Abstract

The occurrence of 6.7-magnitude Hokkaido Eastern Iburi Earthquake on 6th September 2018 made local residents in Japan realise the underneath hazardous threat to their own safety and residential dwellings. Japan has faced various natural disasters for a long time, and Government chose to unveil these hazard data in details to the public to raise every one’s alertness. Despite their long-term awareness of hazards, this short-term unexpected event should have impact on local real estate markets.

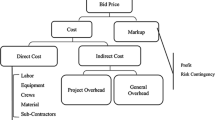

Given the transaction data of properties and lands, this study used machine-learning algorithms to examine whether the unexpected hazard shock (i.e. 2018 Hokkaido Earthquake) or the observed local hazard information in geographic areas (i.e. long-term evaluation of each real estate) would be capitalised into the prices of residential properties and lands in the case of Hokkaido, Japan. It is assumed that the difference in the characteristics of disaster notification would alter individuals’ risk perception and thus the evaluation of properties; compared to uncertain, infrequent occurrence of earthquakes in the unknown future (i.e. beyond the scope of objective estimation), the release of long-term hazardous information (tied to each property or land), which is more perceivable in near future, is more likely to be capitalised into real estate.

It is found that housing/land attributes are still the key features to real estate values in Hokkaido. In comparison with short-term unexpected hazard shock (i.e. 2018 Earthquake), the long-term hazard threats are more influential to prices of properties and lands. This is possibly due to people’s awareness of the hazard conditions of local communities while deciding where to reside.

Similar content being viewed by others

Notes

Please refer to Fire and Disaster Management Agency [総務省消防庁]. Accessed on 5th October 2018 https://www.webcitation.org/72xVIgUSB?url=http://www.fdma.go.jp/bn/22afa3f0714fc2c15c13739de8ad0910c82b2e8c.pdf.

Please refer to World Bank ‘Natural Disaster Hotspots: A Global Risk Analysis’. Accessed on 5th October 2018.

Please refer to ‘Explanation of the National Earthquake Prediction Map: 2018 Edition’ [全国地震動予測 地図 2018 年版の解説], which was released on 26 June 2018, and then revised in January 2019, Accessed on 4th July 2019: https://www.jishin.go.jp/main/chousa/18_yosokuchizu/yosokuchizu2018_chizu_5_1.pdf.

The Sankei News on 10th September 2018 ‘Hokkaido earthquake with magnitude 7: Is there a new active fault near Atsuma-cho?’ [北海道震度7地震: 厚真町付近に新たな活断層が存在か]. Accessed on 4th July 2019: https://www.sankei.com/affairs/news/180910/afr1809100004-n1.html.

As explained by Prof. Hirata of Earthquake Prediction Research Centre at Tokyo University, ‘as the research progressed, it became clear that the phenomena (precursor phenomena) that precede the earthquake occur in various ways, and sometimes they do not occur. Therefore, earthquake prediction is difficult’. This sentence is the translation of the first paragraph on the following website: https://www.nhk.or.jp/sonae/column/20140201.html; accessed on 8th Aug. 2020.

Please refer to the English version of ‘Disaster Preparedness Tokyo’ [東京防災]:

https://www.bousai.metro.tokyo.lg.jp/_res/projects/default_project/_page_/001/008/046/introduction.pdf; accessed on 9th Aug. 2020.

The estimated population is 13,857,443 in January 2019, increased by 103,384 from January 2018; it indicated the 23rd consecutive year of population growth since 1997. Please refer to Population Estimation in Tokyo Metropolis [東京都の人口(推計)の概要]: https://www.metro.tokyo.lg.jp/tosei/hodohappyo/press/2019/01/29/25.html; accessed on 9th Aug. 2020.

Please refer to ‘Summary of the advantages and disadvantages of shaped land and non-shaped land’ [整形地と非整形地、その違いとメリット・デメリットのまとめと比較]: https://www.asaka-mytown.co.jp/column/95/; accessed on 10th Aug. 2020.

As stated on USGS website, ‘Neither the USGS nor any other scientists have ever predicted a major earthquake. We do not know how, and we do not expect to know how any time in the foreseeable future.’ Refer to: https://www.usgs.gov/faqs/can-you-predict-earthquakes?qt-news_science_products=0#qt-news_science_products.

Datun Volcano, just located 15 km from the CBD of Taipei (i.e. Capital of Taiwan), is predicted to erupt within 10 thousand years; please refer to ‘The Academia Sinica team confirmed that Datun Volcano might erupt within ten thousand years’ [中研院團隊證實: 大屯山萬年內有噴發可能] https://news.pts.org.tw/article/485797.

The Cabinet Office, Government of Japan [內閣府]: http://www.bousai.go.jp/kyoiku/hokenkyousai/jishin.html.

The Japan Meteorological Agency: http://www.jma.go.jp/jma/index.html.

