Abstract

Leaders are role models that affect their employees’ efforts. The effect depends on how much an employee identifies with the “boss”. Since this degree of identification is private information of the employee, additional financial incentives must be provided. Therefore, we study a principal-agent problem in which the principal affects the agent’s effort by her own effort and by financial incentives. The resulting principal-agent problem has a few non-standard specifics such as: (i) bilateral externalities as the principal’s effort affects the agent and vice versa and (ii) endogenous reservation utility of the agent. Combined, this leads to non-trivial and interesting contracts.

Similar content being viewed by others

1 Introduction

Leaders are a role model to their followers. Depending on the degree to which a follower (‘he’) identifies with a leader (‘she’), he desires to imitate the leader’s behavior. That is, by choosing their behavior, leaders set behavioral standards which their followers try to meet. Additionally, leaders frequently have access to financial resources which they can use to influence the behavior of their followers. For example, entrepreneurs or managers usually provide financial incentives to their subordinates to motivate them in order to increase their effort. In this case, leaders have (at least) two possibilities to influence their followers: by their own behavior and by providing financial incentives.

In such a situation, conventional wisdom says that financial incentives and the follower’s desire to imitate the leader are substitutes. van Knippenberg et al. (2004) state that “because motivation that flows from self-conception is intrinsic to the individual, the effectiveness of leadership that influences follower motivation and behavior through follower self-conception may be assumed to be less contingent on monitoring and external rewards.” (p. 829) Intuitively, followers who identify strongly with the leader should require less financial incentives to work as their desire to imitate the leader is an additional source of motivation.

We show that the substitution effect between financial incentives and the followers’ identification with the leader is not universal. In our model, an increasing degree of identification with the leader involves an increase in the financial incentives for those followers whose degree of identification exceeds a certain threshold. Followers with an identification degree below the threshold do not receive any incentive payment and, thus, get a compensation independent of their degree of identification. At first glance, this seems economically counterintuitive: Why should the leader provide additional financial incentives only to those who identify strongly with her? The reason is that a contract that relies on the agents’ identification with the leader and that incentivizes agents with a too low degree of identification to increase their effort is not incentive compatible. This provides another example that private information can turn conventional wisdom upside down.

The follower’s effort level increases in his degree of identification with the leader, as one might intuitively expect. The positive effect of identification with the leader on the follower’s effort decision is frequently emphasized in the (charismatic and transformational) leadership literature.Footnote 1 The follower’s effort level further increases in his efficiency and in the leader’s effort level.

In our model both the principal (leader) and the agent (follower) provide costly effort to increase the firm’s outcome. The agent can observe the principal’s effort decision and identifies to some degree with the principal, that is the agent desires to some degree to provide the same effort as the principal. While the agent knows his degree of identification with the principal, the principal only knows the distribution of how the agent identifies himself with the principal. In addition, the principal has financial resources which she can use to offer financial incentives to the agent. Thus, in our model the principal can influence the agent’s effort by two factors: her own effort and financial incentives.

The paper contributes to the stream of literature that expands the traditional principal-agent framework by accounting for observations and results from the literature on behavioral decision making. Prior studies have explored how trust between the principal and the agent (Casadesus-Masanell 2004), the agents concern for the well-being of others (Sliwka 2007), the individual and average norms of the agents (Fischer and Huddart 2008), managerial diligence and employee work ethics (Carlin and Gervais 2009), moral sensitivity of the agents (Stevens and Thevaranjan 2010) and the agents’ identification with the firm (Heinle et al. 2012) can alter the effectiveness of financial incentives. Bauer (2016) studies the consequences of a follower’s desire to imitate a leader in a setting in which both, the follower and the leader, are risk averse agents hired by a risk neutral principal.

2 Framework

2.1 Payoffs and costs

We consider a firm in which the entrepreneur (the principal, “she”) hires an employee (the agent, “he”). The entrepreneur and her employee exert effort that contributes to the firm’s generated revenue, R. R is a linear function of the entrepreneur’s effort, \(e_{0}\), and the employee’s observable output, y,

in which a and b denote the respective productivity of the entrepreneur and the employee. The output of the employee depends on his efficiency, \( \eta \), and his effort \(e_{1}\),

and the employee’s marginal contribution is less than the marginal contribution of the entrepreneur, \(b\eta <a\).

Effort is costly to the entrepreneur and the employee. Both cost functions, \( C_{0}(e_{0})\) and \(C_{1}(e_{1})\), are assumed to be quadratic,

in order to allow for closed form solutions. The slope of the entrepreneur’s marginal effort cost is normalized to one and we assume that the employee suffers more from providing effort than the entrepreneur. In addition, the employee identifies to some degree, \(\theta \), with the entrepreneur and, thus, tries to imitate the entrepreneur’s behavior. This reflects the concept of personal identification of a follower (here the employee) with his leader (here the entrepreneur). More precisely, the agent suffers from negative emotions like a feeling of failure, feeling of guilt or a loss of self-esteem if he cannot follow the example set by the leader (see e.g. Yukl (2013)).Footnote 2 That is, the employee does not only suffer from effort costs when he provides effort but also from emotional or psychological costs, \(K(e_{0}-e_{1})\), when he is not able to perfectly imitate the behavior of the entrepreneur. We refer to these psychological and moral costs as identity costs, K, and assume that they are quadratic in the deviation from the entrepreneur’s effort level,

in which \(\theta \) measures the employee’s degree of identification with the entrepreneur.Footnote 3 That is, an employee who weakly identifies with the entrepreneur suffers less from negative emotions if his effort does not meet the entrepreneur’s effort level than an employee who strongly identifies with the entrepreneur. The identity costs vanish if the employee does not identify with the entrepreneur, \(\theta =0\), or if both provide the same effort level, \( e_{0}=e_{1}\). Note that the incorporation of identity costs in our model allows the entrepreneur to induce effort not only by the use of financial incentives but also by choosing her own effort level.

