Abstract

We apply a land-use approach to biodiversity conservation (BC) by assuming that the global public good ‘biodiversity’ is positively correlated with the share of land protected by land-use restrictions against the deterioration of habitats, ecosystems, and biodiversity. The willingness to pay for BC is positive in developed countries (North), but very low in developing countries (South). Taking the no-policy regime as our point of departure, we analyze two concepts of BC: the northern countries’ financial support of BC in the South, and the coordination of northern countries’ BC efforts. In each regime, governments may either take prices as given or may act strategically by seeking to manipulate the terms of trade in their favor. Our numerical analysis yields results with unexpected policy implications. If northern countries support BC financially in the South without coordinating their actions, the protected land, biodiversity and welfare increase so slightly that this BC policy is almost ineffective. The BC concept with a Coaseian flavor—in which northern countries support BC financially in the South and coordinate their action—is efficient if governments act non-strategically. Otherwise, the concept is an ineffective BC policy instrument, because the incentives for expanding the protected land the BC policy creates are so strong that biodiversity actually becomes excessive.

Similar content being viewed by others

Notes

In its recent Fifth Report to the Convention on Biological Diversity (European Commission 2014), the European Union states that extensive areas of agriculture, grasslands and wetlands continue to decline across Europe, while artificial surfaces continue to expand.

Ferraro and Simpson (2002) have investigated the cost-effectiveness of payments for ecosystem conservation.

In ecology, a large literature applies the “species area curve”, which describes the relationship between the area of a habitat and the number of species found within that area. A reduction in the size of a habitat reduces biodiversity in terms of the species area relationship (e.g. Kinzig and Harte 2000; May et al. 1995), which is also used in economic papers on land use and biodiversity conservation (e.g. Barbier and Schulz 1997; Polasky et al. 2004).

For a more realistic land-use approach based on the new economic geography with centrifugal-centripetal forces in economic and ecological systems, see Rauscher and Barbier (2010).

Since the North is willing to pay more for biodiversity than the South, it is in the North’s interest to compensate the South for expanding its protected area. Panayotou (1994) describes a similar market concept without providing a formal analysis.

In the Coaseian spirit, we refrain from providing an institutional structure for the North–North coordination such as a North–North BC market or a self-enforcing North–North agreement (as e.g. Barrett 1994) to focus on the North–South issue without unnecessary analytical complexity.

We disregard the fourth regime characterized by ‘North–North coordination’ without ‘North–South compensation’, because we find it less relevant than the three regimes listed in Table 1.

We know that the aggregate welfare rises, if we move from Regime 1 with or without strategic action to Regime 3 without strategic action, because Regime 1 is inefficient and Regime 3 without strategic action is efficient.

The Convention on Biological Diversity combined with the Global Environment Facility does not fit precisely into any of the three regimes, but may come close to Regime 2.

It is obvious that the real world exhibits all kinds of intermediate forms of land use. Nonetheless, the partition of land into protected and non-protected areas captures the essence of the allocation problem for the purpose of our conceptual analysis and secures tractability at the same time.

The subscript i [j] denotes an element of the set \(\mathcal{N}\)\([\mathcal{S}]\), and the subscript h represents an element of the set \(\Omega \).

We denote by \(g_h, x_i, y_j\) the supply of goods and by \(g_h^d, x_h^d, y_h^d\) their demand.

For details on ‘degenerate’ profit maximization and land market equilibrium, see “Appendix A”.

Note that (7) defines equilibrium in the markets of protected and unprotected land, and implies clearance of the market for green goods via Walras’ Law.

Observe that all prices are related to the price of the green good, which has been chosen as a numeraire. Hence, \(\frac{\partial P^x}{\partial b_i}\) captures the strategic action of manipulating the terms of trade \(\frac{p_x}{p_g}\).

The information in (12) about the size of the protected area in the fallback Regime 1 is important, in order to rule out the offer of protected areas in the BC market that would already be protected areas in Regime 1.

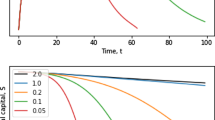

The first-order conditions of Regimes 1–3 for the parametric model are given in “Appendix C”. The closed-form solutions for non-strategic action are presented in “Appendix D”.

