Abstract

The option pricing ability of Robust Artificial Neural Networks optimized with the Huber function is compared against those optimized with Least Squares. Comparison is in respect to pricing European call options on the S&P 500 using daily data for the period April 1998 to August 2001. The analysis is augmented with the use of several historical and implied volatility measures. Implied volatilities are the overall average, and the average per maturity. Beyond the standard neural networks, hybrid networks that directly incorporate information from the parametric model are included in the analysis. It is shown that the artificial neural network models with the use of the Huber function outperform the ones optimized with least squares.

Similar content being viewed by others

References

Ackert, L.F. and Tian, Y.S. (2001). Efficiency in index option markets and trading in stock baskets. Journal of Banking and Finance, 25, 1607–1634.

Andersen, T.G., Benzoni, L. and Lund, J. (2002). An empirical investigation of continuous-time equity return models. Journal of Finance, 57(3), 1239–1276.

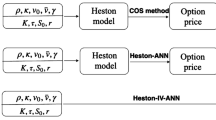

Andreou, P.C., Charalambous, C. and Martzoukos, S.H. (2005). Pricing and trading European options by combining artificial neural networks and parametric models with implied parameters. To be published in the European Journal of Operational Research.

Bakshi, G., Cao, C. and Chen, Z. (1997). Empirical performance of alternative options pricing models. Journal of Finance, 52(5), 2003–2049.

Bakshi, G., Cao, C. and Chen, Z. (2000). Pricing and hedging long-term options. Journal of Econometrics, 94, 277–318.

Bandler, W.J., Chen, H.S., Biernacki, M.R., Gao, L. and Madsen, K. (1993). Huber optimization of circuits: A robust approach. IEEE Transactions on Microwave Theory and Techniques, 41(12), 2279–2287.

Bates, D.S. (1991). The Crash of '87: Was it expected? The evidence from options markets. Journal of Finance, 46(3), 1009–1044.

Bates, D.S. (1996). Jumps and stochastic volatility: Exchange rate processes implicit in Deutsche mark options. The Review of Financial Studies, 9(1), 69–107.

Bates, D.S. (1996b). Testing Option Pricing Models. In G.S. Maddala and C.R. Rao, (eds.), Statistical Methods in Finance (Handbook of Statistics, v. 14). Amsterdam, Elsevier, 567–611.

Bates, D.S. (2003). Empirical option pricing: A retrospection. Journal of Econometrics, 116, 387–404.

Bishop, M.C. (1995). Neural Networks for Pattern Recognition. Oxford University Press.

Black, F. and Scholes, M. (1972). The valuation of option contracts and a test of market efficiency. The Journal of Finance, 27, 399–417.

Black, F. and Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81, 637–654.

Black, F. and Scholes, M. (1975). Fact and fantasy in the use of options. The Financial Analysts Journal, 31, 36–41 and 61–72.

Canica, L. and Figlewski, S. (1993). The informational content of implied volatility. The Review of Financial Studies, 6(3), 659–681.

Chang, W.X. (2005). Computation of Huber's M-estimated for a block-angular regression problem. Forthcoming in the Computational Statistics & Data Analysis.

Chiras, D.P. and Manaster, S. (1978). The informational content of option prices and a test of market efficiency. Journal of Financial Economics, 6, 213–234.

Cont, R. and Fonseca, J. (2002). Dynamics of implied volatility surfaces. Quantitative Finance, 2, 45–60.

Cybenko, G. (1989). Approximation by superpositions of a sigmoidal function. Mathematics of Control, Signal and Systems, 2, 303–314.

Day, T.E. and Lewis, C.M. (1988). The behavior of the volatility implicit in the prices of stock index options. Journal of Financial Economics, 22, 103–122.

Devabhaktuni, V., Yagoub, M.C.E., Fang, Y., Xu, J. and Zhang, Q.J. (2001). Neural networks for microwave modeling: Model development issues and nonlinear modeling techniques. International Journal of RF and Microwave CAE, 11, 4–21.

Dumas, B., Fleming, J. and Whaley, R. (1995). Implied volatility smiles: Empirical tests. Journal of Finance, LIII(6), 2059–2106.

Ederington, L. and Guan, W. (2005). The information frown in option prices. Journal of Banking and Finance, 29(6), 1429–1457.

Franses, H.P., Kloek, T. and Lucas, A. (1999). Outlier robust analysis of long-run marketing effects for weekly scanning data. Journal of Econometrics, 89, 293–315.

Galai, D. (1977). Tests of market efficiency of the Chicago Board Options Exchange. The Journal of Business, 50, 167–197.

Garcia, R. and Gencay, R. (2000). Pricing and hedging derivative securities with neural networks and a homogeneity hint. Journal of Econometrics, 94, 93–115.

Hagan, M.T., Demuth, H. and Beale, M. (1996). Neural Network Design. PWS Publishing Company.