Summarized, the employee’s payoff from delivering output y in the absence of a financial compensation is

The entrepreneur does not know the employee’s type, but knows the probability distribution of the type. The following analysis focuses on the identity type, \(\theta \); the case in which efficiency, \(\eta \), is private information is a variation of the usual agency problem and available upon request. In practice, the follower’s degree of identification is determined by factors that are unknown to the leader (such as the value congruence between follower and leader e.g. Hayibor et al. (2011)). Therefore, the parameter \(\theta \) is the employee’s private information.

The entrepreneur maximizes her expected profit, which equals total output less the entrepreneur’s effort costs and the salary, w, that she pays the employee to induce him to work,

The expectation is taken with respect to the probability distribution of the private information parameter, in our case \(\theta \).

2.2 Assumptions

Throughout the paper we make the following assumptions:

-

1.

The principal can offer a complete, take-it-or-leave-it contract to the agent despite the agent’s private information.

-

2.

The principal must offer at least the wage l, e.g., due to collective wage bargaining (either nationally or at the industry or firm level) but may pay more in order to incentivize her agent.

-

3.

All types \(\theta \in \left[ \underline{\theta },\bar{\theta }\right] \) work for the firm under the wage l but may reject additional incentives, i.e., a higher wage, \(w>l\), that is offered for a higher output y.

-

4.

To simplify our analysis, we assume that the principal’s prior distribution about the unknown degree of identification, \(\theta \), is uniform, i.e., the density function is

$$\begin{aligned} f(\theta )= {\left\{ \begin{array}{ll} \frac{1}{\overline{\theta }-\underline{\theta }} &{} \theta \in \left[ \underline{\theta },\bar{\theta }\right] \\ 0 &{} \theta \notin \left[ \underline{\theta },\bar{\theta }\right] \end{array}\right. } . \end{aligned}$$(6)\(F\left( \theta \right) \) denotes the cumulative distribution function and \( h(\theta ):=f/\left( 1-F\right) =1/\left( \bar{\theta }-\theta \right) \) denotes the hazard rate, which is increasing, \(h^{\prime }>0\); this crucial assumption is standard for agency models and holds for many other distributions as well.

-

5.

The marginal effort cost of the agent exceeds his identity cost for all types, i.e.,

$$\begin{aligned} c>\bar{\theta }. \end{aligned}$$The employee’s marginal contribution is less than that of the entrepreneur and the employee has higher costs of effort,

$$\begin{aligned} b\eta <a,\;c>1, \end{aligned}$$

Remark 1

The choice of a lower effort level by the principal reduces the employee’s disutility and the employer could combine this strategy with the fixed wage and still guarantee the agent his outside option. However, there are various reasons why the principal should refrain from such wage cutting as it triggers (negative) reciprocal actions. Furthermore, this assumption is of no consequence for the design of the (interior) tasks and of little quantitative consequence for the determination of the marginal type and thus the set of agents accepting the financial incentive.

Remark 2

The principal’s objective (5) allows for two interpretations: First, the expected profit from contracting with a single employee. Second, the entrepreneur hires a set of agents with their mass normalized to 1 and the integral in (5) aggregates the output over all agents, each having private information about his \(\theta \). All our results are valid for both possible interpretations if the principal’s effort is not part of the contract (Sect. 3.1) but not if her effort is part of it (Sect. 3.2). Therefore, we always refer in the following to a single employee.

2.3 Full information

If the entrepreneur knew the employee’s degree of identification with her (and the employee’s efficiency) the optimal effort allocation could be obtained by maximizing joint welfare,

with respect to \(e_{0}\) and y,

where superscript f denotes the “full information” solution. Prescribing these tasks requires compensating the employee for his disutility, \(-W\), and his outside option, A, which is in the following normalized to zero, \(A=0\). Therefore, the principal must pay the (type dependent) wage

although all rents are appropriated by her. Differentiating the expressions in (7) with respect to \(\theta \) yields,

due to the assumptions above (in particular Assumption 5).

Proposition 1

The full information outcome of efforts and outputs is given in (7) and requires the wage \(w^{f}\) from (8) since the principal leaves no rent to the agent. An increase in \(\theta \) leads to a decrease in the entrepreneur’s effort level, \(\frac{de_{0}^{f}}{d\theta }<0\), and to an increase in the employee’s effort and thus to an increase in his output, \( \frac{dy^{f}}{d\theta }>0\).

So under full information, the principal is able to substitute her effort with effort of the agent. The derivative of the wage \(w^{f}\) with respect to \(\theta \) is ambiguous. However, even compensating an increase in output with a higher wage (as in our examples below) does not render the first best contract implementable.

Proposition 2

The full information contract, \(\left\{ e_{0}^{f}\left( \theta \right) ,y^{f}\left( \theta \right) ,w^{f}\left( \theta \right) ,\theta \in \left[ \underline{\theta },\bar{\theta }\right] \right\} \), is not implementable under private information because the agent has an incentive to cheat by pretending a wrong type \(\hat{\theta }\) instead of the true type \(\theta \).

The proof of this standard result is omitted but available upon request.

2.4 No incentives (fixed wage contract)

As a reference, we consider the case in which the employee does not receive financial incentives but only a fixed wage l; superscript 0 refers to this situation. In this case the employee maximizes (4) given the example set by the entrepreneur yielding the reaction

The employee’s effort, \(e_{1}=y/\eta \), is linear in the entrepreneur’s effort \(e_{0}\). Output is linear in efficiency, \(\eta ,\) and concave in the degree of identification, \(\theta \). Without an explicit incentive contract the entrepreneur cannot condition her action on the corresponding parameter (here \(\theta \)). Therefore, the best she can do is to choose the (constant) action that maximizes her expected profit,

The fixed wage l that the employer has to pay does not affect the employer’s strategies and is thus suppressed in the objective above. Substituting the employee’s reaction (9) into (10), using the assumption of a uniform distribution, \(f\left( \theta \right) \), and carrying out the above integration in (10) implies

Solving (11) yields:

Proposition 3

The principal’s optimal effort in the absence of monetary incentives is

which determines the employee’s output,

after substituting (12) into (9). That is, the employee’s output is convex (quadratic) in his efficiency, \(\eta \), but concave with respect to his private information parameter, \(\theta \).

