Abstract

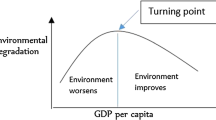

This paper revisits the dynamic relationship between carbon dioxide (CO2) emissions and income growth for the Middle East and North African (MENA) region. There has been a lively debate about the validity of the environmental Kuznets curve (EKC), which postulates the presence of an inverted U-shaped pattern for pollution levels as income increases. Our study proposes a new approach that models the emissions–income nexus without imposing any prior shape on the EKC. Accordingly, we suggest the implementation of a nonlinear panel threshold regression framework in which the change in the dynamics of environmental quality can be modeled endogenously from the data. The empirical results reveal the presence of a threshold effect in CO2 emissions, as the impact of income changes nonlinearly depending on different energy-related variables. We note the role of the energy fuel mix in mitigating emissions as MENA countries switch to low-carbon sources of energy and renewables.

Similar content being viewed by others

Notes

See Ben Cheikh et al. (2018) for a recent discussion.

Including interactions terms between income and other influencing factors into a cubic polynomial model would increase the possibility of multicollinearity issues (see, e.g., Xie et al. 2020). To avert this problem, income-squared and income-cubed variables are excluded from the nonlinear specification, and regime-switching behavior is introduced instead.

See, e.g., Shahbaz and Sinha (2019) for a recent extensive survey of the EKC literature.

See the seminal work by Kraft and Kraft (1978) for an assessment of the linkage within the energy consumption and output nexus.

In line with the pollution haven hypothesis, dirty industries tend to migrate to countries with less stringent environmental standards. In this context, FDI inflows would lead to deteriorating environmental quality in the host country. However, the impact of FDI on environmental quality is still controversial, as it may also result in the increased use of clean energy. Tamazian et al. (2009) reported that FDI helps enterprises to promote technology innovation and adopt new technologies, thus increasing energy efficiency and advancing low-carbon economic growth. In the same vein, Lee (2013) found that FDI has played an important role in reducing the impact of economic growth on CO2 emissions for the G20 economies.

Different indicators of financial development have been used in the literature, such as total credit, domestic credit to the private sector, domestic credit provided by the banking sector, and stock market capitalization. To avoid the multicollinearity issue, Shahbaz et al. (2016) employed principal component analysis (PCA) to construct a financial development index based on banking sector and stock market measures.

Lower-case letters are used here to reflect logarithms.

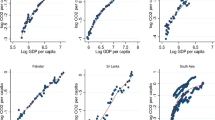

Lee et al. (2009) showed that an inverted U-shaped EKC is found when using a quadratic specification and an N-shaped curve is found when using a cubic form.

Moreover, the introduction of quadratic and cubic income variables into the empirical specification would entail a multicollinearity issue (see, e.g., Jaunky 2011; Demena and Afesorgbor 2020). For the case of our panel data of 12 MENA countries, the pairwise correlation coefficients are equal to 0.956 and 0.926 for income/income squared and income/income cubed, respectively.

Energy intensity is an indication of how much energy is used to produce one unit of economic output, where a lower ratio indicates less energy used.

See Hansen (1999) for further details on testing and estimation procedure of PTR models.

In our sample of MENA countries, Algeria, Bahrain, Egypt, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE are considered net oil-exporting countries while Jordan, Lebanon, Morocco, and Tunisia are net oil-importing countries.

Oil rent data are not displayed for Jordan and Morocco as the ratios are very low (below zero) and do not appear in Fig. 1.

Using the nonlinear autoregressive distributed lag (NARDL) approach, Shahbaz et al. (2021) found an asymmetric long-term impact on CO2 emissions for the Indian economy. Due to its dependence on fossil fuel-based energy consumption and imported crude oil, the authors pointed out that the prevailing growth pattern in the country is environmentally unsustainable.