Hagan, M.T. and Menhaj, M. (1994). Training feedforward networks with the Marquardt algorithm. IEEE Transactions on Neural Networks, 5(6) 989–993.

Hampel, F.R., Ronchetti, E.M., Rousseeuw, P.J. and Stahel, P.J. (1986). Robust Statistics: The Approach Based on Influenced Functions. Wiley, New York.

Haykin, S. (1999). Neural Netwroks – A Comprehensive Foundation, 2nd ed., Prentice Hall.

Huber, P. (1981). Robust Statistics. Wiley, New York.

Hutchison, J.M., Lo, A.W. and Poggio, T. (1994). A nonparametric approach to pricing and hedging derivative securities via learning networks. Journal of Finance, 49(3), 851–889.

Jabr, R.A. (2004). Power system Huber M-estimation with equality and inequality constraints. Forthcoming in Electric Power Systems Research.

Kamara, A. and Miller, T.W. (1995). Daily and intradaily tests of put-call parity. Journal of Financial and Quantitative Analysis, 30, 519–539.

Koenker, R. (1982). Robust Methods in Econometrics. Econometric Reviews, 1(2), 213–255.

Krishnakumar, J. and Ronchetti, E. (1997). Robust estimators for simultaneous equations models. Journal of Econometrics, 78, 295–314.

Lajbcygier P., Boek C., Palaniswami, M. and Flitman, A. (1996). Comparing conventional and artificial neural network models for the pricing of options on futures. Neurovest Journali, 4(5), 16–24.

Lajbcygier, P., Flitman, A., Swan, A. and Hyndman, R. (1997). The pricing and trading of options using a hybrid neural network model with historical volatility. Neurovest Journal, 5(1) 27–41.

Latane, H.A. and Rendleman, R.J. Jr. (1976). Standard deviations of stock price ratios implied in option prices. The Journal of Financei, 31(2), 369–381.

Lim, G.C., Lye, J.N., Martin, G.M. and Martin, V.L. (1997). Jump models and higher moments. In J. Creedy, V. L. Martin (eds.), Nonlinear Economic Models. Cross-sectional, Time Series and Neural Networks Applications. Edward Elgar Publishing, Inc., Lyme NH, US.

Long, D.M. and Officer, D.T. (1997). The Relation Between Option Mispricing and Volume in the Black-Scholes Option Model. Journal of Financial Research, XX(1), 1–12.

Lye, J.N. and Martin, V.L. (1993). Robust Estimation, Non-normalities and Generalized Exponential Distributions. Journal of the American Statistical Association, 88 (421), 253–259.

Morgenthaler, S. (1990). Fitting Redescenting M-estimators in Regression. In K.D. Lawrence and J.L. Arthur (eds.) Robust Regression, Dekker, NY. 105–128.

Ortelli, C. and Trojani, F. (2005). Robust efficient method of moments. The Journal of Econometrics, 128(1), 69–97.

Rousseeuw, P. and Yohai, V.J. (1984). Robust Regression by Means of S-estimators. Robust and Nonlinear time series analysis. Lecture Notes in Statistics, 26, 256–272. Springer, NY.

Rubinstein, M. (1985). Nonparametric tests of alternative option pricing models using all reported trades and quotes on the 30 most active CBOE option classes from August 23, 1976 through August 31, 1978. The Journal of Finance, XL, 455–480.

Schittenkopf, C. and Dorffner, G. (2001). Risk-neutral density extraction from option prices: Improved pricing with mixture density networks. IEEE Transactions on Neural Networks, 12(4), 716–725.

Tsay, S.R. (2002). Analysis of Financial Time Series, Wiley Series in Probability and Statistics.

Watson, P. and Gupta, K.C. (1996). EM-ANN models for microstript vias and interconnected in multilayer circuits. IEEE Trans., Microwave Theory and Techniques, 44, 2495–2503.

Whaley, R.E. (1982). Valuation of American call Options on dividend-paying stocks. The Journal of Financial Economics, 10, 29–58.

Xi, C., Wang, F., Devabhaktuni, V.K. and Zhang, J.Q. (1999). Huber optimization of neural networks: A robust training method. International Joint Conference on Neural Networks, 1639–1642.

Yohai, V.J. (1987). High breakdown-point and high efficiency robust estimates for regression. Annals of Statistics, 15 (2), 642–656.

Yao, J., Li, Y. and Tan, C.L. (2000). Option price forecasting using neural networks. The International Journal of Management Science, 28, 455–466.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification: G13, G14

Rights and permissions

About this article

Cite this article

Andreou, P.C., Charalambous, C. & Martzoukos, S.H. Robust Artificial Neural Networks for Pricing of European Options. Comput Econ 27, 329–351 (2006). https://doi.org/10.1007/s10614-006-9030-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-006-9030-x