In Table 3,

is the value of the variable \(v_h= b_h, w_h\) etc. of country h in Regime \(k = 1, 2, 3\). In addition, we use the superscripts s and \(*\) to indicate the allocation and prices of regimes with and without strategic action, respectively.

is the value of the variable \(v_h= b_h, w_h\) etc. of country h in Regime \(k = 1, 2, 3\). In addition, we use the superscripts s and \(*\) to indicate the allocation and prices of regimes with and without strategic action, respectively.As a consequence, strategic manipulation of the price of green goods is impossible.

In the following tables, we use the notation

for the variable \(v=b, w, p_x, p_y\) with \(k= 2, 3 \) and \(h= \mathcal{N}, \mathcal{S}\).

for the variable \(v=b, w, p_x, p_y\) with \(k= 2, 3 \) and \(h= \mathcal{N}, \mathcal{S}\).The absolute aggregate-welfare gap between Regimes 2 and 3 is small, but almost as large as between Regimes \(1^*\) and \(3^*\).

For the interested reader, we provide in “Appendix C” the relevant results of Example 2, along with those of the Examples 1 and 3, to allow for a row-by-row comparison.

Recall that we denote Regime \(k = 1, 2, 3\) as Regime \(k^*\), if governments act non-strategically, as Regime \(k^s\), if they act strategically, and as Regime k (without superscript) if both types of that regime are addressed.

Items (A)–(C) imply that moving from price-taking to strategic action increases total protected land in all regimes. This feature is reminiscent of the famous observation Hotelling made in a different context, that “the monopolist is the conservationist’s best friend.”

References

Barbier E, Schulz C (1997) Wildlife, biodiversity and trade. Environ Dev Econ 2(2):145–172

Barrett S (1994) The biodiversity supergame. Environ Resour Econ 4:111–122

Brander J, Taylor MS (1997) International trade and open access renewable resources: the small open economy case. Can J Econ 30:526–552

Brander J, Taylor MS (1998) Open access renewable resources in a two-country model. J Int Econ 30:526–552

Brock W, Kinzig A, Perrings C (2010) Modeling the economics of biodiversity and environmental heterogeneity. Environ Resour Econ 46:43–58

Butchart S et al (2010) Global biodiversity: indicators of recent declines. Science 328:1164–1168

Ceballos G, Ehrlich PR, Barnosky AD, Garcia A, Pringle RM, Palmer TM (2015) Accelerated modern human-induced species losses: entering the sixth mass extinction. Sci Adv 1:e1400253. https://doi.org/10.1126/sciadv.1400253

Coase R (1960) The problem of social cost. J Law Econ 3:1–44

Convention on Biological Diversity (CBD) (1992) United Nations

European Commission (2014) Fifth Report of the European Union to the Convention on Biological Diversity

Ferraro PJ, Simpson RD (2002) The cost-effectiveness of conservation payments. Land Econ 78:339–353

Kinzig AP, Harte J (2000) Implications of endemics-area relationships in estimates of species extinctions. Ecology 81:3305–3311

May RM, Lawton JH, Stork NE (1995) Assessing extinction rates. In: Lawton JH, May RM (eds) Extinction rates. Oxford University Press, Oxford

Mee LD, Dublin HT, Eberhard AA (2008) Evaluating the global environment facility: a goodwill gesture or a serious attempt to deliver global benefits? Glob Environ Change 18:800–810

Montero JT, Perrings C (2011) The provision of international environmental public goods. Working Paper Series Environment for Development, The United Nations Environment Programme, Division of Environmental Policy Implementation Paper No. 16

Panayotou T (1994) Conservation of biodiversity and economic development: the concept of transferable development rights. Environ Resour Econ 4:91–110

Pearce DW (2004) Environmental market creation: savior or oversell? Port J Econ 3:115–144

Perrings C, Halkos G (2012) Who cares about biodiversity? Optimal conservation and transboundary biodiversity externalities. Environ Resour Econ 52:585–608

Perrings C, Halkos G (2015) Agriculture and the threat to biodiversity in sub-saharan Africa. Environ Res Lett 10:095015

Polasky S, Costello C, McAusland C (2004) On trade, land use and biodiversity. J Environ Econ Manag 48:911–925

Rauscher M, Barbier EB (2010) Biodiversity and geography. Resour Energy Econ 32:241–260

Sandler T (1993) Tropical deforestation: markets and market failures. Land Econ 69:225–233

Smulders S, van Soest DP, Withagen C (2004) International trade, species and habitat conservation. J Environ Econ Manag 48:891–910

Author information

Authors and Affiliations

Corresponding author

Additional information

Helpful comments from Charles Perrings and two anonymous reviewers are gratefully acknowledged. Remaining errors are the authors’ sole responsibility.

