Abstract

This study addresses interest rate sensitivity of emerging market corporate debt. Previous research suggests that interest rate sensitivity of corporate bonds depends on residual maturity of issues, creditworthiness of issuers, embedded options and other idiosyncratic factors. However, the dependence of interest rate sensitivity on phases of the business cycle has not received an appropriate academic attention. This paper provides empirical evidence and theoretical interpretation of a dichotomy of interest rate sensitivity across the phases of the cycle, and sheds light on how credit spreads respond to interest rates. The historical span of the research covers the period of 2004–2016. The findings imply that hedging interest rate risk ought to be a dynamic process and take into consideration where the economy is positioned in the current business cycle. This research provides important insights on the nature of interest rate sensitivity, capable of enhancing financial stability and improving efficiency of financial system.

Similar content being viewed by others

Change history

15 March 2021

A Correction to this paper has been published: https://doi.org/10.1007/s10479-021-04009-z

References

Ahi, E., Akgiray, V., & Sener, E. (2018). Robust term structure estimation in developed and emerging markets. Annals of Operations Research, 260, 23–49. https://doi.org/10.1007/s10479-016-2282-5.

Alfaro, L., Chari A., Asis, G., & Panizza, U. (2017). Lessons unlearned? Corporate debt in emerging markets. NBER Working Papers 23407, National Bureau of Economic Research, Inc. Retrieved June 18, 2020, from https://ideas.repec.org/p/nbr/nberwo/23407.html.

Bank for International Settlements. (2016). Debt securities data base. http://www.bis.org/statistics/secstats.htm.

Bauer, M., & Hamilton, J. (2015). Robust Bond Risk Premia. NBER Working Paper 23480, National Bureau of Economic Research, Inc. Retrieved May 13, 2018, from https://www.frbsf.org/economic-research/files/wp2015-15.pdf.

Bellalah, M., Hakim, A., Si, K., & Zhang, D. (2020). Long term optimal investment with regime switching: Inflation, information and short sales. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03692-8.

Bessis, J. (2015). Risk management in banking (4th ed.). New York: Wiley Publishers.

Beutler, T., Bichsel, R., Bruhin, A., & Danton, J. (2017). The impact of interest rate risk on bank lending. Working Papers 2017–04, Swiss National Bank. Retrieved April 11, 2018, from https://www.snb.ch/n/mmr/reference/working_paper_2017_04/source/working_paper_2017_04.n.pdf.

Bhaumik, S., Kutan, A. M., & Majumdar, S. (2017). How successful are banking sector reforms in emerging market economies? Evidence from impact of monetary policy on levels and structures of firm debt in India. The European Journal of Finance, 24(12), 1047–1062. https://doi.org/10.1080/1351847X.2017.1391857.

Boulkeroua, M., & Stark, A. (2013). On the determinants of the sensitivity of the yield spread of corporate bonds to changes in the level and slope of the yield curve. In N. Apergis (Ed.), Proceedings of the IV World Finance conference (pp. 118–167).

Chow, G. (1960). Tests of equality between sets of coefficients in two linear regressions. Econometrica, 28(3), 591–605.

Dupoyet, B., Jiang, X., & Zhang, Q. (2018). A new take on the relationship between interest rates and credit spreads. Working paper of Florida International University. Retrieved March 5, 2019, from http://faculty.fiu.edu/~dupoyetb/credit_spreads_heteroskedasticity.pdf.

Fong, H., & Vasicek, O. (2015). A risk minimizing strategy for portfolio immunization. In O. Vasicek (Ed.), Finance, economics and mathematic (pp. 195–202). New York: Wiley.

Gubareva, M. (2014). Financial instability through the prism of flight-to-quality. Saarbrücken: Lambert Academic Publishing.

Gubareva, M., & Borges, M. (2016). Typology for flight-to-quality episodes and downside risk measurement. Applied Economics, 48(10), 835–853. https://doi.org/10.1080/00036846.2015.1088143.

Gubareva, M., & Borges, M. (2017a). Interest rate, liquidity, and sovereign risk: derivative-based VaR. The Journal of Risk Finance, 18(4), 443–465. https://doi.org/10.1108/JRF-01-2017-0018.

Gubareva, M., & Borges, M. (2017b). Binary interest rate sensitivity of emerging markets corporate bonds. The European Journal of Finance, 24(17), 1569–1586. https://doi.org/10.1080/1351847X.2017.1400452.