Substituting \(e_{0}^{0}\) and \(y^{0}\) into (4) determines the employee’s utility,

in which l denotes the fixed wage that compensates the employee for his disutility and covers his outside option A. Our assumption ensures the participation of all types. That is, in the fixed wage setting the employee’s reservation utility \(U^{0}\) is type dependent, declining, and the types \(\theta <\bar{\theta }\) earn an agency rent, \(U^{0}\left( \theta \right) >A\), even absent explicit incentives.

Remark 3

The wage

is the lowest wage such that the agent’s payoff exceeds his outside option (using the normalization, \(A=0\)) for all possible realizations of \(\theta \). However, we assume for the exogenously fixed wage \(l>l^{0}\), in order to ensure participation but not necessarily acceptance of the incentive (incremental wages for higher efforts, and thus outputs).

3 Optimal incentives

It is realistic to assume that the entrepreneur does not know the employee’s attributes, which renders the first best, actions (7) and wage (8), as not implementable (Proposition 2). As mentioned, we focus on the identification parameter. That is, the employer knows the employee’s efficiency \(\eta \) but not his type \(\theta \) about which she only has a probability prior (or knows the aggregate over all her employees but not the type of each individual) given by the density \(f\left( \theta \right) \) for \( \theta \in \left[ \underline{\theta },\overline{\theta }\right] \).

The optimal arrangement requires effort by the entrepreneur as well because of bilateral externalities from the entrepreneur to the employee and vice versa (see the above solutions for the first-best case, Eq. (7), and the no incentives scenario, Eqs. (12) and (13)).Footnote 4 As a consequence, an optimal contract involves actions of both, the employee and the entrepreneur, and one can conceive two different kinds of interactions:

-

1.

The entrepreneur sets her example \(e_{0}\) independent (and presumably ahead) of the realized employee’s type and offers a usual output-wage contract, \(\left\{ y\left( \theta \right) ,w\left( \theta \right) ,\;\theta \in \left[ \underline{\theta },\overline{\theta }\right] \right\} \).

-

2.

The entrepreneur includes a menu of own efforts, i.e., a contract consists of three functions \(\left\{ e_{0}\left( \theta \right) ,y\left( \theta \right) ,w\left( \theta \right) ,\;\theta \in \left[ \underline{ \theta },\overline{\theta }\right] \right\} \). The employee’s choice of output, \(y\left( \theta \right) \), commits then the entrepreneur to her effort \(e_{0}\left( \theta \right) \).

The paper focuses on the more realistic first case, but the second case and the implied differences are also sketched.

3.1 The entrepreneur sets her own standard ex ante

The entrepreneur provides financial incentives to the employee and, in contrast to the first best in (7) but in line with no financial incentives, constant effort \(e_{0}\) independent of the employee’s degree of identification. That is, \(e_{0}\) is, at least for the moment, exogenously given and not necessarily optimally chosen as in the absence of financial incentives (Eq. (12)). This assumption is made in this section for a number of reasons: First, it seems not very likely that an entrepreneur commits to a schedule of her own effort depending on the employee’s report about his type (truthfully due to the revelation principle). Second, an entrepreneur’s effort may be observable (and this is assumed) but not verifiable since it is hard for an employee to sue the boss for shirking. Therefore, the entrepreneur sets an example by exercising her effort \(e_{0}\) and offers on the basis of this observable and constant level monetary incentives that reward output y with the wage w, or in its direct form and based on the revelation principle, \(\left\{ y\left( \theta \right) ,w\left( \theta \right) ,\;\theta \in \left[ \underline{\theta }, \bar{\theta }\right] \right\} \). Although this contract depends on the choice of \(e_{0}\), this dependency is suppressed in the following to simplify the notation. We allow for an optimal effort of the entrepreneur depending on the employee’s degree of identification \(e_{0}\left( \theta \right) \) in Sect. 3.2.

The entrepreneur maximizes her expected profit,

conditional on her own effort, \(e_{0}\), which is for the moment given at an arbitrary level. The optimization in (15) is subject to the following constraints. First, incentive compatibility based on the revelation principle, i.e., the employee does not loose from revealing his true type when facing the contract offer \(\left\{ y\left( \theta \right) ,w\left( \theta \right) ,\;\theta \in \left[ \underline{\theta },\bar{\theta } \right] \right\} \). That is, using \(U\left( \hat{\theta },\theta \right) \) to denote the employee’s payoff from pretending the type \(\hat{\theta }\) instead of the true type \(\theta \),

for all \(\hat{\theta }\) and \(\theta \in \left[ \underline{\theta },\bar{\theta }\right] \). The entrepreneur is committed to \(e_{0}\) even if the employee rejects the incentive. As a consequence, the entrepreneur’s choice of \(e_{0} \) enters (16) and also the second constraint (participation constraint) (17), instead of \(e_{0}^{0}\) from (12). Of course, the entrepreneur may optimize her choice subject to the incentive contract implied by \(e_{0}\). This procedure is briefly addressed below and will, of course, lead to an effort level different to the one obtained in the absence of financial incentives, \(e_{0}\ne e_{0}^{0}\), and presumably to \(e_{0}<e_{0}^{0}\) since monetary incentives substitute for costly own efforts. The participation constraint requires that the employee must not loose from accepting the contract and the revelation principle allows to eliminate the argument \(\hat{\theta }\), i.e.,

