Abstract

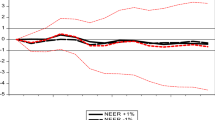

Using the nonlinear ARDL bounds test for cointegration, this empirical study explores the long and the short run asymmetric impact of exchange rate shocks on the demand for money in Turkey from 1986:Q1 to 2014:Q4. Two specifications of money demand have been investigated that reveal that demand for money is explained by the scale and opportunity cost variables as well as the foreign exchange rate which accounts for currency substitution. In particular, the nonlinear ARDL model provides strong proof for asymmetry by using the bootstrap test. Our findings suggest that the response of money demand to a negative shock in exchange rate (appreciation) was stronger than its reaction to a positive shock (depreciation). Thus, individuals should expect further appreciation when Turkish lira appreciates. In addition, based on the dominated effect of inflation expectation caused by the currency depreciation, monetary policy makers should achieve more stable exchange rates to anchor price fluctuations. Furthermore, the findings of stable money demand behaviour emphasizes the important role of money to conduct an efficient monetary policy and achieve price stability.

Similar content being viewed by others

Notes

Autoregressive Distributed Lags

We also tried to use the Turkish discount rate, but it failed to indicate any significant results, therefore supporting the fact that domestic interest rate has an unimportant role in capturing the opportunity cost of holding money in emerging and developing countries.

We further estimate two models of the nonlinear relationship between real money demand and the foreign interest rate and inflation rate. The empirical results of these models do not support the asymmetric impacts of foreign interest rate and inflation rate on the MDF in Turkey.

References

Akcaolayan A, Dommez Atbapy F (2008) How stable is the money demand function in Turkey? The IUP Journal of Applied Economics 7(2):7–18

Akıncı O (2003) Modeling the demand for currency issued in Turkey. Central Bank Review 1:1–25

Akinlo AE (2005) The stability of money demand in Nigeria: an autoregressive distributed lag approach. J Policy Model 28:445–452

Akyurek C, Kutan AM, Yilmazkuday H (2011) Can inflation targeting regimes be effective in developing countries? The Turkish experience. J Asian Econ 22(5):343–355

Alsamara M, Mrabet Z, Dombrecht M, Barkat K (2017a) Asymmetric responses of money demand to oil price shocks in Saudi Arabia: a non-linear ARDL approach. Appl Econ 49(37):3758–3769

Alsamara M, Lanouar C, Mrabet Z (2017b) Money demand and black market exchange rate: a cointegration approach with structural break. Afro-Asian Journal of Finance and Accounting 7(2):177–199

Austin D, Ward B, Dalziel P (2007) The demand for money in China 1987–2004: a non-linear modelling approach. China Econ Rev 18:190–204

Azim Özdemir K, Saygılı M (2013) Economic uncertainty and money demand stability in Turkey. J Econ Stud 40(3):314–333

Bae Y, Jong RM (2007) Money demand function estimation by nonlinear cointegration. J Appl Econ 22:767–793

Bae Y, Kakkar V, Ogaki M (2006) Money demand in Japan and nonlinear Cointegration. J Money Credit Bank 38:1659–1667

Baharumshah AZ, Mohd SH, Mansur M, Masih A (2009) The stability of money demand in China: evidence from the ARDL model. Econ Syst 33:231–244

Bahmani-Oskooee M, Bahmani S (2015) Nonlinear ARDL approach and the demand for money in Iran. Econ Bull 35:381–391

Bahmani-Oskooee M, Rehman H (2005) Stability of money demand function in Asian developing countries. Appl Econ 37:773–792

Bahmani-Oskooee M, Tanku A (2006) Black Market Exchange Rate. Currency Substitution and the Demand For Money in LCDs Economic system 30:249–263

Bahmani-Oskooee M, Wang Y (2007) How stable is the demand for money for China. J Econ Dev 32:21–33

Bahmani-Oskooee M, Xi D, Bahmani S (2016) Asymmetric effects of exchange rate changes on the demand for money in China. Appl Econ Lett 23(15):1104–1109

Ball L (2001) Another look at long-run money demand. J Monet Econ 47:31–44

Benlialper A, Cömert H (2015) Implicit asymmetric exchange rate peg under inflation targeting regimes: the case of Turkey. Camb J Econ 40(6):1553–1580

Ben-Salha O, Jaidi Z (2014) Some new evidence on the determinants of money demand in developing countries – a case study of Tunisia. J Econ Asymmetries 11:30–45

Brun-Aguerre RX, Fuertes AM, Greenwood-Nimmo MJ (2015) Heads I win, tails you lose: asymmetry in aggregate exchange rate pass-through. Conditionally accepted. J R Stat Soc Ser A

Caporale GM, Gil-Alana LA (2005) Fractional cointegration and aggregate money demand functions. Manch Sch 73:737–753

Chen SL, Wu JL (2005) Long-run money demand revisited: evidence from a non-linear approach. J Int Money Financ 24:19–37

Chowdhury A (1997) The financial structure and the demand for money in Thailand. Appl Econ 29:401–409

Chukwu JO, Agu CC, Onah FE (2010) Cointegration and structural breaks in Nigerian long-run money demand function. Int Res J Financ Econ 38:48–56

Civcir I (2003) Money demand, financial liberalization and currency substitution in Turkey. J Econ Stud 30:514–534

Dai, M. (2007). A two-pillar strategy to keep inflation expectations at bay: A basic theoretical framework. Working paper of BETA n° 2007–20

Dai, M. (2009). On the role of money growth targeting under inflation targeting regime. PRA_paper_13780.pdf

