Abstract

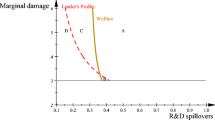

The paper considers an industry where production costs rise due to pollution, but where this effect can be partially off-set by investing in adaptation as a private good. The focus is not on external effects, but industries where economies of scale are introduced from adapting to pollution. The structure of the resulting oligopolistic market is endogenous, since the level of adaptation is chosen by the firms. The analysis of externalities usually disregards defensive or adaptation measures, with a few exceptions that point to considerable complications. The present debate on adaptation to climate change shows the importance of understanding defensive measures. I show that the market failure caused by economies of scale leads to production costs above the social optimum, i.e. to under-adapation. When pollution increases, adaptation only increases if demand is price inelastic. Otherwise, welfare loss from market failure decreases with pollution. The total welfare loss is only convex if demand is price inelastic and the influence of pollution on production costs is stronger than the influence of adaptation. Concave welfare loss has crucial implications for abatement policies.

Similar content being viewed by others

Notes

An alternative would be to compare the market equilibrium with a second-best solution where the social planner only decides about the number of firms (as, e.g. Mankiw and Whinston 1986).

The following proposition also holds when the Cournot equilibrium is compared with a second-best solution. Mankiw and Whinston (1986) show under fairly general conditions that the second-best number of firms \({\bar{n}} < n^+\). This can again be reduced to a counterfactual social planner solution as above by setting \(\alpha =(1+1/({\bar{n}} \epsilon _p))^{-1}\) and \({\tilde{q}} = \alpha q n\). It follows that \(1<\alpha <(1-\epsilon _a)\). When \({\bar{n}}>1\), the second-best resembles a counterfactual social optimum with more pollution and more expensive adaptation than in the first best, but with less pollution and cheaper adaptation than in the Cournot equilibrium.

References

Aakre S, Rübbelke DTG (2010) Adaptation to climate change in the European Union-efficiency vs. equity considerations. Environ Policy Gov 20(3):159–179

Barret S (1994) Self-enforcing international environmental agreements. Oxf Econ Pap 46:878–894

Baumol WJ, Panzar J, Willig R (1982) Contestable markets and the theory of industry structure. Harcourt Brace Jovanovitch

Baumol WJ (1972) On taxation and the control of externalities. Am Econ Rev 62(3):307–322

Baumol WJ, Bradford DF (1972) Detrimental externalities and nonconvexities of the production set. Economica 39:160–176

Butler RV, Maher MD (1986) The control of externalities: abatement vs. damage prevention. South Econ J 52:1088–1102

Coase R (1960) The problem of social cost. J Law Econ 3:1–44

Cropper ML, Oates WE (1992) Environmental economics: a survey. J Econ Lit 30(2):675–740

Dasgupta P, Stiglitz J (1980) Industrial structure and the nature of innovative activity. Econ J 90:266–293

Ebert U, Welsch H (2012) Adaptation and mitigation in global pollution problems: economic impacts of productivity, sensitivity, and adaptive capacity. Environ Resour Econ 52(1):49–64

Eisenack K, Stecker R (2012) A framework for analyzing climate change adaptations as actions. Mitig Adapt Strateg Glob Chang 17(3):243–260

Eisenack K, Kähler L (2012) Unilateral emission reductions can lead to Pareto improvements when adaptation to damages is possible. Tech. Rep. Wirtschaftswissenschaftliche Diskussionpapiere V - 344–12, University Oldenburg

Fankhauser S, Smith JB, Tol RSJ (1999) Weathering climate change: some simple rules to guide adaptation decisions. Ecol Econ 30:67–78

Farrell J (1986) How effective is potential competition. Econ Lett 20:67–70

Gebauer J, Welp M, Lotz W (2010) Ergebnisse des Stakeholderdialogs zu Chancen und Risiken des Klimawandels—Chemieindustrie. Tech. rep, Umweltbundesamt, Germany

Heuson C, Gawel E, Gebhardt O, Hansjürgens B, Lehmann P, Meyer V, Schwarze R (2012) Fundamental questions on the economics of climate adaptation. Tech. Rep. UFZ-Bericht 5/2012, Helmholtz Centre for Environmental Research (UFZ)

Hope CW (2006) The marginal impacts of CO2, CH4 and SF6 emissions. Clim Policy 6(5):537–544

IPCC (2007) Climate change 2007: Impacts, adaptation and vulnerability. Contribution of working group II to the fourth assessment report of the intergovernmental panel on climate change. Intergovernmental panel on climate change, Cambridge University Press, Cambridge, UK

Lecocq F, Shalizi Z (2007) Balancing expenditures on mitigation of and adaptation to climate change: An exploration of issues relevant to developing countries. Tech. Rep. Policy Research Working Paper 4299, World Bank

Mankiw GN, Whinston MD (1986) Free entry and social efficiency. Rand J Econ 17(1):48–58

Maskin E (1986) The existence of equilibrium with price-setting firms. Am Econ Rev 76(2):382–386

McKitrick R, Collinge RA (2002) The existence and uniqueness of optimal pollution policy in the presence of victim defense measures. J Environ Econ Manag 44:106–122

