Abstract

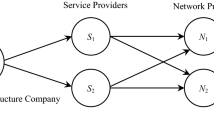

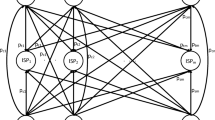

How will bounded rationality influence telecommunication network fluctuations? Recently, there has been an increased research interest in telecommunication network pricing, which leads to many proposals for new pricing schemes motivated by different objectives namely: to maximize service provider’s revenue, to guarantee fairness among users and to satisfy quality of service (QoS) requirements for differentiated network services. In the present paper, we consider a system with N rational service providers (SPs) that offer homogeneous telecommunication services to bounded rational costumers. All SPs offer the same services and seek to persuade more customers in the same system, we model this conflict as a noncooperative game. On the one hand, each SP decide his policies of price and QoS in order to maximize his profit. One the other hand, we assume that the customers are boundedly rational and make their subscription decisions probabilistically, according to Luce choice probabilities. Furthermore, the customers decide to which SP to subscribe, each one may migrate to another SP or alternatively switch to “no subscription state” depending on the observed price/QoS. In this work, we have proved through a detailed analysis the existence and uniqueness of Nash equilibrium. We evaluate the impact of user’s bounded rationality on the equilibrium of game. Using the price of anarchy, we examine the performance and efficiency of equilibrium. We have shown that the SPs have an interest in confusing customers, which means more than the customers are irrational, the SPs earn more.

Similar content being viewed by others

Notes

This function corresponds to a queuing delay in an M/M/1 queue with first-in-first-out discipline or to the more general M/G/1 queue under processor sharing delay.

References

Ahmed E, Agiza HN, Hassan SZ (2000) On modifications of Puu’s dynamical duopoly. Chaos Solitons Fractals 11(7):1025–1028. https://doi.org/10.1016/S0960-0779(98)00322-1

Ait Omar D, Outanoute M, Baslam M, Fakir M, Bouikhalne B (2017) Joint price and QoS competition with bounded rational customers. In: El Abbadi A, Garbinato B (eds) Networked systems, NETYS 2017. Lecture Notes in Computer Science, vol 10299. Springer, Cham, pp 457–471. https://doi.org/10.1007/978-3-319-59647-1_33

Baslam M, El-Azouzi R, Sabir E, Bouyakhf EH (2012) New insights from a bounded rationality analysis for strategic price-QoS war. In: 6th international ICST conference on performance evaluation methodologies and tools, pp 280–289. https://doi.org/10.4108/valuetools.2012.250410

Basov S (2016) Social norms, bounded rationality and optimal contracts, studies in economic theory, vol 30. Springer Singapore, Singapore. https://doi.org/10.1007/978-981-10-1041-5

Basov S, Danilkina S (2014) Bertrand oligopoly with boundedly rational consumers. BE J Theor Econ 15(1):107–123

Bischi GI, Naimzada A (2000) Global analysis of a dynamic duopoly game with bounded rationality. In: Filar JA, Gaitsgory V, Mizukami K (eds) Advances in dynamic games and applications, Annals of the international society of dynamic games, vol 5. Birkhäuser, Boston, pp 361–385. https://doi.org/10.1007/978-1-4612-1336-9_20

Chioveanu I, Zhou J (2013) Price competition with consumer confusion. Manag Sci 59(11):2450–2469. https://doi.org/10.1287/mnsc.2013.1716

Christopher B (2006) Pattern recognition and machine learning. Springer, Cham

Condie S, Ganguli J (2017) The pricing effects of ambiguous private information. J Econ Theory 172:512–557

Elsadany AA (2010) Dynamics of a delayed duopoly game with bounded rationality. Math Comput Modell 52(9):1479–1489. https://doi.org/10.1016/j.mcm.2010.06.011

Guijarro L, Pla V, Vidal JR, Martinez-Bauset J (2011) Analysis of price competition under peering and transit agreements in Internet Service provision to peer-to-peer users. In: 2011 IEEE consumer communications and networking conference (CCNC), pp 1145–1149. https://doi.org/10.1109/CCNC.2011.5766356

Handouf S, Arabi S, Sabir E, Sadik M (2017) Telecommunication market share game: inducing boundedly rational consumers via price misperception. In: 2017 IEEE/ACS 13th international conference of computer systems and applications (AICCSA), pp 1–7. https://doi.org/10.1109/AICCSA.2016.7945762

