Abstract

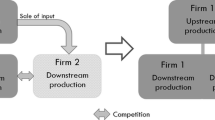

We study upstream horizontal mergers when one of the merging parties is vertically integrated. Under observable contracting in the pre-merger case, we show that such type of mergers always harm consumers. However, under unobservable contracting in the pre-merger case, the input price may decrease and consumer surplus may increase as a result of the merger even in the absence of exogenous cost-synergies between merging firms. A necessary condition for this finding is that the unintegrated downstream firm is more cost-efficient than the downstream division of the integrated firm.

Similar content being viewed by others

Notes

See Sect. 5 for a brief discussion of these merger cases.

For an analysis of horizontal mergers in one-tier industries see the seminal works of Salant et al. (1983), Perry and Porter (1985), Deneckere and Davidson (1985), Farrell and Shapiro (1990), McAfee and Williams (1992) and Werden and Froeb (1994). For an analysis of downstream horizontal mergers in vertically related industries see, among others, von Ungern-Sternberg (1996), Dobson and Waterson (1997), Inderst and Wey (2003), Lommerud et al. (2005), Fauli-Oller and Bru (2008) and Symeonidis (2008, 2010).

Irmen (1998), Fumagalli and Motta (2001) and Symeonidis (2010), by considering a setting with two competing vertically separated chains, show that contract unobservability eliminates any strategic effect associated with the choice of input prices: for any given input price charged by one upstream firm, the best reply of the other upstream firm is to set an input price equal to upstream marginal cost and use the fixed fee to get profit. It is straightforward that this insight extends to the case where one vertical chain is already vertically integrated. For more details on this issue see Sect. 3.

Regarding the analysis carried out in the next section, we note here that the same reasoning applies to the case of unobservable contracting pre-merger, that is, when the vertically integrated firm does not observe the contract stipulated in the vertically separated chain.

An important strand in the literature on secret vertical contracting considers one upstream manufacturer selling its product to many downstream firms (see, for example, Hart and Tirole 1990; O'Brien and Shaffer 1992; Rey and Vergé 2004; Reisinger and Tarantino 2015). In such setting, the equilibrium contracts depend on the nature of the downstream firms’ out-of-equilibrium beliefs. Since in the present model one upstream firm contracts with only one downstream firm, out-of-equilibrium beliefs play no role. See also Sect. 4.

The detailed analysis of the linear-demand case is available upon request.

See Riordan (2008).

See Riordan (2008).

See Bulow and Shapiro (2002) for a very thorough discussion of the BP/ARCO merger.

Case COMP/M.3351 - Arvin Meritor/Volvo (Assets), Commission decision of 1 October 2004.

Case COMP/M.5756 - DFDS/Norfolk, Commission decision of 17 June 2010.

Case COMP/M.6611 - Arla Foods/Milk Link, Commission decision of 27 September 2012.

Case COMP/M.7252 - Holcim/Lafarge, Commission decision of 15 December 2014.

According to Vetter (2017), a soft capacity constraint “implies that production costs exhibit a discontinuity in the upward direction should a firm produce beyond capacity.”.

References

Bulow J, Shapiro C (2002) The BP Amoco/ARCO merger: Alaskan crude oil. Graduate School of Business, Stanford University, Stanford

Deneckere R, Davidson C (1985) Incentives to form coalitions with Bertrand competition. Rand J Econ 16(4):473–486

Dobson PW, Waterson M (1997) Countervailing power and consumer prices. Econ J 107(441):418–430

Farrell J, Shapiro C (1990) Horizontal mergers: an equilibrium analysis. Am Econ Rev 80(1):107–126

Fauli-Oller R, Bru L (2008) Horizontal mergers for buyer power. Econ Bull 12(3):1–7

Fumagalli C, Motta M (2001) Upstream mergers, downstream mergers, and secret vertical contracts. Res Econ 55(3):275–289

Hart O, Tirole J (1990) Vertical integration and market foreclosure. Brook Pap Econ Act Microecon 21:205–286

Horn H, Wolinsky A (1988) Bilateral monopolies and incentives for merger. Rand J Econ 19(3):408–419

