Abstract

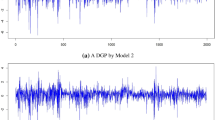

This study considers the problem of testing whether the tail index of the GARCH innovations undergoes a change according to the values of conditional volatilities. Special attention is paid to power-transformed and threshold generalized autoregressive conditional heteroscedasticity processes that can accommodate the GARCH family. We show that the proposed test asymptotically follows a functional of a standard Brownian motion under some regularity conditions. To evaluate our method, we carry out a simulation study and real data analysis using the return series of the Google stock price and DowJones index.

Similar content being viewed by others

References

Berkes, I., Horváth, L. (2004). The efficiency of the estimators of the parameters in GARCH processes. The Annals of Statistics, 32, 633–655.

Billingsley, P. (1968). Convergence of probability measures. New York: Wiley.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31, 307–327.

Bollerslev, T. (1987). A conditionally heteroskedastic time series model for speculative prices and rates of return. Review of Economic Statistics, 31, 542–547.

Bougerol, P., Picard, N. (1992). Stationarity of GARCH processes and of some nonnegative time series. Journal of Econometrics, 52, 115–127.

Carrasco, M., Chen, X. (2002). Mixing and moment properties of various GARCH and stochastic volatility models. Econometric Theory, 18, 17–39.

Chan, N. H., Deng, S.-J., Peng, L., Xia, Z. (2007). Interval estimation of value-at-risk based on GARCH models with heavy-tailed innovations. Journal of Econometrics, 137, 556–576.

Csörgö, M., Horváth, L. (1997). Limit theorems in change-point analysis (Vol. 18). New York: Wiley.

Deo, C. M. (1973). A note on empirical processes of strong-mixing sequences. The Annals of Probability, 1, 870–875.

Drees, H. (2003). Extreme quantile estimation for dependent data, with applications to finance. Bernoulli, 9, 617–657.

Drees, H., de Haan, L., Resnick, S. (2000). How to make a Hill plot. The Annals of Statistics, 28, 254–274.

Eberlein, E. (1984). Weak convergence of partial sums of absolutely regular sequences. Statistics & Probability Letters, 2, 291–293.

Embrechts, P., Frey, R., McNeil, A. (2005). Quantitative risk management. Princeton series in Finance. Princeton: Princeton University Press.

Engle, R. F., Manganelli, S. (2004). CAViaR: Conditional autoregressive value at risk by regression quantiles. Journal of Business & Economic Statistics, 22, 367–381.

Engle, R. F., Ng, V. K. (1993). Measuring and testing the impact of news on volatility. Journal of Finance, 48, 1749–1778.

Glosten, L. R., Jagannathan, R., Runkle, D. E. (1993). On the relation between the expected value and the volatility of the nominal excess return on stocks. Journal of Finance, 48, 1779–1801.

Hall, P. (1982). On some simple estimates of an exponent of regular variation. Journal of Royal Statistical Society Series B, 44, 37–42.

Hansen, B. E. (1994). Autoregressive conditional density estimation. International Economic Review, 35, 705–730.

Higgins, M. L., Bera, A. K. (1992). A class of nonlinear ARCH models. International Economic Review, 33, 137–158.

Hsing, T. (1991). On tail index estimation using dependent data. The Annals of Statistics, 19, 1547–1569.

Hwang, S., Basawa, I. (2004). Stationarity and moment structure for box-cox transformed threshold GARCH(1,1) processes. Statistics & Probability Letters, 68, 209–220.

Hwang, S., Kim, T. Y. (2004). Power transformation and threshold modeling for ARCH innovations with applications to tests for ARCH structure. Stochastic Processes & Their Applications, 110, 295–314.

Kim, M., Lee, S. (2009). Test for tail index change in stationary time series with Pareto-type marginal distribution. Bernoulli, 15, 325–356.

Kim, M., Lee, S. (2011). Change point test for tail index for dependent data. Metrika, 74, 297–311.

Kim, M., Lee, S. (2016a). Nonlinear expectile regression with application to value-at-risk and expected shortfall estimation. Computational Statistics & Data Analysis, 94, 1–19.

Kim, M., Lee, S. (2016b). On the tail index inference for heavy-tailed GARCH-type innovations. Annals of Institute of Statistical Mathematics, 68, 237–267.

Kim, M., Lee, S. (2016c). Inference for location-scale time series models with ASTD and AEPD innovations. Unpublished manuscript.

Lee, S., Lee, T. (2011). Value-at-risk forecasting based on Gaussian mixture ARMA–GARCH model. Journal of Statistical Computation & Simulation, 81, 1131–1144.

Lee, S., Noh, J. (2013). Quantile regression estimator for GARCH models. Scandinavian Journal of Statistics, 40, 2–20.

Li, C. W., Li, W. K. (1996). On a double-threshold autoregressive heteroscedastic time series model. Journal of Applied Econometrics, 11, 253–274.

Móricz, F. (1983). A general moment inequality for the maximum of the rectangular partial sums of multiple series. Acta Mathematica Hungarica, 41, 337–346.

Nelson, D. B. (1991). Conditional heteroskedasticity in asset returns: A new approach. Econometrica, 59, 347–370.

Pan, J., Wang, H., Tong, H. (2008). Estimation and tests for power-transformed and threshold GARCH models. Journal of Econometrics, 142, 352–378.

Peng, L., Yao, Q. (2003). Least absolute deviations estimation for ARCH and GARCH models. Biometrika, 90, 967–975.

Quintos, C., Fan, Z., Phillips, P. C. B. (2001). Structural change tests in tail behaviour and the Asian crisis. Review of Economic Studies, 68, 633–663.

Tweedie, R. L. (1975). Sufficient conditions for ergodicity and recurrence of Markov chains on a general state space. Stochastic Processes & Their Applications, 3, 385–403.

Zakoian, J.-M. (1994). Threshold heteroskedastic models. Journal of Economic Dynamics Control, 18, 931–955.

Zhu, D., Galbraith, J. W. (2010). A generalized asymmetric Student-t distribution with application to financial econometrics. Journal of Econometrics, 157, 297–305.

Acknowledgements

We thank the Editor, an AE and referee for their careful reading and valuable comments and suggestions. This research is supported by Basic Science Research Program through the National Research Foundation of Korea (NRF) funded by the Ministry of Science, ICT and future Planning (No. 2018R1A2A2A05019433).

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Kim, M., Lee, S. Test for tail index constancy of GARCH innovations based on conditional volatility. Ann Inst Stat Math 71, 947–981 (2019). https://doi.org/10.1007/s10463-018-0669-6

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10463-018-0669-6