\(U^{0}\left( \theta \right) \) is the employee’s reservation price, which results if the agent rejects the incentive wage (presumably but not necessarily an upgrade above l, which is exogenously fixed). This reservation price, \(U^{0}\left( \theta \right) \), will be different from the one in the absence of financial incentives, \(U_{0}^{0}\left( \theta \right) \) , from (14), because the employee faces a different and at the moment arbitrary employer’s effort \(e_{0}\ne e_{0}^{0}\). A lower effort level \( e_{0}<e_{0}^{0}\) reduces also the employee’s disutility, the employer could lower the fixed wage offer and still guarantee the outside option to the agent. Since there are various reasons why the principal should refrain from such wage cutting, we exclude this possibility from the analysis (Assumption 1). Eq. (9) determines the employee’s output as in the case of a fixed wage except for the different value of \(e_{0}\). Substituting this output into W determines his disutility and adding the fixed wage determines his reservation price as given on the right hand side in (17).

Using \(U=W+w\) to eliminate the wage from (15), the entrepreneur’s objective depends only on the scalar control y (omitting the argument \( \theta \) from now on),

This maximization is subject to the two constraints (16) and (17). Since applying the envelope theorem to the incentive compatibility constraint, (16), implies the differential equation

the entrepreneur’s optimization problem is turned into an optimal control problem with the ‘dynamic’ constraint (19) and the state constraint (17).

Given \(e_{0}\), the first best assignment of output to the employee follows from

The output \(y^{1}\left( \theta ;e_{0}\right) \) differs from the full information outcome (7) because \(e_{0}\) is fixed. It exceeds the employee’s output without financial incentives, i.e., \(y^{1}\left( \theta ;e_{0}\right) >y^{0}\left( \theta ;e_{0}\right) \) (see Eq. (9)). This implies, combined with the well-known and below derived property of no distortion at the top, that at least the high types will receive incentives to increase their output.

In the standard cases of constant reservation prices, the principal-agent problem is typically solved in the following way: The participation constraint binds only for the least efficient type, who receives the reservation price. The incentive compatibility constraint binds for all other types who earn therefore a rent, \(U\ge U^{0}\). All tasks are determined by the so called relaxed program, i.e., the solution of the above control problem ignoring the state (participation) constraint (17). The negative slope of the employee’s payoff, \(\dot{U}<0\) from (19), implies in the case of a constant reservation price a ‘right to left’ mechanism, i.e. \(\underline{\theta }\) were the most efficient type, because only then \(\dot{U}<0\) coupled with \(U\left( \bar{\theta }\right) =U^{0}\) ensures \(U\left( \theta \right) \ge U^{0}\) for all \(\theta <\bar{ \theta }\). However, such a mechanism running ‘from the right to the left’ is not implementable because of the type dependent reservation price in (17). The economically more intuitive mechanism (at least if accounting for private information and for the fact that \(\bar{\theta }\) must be the most efficient type from the entrepreneur’s perspective) is running from the ‘left to the right’ and requires that U falls less steep than \(U^{0}\) at least for the marginal type (i.e., the lowest type receiving incentives denoted by \(\theta ^{m}\)). And this marginal type is given at the point of intersection, i.e., \(U\left( \theta ^{m}\right) =U^{0}\left( \theta ^{m}\right) \) and \(\dot{U}\left( \theta ^{m}\right) >\dot{U}^{0}\left( \theta ^{m}\right) \),

This inequality implies that financial incentives must increase the employee’s output which makes not only economic sense but ensures also that the participation constraint is met for all \(\theta >\theta ^{m}\) (first locally and then also for all \(\theta >\theta ^{m}\) since \(y>y^{0}\)). However, the participation constraint (17) binds not only for the least efficient type \(\underline{\theta }\) but for all types \(\theta \le \theta ^{m}\).

Proposition 4

Although the principal may be able to choose her own effort (e.g., by maximizing her expected profit) it is assumed that she commits to sufficiently high effort,

such that

Then the optimal contract consists of an interior and a boundary part:

-

1.

In the interior, \(U>U_{0}\), the entrepreneur asks the employee to produce along the relaxed program (denoted by superscript r)

$$\begin{aligned} y^{r}\left( \theta ;e_{0}\right) =\frac{\eta \left( b\eta +e_{0}\left( 2\theta -\bar{\theta }\right) \right) }{c+\left( 2\theta -\bar{\theta }\right) }\text { for }\theta \in \left[ \theta ^{m},\bar{\theta }\right] \end{aligned}$$(24)backed up by corresponding monetary incentives for the efficient types, \( \theta \ge \theta ^{m}\). Along the relaxed program, higher efficiency, a larger productivity and a higher type of the employee increase the output, i.e., \(y_{\eta }^{r}>0\), \(y_{b}^{r}>0\), \(y_{\theta }^{r}>0\) (implying no distortion at the top, \(y^{r}\left( \bar{\theta };e_{0}\right) =y^{1}\left( \bar{\theta };e_{0}\right) \)) as well as does a higher effort delivered by the entrepreneur, \(y_{e_{0}}^{r}>0\).

-

2.

The low types, \(\underline{\theta }\le \theta \le \theta ^{m}\), receive no additional monetary incentive (i.e., get only their fixed wage l such that \(U=U_{0}\)) and thus produce \(y^{0}\left( \theta ,e_{0}\right) \) from Eq. (9).

The domain of a boundary contract without monetary incentives increases as the entrepreneur raises her effort (\(\theta _{e^{0}}^{m}>0\)) and as the employee’s effort cost increases, (\(\theta _{c}^{m}>0\)) but decreases with the employee’s productivity to the revenues (\(\theta _{b}^{m}<0\)) and the employee’s efficiency (\(\theta _{\eta }^{m}<0\)).