Inderst R, Shaffer G (2009) Market power, price discrimination, and allocative efficiency in intermediate-goods markets. Rand J Econ 40(4):658–672

Inderst R, Wey C (2003) Bargaining, mergers, and technology choice in bilaterally oligopolistic industries. Rand J Econ 34(1):1–19

Irmen A (1998) Precommitment in competing vertical chains. J Econ Surv 12(4):333–359

Lommerud KE, Straume OR, Sørgard L (2005) Downstream merger with upstream market power. Eur Econ Rev 49(3):717–743

Mathewson GF, Winter R (1984) An economic theory of vertical restraints. Rand J Econ 15(4):27–38

McAfee RP, Williams MA (1992) Horizontal mergers and antitrust policy. J Ind Econ 40(2):181–187

Milliou C, Pavlou A (2013) Upstream mergers, downstream competition and R&D investments. J Econ Manag Strategy 22(4):787–809

Milliou C, Petrakis E (2007) Upstream horizontal mergers, vertical contracts and bargaining. Int J Ind Organ 25(5):965–987

O’Brien DP, Shaffer G (1992) Vertical control with bilateral contracts. Rand J Econ 23(3):299–308

Perry MK, Porter RH (1985) Oligopoly and the incentive for horizontal merger. Am Econ Rev 75(1):219–227

Reisinger M, Tarantino E (2015) Vertical integration, foreclosure, and productive efficiency. Rand J Econ 46(3):461–479

Rey P, Tirole J (2007) A primer on foreclosure. In: Armstrong M, Porter R (eds) Handbook of industrial organization, vol 3. North Holland Press, Amsterdam

Rey P, Vergé T (2004) Bilateral control with vertical contracts. Rand J Econ 35(4):728–746

Riordan MH (2008) Competitive effects of vertical integration. In: Buccirossi P (ed) Handbook of antitrust economics. The MIT Press, Cambridge

Salant SW, Switzer S, Reynolds RJ (1983) Losses from horizontal merger: the effects of an exogenous change in industry structure on Cournot-Nash equilibrium. Q J Econ 98(2):185–199

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. Rand J Econ 15(4):546–554

Symeonidis G (2008) Downstream competition, bargaining, and welfare. J Econ Manag Strategy 17(1):247–270

Symeonidis G (2010) Downstream merger and welfare in a bilateral oligopoly. Int J Ind Organ 28(3):230–243

Vetter H (2017) Pricing and market conduct in a vertical relationship. J Econ 121(3):239–253

von Ungern-Sternberg T (1996) Countervailing power revisited. Int J Ind Organ 14(4):507–519

Werden GJ, Froeb LM (1994) The effects of mergers in differentiated products industries: logit demand and merger policy. J Law Econ Organ 10(2):407–426

Ziss S (1995) Vertical separation and horizontal mergers. J Ind Econ 43(1):63–75

Acknowledgements

I would like to thank Giacomo Corneo (the Editor), Olivier Bonroy, Christos Constantatos, Paolo G. Garella, Matthias Hunold, Chrysovalantou Milliou, Stylianos Perrakis, Emmanuel Petrakis, Patrick Rey, Nikolaos Vettas and two anonymous referees for their valuable comments and suggestions. Financial support from the Greek State Scholarships Foundation (I.K.Y.) is gratefully acknowledged. I am fully responsible for any errors or omissions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Derivation of the properties described in ( 2 )

The last-stage subgame final-good outputs and prices as functions of input price are \( \hat{q}_{i} = q_{i} \left( w \right) \), \( \hat{p}_{i} = p_{i} \left( {\hat{q}_{i} ,\hat{q}_{j} } \right) \). As noted in Sect. 2.3, these equilibrium outcomes are the same irrespective of whether the merger occurs or not. We derive here their properties described in (2).