Dai M, Sidiropoulos M (2009) Money growth rule and macro-financial stability under inflation-targeting regime. Working paper of BETA n°:2009–2005

Dreger C, Wolters J (2014) Money demand and the role of monetary indicators in forecasting euro area inflation. Int J Forecast 30:303–312

Duca JV, VanHoose DD (2004) Recent developments in understanding the demand for money. J Econ Bus 56:247–272

Greenwood-Nimmo, M., Shin, Y., van Treeck, T., 2013. The decoupling of monetary policy from long-term interest rates in the U.S. and Germany (Available at:) http://ssrn.com/abstract=1894621

Gregory AW, Hansen BE (1996) Residual-based tests for cointegration in models with regime shifts. J Econ 70:99–126

Halicioglu F, Ugur M (2005) On stability of the demand for money in a developing OECD country: the case of Turkey. Glob Bus Econ Rev 7(2/3):203–213

Hamori S, Hamori N (2008) Demand for money in the euro area. Econ Syst 32:274–284

Hatemi-J, A (2008) Tests for cointegration with two unknown regime shifts with an application to financial market integration. Empir Econ 35:497–505

Haug AA (2006) Canadian money demand functions: Cointegration-rank stability. Manch Sch 74:214–230

Hossain AA (2010) Monetary targeting for price stability in Bangladesh: how stable is its money demand function and the linkage between money supply growth and inflation. J Asian Econ 21:564–578

Jawadi F, Sousa M (2013) Money demand in the euro area, the US and the UK: assessing the role of nonlinearity. Econ Model 32:507–515

Jung A (2016) Is euro area money demand for M3 still stable? Q Rev Econ Finance 60:29–39

Kumar S (2011) Financial reforms and money demand: evidence from 20 developing countries. Econ Syst 35:323–334

Kumar S, Rao BB (2012) Error-correction based panel estimates of the demand for money of selected Asian countries with the extreme bounds analysis. Econ Model 29:1181–1188

Kumar S, Webber DJ (2013) Australasian money demand stability: application of structural break tests. Appl Econ 45(8):1011–1025

Kumar S, Chowdhury MB, Rao BB (2013a) Demand for money in the selected OECD countries: a time series panel data approach and structural breaks. Appl Econ 45:1767–1776

Kumar S, Webber DJ, Fargher S (2013b) Money demand stability: a case study of Nigeria. J Policy Model 35:978–999

Lee CC, Chen PF, Chang CP (2007) Testing linearity in a cointegrating STR model for the money demand function: international evidence from G-7 countries. Math Comput Simul 76:293–302

Lucas RE, Nicolini JP (2015) On the stability of money demand. J Monet Econ 73:48–65

Mundell RA (1963) Capital mobility and stabilization policy under fixed and flexible exchange rates. Canadian J Econ Polit Sci 29:475–485

Mutluer D, Barlas Y (2002) Modelling the Turkish broad money demand. Central Bank Review 2:55–75

Nchor D, Adamec V (2016) Investigating the stability of money demand in Ghana. Procedia Soc Behav Sci 220:288–293

Nyong MO (2014) The demand for money, structural breaks and monetary policy in the Gambia. Developing Country Studies 4(19):2014

Ordonez J (2003) Stability and non-linear dynamics in the broad demand for money in Spain. Econ Lett 78:139–146

Owoye O, Onafwora O (2007) M2 targeting, money demand and real GDP growth in Nigeria. J Bus Public Aff 1

Ozdemir KA, Saygili M (2010) Economic uncertainty and money demand stability in Turkey, working paper, no.10/15. In: Central Bank of the Republic of Turkey

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationship. J Appl Econ 16:289–326

Poole W (1970) Optimal choice of monetary policy instruments in a simple stochastic macro model. Q J Econ 84:197–216

Rao BB, Kumar S (2009) A panel data approach to the demand for money and the effects of financial reforms in the Asian. Econ Model 26:1012–1017

Rao, B. B., Tamazian, A. and Singh, P. (2009). Demand for money in the Asian countries: A systems GMM panel data approach and structural breaks. MPRA Paper No. 15030

Saatcoglu C, Korap L, Volkan A (2006) Stability of money multipliers: evidence from Turkey. Journal of Business and Economics Research 4(10):31–42

Sani ID, Olorunsola EO, Stephen OUU, Ibrahim A, Abiodun SB (2014) Structural breaks, Cointegration and demand for money in Nigeria. J Appl Stat 5:15–32

Shin Y, Yu B, Greenwood-Nimmo MJ (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Horrace WC, Sickles RC (eds) Festschrift in Honor of Peter Schmidt. Springer Science and Business Media, New York (NY)

Siddiki J (2010) Demand for money in Bangladesh: a cointegration analysis. Appl Econ 32:1977–1984

Teräsvirta T, Eliasson AC (2001) Non-linear error correction and the UK demand for broad money. J Appl Econ 16:277–288

Thornton DL (2014) Monetary policy: why money matters (and interest rates don’t). Journal of macroeconomics, 40, 202–213 World Bank (2014). Turkey’s transitions: integration, inclusion, institutions. World Bank, Washington, DC, p 2014

Zhao L (2017) The behavior of money demand in the Chinese hyperinflation. China Econ Rev 42:145–154

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Alsamara, M., Mrabet, Z. Asymmetric impacts of foreign exchange rate on the demand for money in Turkey: new evidence from nonlinear ARDL. Int Econ Econ Policy 16, 335–356 (2019). https://doi.org/10.1007/s10368-018-0421-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-018-0421-y