In the discussion on the use of training and test data, James et al. (2013, p. 30) stated that ‘[s]uppose that we are interested in developing an algorithm to predict a stock’s price based on previous stock returns. We can train the method using stock returns from the past 6 months. But we don’t really care how well our method predicts last week’s stock price. We instead care about how well it will predict tomorrow’s price or next month’s price’.

Jibannet Holdings Co. Ltd [地盤ネット株式会社], as an expertise company in foundation analysis in Japan, released the Relief Map of Foundation [地盤安心マップ], which offers online free evaluation of an individual property’s ground improvement ratio [改良工事率], flood risk [浸水リスク], earthquake shake risk [地震による揺れやすさ; it refers to the ease of shaking due to an earthquake], soil fluidization risk [液状化リスク] given the address of each property (or land).

WDSU News (25th Aug 2015), ‘Prices of homes surge post-Katrina’: https://www.wdsu.com/article/prices-of-homes-surge-post-katrina-1/3379361.

Please refer to the photo of ‘Flood depth record of Typhoon Nari in MRT Taipei Main Station’: https://commons.wikimedia.org/wiki/File:Flood_depth_record_of_Typhoon_Nari,_MRT_Taipei_Main_Station_20170624.jpg.

References

Ainslie G, George A (2001) Breakdown of will. Cambridge University Press, Cambridge

Antipov EA, Pokryshevskaya EB (2012) Mass appraisal of residential apartments: an application of random forest for valuation and a CART-based approach for model diagnostics. Expert Syst Appl 39(2):1772–1778

Beebe GS, Omi PN (1993) Wildland burning: the perception of risk. J Forest 91(9):19–24

Bernknopf RL, Brookshire DS, Thayer MA (1990) Earthquake and volcano hazard notices: an economic evaluation of changes in risk perceptions. J Environ Econ Manage 18(1):35–49

Beron KJ, Murdoch JC, Thayer MA, Vijverberg WP (1997) An analysis of the housing market before and after the 1989 Loma Prieta earthquake. Land Econ 73(1):101–113

Bialaszewski D, Newsome BA (1990) Adjusting comparable sales for floodplain location: the case of Homewood, Alabama. Appraisal J 58(1):115–118

Bin O, Polasky S (2004) Effects of flood hazards on property values: evidence before and after Hurricane Floyd. Land Econ 80(4):490–500

Breiman L (2001) Random forests. Mach Learn 45(1):5–32

Breiman L, Friedman J, Olshen R, Stone C (1984) Classification and regression trees. CRC press, Boca Raton

Brieman L, Cutler A (2018) Package ‘randomForest’. https://cran.r-project.org/web/packages/randomForest/randomForest.pdf. Accessed 25 Aug 2020

Bühlmann P, Drineas P, Kane M, van der Laan M (2016) Handbook of big data. CRC Press, New York

Burningham K, Fielding J, Thrush D (2008) ‘It’ll never happen to me’: understanding public awareness of local flood risk. Disasters 32(2):216–238

Burrus RT Jr, Graham JE Jr (2009) Home-buyer sentiment and hurricane landfalls. Appraisal J 77(4):338

Daniel VE, Florax RJ, Rietveld P (2009) Floods and residential property values: a hedonic price analysis for the Netherlands. built environ 35(4):563–576

Donovan GH, Champ PA, Butry DT (2007) Wildfire risk and housing prices: a case study from Colorado Springs. Land Econ 83(2):217–233

Fan GZ, Ong SE, Koh HC (2006) Determinants of house price: a decision tree approach. Urban Stud 43(12):2301–2315

Foulkes AS (2009) Applied statistical genetics with R: for population-based association studies. Springer, New York

Ghoddusi H, Creamer GG, Rafizadeh N (2019) Machine learning in energy economics and finance: a review. Energy Econ 81:709–727

Graham JE Jr, Hall WW Jr (2001) Hurricanes, housing market activity, and coastal real estate values. Appraisal J 69(4):379–387

Grömping U (2009) Variable importance assessment in regression: linear regression versus random forest. Am Stat 63(4):308–319

Gründler K, Krieger T (2016) Democracy and growth: evidence from a machine learning indicator. Eur J Polit Econ 45:85–107

Guo L, Shi F, Tu J (2016) Textual analysis and machine leaning: crack unstructured data in finance and accounting. J Finance Data Sci 2(3):153–170

Harrison D, Smersh GT, Schwartz A (2001) Environmental determinants of housing prices: the impact of flood zone status. J Real Estate Res 21(1):3–20

Hidano N, Hoshino T, Sugiura A (2015) The effect of seismic hazard risk information on property prices: evidence from a spatial regression discontinuity design. Reg Sci Urban Econ 53:113–122

Hua GB (1996) Residential construction demand forecasting using economic indicators: a comparative study of artificial neural networks and multiple regression. Constr Manag Econ 14(1):25–34

