Abstract

The effect of motherhood on women’s labour supply has been the focus of a large body of economic literature over the last decades. Since the mid-1990s, increasing attention has been paid to the “family pay gap” or the “motherhood wage gap”, i.e., the differential in wages between women with and without children. As for the long-term effects of children on pension entitlements, the empirical evidence is limited. Nevertheless, different countries have introduced pension caregiver credits into their pension systems in order to compensate parents—especially mothers—for the impact that children can have on their careers and, ultimately, on their retirement benefits. Whether or not these caregiver credits achieve this objective is still an unresolved issue. We deal with this question in the French case, as the French pension system includes the widest range of caregiver credits compared to other countries. We first compute the family pension gap at given ages for women born between 1950 and 1966, initially while ignoring caregiver credits. This gap increases with the number of children. We then show that caregiver credits do fulfil their role of compensating women for the impact of children on their pension entitlements. Taking these benefits into account offsets almost completely the difference in pension entitlements among women, whatever the number of children. For men, children have almost no impact on their pension entitlements, and caregiver credits play a minor role with the one exception that they favour the fathers of at least three children.

Source: Inter-Scheme sample of Contributors (EIC 2005) matched with the Permanent Demographic Sample (EDP)

Similar content being viewed by others

Notes

This has been the case in Germany since the reforms of 1999 and 2002, in Sweden since 1998, and in the UK since 2002.

Beginning in 2011, the minimum age gradually increased for cohorts born after mid-1951; it reached 62 for cohorts born in or after 1955. Simultaneously, the age required for the full rate gradually increased for the same cohorts and reached 67 for cohorts born in and after 1955. For simplification, our presentation maintains the ages 60 and 65.

Until recently, private sector schemes granted this benefit only to mothers. However, for children born after 1 April 2010, the second four quarters of extra contributions can be granted to fathers or split between both parents upon request.

In 2017, the household income could not exceed 24,404 yearly € with one child, + 5632 € per extra child.

For private sector employees, a quarter is not actually defined as a period: a worker acquires a quarter as soon as she has contributed on a wage corresponding to 200 h (150 since 2014) at the minimum wage.

Our reasoning is based on the number of children individuals have had. We do not know whether parents actually raised their children after birth (in the event of divorce, for example). Similarly, we do not know how many stepchildren people have raised in the context of stepfamilies, although these children may also have had an impact on pension entitlements.

Specifically, we excluded from our analysis workers who have more than 12 quarters outside the General Scheme by age 39. Our sample represents 73% of women (between 71 and 76%, depending on the cohort) and 64% of men (between 61 and 72%).

Graphs for the other two cohorts are available on request.

Due to the trend towards postponing motherhood, childless women or those with only one child at age 39 may have different characteristics, depending on their cohort. Thus, the same analysis based on completed fertility (which the oldest cohorts are closest to at age 39) could lead to slightly different findings for cohorts born in the 1960s.

Comparing the pension gap at the same age across cohorts leads us to consider individuals who may (on average) be at different stages of their careers, depending on their cohort. In particular, younger cohorts entered the labour market at a later age (see, e.g. Rapoport 2012) and therefore the career length they reach at age 39 will be shorter on average than for older cohorts. This difference in the observation window of different cohorts may create gaps between cohorts.

The effects (in percentage terms) are positive and appear to be very high among women born in 1966 (comparison of childless women and mothers with one child). This results from the low level of the initial gap (41€).

References

Adda, J., Dustmann, C., & Stevens, K. (2017). The career costs of children. Journal of Political Economy,125(2), 293–337.

Anderson, K., & Meyer, T. (2006). New social risks and pension reform in Germany and Sweden: The politics of pension rights for child care. In K. Armingeon & G. Bonoli (Eds.), The politics of post-industrial welfare states: Adapting post-war social policies to new social risks (pp. 171–191). Routledge: London.

Beblo, M., Bender, S., & Wolf, E. (2009). Establishment-level wage effects of entering motherhood. Oxford Economic Papers,61(Suppl 1), i11–i34.

Betti, G., Bettio, F., Georgiadis, T., & Tinios, P. (2015). Unequal ageing in Europe. Women’s independence and pensions. New York: Palgrave Macmillan.

Bianchi, S., Sayer, L., Milkie, M., & Robinson, J. (2012). Housework: Who did, does or will do it, and how much does it matter? Social Forces,91(1), 55–63.

Bichot, J. (1994). Familles et retraites: un système incohérent et injuste. Droit Social,7(8), 734–741.

Bolin, K., Linfgren, B., & Lundborg, P. (2008). Your next of kin or your own carer? Caring and working among the 50 + of Europe. Journal of Health Economics,27, 718–738.