Gubareva, M., & Borges, M. (2018). Rethinking economic capital management through the integrated derivative-based treatment of interest rate and credit risk. Annals of Operations Research, 266(1–2), 71–100. https://doi.org/10.1007/s10479-017-2438-y.

Hainaut, D., Shen, Y., & Zeng, Y. (2018). How do capital structure and economic regime affect fair prices of bank’s equity and liabilities? Annals of Operations Research, 262, 519–545. https://doi.org/10.1007/s10479-016-2210-8.

Kamin, S. A., & Kleist, K. V. (1999). The evolution and determinants of emerging markets credit spreads in the 1990s. Working Paper No. 68. Bank of International Settlements. Retrieved May 14, 2018, from https://www.bis.org/publ/work68.pdf.

Merton, R. C. (1974). On the pricing of corporate debt: The risk structure of interest rates. Journal of Finance, 29, 449–470.

Muthuramu, P., & Maheswari, T. (2019). Tests for structural breaks in time series analysis: A review of recent development. Shanlax International Journal of Economics, 7(4), 66.

Neal, R., Rolph, D., Dupoyet, B., & Jiang, X. (2015). Interest rates and credit spread dynamics. The Journal of Derivatives, 23(1), 25–39. https://doi.org/10.3905/jod.2015.23.1.025.

Piazzesi, M., & Schneider, M. (2010). Interest rate risk in credit markets. American Economic Review, 100(2), 579–584. https://doi.org/10.1257/aer.100.2.579.

Sensoy, A., Nguyen, D. K., Rostom, A., & Hacihasanoglu, E. (2019). Dynamic integration and network structure of the EMU sovereign bond markets. Annals of Operations Research, 281, 297–314. https://doi.org/10.1007/s10479-018-2831-1.

Shen, C., Ren, J., Huang, Y., Shi, J., & Wang, A. (2018). Creating financial cycles in China and interaction with business cycles on the Chinese economy. Emerging Markets Finance and Trade, 54(13), 2897–2908. https://doi.org/10.1080/1540496X.2017.1369402.

Yasuoka, T. (2017). Correlations between the market price of interest rate risk and bond yields. Journal of Reviews on Global Economics, 6, 208–217. https://doi.org/10.6000/1929-7092.2017.06.19.

Acknowledgements

Maria Rosa Borges: UECE (Research Unit on Complexity and Economics) is financially supported by FCT (Fundação para a Ciência e a Tecnologia), Portugal. This article is part of the Strategic Project (UIDB/05069/2020). Mariya Gubareva: The author thankfully acknowledges the research support by FCT (Fundação para a Ciência e a Tecnologia), under the Project UIDB/04521/2020. The article was prepared within the framework of the Basic Research Program at HSE University.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Robustness checks

This part of our research is dedicated to the robustness checks performed to certify the fairness and similarity of our results, which were obtained using different assumptions regarding the shape of the modeled yield curves. We assess whether our results are fairly robust by reshaping the UST and EM corporate yield term structures, i.e., we relax our model flat-curve assumption employed for simplicity reasons in our calculations, by using instead the assumption of linearly-sloped term structures for the analyzed risk-free and risky asset portfolios.

We present below a comparative analysis of the annual capital gain-wise sensitivities obtained under the different assumptions for the yield curve. The upward-sloping, i.e., positive slope curves are obtained by adopting the pro rata temporis interpolation of yield values between zero and 5Y point of the respective yield term structure, while the downward-sloping, i.e., negative-slope curves represent their reflections mirrored vertically through the 5Y yield level. They decay downwards with maturity, reaching a flat yield level at the 5Y point.

Table 4 shows the comparison between the UST capital gains, the EMIG capital gains, and sensitivity values obtained for the pre-crisis period for the three above-mentioned cases: (i) flat curve (taken from Table 1); (ii) upward-sloping curve, and; (iii) downward-sloping curve. The results for the two latter cases are specifically calculated for this robustness check exercise. As can be seen in Table 4, in the case of the pre-crisis period, both the upward-sloping and downward-sloping term structures result in similar outcomes to those obtained under the flat curves assumption. The average endurance-times-amplitude weighted sensitivities figures of 0.965 for the flat curve, 0.956 for the positive slope, and 0.969 for the negative slope, are remarkably similar for the reasons explained in Sect. 2 of the main body of this paper.