Kim HS, Yoon CH (2004) Determinants of subscriber churn and customer loyalty in the Korean mobile telephony market. Telecommun Policy 28(9):751–765. https://doi.org/10.1016/j.telpol.2004.05.013

Kleinrock L (1975) Queueing systems, vol I. Wiley Interscience, New York

Koutsoupias E, Papadimitriou C (2009) Worst-case equilibria. Comput Sci Rev 3(2):65–69. https://doi.org/10.1016/j.cosrev.2009.04.003

Lasaulce S, Debbah M, Altman E (2009) Methodologies for analyzing equilibria in wireless games. IEEE Signal Process Mag 26(5):41–52

Lorkowski J, Kreinovich V (2018) Bounded rationality in decision making under uncertainty: towards optimal granularity, studies in systems, decision and control, vol 99. Springer International Publishing, Cham. https://doi.org/10.1007/978-3-319-62214-9

Maillé P, Naldi M, Tuffin B (2009) Price war with migrating customers. In: 2009 IEEE international symposium on modeling, analysis simulation of computer and telecommunication systems, pp 1–8. https://doi.org/10.1109/MASCOT.2009.5362674

Maillé P, Tuffin B (2008) Analysis of price competition in a slotted resource allocation game. In: IEEE INFOCOM 2008—the 27th conference on computer communications. https://doi.org/10.1109/INFOCOM.2008.141

Mele A, Sangiorgi F (2015) Uncertainty, information acquisition, and price swings in asset markets. Rev Econ Stud 82(4):1533–1567

Milgrom P, Roberts J (1990) Rationalizability, learning, and equilibrium in games with strategic complementarities. Econometrica 58(6):1255–1277. https://doi.org/10.2307/2938316

Mouhyiddine T, Sabir E, Sadik M (2014) Telecommunications market share game with ambiguous pricing strategies. In: 2014 international conference on next generation networks and services (NGNS), pp 202–208. https://doi.org/10.1109/NGNS.2014.6990253

Moulin H (1980) On the uniqueness and stability of Nash equilibrium in non-cooperative games. In: Benoussan A, Kleindorfer PR, Tapiero CS (eds) Applied stochastic control in econometrics and management science. North-Holland Publishing Company, Amsterdam, p 271

Orda A, Rom R, Shimkin N (1993) Competitive routing in multiuser communication networks. IEEE/ACM Trans Netw 1(5):510–521. https://doi.org/10.1109/90.251910

Pleskac TJ (2012) Decision and choice: Luce choice axiom. Int Encycl Soc Behav Sci 5:895–900

Qi J, Zhang Y, Zhang Y, Shi S (2006) TreeLogit model for customer churn prediction. In: 2006 IEEE Asia-Pacific conference on services computing (APSCC’06), pp 70–75. https://doi.org/10.1109/APSCC.2006.111

Ren H, Huang T (2018) Modeling customer bounded rationality in operations management: a review and research opportunities. Comput Oper Res 91:48–58. https://doi.org/10.1016/j.cor.2017.11.002

Rosen JB (1965) Existence and uniqueness of equilibrium points for concave N-person games. Econometrica 33(3):520–534. https://doi.org/10.2307/1911749

Roughgarden T, Syrgkanis V, Tardos E (2017) The price of anarchy in auctions. J Artif Intell Res 59:59–101

Simon HA (1957) Models of man: social and rational. Wiley, New York (OCLC: 165735)

Sutton RS, Barto AG (1998) Reinforcement learning, Adaptive computation and machine learning. The MIT Press

Varian HR (1992) Microeconomic analysis. W. W. Norton & Company, New York

Neumann Jv, Morgenstern O (2004) Theory of games and economic behavior, 60th edn. Princeton Classic Editions, Princeton University Press

Yassen MT, Agiza HN (2003) Analysis of a duopoly game with delayed bounded rationality. Appl Math Comput 138(2):387–402. https://doi.org/10.1016/S0096-3003(02)00143-1

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ait Omar, D., Outanoute, M., Baslam, M. et al. On understanding price-QoS war for competitive market and confused consumers. Computing 101, 1327–1348 (2019). https://doi.org/10.1007/s00607-018-0642-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00607-018-0642-5