Abstract

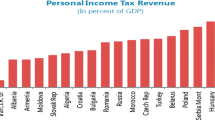

People mostly pay their taxes although there is a low probability of getting caught and being penalized. Thus, new attempts in the tax compliance literature try to go beyond standard economic theory. This paper examines citizens’ attitudes toward paying taxes – what is sometimes termed their “tax morale”, or the intrinsic motivation to pay taxes. Tax morale may be a key determinant to explain why people are honest. However, there are very few papers that explore the concept of tax morale theoretically and empirically. This study, based on the World Values Survey and the European Values Survey, therefore attempts to fill this gap in the literature, focusing on tax morale in Austria. Societal variables such as trust or pride have been identified as key determinants that shape tax morale in Austria. Furthermore, a lower perceived compliance leads to a decrease of tax morale, which indicates that social comparisons are relevant. The results also show a decrease of tax morale between 1990 and 1999, although Austria’s taxpayers still have a very high tax morale compared to other European countries.

Similar content being viewed by others

References

Sherie S. Aitken Laura Bonneville (1980) A General Taxpayer Opinion Survey Internal Revenue Service Washington, DC

James Alm (1999) ‘Tax Compliance and Administration’ W. Bartley Hildreth James A. Richardson (Eds) Handbook on Taxation. Marcel Dekker New York 741–768

James Alm Jorge Martinez-Vazquez (2003) ‘Institutions, Paradigms, and Tax Evasion in Developing and Transition Countries’ Jorge Martinez-Vazquez James Alm (Eds) Public Finance in Developing and Transitional Countries. Essays in Honor of Richard Bird. Cheltenham Edward Elgar UK 146–178

James Alm Gary H. McClelland William D. Schulze (1992) ArticleTitle‘Why Do People Pay Taxes?’ Journal of Public Economics 48 21–48

James Andreoni Brian Erard Jonathan S. Feinstein (1998) ArticleTitle‘Tax Compliance’ Journal of Economic Literature 36 818–860

Jonathan C. Baldry (1987) ArticleTitle‘Income Tax Evasion and the Tax Schedule: Some Experimental Results’ Public Finance 42 357–383

Massimo Bordignon (1993) ArticleTitle‘A Fairness Approach to Income Tax Evasion’ Journal of Public Economic 52 345–362

David Dollar Fisman Raymond Gatti Roberta (2001) ArticleTitle‘Are Women Really the “Fairer” Sex? Corruption and Women in Government’ Journal of Economic Behavior and Organization 46 423–429

Brian Erard Jonathan S. Feinstein (1994) ArticleTitle‘The Role of Moral Sentiments and Audit Perceptions in Tax Compliance’ Public Finance 49 70–89

European Values Study (1999) Questionnaire, Tilburg University.

Frey, Bruno S., Lars P. Feld (2002) ‘Deterrence and Morale in Taxation: An Empirical Analysis’, CESifo Working Paper No. 760, August 2002.

Frey, Bruno S. Stepahn Meier (2004) ‘Pro-Social Behavior in a Natural Setting’, Journal of Economic Behavior and Organization, forthcoming.

Bruno S. Frey Stutzer Alois (2002) Happiness and Economics. How the Economy and Institutions Affect Well-Being Princeton University Press Princeton

Frey, Bruno S., Benno Torgler (2004) Taxation and Conditional Cooperation, CREMA Working Paper 2004-20, Basel, Center for Research in Economics, Management and the Arts.

Gërxhani, Klarita (2002) Tax Evasion in Albania: An Institutional Vacuum?, paper presented at the Annual Meeting of the European Public Choice Society, Belgirate.

James P.F. Gordon (1989) ArticleTitle‘Individual Morality and Reputation Costs as Deterrents to Tax Evasion’ European Economic Review 33 797–805

Michael R. Gottfredson Hirschi Travis (1990) A General Theory of Crime Stanford University Press Stanford

Michael J. Graetz Louis L. Wilde (1985) ArticleTitle‘The Economics of Tax Compliance: Facts and Fantasy’ National Tax Journal 38 355–363

Travis Hirschi Michael R. Gottfredson (2000) ‘Age and the Explanation of Crime.’ Robert D. Crutchfield George S. Bridges Joseph G. Weis Kubrin Charis (Eds) Crime Readings Pine Forge Press Thousand Oaks 138–142

Brooks B. Hull (2000) ArticleTitle‘Religion Still Matters’ Journal of Economics 26 35–48