Bonnet, C., Bozio, A., Landais, C., Rabaté, S., & Tenand, M. (2013). Pension reform: Towards an overhaul offamily rights? IPP Policy Brief, 8, 1–5.

Bonnet, C., & Geraci, M. (2009). Correcting gender inequalities in pensions. The experience of five countries. Population and Societies,453, Ined, 1–4.

Bonnet, C., & Hourriez, J. M. (2012a). Gender equality in pension: What role for rights accrued as a spouse or a parent? Population-E,67(1), 123–146.

Bonnet, C., & Hourriez, J. M. (2012b). Inégalités entre hommes et femmes au moment de la retraite en France. In Regards sur la Parité (pp. 39–51). Insee, France.

Bonnet, C., Meurs, D., & Rapoport, B. (2018). Gender inequalities in pensions: Different components, similar levels of dispersion”. The Journal of Economic Inequality,16(4), 527–552.

Bridenne, I., & Couhin, J. (2012). La contributivité accrue de la pension de base: Source d’inégalités entre genres? Retraite et société,63, 190–203.

Brocas, A. M. (2004). Les femmes et les retraites en France: un aperçu historique. Retraite et société,43, 11–33.

Brugiavini, A., Pasini, G., & Trevisan, E. (2011). Maternity and labour market outcome: Short and long term effects. In A. Börsch-Supan, M. Brandt, K. Hank, & M. Schröder (Eds.), The individual and the welfare state: Life histories in Europe (pp. 151–159). Heidelberg: Springer.

Cigno, A., & Werding, M. (2007). Children and pensions. Cambridge, MA: MIT Press.

COR. (2008). Retraites: droits familiaux et droits conjugaux, 6e rapport. La Documentation française.

d’Addio, A. (2013). Pension entitlements of women with children: The role of credits within pension systems in ECD and EU Countries. In R. Holzmann, E. Palmer, & D. Robalino (Eds.), Nonfinancial defined contribution pension schemes in a changing pension world (Vol. 2, pp. 75–110)., Gender, politics, and financial stability Washington, DC: World Bank.

Davies, H., Joshi, H., & Peronaci, R. (2000). Forgone income and motherhood: What do recent British data tell us? Population Studies,54(3), 293–305.

Davies, R., & Pierre, G. (2005). The family gap in pay in Europe: A cross-country study. Labour Economics,12(4), 469–486.

Demeny, P. (1987). Re-linking fertility behaviour and economic security in old age: A pronatalist reform. Population and Development Review,13(1), 128–132.

Evandrou, M., & Glaser, K. (2003). Combining work and family life: The pension penalty of caring. Ageing & Society,23(5), 83–601.

Folbre, N. (1994). Children as public goods. American Economic Review,84(2), 86–90.

Fragonard, B., Gonzalez, L., Marc, C., & Fillion, S. (2015). Les droits familiaux de retraite. Report to Parliament, March.

Fultz, E. (2011). Pension crediting for caregivers policies in Finland, France, Germany, Sweden, the United Kingdom, Canada, and Japan. Report #D497. Washington, DC: Institute for Women’s Policy Research.

Gangl, M., & Ziefle, A. (2009). Motherhood, labor force behavior and women’s careers: An empirical assessment of the wage penalty for motherhood in Britain, Germany and the United-States. Demography,46(2), 341–369.

Gimenez-Nadal, J. I., & Sevilla, A. (2012). Trends in time allocation: A cross-country analysis. European Economic Review,56(6), 1338–1359.

Ginn, J. (2004). Actuarial fairness or social justice? A gender perspective on redistribution in pension systems. CeRP Working Paper, 37.

Heckman, J. (1979). Sample selection bias as a specification error. Econometrica,47(1), 153–161.

Herd, P. (2006). Crediting care or marriage? Reforming social security family benefits. The Journals of Gerontology Series B Psychological Sciences and Social Sciences,61(1), S24–S34.

Iams, H., & Sandell, S. (1994). Changing social security benefits to reflect child-care years: A policy whose time has passed? Social Security Bulletin,57(4), 10–24.

Jankowski, J. (2011). Caregiver credits in France, Germany, and Sweden: Lessons for the United States. Social Security Bulletin,71(4), 61–76.

Jefferson, T. (2009). Women and retirement pensions: A research review. Feminist Economics,15(4), 115–145.

Köppen, K., Mazuy, M., & Toulemon, L. (2017). Childlessness in France. In D. Konietza & M. Kreyenfeld (Eds.), Childlessness in Europe: Contexts, causes, and consequences (pp. 77–95). Heidelberg: Springer.