Appendix

Appendix

1.1 Appendix A: Protected and Unprotected Land Markets

For simplicity, we treat the protected area \(b_h\) as the governments’ policy parameter assuming that the land zones are imposed in a command and control fashion. It is straightforward to introduce competitive domestic markets, one for protected and one for unprotected land, to allocate the land to domestic firms. We determine the equilibrium on these markets as follows. After the government of country \(h \in \Omega \) has divided total land into protected and unprotected land, the equilibrium prices for the goods X and Y are determined by (8). Denote by \(p_{e}^i\) and \(p_{e}^j\) the price of unprotected land use in the production of good X, \(i \in \mathcal{N}\) and good Y, \(j \in \mathcal{S}\), respectively. Consider the first-order conditions of profit maximization \(p_x X_i'(e_i) =p_{e}^i\) and \(p_y Y_i'(e_i) =p_{e}^j\), respectively. The first-order conditions clearly define the land prices, \(p_{e}^i= p_x X_i'(e_i) \) and \(p_{e}^j= p_y Y_i'(e_i) \).

Next, consider the market for ecosystem services in country h and define the prices \(p_g=1\), \(p_b^h\) and the profit of the firm in country h that produces green goods, \(G_h(b_h) - p_b^h b_h\). The first-order condition of profit maximization determines the equilibrium price of protected land in country h: \(p_b^h{:=} G_h'(b_h)\).

Finally, observe that the income of country \(i\in \mathcal{N}\) and \(j \in \mathcal{S}\), respectively, is given by

1.2 Appendix B: Social Optimum

Maximizing the Lagrangian (24) yields the first-order conditions

The standard procedure of equating shadow prices with prices on perfectly competitive markets yields \(\lambda _x = p_x\), \(\lambda _y = p_y\), \(\lambda _g =p_g\) and \(\lambda _z = p_z\), and proves that the allocation in Regime \(3^*\) is efficient.

1.3 Appendix C: Parametric Functions and Numerical Examples

Regime 1 The consumer’s demand for good X and Y is given by

Inserting the demands (C1), (C2) and the supplies \(x_h =2 \alpha _{x} \sqrt{\ell - b_{\mathcal{N}}}\) and \(y_h =2 \alpha _{y} \sqrt{\ell - b_{\mathcal{S}}}\) into the equilibrium conditions \((n+s) x^d = n x_{\mathcal{N}} \) and \((n+s) y^d = sx_{\mathcal{S}}\) we obtain

Inserting the parametric functions (25) into (10) and (11) we get

for non-strategic action and

for strategic action.

Regime 2 In Regime 2 the consumer’s demands are given by \(x^d = \frac{a_x - p_x}{\beta _x}\), \(y^d = \frac{a_y - p_y}{\beta _y}\) and the price functions by

For the parametric functions (25) the first-order conditions (18)–(20) turn into

for non-strategic action and

for strategic action.

Regime 3 In Regime 3 the first-order conditions (18), (22) and (23) turn into

for non-strategic action and

for strategic action.

1.4 Appendix D: Closed-Form Solution for Non-strategic Action

For non-strategic action we get the following closed-form solutions.

Regime 1 Solving (C4) we get

where  and

and  . The welfare levels of northern and southern countries are given by

. The welfare levels of northern and southern countries are given by

Regime 2 Solving (C9) one gets

where  and

and  . Inserting (D1) and (D2) into (D8) and (D9) and solving for

. Inserting (D1) and (D2) into (D8) and (D9) and solving for  and

and  yields

yields

The welfare levels are

where  and

and  .

.

Regime 3 Solving (C12) and (C13), we obtain

where  and

and  . Inserting (D2) and (D3) into (D18) and (D19) and solving for

. Inserting (D2) and (D3) into (D18) and (D19) and solving for  and

and  yields

yields

The welfare levels are given by

where  and

and  .

.

Rights and permissions

About this article

Cite this article

Eichner, T., Pethig, R. Coaseian Biodiversity Conservation and Market Power. Environ Resource Econ 72, 849–873 (2019). https://doi.org/10.1007/s10640-018-0225-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-018-0225-0

is the value of the variable

is the value of the variable  exceeds price

exceeds price  by an amount that is too small to be captured in Table

by an amount that is too small to be captured in Table  for the variable

for the variable