Brooks B. Hull Bold Frederick (1989) ArticleTitle‘Towards an Economic Theory of the Church’ International Journal of Social Economics 16 5–15 Occurrence Handle12282388

Ronald Inglehart et al. (2000) Codebook for World Values Survey Institute for Social Research Ann Arbor

Betty R. Jackson Valerie C. Milliron (1986) ArticleTitle‘Tax Compliance Research: Findings, Problems, and Prospects’ Journal of Accounting Literature 5 125–166

Stephen Knack Keefer Philip (1997) ArticleTitle‘Does Social Capital Have an Economic Payoff: A Cross-Country Investigation’ Quarterly Journal of Economics 112 1251–1288

Marianne Junger (1994) ‘Accidents’ Travis Hirschi Michael C. Gottfredson (Eds) The Generality of Deviance Transaction Publishers New Brunswick 81–112

Alan Lewis (1982) The Psychology of Taxation Martin Robertson Oxford

Jody Lipford E. McCormick Robert D. Tollison Robert (1993) ArticleTitle‘Preaching Matters’ Journal of Economic Behavior and Organization 21 235–250

Mocan, Naci (2004). What Determines Corruption? International Evidence from Micro Data, NBER Working Paper Series, Nr. 10460, Cambridge, MA, April.

Marta Orviska Hudson John (2002) ArticleTitle‘Tax Evasion, Civic Duty and the Law Abiding Citizen’ European Journal of Political Economy 19 83–102

Werner W. Pommerehne Weck-Hannemann Hannelore (1996) ArticleTitle‘Tax Rates, Tax Administration and Income Tax Evasion in Switzerland’ Public Choice 88 161–170

Friedrich Schneider H. Enste Dominik (2002) The Shadow Economy. An International Survey Cambridge University Press Cambridge

Schneider, Friedrich, Robert Klinglmair (2004) ‘Shadow Economies Around the World: What Do we Know?’, CREMA Working Paper No. 2004–03, Basel.

Schnellenbach, Jan (2002) Tax Morale, Leviathan and the Political Process: A Theoretical Approach, Paper presented at the Annual European Public Choice Society Conference in Belgirate, April 4–7.

John T. Scholz Lubell Mark (1998) ArticleTitle‘Adaptive Political Attitudes: Duty, Trust and Fear as Monitors of Tax Policy’ American Journal of Political Science 42 398–417

Michael W. Spicer A. Becker Lee (1980) ArticleTitle‘Fiscal Inequity and Tax Evasion: An Experimental Approach’ National Tax Journal 33 171–175

Michael W. Spicer E. Hero Rodney (1985) ArticleTitle‘Tax Evasion and Heuristics. A Research Note’ Journal of Public Economics 26 263–267

Anand Swamy Knack Stephen Lee Young Azfar Omar (2001) ArticleTitle‘Gender and Corruption’ Journal of Development Economics 64 25–55

Charles Tittle (1980) Sanctions and Social Deviance: The Question of Deterrence Praeger New York

Benno Torgler (2001) ArticleTitle‘Is Tax Evasion Never Justifiable?’ Journal of Public Finance and Public Choice 19 143–168

Benno Torgler (2002) ArticleTitle‘Speaking to Theorists and Searching for Facts: Tax Morale and Tax Compliance in Experiments’ Journal of Economic Surveys 16 657–684

Benno Torgler (2003a) ArticleTitle‘To Evade Taxes or Not: That Is the Question’ Journal of Socio-Economics 32 283–302

Benno Torgler (2003b) ArticleTitle‘Does Culture Matter? Tax Morale in an East-West-German Comparison’ FinanzArchiv 59 504–528

Torgler, Benno (2004) ‘Tax Morale in Latin America’, Public Choice, forthcoming.

Torgler, Benno and Neven T. Valev (2004) ‘Corruption and Age’, CREMA Working Paper No. 2004–24, Basel.

Tom R. Tyler (2000) ‘Why Do People Cooperate in Groups?’ Vught Van Mark Snyder Mark R. Tyler Tom Biel Anders (Eds) Cooperation in Modern Society. Promoting the Welfare of Communities, States and Organizations Routledge London 65–82

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Torgler, B., Schneider, F. Attitudes Towards Paying Taxes in Austria: An Empirical Analysis. Empirica 32, 231–250 (2005). https://doi.org/10.1007/s10663-004-8328-y

Issue Date:

DOI: https://doi.org/10.1007/s10663-004-8328-y