Abstract

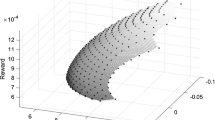

This paper investigates the use, in practical financial problems, of the Mixed Tempered Stable distribution both in its univariate and multivariate formulation. In the univariate context, we study the dependence of a given coherent risk measure on the distribution parameters. The latter allows to identify the parameters that seem to have a greater influence on the given measure of risk. The multivariate Mixed Tempered Stable distribution enters in a portfolio optimization problem built considering a real market dataset of seventeen hedge fund indexes. We combine the flexibility of the multivariate Mixed Tempered Stable distribution, in capturing different tail behaviors, with the ability of the ARMA-GARCH model in capturing the time dependence observed in the data.

Similar content being viewed by others

Notes

The dataset is taken from www.hedgefundresearch.com.

References

Anderson TW, Darling DA (1954) A test of goodness of fit. J Am Stat Assoc 49(268):765–769

Artzner P, Delbaen F, Eber J, Heath D (1999) Coherent measures of risk. Math Financ 9:203–228

Barndorff-Nielsen O, Kent J, Sørensen M (1982) Normal variance-mean mixtures and z distributions. Int Stat Rev 50:145–159

Bianchi ML, Tassinari GL, Fabozzi FJ (2016) riding with the four horsemen and the multivariate normal tempered stable model. Int J Theor Appl Financ 19:1650027

Chaussé P (2010) Computing generalized method of moments and generalized empirical likelihood with R. J Stat Softw 34(11):1–35

Choueifaty Y, Coignard Y (2008) Towards maximum diversification. J Portf Manag 35:40–51

Daníelsson J, de Vries C, Jorgensen B, Samorodnitsky G, Mandira S (2012) Fat tails, VaR and subadditivity. J Econom 172(2):283–291

Eberlein E (2001) Application of generalized hyperbolic Lévy motions to finance. In: Lévy processes. Springer, pp 319–336

Efron B (1979) Bootstrap methods: another look at the jackknife. Ann Stat 7:1–26

Fallahgoul H, Kim YS, Fabozzi FJ, Park J (2017) Quanto option pricing with Lévy models, working paper. Available at SSRN

Francq C, Zakoïan JM (2004) Maximum likelihood estimation of pure GARCH and ARMA-GARCH processes. Bernoulli 10:605–637

Hansen LP (1982) Large sample properties of generalized method of moments estimators. Econometrica 50:1029–1054

Hitaj A, Hubalek F, Mercuri L, Rroji E (2018) Multivariate mixed tempered stable distribution. Int Sta Rev. https://doi.org/10.1111/insr.12265

Hitaj A, Martellini L, Zambruno G (2012) Optimal hedge fund allocation with improved estimates for coskewness and cokurtosis parameters. J Altern Invest 14:6–16

Hitaj A, Mercuri L (2013) Portfolio allocation using multivariate variance gamma models. Fin Markets Portfolio Mgmt 27:65–99

Hitaj A, Mercuri L, Rroji E (2015) Portfolio selection with independent component analysis. Financ Res Lett 15:146–159

Hitaj A, Zambruno G (2016) Are Smart Beta strategies suitable for hedge fund portfolios? Rev Financ Econ 29:37–51

Jondeau E, Poon S, Rockinger M (2007) Financial modeling under non-Gaussian distributions. Springer, Berlin

Kim YS, Giacometti R, Rachev ST, Fabozzi FJ, Mignacca D (2012) Measuring financial risk and portfolio optimization with a non-Gaussian multivariate model. Ann Oper Res 201:325–343

Kim YS, Rachev ST, Bianchi ML, Fabozzi FJ (2010) Tempered stable and tempered infinitely divisible GARCH models. J Bank Financ 34:2096–2109

Kim YS, Rachev ST, Bianchi ML, Fabozzi FJ (2010) Computing VaR and AVaR in infinitely divisible distributions. Probab Math Stat 30:223–245

Madan DB, Carr PP, Chang EC (1998) The variance gamma process and option pricing. Rev Financ 2:79–105

Maillard S, Roncalli T, Teiletche J (2010) On the properties of equally-weighted risk contributions portfolios. J Portf Manag 36:60–70

Mainik G, Mitov G, Rüschendorf L (2015) Portfolio optimization for heavy-tailed assets: Extreme Risk Index vs. Markowitz. J Emp Financ 32:115–134

Marsaglia G, Marsaglia J (2004) Evaluating the Anderson–Darling distribution. J Stat Softw 9:1–5

Markowitz H (1952) Portfolio selection. J Financ 7:77–91

Mercuri L, Rroji E (2018) Option pricing in an exponential MixedTS Lévy process. Ann Oper Res 260(1):353–374

