Abstract

This article develops and implements a stochastic optimal control approach to value renewable natural resources in the case of Marine Fisheries. The model includes two sources of uncertainty: the resource biomass and the price of fish, and it can be used by fisheries and regulators to optimally adapt their harvesting strategy to changing conditions in these stochastic variables. The model also features realistic operational cash flows. Using publicly available data on the British Columbia halibut fishery, the required parameters are estimated and the model is solved. The results indicate that price uncertainty is especially important in valuing fisheries and determining the optimal harvesting policy.

Similar content being viewed by others

Notes

In this article the words ’risk’ and ’uncertainty’ are used interchangeably. Both are meant to mean an environment that is not deterministic.

If the biomass becomes larger than the carrying capacity the natural growth becomes negative.

The derivation of this volatility specification, and the underlying assumptions, are excellently presented in Sims et al. (2018)

This assumption was initially made for computational convenience and can be easily relaxed, although we tested the independence of the historical realizations of both stochastic processes finding that the correlation between them is 0.01, and not statistically different from zero.

We also considered price specifications in which the price depends on the harvest. But these were rejected by the data implying that for the BC Halibut the size of the local harvest does not influence the price.

In 2006 all commercial fishermen targeting groundfish (including halibut) were integrated into a single catch share program Bonzon et al. (2010).

http://www.dfo-mpo.gc.ca.The website provides price data only until 2017, so the 2018 price was extrapolated from the growth rate of the Alaskan halibut price: https://www.fisheries.noaa.gov/action/north-pacific-observer-program-standard-ex-vessel-prices-groundfish-and-halibut-federal.

Even though the estimated drift of the log-normal process is not statistically significant (Table 2), we use the point estimate to solve the model and simulate.

Given that the cost function is undefined if the biomass is zero, we choose this small value to represent the depletion of the resource.

The solution algorithm takes approximately 700 iterations to fulfill the stopping criteria (absolute change of \(1.0\times 10e^{-7}\) in the value function). The iteration errors and changes in the optimal policy converge smoothly.

The harvesting policy upper-bound was set at 45 million pounds per year. This limit is not binding.

As in the previous section, for the Mean-Reverting No Volatility Case we set the volatilities of the two processes to zero (\(\sigma _P=0\) and \(\sigma _I=0\)), and solve for the optimal harvesting policy.

References

Bonzon K, McIlwain K, Strauss C, Van Leuvan T (2010) Catch shares in practice: British Columbia integrated groundfish program. A guide for managers and fishermen. Environmental Defense Fund, In Catch Share Design Manual

Clark CW, Kirkwood GP (1986) On uncertain renewable resource stocks: optimal harvest policies and the value of stock surveys. J Environ Econ Manag 13(3):235–244

Clark CW, Munro GR, Turris B (2009) Impacts of harvesting rights in Canadian Pacific fisheries. Fisheries and Oceans Canada

Fama EF, French KR (1997) Industry costs of equity. J Financ Econ 43(2):153–193

FAO (2008) Fisheries management 3: managing fishing capacity. FAO Technical Guidelines for Responsible Fisheries

Heer B, Maussner A (2009) Dynamic general equilibrium modeling: computational methods and applications. Springer, Berlin

Kvamsdal SF, Poudel D, Sandal LK (2016) Harvesting in a fishery with stochastic growth and a mean-reverting price. Environ Resource Econ 63(3):643–663

Nelson S (2009) Pacific commercial fishing fleet: financial profiles for 2007. Fisheries and Oceans Canada (DFO)

Nelson S (2011) Pacific commercial fishing fleet: financial profiles for 2009. Fisheries and Oceans Canada (DFO)

Nøstbakken L (2006) Regime switching in a fishery with stochastic stock and price. J Environ Econ Manag 51(2):231–241

Pindyck RS (1984) Uncertainty in the theory of renewable resource markets. Rev Econ Stud 51(2):289–303

Poudel D, Sandal LK, Kvamsdal SF, Steinshamn SI (2013) Fisheries management under irreversible investment: does stochasticity matter? Marine Resource Econ 28(1):83–103

Sethi G, Costello C, Fisher A, Hanemann M, Karp L (2005) Fishery management under multiple uncertainty. J Environ Econ Manag 50(2):300–318

Sims C, Horan RD, Meadows B (2018) Come on feel the noise: ecological foundations in stochastic bioeconomic models. Nat Resource Model 31(4):e12191

Stewart I, Hicks A (2017) Assessment of the Pacific halibut (Hippoglossus stenolepis) stock at the end of 2017. International Pacific Halibut Commission

Stewart I, Webster R(2017) Overview of data sources for the Pacific halibut stock assessment, harvest strategy policy, and related analyses. International Pacific Halibut Commission

Ye Y, Gutierrez N (2017) Ending fishery overexploitation by expanding from local successes to globalized solutions. Nat Ecol Evol 1:0179

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Tom Kong and Ian Stewart from the Pacific Halibut Research & Stock Management for their help with the halibut data. We also thank Jack Favilukis, Ron Giammarino, Michael Devereux, Giovanni Gallipoli, Viktoria Hnatkovska and seminar participants at Universidad de Chile, Pontificia Universidad Catolica de Chile, Simon Fraser University, Universidad Carlos III and Pontificia Universidad Comillas for their helpful comments. We specially thank the four referees and the editor of this journal for many insightful comments and suggestions. An earlier version of this paper circulated under the title “The Valuation of Fisheries Rights with Sustainable Harvest”.