Table 5, relative to the through-the-crisis period, shows that both the upward-sloping and downward-sloping shapes of term structures result in quite similar outcomes to those obtained under the flat curves assumption. The average endurance-times-amplitude weighted sensitivities figures, − 0.526 for flat curves, − 0.537 for positive slope, and − 0.514 for negative slope, are also approximately the same, similar to the situation observed for the pre-crisis period.

Table 6, relative to the post-crisis period, shows that both the upward-sloping and downward-sloping shapes of term structures once again result in similar outcomes to those obtained under the flat curves assumption. The average endurance-times-amplitude weighted sensitivities figures are, 0.575 for flat curves, 0.561 for positive slope, and 0.586 for negative slope—which are also in very close proximity to each other.

Table 7 provides a comparison between the endurance-times-amplitude weighted sensitivities averaged along the different phases for the three shapes of term structures discussed above.

Table 7 evidences the robustness of both our quantitative outcomes and qualitative conclusions, under different parameter choices. The signs of the sensitivities for all the three studied periods do not depend on the term-structure assumptions. The percentage differences in amplitude, i.e., in absolute value of sensitivity coefficient, always remain below the 2.5% mark. In summary, Table 7 shows that, subject to reasonable diverse assumptions, our conclusions remain robust across the three sub-periods.

Moreover, the advantage of our capital gains and yield-based approach is that it enables us to reach robust conclusions regarding the quantitative magnitude of IR sensitivities, even without having an exact knowledge of the yield term structures. In other words, these robustness checks corroborate that the proposed methodology enables robust conclusions to be drawn concerning the capital gains and IR sensitivity of assets under diverse model choices of term structure profiles.

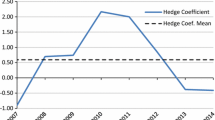

Appendix B: Clustering approach to split the pre-crisis, crisis, and post-crisis periods

A statistical analysis, similar to structural break tests, is performed to study the homogeneity of the observed sample of the 71 capital-gain wise sensitivities (see Tables 1, 2, 3 of the main body of the paper), which correspond to the 71 identified time-intervals, grouped in their turn into three sub periods: pre-crisis, through-the-crisis, and post-crisis. Instead of an arbitrary choice of the sub-periods, we solve the problem of identifying the regime switching, i.e., splitting the whole sample into the three above-mentioned subsamples, by employing a clustering approach, based on minimization of standard deviation (see Gubareva and Borges 2016).

First, we divide the whole sample into two subsamples, using a clustering approach, based on standard deviation minimization. In other words, we arrange the sensitivities in a chronological order and vary a number of major UST capital gain moves in the subsamples from 1 to 70, i.e., we vary the final date of one trial subsample, which is, in effect, just the initial date of the other subsample. For each of the 70 divisions of the whole spectrum of arrays, the combined standard deviation of sensitivities is calculated in such a way that, instead of calculating the whole sample average, the respective averages of sub-arrays are used to calculate the deviation of each sensitivity value according to its positioning in one of the sub-arrays.

Figure 7 shows the combined standard deviation as a function of the date used to separate time interval into two trial sub-intervals. The behavior of the combined standard deviation shown in Fig. 7 presents the two major local minima, whose dates, namely July 13, 2007 and April 03, 2013, separate the whole sample into the three most homogeneous subsamples.

As a sanity check, we perform the refined calculations of the standard deviation combined from the three sample-as-stand-alone standard deviation values. For instance, as the sub-array border between the first and the second sub-arrays occurs on July 13, 2007, changing the quantity of the constituent time intervals between the first and the second sub-arrays in − 1, 0, and 1, results, respectively, in the following combined standard deviation values: 1.30, 1.29, and 1.30. Similarly, as the sub-array border between the second and the third sub-arrays occurs on April 03, 2013, changing the quantity of the constituent time intervals between the second and the third sub-arrays in − 1, 0, and 1, results, respectively, in the following combined standard deviation values: 1.31, 1.29, and 1.30. Thus, the three statistically selected sub-arrays, with sub-array borders on July 13, 2007 and April 03, 2013 are reconfirmed, which, in fact, represent the most homogeneous sub-samples of sensitivity values, resulting in the minimum possible combined standard deviation of 1.29.

Rights and permissions

About this article

Cite this article

Gubareva, M., Borges, M.R. Governed by the cycle: interest rate sensitivity of emerging market corporate debt. Ann Oper Res 313, 991–1019 (2022). https://doi.org/10.1007/s10479-021-03972-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-03972-x

Keywords

- Fixed income

- Downside risk management

- Emerging markets

- Corporate debt

- Interest rate sensitivity

- Capital gains