Lundberg, S., & Rose, E. (2000). Parenthood and the earnings of married men and women. Labour Economics,7(6), 689–710.

Meurs, D., Pailhé, A., & Ponthieux, S. (2010). Child related career interruptions and the gender wage gap in France. Annales d’Économie et de Statistiques,99/100, 15–46.

Mincer, J., & Ofek, H. (1982). Interrupted work careers: Depreciation and restoration of human capital. Journal of Human Resources,17, 3–24.

Mincer, J., & Polachek, S. (1974). Family investments in human capital: Earnings of women. Journal of Political Economy,82(2), S76–S108.

Möhring, K. (2015). Employment histories and pension incomes in Europe. A multilevel analysis of the role of institutional factors. European Societies,17(1), 3–26.

Möhring, K. (2018). Is there a motherhood penalty in retirement income in Europe? The role of lifecourse and institutional characteristics. Ageing & Society,38(12), 2560–2589.

Monticone, C., Ruzik, A., & Skiba, J. (2008). Women’s pension rights and survivors’ benefits: A comparative analysis of EU Member States and Candidate Countries. ENEPRI Research Report, 53. Brussels: European Network of Economic Policy Research Institutes.

Neels, K., De Wachter, D., & Peeters, H. (2018). The effect of family formation on the build-up of pension rights among minority ethnic groups and native women in Belgium. Ageing & Society,38(6), 1253–1278.

Peeters, H., & De Tavernier, W. (2015). Lifecourses, pensions and poverty among elderly women in Belgium: Interactions between family history, work history and pension regulations. Ageing & Society,35(6), 1171–1199.

Ponthieux, S., & Meurs, D. (2015). Gender inequality. In A. Atkinson & F. Bourguignon (Eds.), Handbook on income distribution (Vol. 2A, pp. 981–1146). Amsterdam: Elsevier.

Rapoport, B. (2012). L’évolution au fil des générations des droits à retraite acquis en début de carrière. Avant 30 ans, de moins en moins de droits acquis et de différences entre catégories socioprofessionnelles. Revue Française des Affaires Sociales,4, 52–78.

Rutledge, M., Zulkarnain, A., & King, S. E. (2017). How much does motherhood cost women in social security benefits? Center for Retirement Research Working Paper, 2017-14.

Sass, S. (2016). How work & marriage trends affect social security’s family benefits? Center for Retirement Research Brief, 16-9.

Sefton, T., Evandrou, M., Falkingham, J., & Vlachantoni, A. (2011). The relationship between women’s work histories and incomes in later life in the UK, US and West Germany. Journal of European Social Policy,21(1), 20–36.

Solard, G. (2016). Les masses financières liées aux dispositifs de solidarité dans le système de retraite. Dossiers Solidarité et Santé, Drees,72, 5–19.

Stahlberg, A. C., Cohen Birman, M., Kruse, A., & Sunden, A. (2006). Pension reforms and gender: The case of Sweden. In N. Gilbert (Ed.), Gender and social security reform: What’s fair for women? (pp. 175–205). Geneva: International Social Security Association.

Waldfogel, J. (1997). The effect of children on women’s wages. American Sociological Review,62(2), 209–217.

Waldfogel, J. (1998). Understanding the “family gap” in pay for women with children. The Journal of Economic Perspectives,12(1), 137–156.

Acknowledgements

The authors would like to thank Virginie Andrieux for her fruitful collaboration in an earlier version of this paper. We are grateful to Anna d’Addio for her helpful comments and to the DREES (Ministry of Labor and Social Affairs) for providing data and for their remarks on an earlier draft of this work. Benoît Rapoport thanks the iPOPs Labex from the heSam Pres (reference ANR-10-LABX-0089) for financial support. We also thank two anonymous referees for their comments and suggestions. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

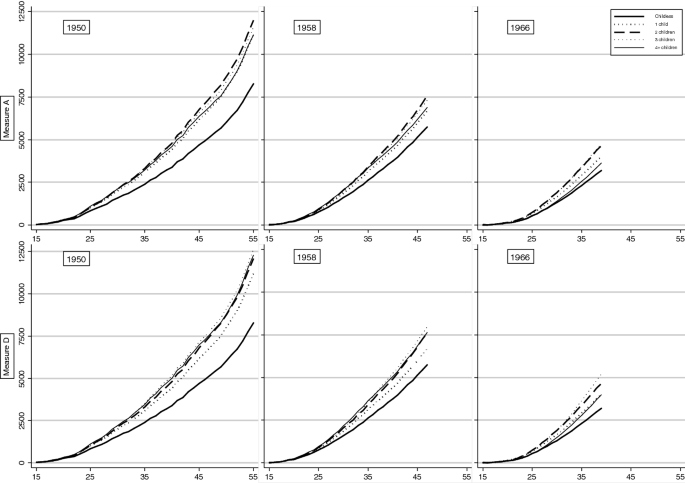

Appendix 1: Effect of caregiver credits on average pension, depending on the number of children and birth cohort, men