Appendices

Appendix A: Value-Function Algorithm Scheme

In this section we sketch the solution algorithm, describing the key steps, but abstracting from detailed calculations. Broadly, we start from an initial value function and iterate over the policy space until a maximum is attained. The outcome of the process is the maximized value-function, and the optimal policy, for each point in our two-dimensional grid representing the state space. As all the estimated parameters are annual, we set the time step to 1 year \(\Delta t =1\).

Step 1: Initialize \(v_{0}\)

We use a grid on the defined interval \(\left[ I_{1},I_{N}\right] \times \left[ P_{1},P_{M}\right]\), and compute the optimal value using our algorithm.

Step 2: Compute a new value function \(v_{1}\), and the policy \(q_{1}\).

For each \((n,m)\in \left\{ \left( 1,1\right) ,\left( 1,2\right) ,..,\left( N,M\right) \right\}\) repeat the following steps:

Step 2.1: Initialize the policy \(q^{*}(I_{n},P_{m}) = q_{1}\)

Step 2.2.A: For the Log-Normal price specification, find the index \(i^{*}\) that maximizes:

Where \(q_{i^{*}}\) is \(q^{*}(I_{n},P_{m})=q_{i^{*}}\), and \(\hat{v^{0}}\) is the linearly-interpolated value-function, for the state \(\left( I_{n} + \gamma I_{n}(1-I_{n}/I_{max}) - q_{j} + \sigma _{I}\sqrt{\left( \gamma I_{n}(1-I_{n}/I_{max})\right) ^2}Z_{k}^{I},P_{m}e^{\nu _{P} + \sigma _{P}Z_{l}^{P}}\right)\), calculated using the initial value-function \(v_{0}\).

Step 2.2.B: For the Mean-Reverting price specification, find the index \(i^{*}\) that maximizes:

where \(q_{i^{*}}\) is \(q^{*}(I_{n},P_{m})=q_{i^{*}}\), and \(\hat{v^{0}}\) is the linearly-interpolated value-function, for the state \(\left( I_{n} + \gamma I_{n}(1-I_{n}/I_{max}) - q_{j} + \sigma _{I}\sqrt{\left( \gamma I_{n}(1-I_{n}/I_{max})\right) ^2}Z_{k}^{I},P_{m}e^{\theta _P\left( \mu _P - \ln P_{m}\right) + \sigma _{P}Z_{l}^{P}}\right)\), calculated using the initial value-function \(v_{0}\).

Step 2.3: At each point of the state space (n, m), replace \(v^{1}\) with the respective elements of \(w_{i^{*}}\).

Step 3: Check for convergence. If:

stop iterating, else, replace \(v^{0}\) with \(v^{1}\), and return to step 2.

When the algorithm converges we have the optimal \(v(I_{n},P_{m})\) and \(q(I_{n},P_{m})\) for the state space \((I_{n},P_{m})\in \left[ I_{1},I_{N}\right] \times \left[ P_{1},P_{M}\right]\).

The transition probabilities \(\{\lambda _{k}^{I},\lambda _{j}^{P}\}\) are obtained from the standard normal, as in both cases the shocks are assumed to follow this distribution. The shock grid \(Z_{k}\in [-\varrho ,\varrho ]\) is defined according to the desired confidence level. We set the confidence level to 99%, hence \(\varrho =2.33\). The transition probability is the area under the probability density function of the standard normal for the interval \([Z_{k}-dZ,Z_{k}+dZ]\), where dZ is half of the distance between two consecutive grid points.

Appendix B: Comparison Between the Simulated Dynamics for the Benchmark Case and the Mean-Reverting Case

In this section we compare the simulated dynamics of the Benchmark Case with those of the Mean-Reverting Case, which is the model we solve using Eq. (7) instead of Eq. (6) as the price dynamics specification while all the remaining parameters are the same as in the Benchmark Case.

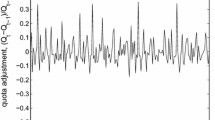

Panel A of Fig. 13 compares the simulated prices for the log-normal and mean-reverting price dynamics, showing the median and the \(1^{th}\) and \(99^{th}\) percentiles.

Median, \(1^{th}\) and \(99^{th}\) Percentiles of the Simulated Harvesting Policy and the Probability of having a Log-Normal Price higher than the \(99^{th}\) Mean-Reverting Simulated Price. For the Benchmark Case, and the Mean-Reverting Case for the British Columbia Halibut Fishery. Source: Own Elaboration Based on the Constructed Simulations

Note that the median drift price is positive for the log-normal case since the estimated growth rate is 2%. Whereas the median drift price for the mean-reverting process is negative since the estimated long-run price for this process is \(\$5.37\) [CAD/lb.], which is below the current price. A second point to notice is that the \(99^{th}\) percentile of the log-normal process is significantly higher than the \(99^{th}\) percentile of the mean-reverting process. This is mainly because the log-normal process in non-stationary so the dispersion of prices increases with time, whereas the mean-reverting process is stationary. But it is also due to the differences in drift, positive in the first and negative in the second.