Note first that \( \hat{q}_{1} \) depends on the input price only indirectly through \( \hat{q}_{2} \), thus \( \hat{q}_{1} = q_{1} \left( {\hat{q}_{2} } \right) \) and \( d\hat{q}_{1} /dw = \left( {dq_{1} /dq_{2} } \right)\left( {d\hat{q}_{2} /dw} \right) \). Given strategic substitutability, it holds that \( dq_{1} /dq_{2} < 0 \). It is then straightforward that \( d\hat{q}_{1} /dw \) and \( d\hat{q}_{2} /dw \) have opposite signs. We show that \( d\hat{q}_{2} /dw < 0 \).

The last-stage subgame equilibrium final-good outputs \( \hat{q}_{1} \) and \( \hat{q}_{2} \) must satisfy the F.O.Cs in the downstream market, therefore (1) can be written as: \( \hat{p}_{2} + \hat{q}_{2} \left( {\partial p_{2} /\partial q_{2} } \right) - w - c_{D2} = 0 \). Using the implicit function theorem in the above expression, we obtain \( d\hat{q}_{2} /dw = 1/\left( {\partial^{2} \pi_{D2} /\partial q_{2}^{2} } \right) < 0 \), where the denominator is negative due to the assumption that S.O.Cs are satisfied. Thus, it holds that \( d\hat{q}_{2} /dw < 0 \) and \( d\hat{q}_{1} /dw > 0 \). Moreover, given that \( \left| {dq_{1} /dq_{2} } \right| < 1 \), it also holds that \( d\hat{q}_{1} /dw < \left| {d\hat{q}_{2} /dw} \right| \). The last inequality implies that an increase in the input price decreases the total quantity supplied in the downstream market, i.e., \( d\hat{Q}/dw < 0 \).

Regarding the effect of \( w \) on \( \hat{p}_{2} \), we have that,

where the bracketed term in the last inequality is negative since \( \left| {\partial p_{2} /\partial q_{2} } \right| > \left| {\partial p_{2} /\partial q_{1} } \right| \) and \( \left| {dq_{1} /dq_{2} } \right| < 1 \). Finally, regarding the effect of \( w \) on \( \hat{p}_{1} \), we have that,

An increase in \( w \) affects indirectly \( \hat{p}_{1} \) through \( \hat{q}_{2} \) in two ways: On the one hand, a decrease in \( \hat{q}_{2} \) increases \( \hat{p}_{1} \)—a second-order effect. On the other hand, a decrease in \( \hat{q}_{2} \) leads to an increase in \( \hat{q}_{1} \) which in turn decreases \( \hat{p}_{1} \)—a third order effect. It is natural to assume that the second-order effect is of greater importance than the third-order effect, implying \( \hat{p}_{1} \) increases with \( w \).□

Proof of Lemma 1

By making use of \( d\hat{q}_{1} /dw = \left( {dq_{1} /dq_{2} } \right)\left( {d\hat{q}_{2} /dw} \right) \), the expression in (4) can be rewritten as:

Given that \( d\hat{q}_{2} /dw \ne 0 \), the bracketed term in the above expression must be equal to zero, which gives the expression in (5). It is then straightforward that the input price is always lower than upstream marginal cost. □

Proof of Lemma 2

By making use of \( d\hat{q}_{1} /dw = \left( {dq_{1} /dq_{2} } \right)\left( {d\hat{q}_{2} /dw} \right) \) and \( \partial p_{i} /\partial q_{j} = \partial p_{j} /\partial q_{i} \), the expression in (7) can be rewritten as:

Given that \( d\hat{q}_{2} /dw \ne 0 \), the bracketed term in the above expression must be equal to zero, which gives the expression in (8). It is then straightforward that in order for the input price to be lower than upstream marginal cost, it must hold that

Given that \( \left| {dq_{1} /dq_{2} } \right| < 1 \), in order for the above condition to be satisfied it must hold that \( \hat{q}_{1} < \hat{q}_{2} \). For any given input price, and given that the downstream division of the merged firm obtains the input at marginal cost, the latter can be true only if \( c_{D1} > c_{D2} \). □

Rights and permissions

About this article

Cite this article

Pinopoulos, I.N. Upstream horizontal mergers involving a vertically integrated firm. J Econ 130, 67–83 (2020). https://doi.org/10.1007/s00712-019-00677-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-019-00677-5