James G, Witten D, Hastie T, Tibshirani R (2013) An introduction to statistical learning vol 112. Springer, Berlin Heidelberg

Kaish S (1986) Behavioral economics in the theory of the business cycle. In: Gilad B (ed) Handbook of behavioral economics, vol B. JAI Press Inc, Greenwich

Keskin B, Dunning R, Watkins C (2017) Modelling the impact of earthquake activity on real estate values: a multi-level approach. J Eur Real Estate Res 10(1):73–90

Khandani AE, Kim AJ, Lo AW (2010) Consumer credit-risk models via machine-learning algorithms. J Bank Finance 34(11):2767–2787

Kiel KA, Matheson VA (2018) The effect of natural disasters on housing prices: An examination of the Fourmile Canyon fire. J For Econ 33:1–7

Liaw A, Wiener M (2002) Classification and regression by randomForest. R News 2(3):18–22

Lindell MK, Hwang SN (2008) Households’ perceived personal risk and responses in a multihazard environment. Risk Anal 28(2):539–556

Linoff GS, Berry MJA (2011) Data mining techniques: for marketing, sales, and customer relationship management. John Wiley & Sons, Indianapolis, Indiana

Mimis A, Rovolis A, Stamou M (2013) Property valuation with artificial neural network: the case of Athens. J Prop Res 30(2):128–143

Mueller J, Loomis J, González-Cabán A (2009) Do repeated wildfires change homebuyers’ demand for homes in high-risk areas? A hedonic analysis of the short and long-term effects of repeated wildfires on house prices in Southern California. J Real Estate Finance Econ 38(2):155–172

Murdoch JC, Singh H, Thayer M (1993) The impact of natural hazards on housing values: the Loma Prieta earthquake. Real Estate Econ 21(2):167–184

Nakagawa M, Saito M, Yamaga H (2007) Earthquake risk and housing rents: evidence from the Tokyo Metropolitan Area. Reg Sci Urban Econ 37(1):87–99

Nakagawa M, Saito M, Yamaga H (2009) Earthquake risks and land prices: evidence from the Tokyo metropolitan area. Japanese Econ Rev 60(2):208–222

Naoi M, Seko M, Sumita K (2009) Earthquake risk and housing prices in Japan: evidence before and after massive earthquakes. Reg Sci Urban Econ 39(6):658–669

Park B, Bae JK (2015) Using machine learning algorithms for housing price prediction: the case of Fairfax county, Virginia housing data. Expert Syst Appl 42(6):2928–2934

Patel J, Shah S, Thakkar P, Kotecha K (2015) Predicting stock market index using fusion of machine learning techniques. Expert Syst Appl 42(4):2162–2172

Pérez-Rave JI, Correa-Morales JC, González-Echavarría F (2019) A machine learning approach to big data regression analysis of real estate prices for inferential and predictive purposes. J Prop Res 36(1):59–96

Plakandaras V, Gupta R, Gogas P, Papadimitriou T (2015) Forecasting the US real house price index. Econ Model 45:259–267

Pryce G, Chen Y, Galster G (2011) The impact of floods on house prices: an imperfect information approach with myopia and amnesia. Hous Stud 26(02):259–279

Rosen S (1974) Hedonic prices and implicit markets: product differentiation in pure competition. J Polit Econ 82(1):34–55

Santin D, Delgado FJ, Valino A (2004) The measurement of technical efficiency: a neural network approach. Appl Econ 36(6):627–635

Schaefer KA (1990) The effect of floodplain designation/regulations on residential property values: a case study in North York, Ontario. Can Water Resour J 15(4):319–332

Siegrist M (1997) Communicating low risk magnitudes: incidence rates expressed as frequency versus rates expressed as probability. Risk Analysis 17(4):507–510

Sirmans S, Macpherson D, Zietz E (2005) The composition of hedonic pricing models. J Real Estate Lit 13(1):1–44

Slovic P, Monahan J, MacGregor DG (2000) Violence risk assessment and risk communication: the effects of using actual cases, providing instruction, and employing probability versus frequency formats. Law Hum Behav 24(3):271–296

Therneau T, Atkinson B (2019) rpart: recursive partitioning and regression trees. R package version 4.1–15. https://CRAN.R-project.org/package=rpart. Accessed 10 Sep 2020

Tversky A, Kahneman D (1973) Availability: a heuristic for judging frequency and probability. Cogn Psychol 5:207–232

Varian HR (2014) Big data: new tricks for econometrics. J Econ Perspect 28(2):3–27

Yoo S, Im J, Wagner JE (2012) Variable selection for hedonic model using machine learning approaches: a case study in Onondaga County, NY. Landsc Urban Plan 107(3):293–306

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Peng, TC. The effect of hazard shock and disclosure information on property and land prices: a machine-learning assessment in the case of Japan. Rev Reg Res 41, 1–32 (2021). https://doi.org/10.1007/s10037-020-00148-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10037-020-00148-1