Remark 4

If the principal’s initial effort is exogenously constrained to very low efforts (i.e., \(e_{0}<b\eta /c\)) for whatever reason, then bunching is optimal (see e.g. Fudenberg and Tirole (1992)): The principal asks each type to produce \(y^{1}\left( \bar{\theta }\right) \) from (20) and backs it up by payments that satisfy the two constraints of incentive compatibility (19) and individual rationality (17). Arithmetically: substitute \(y^{1}\left( \bar{\theta }\right) \) into (19) and integrate \(\dot{U}\) using the boundary condition \(U\left( \underline{\theta }\right) =U^{0}\left( \underline{\theta }\right) \); finally compute the wage from \(w=U-W\) substituting \(y^{1}\left( \bar{\theta } \right) \) into W.

The proof of Proposition 4 is relegated to the “Appendix”. The relaxed program (24) follows from the familiar condition (see Fudenberg and Tirole (1992))

in which the left hand side is the derivative of the joint surplus and h denotes the hazard rate. Since \(0=1/h\left( \bar{\theta }\right) \), the joint surplus is maximized at \(\theta =\bar{\theta }\), which leads to the claimed property of no distortion at the top. The agent is asked to produce below the joint surplus maximizing level as the agency cost captured on the right hand side, \(W_{y\theta }/h\), is positive, which holds along the relaxed program under the assumption of sufficiently large \(e_{0}\). High entrepreneur’s efforts can pay off for two different reasons: (i) by motivating the employee directly and thereby serving as a substitute for otherwise necessary compensation for the agents’ efforts and (ii) by reducing information rents because of the associated restriction of the monetary incentives to higher and thus also to fewer types, because

Hence, a combination of boundary and interior (=relaxed) program contracts is very likely unless the entrepreneur’s effort is constrained to low levels or the employee’s marginal contribution is large even for the lowest type, \( \underline{\theta }\ge \theta ^{m}\) as defined in Eq. (23) and derived in the “Appendix” in (50), so that the relaxed program applies to all types, holds if and only if,

If \(\theta ^{m}>\underline{\theta }\), higher costs of effort increase the critical level \(\theta ^{m}\) as it gets more costly to incentivize the employee since

In contrast, and as expected, a larger productivity of the employee lowers \( \theta ^{m}>\underline{\theta }\ge 0\),

Finally, higher efficiency increases the set of employees receiving monetary incentives,

This derivative combined with the quadratic effect of efficiency on output stresses how important an agent’s efficiency, \(\eta \), is for incentives. The last two observations imply that firms with a more efficient labor force and/or a larger productivity by the employees to the firm’s profit (e.g., advocates in law firms versus factory workers) will use monetary incentives more broadly. In other words, employees with little identification with the entrepreneur receive flat wages and only those employees with a sufficiently strong identification with the leader receive financial incentives.

The derivation of the optimal contract lacks so far the determination of the financial incentives needed in order to support the (interior part of the) contract and of course the optimal level of commitment \(e_{0}\) by the entrepreneur. Integration of the incentive compatibility constraint (16) determines the employee’s payoff in the interior, \(U>U^{0}\) for \( \theta >\theta ^{m}\),

Since \(w=U-W\), adding the compensation that is needed for an employee of type \(\theta \) carrying out the task \(y^{r}\left( \theta \right) \),

to \(U\left( \theta \right) \) from above determines the wage \(w\left( \theta \right) \), which requires to substitute the marginal type \(\theta ^{m}\) from (23) and for this reason we save reporting the lengthy expression of the wage. Finally, solving the relaxed program, Eq. (24), for the type instead of the output,

and substituting this into the above derived wage determines the wage as a function of output, \(w\left( y,e_{0}\right) =w\left( \theta \left( y,e_{0}\right) \right) \). However, this still analytical but very cumbersome expression is suppressed.

The characterization so far is contingent on the example set by the entrepreneur (i.e., \(e_{0}\)), which can be and often is a choice variable for her. If the interior contract is globally optimal, a closed form (but clumsy) solution of the entrepreneur’s optimal ex ante commitment can be obtained (available upon request). Otherwise, this does not seem possible as the entrepreneur’s payoff is the integral over interior and boundary solutions of the family of optimal contracts contingent on \(e_{0}\). More precisely, the principal’s objective is then (dropping again the argument \( \theta \)),

in which \(\theta ^{m}\), \(y^{0},\) \(y^{r}\) and U depend on \(e_{0}\). The entrepreneur’s choice of \(e_{0}\) faces the following trade-off: A higher effort \(e_{0}\) is more costly, but raises directly the marginal contribution of all employee types (ceteris paribus) and reduces the set of employees who must be incentivized and thereby the employee’s informational rents.

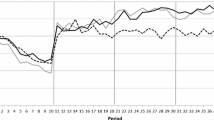

Given the lack of a closed-form solution for the entrepreneur’s optimal ex ante choice of her effort, \(e_{0}^{*}\), Fig. 1 sketches the corresponding optimal contract for a particular example:

In line with our assumptions: the entrepreneur’s effort is more important than the employee’s effort (by a factor of 2); the agent’s effort costs are twice those of the entrepreneur and larger than the costs of shirking relative to the standard set by the entrepreneur. The expected value of the private information parameter \(\theta \) is normalized to 1 varying up to \( \pm 1/2\). These assumptions ensure positive outputs even in the absence of financial incentives and allow to test implicitly for the sensitivity of the conclusions. Given the type dependent reservation price \(U^{0}\) and the above derivation, one must expect that the corresponding state constraint binds over a set with positive Lebesque measure. And this is indeed the case for low and thus relatively inefficient types \(\theta \). In the optimal contract, i.e., including the optimal choice of the employer’s constant effort of \(e_{0}\), almost 40% of the employees are not incentivized, \( \theta ^{m}=0.88\), and only the remaining higher types get monetary incentives increasing in type and output. As mentioned, offering monetary incentives serves as a substitute for the entrepreneur’s own costly effort and thus allows the entrepreneur to lower her own effort. However, this effect is only very moderate compared with the out of contract optimal choice (\( e_{0}^{0}=2.33>e_{0}^{*}=2.31\) where \(e_{0}^{*}\) is the optimal ex ante effort combined with the optimal contract from Proposition 3). The reason is that the entrepreneur’s effort is much more important and thus cannot be conditioned on the agent’s type in a sensitive way (the example in the following subsection demonstrates that this allows for a substantial reduction of the principal’s effort). Furthermore, the incentives are restricted to a little bit more than half of the employee’s types for whom the high standards set by the entrepreneur are very effective due to their high identity costs.