Mercuri L, Rroji E (2018) Risk parity for Mixed Tempered Stable distributed sources of risk. Ann Oper Res 260(1):375–393

Newey WK, West KD (1987) A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55(3):703–708

Qian E (2006) On the financial interpretation of risk contribution: risk budgets do add up. J Invest Manag 4:41–51

Rachev ST, Kim YS, Bianchi ML, Fabozzi F (2011) Financial models with Lévy processes and volatility clustering, vol 187. Wiley, Hoboken

Rockafellar RT, Uryasev S (2000) Optimization of conditional value-at-risk. J Risk 2:21–41

Rockafellar RT, Uryasev S (2002) Conditional value-at-risk for general loss distributions. J Bank Financ 26:1443–1471

Rroji E, Mercuri L (2015) Mixed Tempered Stable distribution. Quant Financ 15:1559–1569

Satchell S (2016) Derivatives and hedge funds. Springer, Berlin

Shi X, Kim A (2015) Coherent risk measure and normal mixture distributions with application in portfolio optimization and risk allocation, working paper. Available at SSRN 2548057

Stoyanov S, Rachev S, Fabozzi F (2013) CVaR sensitivity with respect to tail thickness. J Bank Financ 37(3):977–988

Stoyanov S, Rachev S, Fabozzi F (2013) Sensitivity of portfolio VaR and CVaR to portfolio return characteristics. Ann Oper Res 205(1):169–187

Yamai Y, Yoshiba T (2005) Value-at-risk versus expected shortfall: a practical perspective. J Bank Financ 29:997–1015

Acknowledgements

The authors would like to thank the Editor and three anonymous Referees for their helpful comments. All remaining errors are responsibility of the authors. This research is part of the project “Advanced Methods for Portfolio Optimization” (Number 35364), which is financially supported by the “MIUR-DAAD Joint Mobility Program (2nd Edition)”.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Generalized method of moments

We discuss briefly the GMM proposed in Hansen (1982) and show how to apply this method to the Multivariate MixedTS. The aim of this procedure is to estimate the vector of parameters \(\theta _0 \in {\mathbb {R}}^p\) from a model based on the following \(q\times 1\) vector of unconditional moment conditions:

where \(g\left( \cdot \right) :\Theta \times {\mathbb {R}}^{N} \rightarrow {\mathbb {R}}^{q}\), \(\Theta \subset {\mathbb {R}}^p\) is a compact space. For a given sample \(X_1,X_2,\ldots ,X_T\), we replace the expectation in (12) with sample means and obtain:

The GMM estimator depends on the choice of a positive definite weight matrix \(W_T\in {\mathbb {R}}^{q\times q}\) and is the solution of the following minimization problem:

To find an estimator, we need at least as many moment conditions as the number of parameters. In particular we have the classical Method of Moments for \(q = p\) and the GMM for \(q>p\). Under mild conditions, for any positive definite weight matrix \(W_T\), the GMM produces consistent estimators. Moreover the asymptotic distribution of \({\hat{\theta }}\) is:

where V is the asymptotic variance-covariance matrix defined as:

with \(D \in {\mathbb {R}}^{q\times p}\):

and \(S \in {\mathbb {R}}^{q\times q}\):

\(W_T\overset{P}{\rightarrow } W\) as \(T\rightarrow \infty \). An appropriate choice of matrix W improves the efficiency within the class of GMM type estimators. The most efficient estimator is obtained if the following condition holds:

and, in that case, the variance-covariance matrix V reads:

Several algorithms have been proposed in literature in order to reach the variance-covariance matrix in (13). In this paper we use the R package gmm developed in Chaussé (2010) where the optimal matrix W is estimated using the Heteroskedastic Auto-Correlation consistent (HAC) approach proposed in Newey and West (1987). It is required to choose a certain grid \(u_1,\ldots , u_j, \ldots , u_q\) where \(u_j \in {\mathbb {R}}^{N}\) with \(i=1,\ldots ,q\) while \(g\left( \theta , X, u_j\right) \) is defined as:

\(\left\langle \ , \ \right\rangle \) is the scalar product. The moment conditions require:

where the j-th element of the vector function \({\bar{g}}_T\left( \theta \right) \) is:

Observe that for each t, \(X_t\) is multivariate i.i.d MixedTS distributed though we have:

The grid is chosen from a multivariate standard normal distribution and the multivariate joint characteristic function \(\phi _{X,\theta }\left( u\right) \) is defined in (5).

Rights and permissions

About this article

Cite this article

Hitaj, A., Mercuri, L. & Rroji, E. Sensitivity analysis of Mixed Tempered Stable parameters with implications in portfolio optimization. Comput Manag Sci 16, 71–95 (2019). https://doi.org/10.1007/s10287-018-0306-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10287-018-0306-0