Abstract

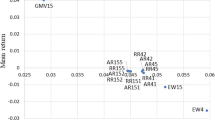

In financial markets with high uncertainties, the trade-off between maximizing expected return and minimizing the risk is one of the main challenges in modeling and decision making. Since investors mostly shape their invested amounts towards certain assets and their risk aversion level according to their returns, scientists and practitioners have done studies on that subject since the beginning of the stock markets’ establishment. In this study, we model a Robust Optimization problem based on data. We found a robust optimal solution to our portfolio optimization problem. This approach includes the use of Robust Conditional Value-at-Risk under Parallelepiped Uncertainty, an evaluation and a numerical finding of the robust optimal portfolio allocation. Then, we trace back our robust linear programming model to the Standard Form of a Linear Programming model; consequently, we solve it by a well-chosen algorithm and software package. Uncertainty in parameters, based on uncertainty in the prices, and a risk-return analysis are crucial parts of this study. A numerical experiment and a comparison (back testing) application are presented, containing real-world data from stock markets as well as a simulation study. Our approach increases the stability of portfolio allocation and reduces the portfolio risk.

Similar content being viewed by others

References

Ben-Tal A, Nemirovski A (1998) Robust convex optimization. Math Oper Res 23(4):769–805. https://doi.org/10.1287/moor.23.4.769

Ben-Tal A, Nemirovski A (2000) Robust solutions of linear programming problems contaminated with uncertain data. Math Program 88(3):411–424. https://doi.org/10.1007/PL00011380

Ben-Tal A, El Ghaoui L, Nemirovski A (2009) Robust optimization. Princeton University Press, Princeton. https://doi.org/10.1515/9781400831050

Bertsimas D, Brown DB (2009) Constructing uncertainty sets for robust linear optimization. Oper Res 57(6):1483–1495. https://doi.org/10.1287/opre.1080.0646

Bertsimas D, Sim M (2004) The price of robustness. Oper Res 52(1):35–53. https://doi.org/10.1287/opre.1030.0065

Black F, Litterman R (1992) Global portfolio optimization. Financ Anal J 48(5):28–43. https://doi.org/10.2469/faj.v48.n5.28

Boyle P, Siu TK, Yang H (2002) Risk and probability measures. Risk 15(7):53–57

Fabozzi FJ, Huang D, Zhou G (2010) Robust portfolios: contributions from operations research and finance. Ann Oper Res 176(1):191–220

Fonseca RJ, Zymler S, Wiesemann W, Rustem B (2011) Robust optimization of currency portfolios. J Comput Finance 15(1):1–28

Griva I, Nash SG, Sofer A (2009) Linear and nonlinear optimization. SIAM, Philadelphia. https://doi.org/10.1137/1.9780898717730

Hastie T, Tibshirani R, Friedman J (2009) The elements of statistical learning. Springer, New York. https://doi.org/10.1007/978-0-387-84858-7

Hasuike T, Katagiri H (2013) Robust-based interactive portfolio selection problems with an uncertainty set of returns. Fuzzy Optim Decis Making 12(3):263–288. https://doi.org/10.1007/s10700-013-9157-x

Huang D, Zhu S, Fabozzi FJ, Fukushima M (2010) Portfolio selection under distributional uncertainty: a relative robust CVaR approach. Eur J Oper Res 203(1):185–194. https://doi.org/10.1016/j.ejor.2009.07.010

Jalilvand-Nejad A, Shafaei R, Shahriari H (2016) Robust optimization under correlated polyhedral uncertainty set. Comput Ind Eng 92:82–94. https://doi.org/10.1016/j.cie.2015.12.006

Jongen HT, Weber GW (1991) Nonlinear optimization: characterization of structural stability. J Global Optim 1(1):47–64

Jongen HT, Twilt F, Weber GW (1992) Semi-infinite optimization: structure and stability of the feasible set. J Optim Theory Appl 72(3):529–552

Kara G (2016) Robust conditional value-at-risk under parallelepiped uncertainty: an application to portfolio optimization, unpublished Master’s thesis. Institute of Applied Mathematics Middle East Technical University

Kirilyuk V (2008) Polyhedral coherent risk measures and investment portfolio optimization. Cybern Syst Anal 44(2):250–260. https://doi.org/10.1007/s10559-008-0025-6