To assess how important these differences are, we estimate the probability of the simulated log-normal prices being above the \(99^{th}\) percentile of the simulated mean-reverting price. Panel B of Fig. 13 shows that although the \(99^{th}\) percentiles look quite different, the probability of having a log-normal price above the \(99^{th}\) percentile of the mean-reverting price is less significant, for example at 5 years this probability is less than \(10\%\) and at 10 years this probability is approximately \(21\%\).

Next, we proceed to compare the optimal harvest for the Mean-Reverting Case with the Benchmark Case (log-normal price). Panel A of Fig. 14 shows the effect of the drifts in the price dynamics is that the median of the Benchmark Case’s optimal harvest is increasing, while the median of the Mean-Reverting Case’s optimal harvest is decreasing. There are also significant differences for the optimal harvest in both cases in the \(99^{th}\) percentile.

Panel B in Fig. 14 shows that differences in the simulated biomass for these two cases are not significant except for the median biomass; which are produced by the median of the harvest, itself is driven by the drift of the price dynamics.

Appendix C: Equivalent Representation of the Model in Continuous Time

To highlight some of the characteristics of the solution of the model discussed in Sect. 2, we present its equivalent representation in continuous time. The dynamics of the biomass is now assumed to follow:

where \(I_{t}\) is the biomass at time t, \(g\left( I_{t}\right)\) is the instantaneous expected rate of growth of the biomass presented in Eq.(2), \(q_{t}\) is the instantaneous harvesting rate and the stochastic control in the model, \(f\left( I_{t}\right)\) is the instantaneous volatility and \(dZ^I\) is a standard Wiener process. The instantaneous biomass volatility \(f\left( I_{t}\right)\) is assumed to follow the two specifications presented in Eqs. (3) and (4).

The resource price now follows the stochastic process:

where \(P_{t}\) is the unit fish price at time t, \(\bar{m}\left( P_{t}\right)\) is the instantaneous expected rate of growth of the price, \(s\left( P_t\right)\) is the instantaneous volatility and \(dZ^P\) is a Wiener process, with \(\mathbb {E}\left[ dZ^I \times dZ^P\right] = 0\). The rate of growth \(\bar{m}\left( P_{t}\right)\) is:

where the function \(m\left( \ln P_{t}\right)\) is assumed to follow the two specifications presented in Eqs. (6) and (7). The instantaneous volatility \(s\left( P_t\right)\) is:

We consider an infinitely-lived value-maximizing fishery. The present value of the future expected cash flows at time t for a given harvesting policy \(q_{t} = q\left( I_{t},P_{t}\right)\) is:

where r is the fishery’s risk-adjusted discount rate and \(\pi \left( I_{t},P_{t},q_{t}\right)\) is the instantaneous profit, as defined in Eq. (8). Thus, the value of the representative fishery is:

then the Hamilton-Jacobi-Bellman (HJB) equation is:

Replacing Eqs. (8) and (9) into Eq.(30), the HJB equation can be written as:

were:

If we use the optimal harvesting policy \(q^{*}_t\) in Eq.(31) we obtain:

We rearrange Eq.(32) to obtain the rate of return:

where \(A\left( I_{t},P_{t}\right) = - \frac{1}{2} \frac{V_{II}}{V\left( I_{t},P_{t}\right) }\) and \(B\left( I_{t},P_{t}\right) = - \frac{1}{2} \frac{V_{PP}}{V\left( I_{t},P_{t}\right) }\). As in Pindyck (1984) we interpret the indicated part of Eq. (33) as the risk-premium, that is, the premium that resource owners would pay to eliminate biomass and price uncertainty.

Equation (33) allows us to identify the effect that the different stochastic dynamics have on the fishery’s return. Concerning the biomass dynamics, we note that for the environmental volatility (Eq.(4)) the effect of an additional unit of biomass on the risk-premium depends on the biomass level. If the biomass is below \(I_{max}/2\), an additional unit of the resource will increase the variance of the stock, increasing the risk-premium. If the biomass is above \(I_{max}/2\), an increase in the stock will reduce its variance, consequently diminishing the risk-premium.

From the price volatility presented in Eq.(27) we note that as the price increases the risk-premium will also increase. This relationship indicates that an increment in the price makes the price dynamics more volatile thus increasing the required risk premium.

Overall, the continuous-time version of the model helps us understand the impact of uncertainty. In particular, how the specified dynamics affect the risk premium.

Rights and permissions

About this article

Cite this article

Pizarro, J., Schwartz, E. Fisheries Optimal Harvest Under Price and Biomass Uncertainty. Environ Resource Econ 78, 147–175 (2021). https://doi.org/10.1007/s10640-020-00528-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-020-00528-8