Abstract

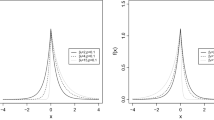

This paper studies the application of extreme value statistics (EVS) theory on analysis for stock data, based on interior penalty function algorithm and Bootstrap methods. The generalized Pareto distribution (GPD) models are considered in analyzing the closing price data of Shanghai stock market. The maximum likelihood estimates (MLEs) are obtained by using the interior penalty function algorithm. Correspondingly, the bias and standard errors of MLEs, and the hypothesis test on the shape parameter are concerned through Bootstrap methods. Some simulations are performed to demonstrate the efficacy of parameter estimation and the power of the test. The estimates of the tail index in this paper are compared with those obtained via classical methods. At last, the model is diagnosed by numerical and graphical methods and the Value-at-Risk (VaR) is estimated.

Similar content being viewed by others

References

Anderson T. W. (1971) The statistical analysis of time series. Wiley, New York

Angus J. E. (1993) Asymptotic theory for bootstrapping the extremes. Communications in Statistics: Theory and Methods 22: 15–30

Auslender A. (1999) Penalty and barrier methods: A unified framework. SIAM Journal on Optimization 10: 211–230

Balkema A. A., de Haan L. (1974) Residual lifetime at great age. Annals of Probability 2: 792–804

Box G. E. P., Jenkins G. M. (1976) Time series analysis: Forecasting and control. Holden-Day, San Francisco, USA, p 575

Castillo E., Hadi A. S. (1997) Fitting the generalized Pareto distribution to data. Journal of the American Statistical Association 92: 1609–1620

Clauset A., Shalizi C. R., Newman M. E. J. (2009) Power-law distributions in empirical data. SIAM Review 51(4): 661–703

Coles S. (2001) An introduction to statistical modeling of extreme values. Springer-Verlag, London

Danielsson J., de Haan L., Peng L., de Vries C. G. (2001) Using a bootstrap method to choose the sample fraction in tail index estimation. Journal of Multivariate Analysis 76: 226–248

Davison A. C. (1984) Modeling excesses over high thresholds, with an application. In: Tiago de Oliveira J. (Ed.) Statistical extremes and applications. Reidel, Dordrecht, pp 461–482

Davison A. C., Smith R. L. (1990) Models for exceedances over high thresholds (with discussion). Journal of the Royal Statistical Society B 52: 393–442

de Haan L., Ferreira A. (2006) Extreme value theory: An introduction. Springer, New York

de Haan L., Peng L. (1998) Comparison of tail index estimators. Statistica Nederlandica 52(1): 60–70

Dekkers A. L. M., Einmahl J. H. J., de Haan L. (1989) A moment estimator for the index of an extreme value distribution. Annals of Statistics 17: 1833–1855

Di Pillo G., Grippo L. (1989) Exact penalty functions in constrained optimization. SIAM Journal on Control and Optimization 27: 1333–1360

Drees H., Kaufmann E. (1998) Selecting the optimal sample fraction in univariate extreme value estimation. Stochastic Processes and their Applications 75(2): 149–172

Efron B., Tibshirani R. J. (1993) An introduction to the bootstrap. Chapman & Hall, New York

Embrechts P., Kluppelbern C., Mikosch T. (1997) Modelling extreme events for insurance and finance. Springer, New York

Eremin I. I. (1971) The penalty method in convex programming. Cybernetics 3: 53–56

Fan J. Q., Yao Q. W. (2003) Nonlinear time series: Nonparametric and parametric methods. Springer-Verlag, New York

Fisher R. A., Tippet L. H. C. (1928) Limiting forms of the frequency distributions of the largest or smallest member of a sample. Proceedings of the Cambridge Philosophical Society 24: 180

Gnedenko B. V. (1943) Sur la distribution limite du terme maximum d’un serie aleatoire. Annals of Mathematics 44: 423

Hall P. (1990) Using the bootstrap to estimate means squared error and select smoothing parameter in nonparametric problems. Journal of Multivariate Analysis 32: 177–203

Hill B. M. (1975) A simple general approach to inference about the tail of a distribution. Annals of Statistics 3: 1163–1174

Hosking J. R. M. (1984) Testing whether the shape parameter is zero in the generalized extreme value distribution. Biometrika 71: 367–374

Hosking J. R. M., Wallis J. R. (1987) Parameter and quantile estimation for the generalized Pareto distribution. Technometrics 29: 339–349

Hosking J. R. M., Wallis J. R., Wood E. F. (1985) Estimation of the generalized extreme-value distribution by the method of probability-weighted moments. Technometrics 27: 251–261

Jansen D. W., de Vries C. G. (1991) On the frequency of large stock returns:putting booms and busts into perspective. The Review of Economics and Statistics 73(1): 18–24

Kearns P., Pagan A. (1997) Estimating the density tail index for financial time series. The Review of Economics and Statistics 79(2): 171–175

Kedem B., Fokianos K. (2002) Regression models for time series analysis. Wiley, New York

McNeil A. J., Frey R., Embrechts P. (2005) Quantitative risk management: Concepts, techniques and tools. Princeton University Press, Princeton

Pickands J. (1975) Statistical inference using extreme order statistics. The Annals of Statistics 3(1): 119–131

Rasmussen P. F. (2001) Generalized probability weighted moments: application to the generalized Pareto distribution. Water Resources Research 37(6): 1745–1751

Smith R. L. (1985) Maximum likelihood estimation in a class of non-regular cases. Biometrika 72: 67–90

Zangwill W. (1963) Non-linear programming via penalty functions. Management Science 13: 344–358

Zhang J. (2007) Likelihood moment estimation for the generalized Pareto distribution. Australian & New Zealand Journal of Statistics 49(1): 69–77

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Huang, C., Lin, JG. & Ren, YY. Statistical Inferences for Generalized Pareto Distribution Based on Interior Penalty Function Algorithm and Bootstrap Methods and Applications in Analyzing Stock Data. Comput Econ 39, 173–193 (2012). https://doi.org/10.1007/s10614-011-9256-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-011-9256-0