3.2 Incentives including the entrepreneur’s effort

In order to account for the bilateral externality between the entrepreneur and the employee, both efforts are now contracted. That is, the entrepreneur offers an entire menu of contracts including her own effort conditional on the employee’s type, i.e., the contract consists of three functions \(\left\{ e_{0}\left( \theta \right) ,\;y\left( \theta \right) ,\;w\left( \theta \right) ,\;\theta \in \left[ \underline{\theta },\overline{\theta }\right] \right\} \). This setup accounts fully for the bilateral externality but requires the assumptions that the entrepreneur’s effort is verifiable (i.e., the agent can take the principal to court if the principal does not deliver the contracted effort) and that the employee reveals his type first (or respectively produces y), which then forces the entrepreneur to contribute the effort level \(e_{0}\left( \theta \right) \) on the basis of the signed (and complete) contract. In addition, it can only apply to a single agent while the analysis in the previous subsection applies to many agents as well. A possible example is that the employee is located upstream and the entrepreneur downstream such that the employee has to deliver first. Aside from the upstream-downstream example, the assumption about a principal including her own effort as a part of a contract seems quite demanding. Therefore, the following analysis is kept brief and focuses on the interior solution.

If the entrepreneur has the flexibility to include a schedule for her own effort \(\left\{ e_{0}\left( \theta \right) ,\;\theta \in \left[ \underline{ \theta },\overline{\theta }\right] \right\} \) contingent on the employee’s reported type, then the optimal contract in its direct form (based on the revelation principle and using, as above, \(w=U-W\)) is the solution of the following optimal control problem:

subject to the incentive compatibility and participation constraints,

Note that \(y^{0}=y^{0}\left( e_{0}\right) \) from (9) since the agent reacts to the principal’s choice according to (9) even if rejecting the incentive.

This control problem implies the same optimality condition for output as the previous one, (see (40)–(46) in the “Appendix”) and an additional one in order to determine \(e_{0}\left( \theta \right) \). Focusing on interior solutions, which are given by the relaxed program (i.e., setting \(\mu =0\) in Eqs. (40) and (41) in the “Appendix”), the following two simultaneous equations result,

The left hand sides are the partial derivatives with respect to the instruments and both are declining due to the concave objectives, R and W . Therefore, if the right hand side in (30) were 0, the (hypothetical) principal’s ‘first best’ effort resulted conditional on y instead of the true first best \(y^{1}\) from (7). However, the right hand side is negative in (30) since \(W_{e_{0}\theta }<0\) due to \(e_{0}>e_{1}=y/\eta \). Hence, the entrepreneur raises her effort above the (hypothetical) ‘first best’ effort given the employee’s (at the moment unknown) output y. The employee is asked to produce less than the hypothetical first best response (from \(R_{y}+W_{y}=0\) given \(e_{0}\) and declining in y) since \(W_{y\theta }>0\), economically, due to the agency costs associated with incentivizing higher agent output. Evaluated against the true first bests, the same relation holds, namely the principal’s effort exceeds the first best, \(e_{0}>e_{0}^{1}\) but the agent’s output falls short \(y<y^{1}\), except at the top \(e_{0}\left( \bar{\theta }\right) =e_{0}^{1}\left( \bar{\theta }\right) \) and \(y\left( \bar{\theta }\right) =y^{1}\left( \bar{\theta }\right) \), because both right hand sides vanish in (30) and (31) for \(\theta \rightarrow \bar{\theta }\). Solving the two equations simultaneously yields the relaxed program, again identified by the superscript r,

Note, that this program exists for \(\theta \rightarrow \bar{\theta }\) and thus in any case for the high types. However, the relaxed program need not characterize the optimal contract globally for two reasons. First, for pure arithmetical reasons since the denominator switches its sign between \(\theta \rightarrow 0\) and \(\theta \rightarrow \bar{\theta }\). This leads to a singularity, \(y\rightarrow -\infty \) at

from the right and thus to \(y<0\) already for \(\theta >\theta ^{crit}\). This negative output cannot be optimal. Therefore, the relaxed program cannot be optimal globally if \(\underline{\theta }\) is sufficiently small. Even if \( \underline{\theta }>\theta ^{crit}\) ensured the existence of the relaxed program, it need not be optimal. First, the solutions of (30) and (31) can turn very large (for \(e_{0}^{r} \)) and small (for \(y^{r}\)) and it seems to make little sense to ask the employee to produce below the intrinsically provided output, \(y^{r}<y^{0}\), and to pay for that. Second, the relaxed program must satisfy the participation constraint, i.e., \(U\ge U^{0}\) hence, \(\dot{U}\ge \dot{U}^{0} \) at least for types close to the marginal and so far undetermined type \(\theta ^{m}\). Therefore, a condition similar to (21) must hold,

Therefore, financial incentives must increase the output and thus the effort of the employee so that the difference between the principal’s and the agent’s efforts decreases when entering the interior part and the marginal type is determined by the equality in output,

and principal’s effort. Clearly, this supersedes the pure arithmetic constraint: \(\theta ^{m}>\theta ^{crit}\).