Pielke R, Prins G, Rayner S, Sarewitz D (2007) Lifting the taboo on adaptation. Nature 445:597–598

Stern N (2006) The economics of climate change. Cambridge University Press, Cambridge

Winrich JS (1982) Convexity and corner solutions in the theory of externality. J Environ Econ Manag 9:29–41

Acknowledgments

The author wants to thank Heinz Welsch for a valuable hint. This paper is a work of the Chameleon Research Group (www.climate-chameleon. de), funded by the German Ministry for Education and Research under grant 01UU0910.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Comparative Statics of Social Planner

The social planner solution is determined by Eqs. (2), (3), here stated again as

since \(x_i^*=x^*, a_i^*=a^*\). The total differential is

It follows from Eq. (38) that

First consider the case where the unit cost of adaptation \(q\) changes ceteris paribus, i.e., \(dk=0\). It then follows from substituting Eqs. (40) into (39) that

Equation (42) together with Eq. (40) yields

I now turn to the effect of ceteris paribus changing pollution, i.e. \(dq=0\). It follows from Eq. (39) that

and equating with Eq. (41) yields

and by analogue calculations

These expressions are now simplified using elasticities. Due to Eq. (2)

The (identical) denominator in Eqs. (42)–(45) is thus equal to

This can now be applied to all four equations. Define \(u:=(\epsilon _a \epsilon _p + \epsilon _a -1)\). Equation (42) boils down to

is obtained. With the pollution elasticity of costs \(\epsilon _k = c_k\frac{k}{c} > 0\), the numerator of Eq. (45)

and

By Eq. (46), the numerator of Eq. (44) equals

yielding

1.2 Comparison of Market and Social Optimum

This section shows that \(x_i^+ < x_i^* \Leftrightarrow a_i^+ < a_i^*\).

The inequality \(x_i^+ < x_i^*\) implies that

Consequently, due to Eqs. (20) and (3), \(c_a(a_i^+,k) < c_a(a_i^*,k),\) such that the convexity of \(c\) implies \(a_i^+ < a_i^*\), being the first direction of the proposition.

Now assume that \(a_i^+ < a_i^*\), such that the monotonicity of \(c\) results in

Thus also \((1-\epsilon _a) c(a_i^+,k) > c(a_i^*,k)\), since the first term is greater than one. Then Eqs. (19) and (2) imply \(p(n^+ x_i^+) > p(n^* x_i^*)\). Since \(n^+ > 1 = n^*\), the monotonicity of \(p\) implies that \(x_i^+ < x_i^*\).

1.3 Proof of the Overall Effects of Increasing Pollution

Proof of Proposition 5.

-

(i)

The production of a single firm \(x_i^+\) decreases with \(k\) due to the comparative statics Eq. (24). Since the number of firms is independent of \(k\) due to Eq. (18), total production \(x^+\) decreases as well.

-

(ii)

Welfare decreases with pollution by Eq. (30).

-

(iii)

Under-adaptation for all cases is already stated in Proposition 4.

Proof of Proposition 6.

Adaptation: The difference between case (2) on the one hand, and case (1a), (1b) becomes obvious when comparing with Table 1. Recall that Eqs. (22)–(25) show that the comparative statics for the oligopoly solution have the same signs. Thus, adaptation is increasing with pollution in case (1a), (1b), while in case (2), the opposite holds.

Total welfare loss: Recall that the welfare loss is convex if Eq. (33) holds. In case (2), this is impossible since \(\epsilon _p+1<0\), and \(u<0\) by assumption. In cases (1a) and (1b) with \(0<\epsilon _p+1\), Eq. (33) is simply equivalent to the condition \(\epsilon _k<\frac{1}{\epsilon _p+1}-\epsilon _a\).

Welfare loss from market failure: By defining

Equation (35) can be written as

Now use the elasticities and the comparative statics Eqs. (10), (25) to determine

with

Since \(u<0,\,\mu \) has the same sign as \((\epsilon _p+1)\). Equation (54) represents a differential equation for \(v\) with respect to \(k\) that is solved by

where \(v_0\) is a constant that needs to be chosen properly. The welfare loss from market failure \(\varDelta (k)>0\) in the presence of pollution \(k\) can then be determined by integrating Eq. (53) with respect to \(k\) as

In case (2), \(\mu \) is negative, such that Eq. (57) shows that \(\varDelta \) is convexly decreasing in \(k\) as stated in Table 2. In case (1b), the condition \(\epsilon _k<\frac{1}{\epsilon _p+1}-\epsilon _a\) is equivalent to \(0 < \mu < 1\), making \(\varDelta \) an increasing but concave function in \(k\). By the same argument \(1<\mu \) in case (1a), yielding a convex function.

It has thus been shown that all the properties given in Table 2 hold under the conditions given in the first row and the assumption that there is an interior solution for the oligopoly market.

Rights and permissions

About this article

Cite this article

Eisenack, K. The Inefficiency of Private Adaptation to Pollution in the Presence of Endogenous Market Structure. Environ Resource Econ 57, 81–99 (2014). https://doi.org/10.1007/s10640-013-9667-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-013-9667-6