Effect of caregiver credits on average pension, depending on the number of children and birth cohort, men. Note age is on X-axis; pension level on Y-axis. Measure A: pension level before caregiver credits; Measure D = Pension level including all caregiver credits. Source: French Contributor Inter-Scheme sample (EIC 2005) matched with the Permanent Demographic Sample (EDP)

Source: Inter-Scheme sample of Contributors (EIC2005) matched with the Permanent Demographic Sample (EDP). Interpretation: all things being equal, the expected annual pension at age 39 for two-child fathers of the 1950 birth cohort is roughly 1100 euros higher compared to childless men (Measure A). When considering Measure D, which includes all caregiver credits, the bonus is increased for fathers of three children or more. The gap reaches roughly 1500 euros

Marginal effects of the number of children on pension entitlements at age 39, according to birth cohort (in constant 2006 euros, annual). Note the number of children is at age 39; childless men are the reference category. We control for level of education, pension entitlement at age 20, number of children at age 20, age at entry into the labour market, age at the first stable job and birthplace.

Appendix 2: Breakdown of the Effects of Caregiver Credits on Pension Calculation

1.1 The Impact of Caregiver Credits on the Contribution Period

When no caregiver credits are included, the graphs for the number of quarters by age and number of children are fairly similar to those for pensions (Fig. 5). However, from a certain age—which increases with the number of children—the differences between contribution periods stabilize regardless of the number of children, reflecting the fact that after a certain age women increase their contribution periods at the same pace, regardless of how many children they have. Thus, at age 55, the contribution periods of women in the 1950 cohort had reached 117, 99, 86 and 70 quarters for mothers with one, two, three and four or more children, respectively. Having at least a child results in a contribution duration that is shorter by about 2.8 years on average. The gap is similar at age 39. When AVPF (old-age insurance for non-working parents) is taken into account (Measure B), differences in duration are virtually netted out at all ages. For example, at age 55, mothers in the 1950 cohort had acquired 119, 106, 112 and 113 quarters with one, two, three and four or more children, respectively. The gap is therefore much smaller, but it still persists for the mothers of two children who could not fully benefit from the AVPF, which was introduced in 1972 (such mothers were 22 years old in 1972, and some of them already had two children). In the 1966 cohort, the number of quarters at age 39 is the same for all women regardless of the number of children, except for mothers of four or more children who have slightly fewer quarters of contributions. Since AVPF already significantly reduces differences in quarters according to the number of children, taking MDA (contribution years for mothers) into account (eight quarters per child) (Measure C) completely reverses the order of the curves and transforms the initial penalty into a bonus: the number of quarters of contributions at a given age increases with the number of children.

1.2 The Impact of Caregiver Credits on the Reference Wage

The effect of caregiver credits on the reference wage is less striking. AVPF (old-age insurance for non-working parents) reduces the differences in reference wage that appear relatively early and tend to increase over time, but it does not offset them completely (Fig. 6). In particular for the 1966 cohort at 39 years of age, the reference wage of childless women is equal to that of mothers of one child (Measure A). And compared to the reference wage of mothers with one child, that of mothers with two children is 10% lower; that of mothers with three children is 30% lower; and that of mothers with four or more children is 43% lower. AVPF reduces these differences. Indeed, the reference wage of mothers with three or more children is “only” 10% lower than the reference wage of mothers with one child when AVPF is taken into account. For the 1950–1962 cohorts, the impact of AVPF is less significant. For the 1950 cohort at age 39, differences in the reference wage without AVPF are quite similar to those of the 1966 cohort (although they are slightly higher between mothers with one or two children and childless women). With AVPF, the differences remain significant: on the order of 20–25% for mothers of three or four or more children (compared to childless women).

Source: Inter-Scheme sample of Contributors (EIC 2005) matched with the Permanent Demographic Sample (EDP)

Earnings measure (in constant 2006 euros), according to birth cohort and number of children (at age 39), women, with and without old-age insurance for non-working parents (Measures A and B). Note age is on X-axis; earnings measure on Y-axis.

Rights and permissions

About this article

Cite this article

Bonnet, C., Rapoport, B. Is There a Child Penalty in Pensions? The Role of Caregiver Credits in the French Retirement System. Eur J Population 36, 27–52 (2020). https://doi.org/10.1007/s10680-019-09517-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10680-019-09517-0