For a sample of MENA countries, Magazzino (2019) tested the stationarity and convergence of CO2 emissions series using univariate unit root tests. The author found that the relative per capita CO2 emissions series is stationary in ten countries.

We conduct the Hausman specification test, which suggests a preference for the fixed-effect model, as the null hypothesis of random effects is strongly rejected. The results of the Hausman test are available on request but not reported here due to space constraints.

In line with the general-to-specific approach, it is recommended to start with a general specification that includes all the moderator variables and then reduce to a specific model by systematically removing the nonsignificant variables from the general model one by one until only significant variables remain (see, e.g., Stanley and Doucouliagos 2012).

The energy mix in the MENA countries relies heavily on fossil fuels, particularly oil (45%) and natural gas (47%), with a minor share belonging to coal (5%). Renewables accounted for the remaining 3% in 2015 (see Menichettti et al. 2018).

References

Acheampong AO (2018) Economic growth, CO2 emissions and energy consumption: what causes what and where? Energy Econ 74:677–692

Ahmed Qahtan AS, Xu H, Abdo A (2021) Stochastic convergence of disaggregated energy consumption per capita and its catch-up rate: an independent analysis of MENA net oil-exporting and importing countries. Energy Policy. https://doi.org/10.1016/j.enpol.2021.112151

Ang J (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35:4772–4778

Arouri MH, Ben Youssef A, M’henni H, Rault C (2012) Energy consumption, economic growth and CO2 emissions in Middle East and north African countries. Energy Policy 45:342–349

Baek J (2016) A new look at the FDI–income–energy–environment nexus: dynamic panel data analysis of ASEAN. Energy Policy 91:22–27

Baek J, Cho Y, Koo WW (2009) The environmental consequences of globalization: a country-specific time-series analysis. Ecol Econ 68:2255–2264

Baumert KA, Herzog T, Pershing J (2005) Navigating the numbers: greenhouse gas data and international climate change policy. WRI report. World Resources Institute, Washington, D.C.

Bellakhal R, Ben Kheder S, Haffoudhi H (2019) Governance and renewable energy investment in MENA countries: how does trade matter? Energy Econ. https://doi.org/10.1016/j.eneco.2019.104541

Ben Cheikh N, Ben Naceur S, Kanaa O, Rault C (2018) Oil prices and GCC stock markets: new evidence from smooth transition models. IMF working paper no. 18/98

Ben Cheikh N, Ben Zaied Y, Chevallier J (2021) On the nonlinear relationship between energy use and CO2 emissions within an EKC framework: evidence from panel smooth transition regression in the MENA region. Res Int Bus Financ. https://doi.org/10.1016/j.ribaf.2020.101331

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energy 139:198–213

De Bruyn SM, van den Bergh JC, Opschoor JB (1998) Economic growth and emissions: reconsidering the empirical basis of environmental Kuznets curves. Ecol Econ 25(2):161–175

Demena BA, Afesorgbor SK (2020) The effect of FDI on environmental emissions: evidence from a meta-analysis. Energy Policy. https://doi.org/10.1016/j.enpol.2019.111192

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49:431–455

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676

Fodha M, Zaghdoud O (2010) Economic growth and pollutant emissions in Tunisia: an empirical analysis of the environmental Kuznets curve. Energy Policy 38(2):1150–1156

Granger CWJ, Teräsvirta T (1999) A simple nonlinear time series model with misleading linear properties. Econ Lett 62:161–165

Hansen BE (1999) Threshold effects in non-dynamic panels: estimation, testing, and inference. J Econ 93:345–368

Holtz-Eakin D, Selden TM (1995) Stoking the fires? CO2 emissions and economic growth. J Public Econ 57(1):85–101

Im KS, Pesaran H, Shin Y (2003) Testing for unit roots in heterogenous panels. J Econ 115:53–74

Jaunky VC (2011) The CO2 emissions–income nexus: evidence from rich countries. Energy Policy 39:1228–1240