Proposition 5

In an optimal contract and along the interior, \(U>U^{0}\), effort by the entrepreneur and output delivered by the employee are given by the Eqs. (32) and (33). However, this part of the contract must be restricted to sufficiently high types, more precisely to \(\theta \ge \theta ^{m}>\theta ^{crit}\) satisfying (36). Therefore, the relaxed program need not be globally optimal (and cannot be for \(\theta \rightarrow 0\)) and incentives are then restricted to high types.

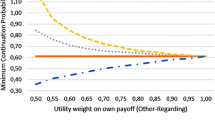

Figure 2 compares the entrepreneur’s effort and the employee’s output if the entrepreneur can or cannot make her effort contingent on the employees reported type. Globally interior solutions are not very likely and in particular not in the case of the contract \(\left\{ e_{0},y,w\right\} \) as the relaxed program does not exist for (relatively) low types due to (32) and (33) and violates the monotonicity condition to the left of the critical type, \(\theta ^{crit}\). Therefore, the choice of parameters in Fig. 2 is different from (26) so that globally interior solutions (i.e., the relaxed programs) are optimal in both cases.Footnote 5 The example in Fig. 2 highlights that the entrepreneur’s effort is substantially reduced compared with the ex ante commitment, \(e_{0}\left( \theta \right) <e_{0}^{*}\), and is declining with respect to the employee’s type. The principal’s reduction of her own, type dependent effort depresses the employee’s effort (and thus output). The output barely exceeds the one under a fixed wage and is substantially less if the principal committed ex ante a fixed (and in this example optimal) effort level, \( y\left( e_{0}^{*}\right) >y\left( \theta \right) \).

4 Conclusion

This paper extends the principal-agent framework by assuming that the agent identifies with the principal, and thus desires to some degree to imitate the behavior of the principal. Consequently, the principal cannot only use financial means to incentivize the agent (as is the case in the standard principal-agent framework) but also her own effort. This extension leads to bilateral externalities, from the principal to the agent and vice versa. This plus other crucial features like an endogenous reservation price complicates the resulting optimal contracts that need not exist and may require combining interior and boundary solutions. The take-away message is that employees, who are characterized by a high level of identification with the principal and thus seem less in need for monetary compensations, should receive the largest financial incentives. Employees with a low identification level receive little or no financial incentives at all.

Financial incentives allow to reduce the principal’s own and costly effort so that lack thereof strengthens the principal’s role model. And this is definitely the case in academic research. Our paper can be extended into both, empirical and analytical, directions. For example, one may try to quantify the importance of a principal’s role model in different kinds of occupations. Possible theoretical extensions are: The study of incentives over more than one (here two) private information parameters; or investigating how signaling could allow the principal to infer how an agent identifies himself with the firm and the principal (unless pooling results).

Notes

For instance, Shamir et al. (1993) say that charismatic leaders “cause followers to become highly committed to the leader’s mission, to make significant personal sacrifices in the interest of the mission, and to perform above and beyond the call of duty.” (p. 577).

While we assume that the follower imitates the behavior of the leader to avoid emotional costs that would arise otherwise, another reason why followers imitate a leader’s behavior is that they assume the leader to possess better information (Hermalin 1998). This phenomenon is extensively discussed in the financial herding literature, see Xue (2017) for an example.

We use the terms “degree of identification”, “identification type” and, briefly, “type” interchangeably throughout the paper.

Multilateral externalities are pervasive in economic decision making, see Helm and Wirl (2014) for an example in the context of pollution mitigation contracts.

Further details of the contract including the boundary solution and the joining with interior solution are not further explored given its lack of realism and its complexity; Helm and Wirl (2014) show how one must proceed in such cases of bilateral externalities and a binding participation constraint

References

Bauer Thomas (2016) Managerial Accounting, Coordination and Taxation. Ph.D. thesis, University of Vienna

Carlin Bruce Ian, Gervais Simon (2009) Work ethic, employment contracts, and firm value. J Finance 64(2):785–821

Casadesus-Masanell Ramon (2004) Trust in Agency. J Econom Manage Strat 13(3):375–404

Fischer Paul, Huddart Steven (2008) Optimal contracting with endogenous social norms. Am Econom Rev 98(4):1459–1475

Drew Fudenberg, Jean Tirole (1992) Game Theory, 2nd edn. MIT Press, Cambridge, Mass

Hartl Richard F (1987) A simple proof of the monotonicity of the state trajectories in autonomous control problems. Journal of Economic Theory 41(1):211–215

Hayibor Sefa, Agle Bradley R, Sears Greg J, Sonnenfeld Jeffrey A, Ward Andrew (2011) Value congruence and charismatic leadership in CEO-Top manager relationships: an empirical investigation. J Bus Ethics 102(2):237–254

Heinle Mirko S, Hofmann Christian, Kunz Alexis H (2012) Identity, incentives, and the value of information. Account Rev 87(4):1309–1334

Helm Carsten, Wirl Franz (2014) The principal-agent model with multilateral externalities: an application to climate agreements. J Environ Econ Manage 67(2):141–154

Hermalin Benjamin E (1998) Toward an economic theory of leadership: leading by example. Am Econom Rev 88(5):1188–1206

Seierstad Atle, Sydsaeter Knut (1986) Optimal control theory with economic applications. Elsevier North-Holland Inc, New York, USA

Shamir Boas, House Robert J, Arthur Michael B (1993) The motivational effects of charismatic leadership: a self-concept based theory. Organ Sci 4:577–694

Sliwka Dirk (2007) Trust as a signal of a social norm and the hidden costs of incentive schemes. Am Econom Rev 97(3):999–1012

Stevens Douglas E, Thevaranjan Alex (2010) A moral solution to the moral hazard problem. Account Organ Soc 35(1):125–139

van Knippenberg Daan, van Knippenberg Barbara, de Cremer David, Hogg Michael A (2004) Leadership, self, and identity: a review and research agenda. Leader Q 15(6):825–856

Xue Hao (2017) Independent and affiliated analysts: disciplining and herding. Account Rev 92:243–267

Yukl Gary (2013) Leader Organ. Pearson, Edinburgh

Funding

Open Access funding provided by University of Vienna.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

F. Wirl: I thank the editors for the kind invitation to contribute to this Festschrift for Professor Vetschera, with whom I enjoyed cooperating personally and scientifically for many years. I have chosen a topic that fits him very well, namely, to incentivize by setting example for young researchers and colleagues alike. Our thanks are also to an anonymous referee who provided exceptionally many and also very valuable comments.