Knight FH (1921) Risk, uncertainty, and profit. Houghton Mifflin, Boston

Kuhn D, Parpas P, Rustem B, Fonseca R (2009) Dynamic mean-variance portfolio analysis under model risk. J Comput Finance 12(4):91

Markowitz H (1952) Portfolio selection. J Finance 7(1):77–91. https://doi.org/10.1111/j.1540-6261.1952.tb01525.x

Natarajan K, Pachamanova D, Sim M (2009) Constructing risk measures from uncertainty sets. Oper Res 57(5):1129–1141. https://doi.org/10.1287/opre.1080.0683

Özmen A (2010) Robust conic quadratic programming applied to quality improvement—a robustification of CMARS. Master’s thesis. Institute of Applied Mathematics, Middle East Technical University

Özmen A (2016) Robust optimization of spline models and complex regulatory networks-theory, methods and applications. In: Contributions to management science. Springer International Publishing, Berlin. https://doi.org/10.1007/978-3-319-30800-5

Özmen A, Weber GW (2014) RMARS: robustification of multivariate adaptive regression spline under polyhedral uncertainty. J Comput Appl Math 259:914–924. https://doi.org/10.1016/j.cam.2013.09.055

Özmen A, Weber GW, Batmaz I, Kropat E (2011) RCMARS: robustification of CMARS with different scenarios under polyhedral uncertainty set. Commun Nonlinear Sci Numer Simul 16(12):4780–4787. https://doi.org/10.1016/j.cnsns.2011.04.001

Pachamanova DA (2002) A robust optimization approach to finance. PhD thesis. Operations Research Center, Massachusetts Institute of Technology

Quaranta AG, Zaffaroni A (2008) Robust optimization of conditional value at risk and portfolio selection. J Bank Finance 32(10):2046–2056. https://doi.org/10.1016/j.jbankfin.2007.12.025

RiskMetrics (1996) \(\text{RiskMetrics}^{\rm TM}\)—Technical Document

Rockafellar RT (1997) Convex analysis. Princeton University Press, Princeton, NJ. https://doi.org/10.1515/9781400873173

Rockafellar RT, Uryasev S (2000) Optimization of conditional value-at-risk. J Risk 2:21–42. https://doi.org/10.21314/JOR.2000.038

Sarykalin S, Serraino G, Uryasev S (2008) Value-at-risk vs. conditional value-at-risk in risk management and optimization. Tutorials in operations research. INFORMS, Hanover, pp 270–294. https://doi.org/10.1287/educ.1080.0052

Savku E, Weber GW (2017) A stochastic maximum principle for a markov regime-switching jump-diffusion model with delay and an application to finance. J Optim Theory Appl. https://doi.org/10.1007/s10957-017-1159-3

Schöttle K, Werner R (2006) Consistency of robust portfolio estimators. OR and Management Sciences, pp 1–23

Sim M (2004) Robust optimization. PhD thesis, Massachusetts Institute of Technology. Operations Research Center, Boston

Siu TK, Tong H, Yang H (2001) Bayesian risk measures for derivatives via random esscher transform. North American Actuarial Journal 5(3):78–91

Soyster AL (1973) Convex programming with set-inclusive constraints and applications to inexact linear programming. Oper Res 21(5):1154–1157

Tütüncü RH, Koenig M (2004) Robust asset allocation. Ann Oper Res 132(1–4):157–187. https://doi.org/10.1023/B:ANOR.0000045281.41041.ed

Werner R (2007) Consistency of robust portfolio estimates. Presented at Workshop on Optimization in Finance. Coimbra, Portugal

Zhu S, Fukushima M (2009) Worst-case conditional value-at-risk with application to robust portfolio management. Oper Res 57(5):1155–1168. https://doi.org/10.1287/opre.1080.0684

Acknowledgements

The authors of this paper would gradually thank to the Editor and to the two anonymous reviewers for their important and insightful comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kara, G., Özmen, A. & Weber, GW. Stability advances in robust portfolio optimization under parallelepiped uncertainty. Cent Eur J Oper Res 27, 241–261 (2019). https://doi.org/10.1007/s10100-017-0508-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-017-0508-5