Abstract

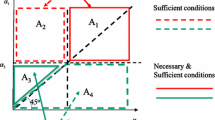

Recent literature has investigated whether the welfare gains from environmental taxation are larger or smaller in a second-best setting than in a first-best setting. This question has mainly been addressed indirectly, by asking whether the second-best optimal environmental tax is higher or lower than the first-best Pigouvian rate. Even this indirect question has itself been approached indirectly, comparing the second-best optimal environmental tax to a proxy for its first-best value, marginal social damage (MSD). On closer examination, however, MSD becomes ambiguously defined and variable in a second-best setting making it an unreliable proxy for the Pigouvian rate. Given these observations, the current analysis reevaluates these welfare questions and finds that when compared directly to its first-best value, the second-best optimal environmental tax generally rises with increased revenue requirements. Even in cases where the second-best environmental tax is lower than its first-best value, the welfare gains may be greater than in a first-best setting. These results suggest that the marginal fiscal benefit (revenue recycling effect) exceeds the marginal fiscal cost (tax base effect) over a range of environmental tax rates that, for benchmark models, extends above the first-best Pigouvian rate. These findings reinforce the intuition that environmental policy complements rather than competes with the provision of other public goods.

Similar content being viewed by others

References

Auerbach AJ, Hines JR Jr (2002) Taxation and economic efficiency. In: Auerbach AJ, Feldstein M (eds) Handbook of public economics, vol 3. Elsevier, Amsterdam

Boadway R, Tremblay J (2008) Pigouvian taxation in a Ramsey world. Asia Pac J Account Econ 15(3): 183–204

Bovenberg AL, de Mooij RA (1994) Environmental levies and distortionary taxation. Am Econ Rev 94(4): 1085–1089

Bovenberg AL, Goulder LH (1996) Optimal environmental taxation in the presence of other taxes: general equilibrium analysis. Am Econ Rev 86(4): 985–1000

Bovenberg AL, Goulder LH (2002) Environmental taxation and regulation. In: Auerbach AJ, Feldstein M (eds) Handbook of public economics, vol 3, pp 1471–1545

Bovenberg AL, van der Ploeg F (1994) Environmental policy, public finance and the labour market in a second-best world. J Public Econ 55(3): 349–390

Browning EK (1987) On the marginal welfare cost of taxation. Am Econ Rev 77(1): 11–23

Cremer H, Gahvari F (2001) Second-best taxation of emissions and polluting goods. J Public Econ 80(2): 169–197

Cremer H, Gahvari F, Ladoux N (1998) Externalities and optimal taxation. J Public Econ 70(3): 343–364

Diamond PA (1985) A many-person Ramsey tax rule. J Public Econ 4(4): 335–342

Fullerton D (1997) Environmental levies and distortionary taxation: comment. Am Econ Rev 87(1): 245–251

Goulder LH, Parry IW, Williams RC III, Burtraw D (1999) The cost-effectiveness of alternative instruments for environmental protection in a second-best setting. J Public Econ 72(3): 329–360

Howarth RB (2005) The present value criterion and environmental taxation: the sub-optimality of first-best decision rules. Land Econ 81(3): 321–336

Jaeger WK (2002) Carbon taxation when climate affects productivity. Land Econ 78(3): 354–367

Jaeger WK (2004) Optimal environmental taxation from society’s perspective. Am J Agric Econ 86(3): 805–812

Lee DR, Misiolek WS (1986) Substituting pollution taxation for general taxation: some implications for efficiency in pollution taxation. J Environ Econ Manag 13(4): 228–247

Orosel GO, Schöb R (1996) Internalizing externalities in second-best tax systems. Public Finance 51: 242–257

Parry IWH (1995) Pollution taxes and revenue recycling. J Environ Econ Manag 29(3): 564–577

Parry IWH, Bento A (2002) Revenue recycling and the welfare effects of road pricing. Scand J Econ 103: 645–671

Parry IWH, Oates WE (2000) Policy analysis in the presence of distorting taxes. J Policy Anal Manag 19(4): 603–613

Pearce D (1991) The role of carbon taxes in adjusting to global warming. Econ J 101: 938–948

Ramsey FP (1927) A contribution to the theory of taxation. Econ J 37: 47–61

Sandmo A (1975) Optimal taxation in the presence of externalities. Swed J Econ 77(1): 86–98

Sandmo A, Dreze JH (1971) Discount rates for public investment in closed and open economies. Economica 38(152): 395–412

Schöb R (1996) Evaluating tax reforms in the presence of externalities. Oxford Econ Papers 48(4): 537–555

Schwartz J, Repetto R (2000) Nonseparable utility and the double dividend debate: reconsidering the tax-interaction effect. Environ Resour Econ 15: 149–157

Terkla D (1984) The efficiency value of effluent tax revenues. J Environ Econ Manag 11(2): 107–123

Tullock G (1967) Excess benefit. Water Resour Res 3(2): 643–644

van der Ploeg F, Bovenberg AL (1994) Environmental policy, public goods and the marginal cost of public funds. Econ J 104: 444–454

Viscusi WK (1993) The value of risks to life and health. J Econ Lit 31(4): 1912–1946

Williams RC III (2001) Tax normalizations, the marginal cost of funds, and optimal environmental taxes. Econ Lett 71: 137–142

Williams RC III (2002) Environmental tax interactions when pollution affects health or productivity. J Environ Econ Manag 44(2): 261–270

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jaeger, W.K. The Welfare Effects of Environmental Taxation. Environ Resource Econ 49, 101–119 (2011). https://doi.org/10.1007/s10640-010-9426-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-010-9426-x