Appendix: Proofs

Appendix: Proofs

1.1 Proof of Proposition 4

The difficulty of solving the control problem resulting from the contracting problem in 3.1 is due to the state or participation constraint. Using the indirect method we replace the state constraint (17) by

This applies whether \(e_{0}\) is constant and fixed ex ante or type dependent (in the interior as well as along the boundary).

Using the definitions of the Hamiltonian, H, with the costate \(\lambda \) and of the Lagrangean, \(\mathcal {L}\), by using the Kuhn-Tucker multiplier \( \mu \) in order to append the state constraint derived above by the indirect method

the first order optimality conditions are (see Seierstad and Sydsaeter (1986)):

with the boundary conditions

The interior solution, i.e., assuming \(U>U^{0}\Leftrightarrow \mu =0\) and thus

follows from the so called relaxed program, see e.g., Fudenberg and Tirole (1992), since then the maximization of \({\mathcal {L}}\) (and thus of H) implies according to Eq. (40),

in which \(h\left( \theta \right) =f/(1-F)\) denotes the hazard rate (\( 1/\left( \bar{\theta }-\theta \right) \) for the uniform distribution). Therefore, the tasks prescribed along the relaxed program (identified by the superscript r and conditional on \(e_{0}\)) are

Since \(y^{r}\left( \bar{\theta };e_{0}\right) =y^{1}\left( \bar{\theta } ;e_{0}\right) \) (known as “no distortion at the top”), the relaxed program must exist if the first best solution exists. The denominator is positive since \(c>\bar{\theta }\), i.e., effort costs exceed the (maximal) urge to match the entrepreneur’s effort, due to our assumptions that \(c>1=c_{0}\) and \(c>\theta \) for all \(\theta \). However, a positive output requires also \( b\eta >e_{0}\left( 2\theta -\bar{\theta }\right) \). Hence, \(y^{r}\left( \theta ;e_{0}\right) <0\) is possible for high efforts of the entrepreneur, low types and low marginal contributions from the employee. Even if the relaxed program \(y^{r}\) is positive it may violate the monotonicity constraint,

for low \(e_{0}\). However, such a low effort makes no economic sense, because \(e_{0}=a\) is the entrepreneur’s effort in the absence of an employee and \( a>b\eta >b\eta /c\) due to the assumptions. Therefore, it is assumed in the following that the (at the moment) arbitrary choice of \(e_{0}\) by the entrepreneur is such that the monotonicity constraint (48) is met, which explains the assumption in Proposition 4. If \(e_{0}<b\eta /c\)), then bunching is optimal as sketched in Remark 5.

If the monotonicity requirement is met, this does not ensure the optimality of the relaxed program, because it can fall below the output achieved without monetary incentives if

The type \(\theta ^{m}\) is determined (and defined in (50)) as the unique point of the intersection between the output without incentives and the relaxed program, i.e.,

This type \(\theta ^{m}\) is indeed the marginal type at which

and \(y^{r}\) cuts \(y^{0}\) from below, because the control problem (18) subject to Eq. (19) and inequality (17) meets a regularity condition (i.e., a constraint qualification, for details see Feichtinger and Hartl (1987)) such that the control y must be continuous across the type joining the interior, \(U>U^{0}\), with the boundary solution, \(U=U^{0}\). This joining of interior and boundary solutions satisfies the monotonicity, (48), and the participation constraints and is also intuitively plausible, because paying for outputs below those achievable without any payment (in addition to l) cannot make economic sense. Therefore, the state constraint binds for all types \(\theta \le \theta ^{m}\), who receive no financial incentives (beyond l) and thus perform (9) and earn \(U=U^{0}\). Monetary incentives should be restricted to sufficiently high types, \(\theta >\theta ^{m}\), whose outputs follow from the relaxed program, Eq. (49), and substituting this output into the incentive compatibility constraint determines the employee’s payoff U starting at \(U\left( \theta ^{m}\right) =U^{0}\left( \theta ^{m}\right) \). The above sketched solution satisfies all above (necessary and also sufficient due to the concavity of the Hamiltonian) optimality conditions.

1.2 Proof of Proposition 5

Using as in the proof of Proposition 4 the indirect method, the same Hamiltonian (38) and Lagrangian (39) result, except for a slight difference in the state constraint (see (51) below). The first order condition for the agent’s output remains the same but an additional condition is needed to determine the employer’s effort function (based on the assumed functional forms),

Note that the above optimality condition applies if the principal specifies \( e_{0}\left( \theta \right) \) for all types whether the type \(\theta \) is participating or not. Therefore, the derivative \(y_{e_{0}}^{0}\) matters even if the state constraint is binding. Adding this condition to (40)–( 46) gives the set of necessary optimality conditions for this case and setting \(\mu =0\) for interior solution implies the relaxed program (30).

As indicated, the analysis of the boundary solution is now more complicated due to the bilateral externality. Entering the interior part at the type \( \theta ^{m}\) requires in its right hand side neighborhood that

Hence,

where superscript b refers to the boundary solution. In other words, entering the interior part reduces the difference between the principal’s and the agent’s effort. Furthermore, continuity must hold for both, principal’s and agent’s, efforts.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bauer, T., Wirl, F. Incentivizing by example and money. Cent Eur J Oper Res 29, 89–111 (2021). https://doi.org/10.1007/s10100-020-00726-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-020-00726-1