Abstract

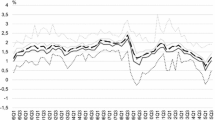

This paper studies uncertainty using the ECB Survey of Professional Forecasters’ data. Both inflation and real GDP growth forecasts at the micro level are considered. Our analysis indicates that individual inflation uncertainty is closely related to output growth uncertainty. Individual forecasters seem to behave according to an uncertainty-augmented hybrid specification of the New Keynesian Phillips curve. We also find evidence that inflation uncertainty has a negative impact on economic activity by lowering output growth, boosting inflation and reducing the price-sensitiveness of aggregate supply.

Similar content being viewed by others

Notes

The ECB SPF survey is described in detail in Bowles et al (2007).

Kenny et al. (2012) provide some evidence of the usefulness of these data by showing that distributional information helps to predict future inflation and output developments.

In our data, we found the expected values to be very close to the point forecasts. Thus, we do not do separate analyses for these two series.

This finding is consistent with Döpke and Fritsche (2006), who analyzed forecast dispersion of German professional forecasts for 1970–2004. They find that forecast dispersion varies over time and is particularly high before and during recessions.

Typically, long-term forecast uncertainty is interpreted using the standard deviation measure. Unfortunately, the sample size with long-term forecasts is so small that it is difficult to do a proper statistical analysis.

We in fact computed the number of respondents that attached a nonzero probability to more than four inflation values (ranges). The average value for the whole data sample was 20, but the minimum was nine.

Scrutiny of the distribution of individual distributions suggests, however, that the new questionnaires did not awfully much affect the reported distributions in the sense that many forecasters would have wanted to produce more gloomy forecasts prior to 2007 but would have been prevented in doing so because of missing values on the scale.

From the point of view of the Lucas (1973) supply curve, increased aggregate inflation uncertainty directly affects the supply curve coefficient and thus the price-sensitiveness of supply.

References

Baker S, Bloom N, Davis S (2012) Has economic policy uncertainty hampered the recovery? Chicago Booth Research Paper N. 12-06

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77(3):623–685

Boero G, Smith J, Wallis KF (2008) Uncertainty and disagreement in economic prediction: the Bank of England survey of external forecasters. Econ J 118:1107–1127

Bowles C, Friz R, Genre V, Kenny G, Meyler A, Rautanen T (2007) The ECB survey of professional forecasters: a review after eight years experience. ECB Occasional Paper 58

Bowles C, Friz R, Genre V, Kenny G, Meyler A, Rautanen T (2010) An evaluation of the growth and unemployment forecasts in the ECB survey of professional forecasters. OECD J 2:1–28

Conflitti C (2011) Measuring uncertainty and disagreement in the European survey of professional forecasters. OECD J 2:69–103

Döpke J, Fritsche U (2006) When do forecasters disagree? An assessment of German growth and inflation forecast dispersion. Int J Forecast 22:125–135

Dovern J, Fritsch U, Slacalek J (2009) Disagreement among forecasters in G7 countries. ECB Working Paper 1082

Fendel R, Lis E, Rülke JC (2011) Do professional forecasters believe in the Phillips curve? Evidence from G7 countries. J Forecast 30:268–287

Friedman M (1977) Nobel lecture: inflation and unemployment. J Polit Econ 85(3):451–472

Kenny G, Kostka T, Masera F (2012) How informative are the subjective density forecasts of macroeconomists? ECB Working Paper, 1446

Kortelainen M, Paloviita M, Viren M (2011) Observed inflation forecasts and the New Keynesian macro model. Econ Lett 112(1):88–90

Leduc S, Liu Z (2012) Uncertainty, Unemployment, and Inflation. FRBSF Econ Lett 28:1–5

Levi M, Makin J (1980) Inflation uncertainty and the phillips curve: some empirical evidence. Am Econ Rev 70(5):1022–1027

Lucas R (1973) Some international evidence on output-inflation trade-offs. Am Econ Rev 63:326–334

Pesaran MH, Weale M (2006) Survey expectations. In: Elliot G, Granger CWJ, Timmermann A (eds) Handbook in economic forecasting, chapter 14. Elsevier, Amsterdam

Sill K (2012) Measuring economic uncertainty using the survey of professional forecasters. Business Review of Philadelphia FED, Q4/2012:16-27

Sinclair P (2010) Inflation expectations ed. Peter J. N. Sinclair, Routledge International Studies in Money and Banking, London

Tillmann P (2010) The Fed’s perceived Phillips curve: evidence from individual FOMC forecasts. J Macroecon 32:1008–1013

Acknowledgments

Antti Komonen, Sami Oinonen and Tarja Yrjölä have kindly derived the data. Useful comments from two anonymous referees are also acknowledged.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Paloviita, M., Viren, M. Inflation and output growth uncertainty in individual survey expectations. Empirica 41, 69–81 (2014). https://doi.org/10.1007/s10663-013-9225-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-013-9225-z