Koop G, Potter SM (2000) Nonlinearity, structural breaks or outliers in economic time series? In: Barnett WA, Hendry DF, Hylleberg S, Teräsvirta T, Tjostheim D, Wurtz AH (eds) Nonlinear econometric modeling in time series analysis. Cambridge University Press, Cambridge

Kraft J, Kraft A (1978) On the relationship between energy and GNP. J Energy Dev 3:401–403

Lee WL (2013) The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 55:483–489

Lee CC, Chiu YB, Sun CH (2009) Does one size fit all? A reexamination of the environmental Kuznets curve using the dynamic panel data approach. Rev Agric Econ 31(4):751–778

Lorente DB, Álvarez-Herranz A (2016) Economic growth and energy regulation in the environmental Kuznets curve. Environ Sci Pollut Res 23(16):16478–16494

Magazzino C (2015) Economic growth, CO2 emissions, and energy use in Israel. Int J Sustain Dev World Ecol 22(1):89–97. https://doi.org/10.1080/13504509.2014.991365

Magazzino C (2016) The relationship between real GDP, CO2 emissions and energy use in the GCC countries: a time-series approach. Cogent Econ Financ 4(1). https://doi.org/10.1080/23322039.2016.1152729

Magazzino C (2019) Testing the stationarity and convergence of CO2 emissions series in MENA countries. Int J Energy Sect Manag 13(4):977–990

Magazzino C, Cerulli G (2019) The determinants of CO2 emissions in MENA countries: a responsiveness scores approach. Int J Sustain Dev World Ecol 26(6):522–534

Mehrara M (2007) Energy consumption and economic growth: the case of oil exporting countries. Energy Policy 35:2939–2945

Menichettti E, El Gharras A, Duhamel B, Karbuz S (2018) The MENA region in the global energy markets. MENARA working paper no. 21

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Pesaran H (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94:621–634

Richmond AK, Kaufman RK (2006) Is there a turning point in the relationship between income and energy use and/or carbon emissions? Ecol Econ 56:176–189

Shahbaz M, Sinha A (2019) Environmental Kuznets curve for CO2 emissions: a literature survey. J Econ Stud 46(1):106–168

Shahbaz M, Shahzad JH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Shahbaz M, Balsalobre-Lorente D, Sinha A (2019) Foreign direct investment–CO2 emissions nexus in Middle East and North African countries: importance of biomass energy consumption. J Clean Prod 217:603–614

Shahbaz M, Sharma R, Sinha A, Jiao Z (2021) Analyzing nonlinear impact of economic growth drivers on CO2 emissions: designing an SDG framework for India. Energy Policy. https://doi.org/10.1016/j.enpol.2020.111965

Soytas U, Sari R, Ewing T (2007) Energy consumption, income, and carbon emissions in the United States. Ecol Econ 62:482–489

Stanley TD, Doucouliagos H (2012) Meta-regression analysis in economics and business. Routledge, Oxford

Stern DI (2004) The rise and the fall of environmental Kuznets curve. World Dev 32(8):1419–1439

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation? Evidence from BRIC countries. Energy Policy 37:246–253

Timmermann A (2000) Moments of Markov switching models. J Econ 96:75–111

Torras M, Boyce JK (1998) Income, inequality, and pollution: a reassessment of the environmental Kuznets curve. Ecol Econ 25(2):147–160

Westerlund J (2007) Testing for error correction in panel data. Ox Bull Econ Stat 69(6):709–774

Xie Q, Wang X, Cong X (2020) How does foreign direct investment affect CO2 emissions in emerging countries? New findings from a nonlinear panel analysis. J Clean Prod. https://doi.org/10.1016/j.jclepro.2019.119422

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Ben Cheikh, N., Ben Zaied, Y. A new look at carbon dioxide emissions in MENA countries. Climatic Change 166, 27 (2021). https://doi.org/10.1007/s10584-021-03126-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10584-021-03126-9