J. (2002). Forecasting risk attitudes: An experimental study of actual and forecast risk attitudes of women and men. Unpublished Manuscript. Department of Economics, Virginia Tech.

Gonzalez, R., & Wu, G. (1999). On the shape of the probability weighting function. Cognitive Psychology, 38, 129–166.

Harrison, G. W., (1992). Theory and misbehavior of first-price auctions: Reply. American Economic Review, 82, 1426–1443.

Harrison, G. W., Harstad, R. M., & Rutström, E. E. (2004). Experimental methods and elicitation of values. Experimental Economics, 7(2), 123–140.

Harrison, G. W., Johnson, E., McInnes, M. M., & Rutström, E. E. (2005). Risk aversion and incentive effects: Comment. American Economic Review, 95(3), 897–901.

Harrison, G. W., Lau, M. I., Rutström, E. E., & Sullivan, M. B. (2005). Eliciting risk and time preferences using field experiments: Some methodological issues. In Carpenter, J., Harrison, G.W., & List, J.A., (Eds.), Field Experiments in Economics (Greenwich, CT: JAI Press, Research in Experimental Economics, Volume 10).

Harrison, G. W., Lau, M. I., & Williams, M. B. (2002). Estimating individual discount rates for denmark: A field experiment. American Economic Review, 92(5), 1606–1617.

Hoffman, E., Menkhaus, D. J., Chakravarti, D., Field, R. A., & Whipple, G. D. (1993). Using laboratory experimental auctions in marketing research: a case study of new packaging for fresh beef. Marketing Science, 12(3), 318–338.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92(5), 1644–1655.

Kahneman, D., Knetsch, J. L., & Thaler, R. H. (1990). Experimental tests of the endowment effect and the coase theorem. Journal of Political Economy, 98, 1325–1348.

Kirby, K. N., & Marakovic, N. N. (1996). Delay-discounting probabilistic rewards: Rates decrease as amounts increase. Psychonomic Bulletin & Review, 3(1), 100–104.

Kirby, K. N., Petry, N. M., & Bickel, W. K. (1999). Heroin addicts have higher discount rates for delayed rewards than non-drug-using controls. Journal of Experimental Psychology: General, 128(1), 78–87.

Laury, S. K., & Holt, C. A. Further reflections on prospect theory. Working Paper.

Miller, L., Meyer, D. E., & Lanzetta, J. T. (1969). Choice among equal expected value alternatives: Sequential effects of winning probability level on risk preferences. Journal of Experimental Psychology, 79(3), 419–423.

Mitchell, R. C., & Carson, R. T. (1989). Using surveys to value public goods: The contingent valuation method. Baltimore, Johns Hopkins Press.

Murnighan, K. J., Roth, A. E., & Shoumaker, F. (1987). Risk aversion and bargaining: Some preliminary results. European Economic Review, 31, 265–271.

Murnighan, K. J., Roth, A. E., & Shoumaker, F. (1988). Risk aversion in bargaining: An experimental study. Journal of Risk and Uncertainty, 1(1), 101–124.

Rabin, M. (2000). Risk aversion and expected utility theory: A calibration theorem. Econometrica, 68, 1281–1292.

Rutström, E. E. (1998). Home-grown values and the design of incentive compatible auctions. International Journal of Game Theory, 27(3), 427–441.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification C9, D81, D91

An erratum to this article is available at http://dx.doi.org/10.1007/s10683-008-9204-6.

Electronic supplementary material

Rights and permissions

About this article

Cite this article

Andersen, S., Harrison, G.W., Lau, M.I. et al. Elicitation using multiple price list formats. Exp Econ 9, 383–405 (2006). https://doi.org/10.1007/s10683-006-7055-6

Received:

Revised:

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/s10683-006-7055-6