Abstract

With the development of informatization, traditional industries have been seriously impacted by cross-border e-commerce (CBEC), and the financial management mode no longer meets the needs of CBEC users. As cross-border electronic trading platforms face enormous financial data challenges, they need financial supervision and effective network risk protection. Artificial intelligence (AI) can effectively improve the financial accounting ability and resource integration of platforms. However, at present, the underdeveloped financial management system of CBEC platforms and problems, such as the running records of platform funds have seriously hindered the development of the financial standardization of platforms because the financial management system affects managers’ statistical analysis of financial data. Therefore, this paper analyzes the financial risks, the management problems and the causes of these problems of CBEC platforms and then uses AI to study the financial operation of CBEC platforms. Subsequently, this paper uses a machine learning (ML) algorithm to analyze the financial data clustering center and the security factor of the financial model. Finally, this paper proposes some corresponding strategies for financial model optimization and construction that can improve the information security and capital management of CBEC finance and promote the long-term development of CBEC platforms. The experimental results show that the classifier value and the safety factor of the financial model of CBEC platforms gradually increase under the ML algorithm. The mean value of the classifier value is approximately 1.14, and the mean value of the safety factor is approximately 1.37. Overall, the initial value of the classifier value of the platform financial model is 0.85, which increases to 1.41 on the seventh day, while the whole process increases by 0.56. The initial value of the safety factor of the platform financial model is 1.10, which increases to 1.64 on the seventh day, while the whole process increases by 0.54. The transaction information security and financial accounting accuracy of the CBEC platform financial model is better than that of the original financial model. The transaction information security is 10.4% higher than that of the original financial model, and the financial accounting accuracy is 10% higher than that of the original financial model. In other words, both AI and ML can promote the financial accounting standards and long-term development of CBEC platforms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

CBEC is an innovative business model based on traditional foreign trade, which can be improved through the network and CBEC. At the same time, CBEC is also an advanced application mode because the CBEC platform can convert capital, foreign exchange and transaction. With the emergence of cross-border e-commerce, significant changes have occurred in the world economy and trade. It effectively overcomes regional barriers in international trade and promotes the smooth development of foreign trade. Moreover, the CBEC platform is more in line with modern characteristics because it integrates the original CBEC transactions and forms a new trading platform. In recent years, CBEC has developed rapidly, and its import and export trade share has been increasing. Therefore, the study of CBEC’s financial issues in this paper would play an important role in developing the platform.

Many scholars have studied CBEC. Ma used the CBEC hosting service database to build an index of CBEC’s prosperity and risk level and revealed that the industry has gradually turned to cheaper and more effective marketing technologies and channels, and the risk level has significantly improved [1]. Based on participation theory and commitment participation theory, Mou proposed a CBEC purchase intention research model, and tested the research model using structural equation modeling technology based on covariance [2]. Yang built a new CBEC mobile market user transfer intention framework, and analyzed the relationship among user loyalty, transfer cost and transfer intention in the CBEC mobile market, providing suggestions for enterprises in CBEC mobile market [3]. Lv took supply chain decision-making as the object, and described the impact of typical behavior characteristics of platform participants on CBEC platform supply chain decision-making and its mechanism, to study the platform revenue management and the competition and coordination between platform providers and online retailers [4]. Sun provided a set of CBEC sales data from fast fashion retailers, which aimed to clarify the impact of fulfillment options on CBEC sales and the bottom line [5]. Hazarika and Reza identified the main themes in the context of CBEC and provided a framework to explain the main factors contributing to CBEC. He identified existing gaps in the literature and guided future research to address these gaps [6]. Based on the satisfaction of different stakeholders, Miao applied the bilateral matching method to the CBEC environment then demonstrated the model's feasibility and performance through numerical simulation [7]. The above studies have all described the role of CBEC but not related financial factors.

CBEC financial management can standardize the fund transaction of the platform. From the perspective of establishing a financial early warning model based on in-depth learning, Cao built a financial risk early warning mechanism of the CBEC platform to analyze and predict the financial risks of listed enterprises [8]. Yang studied the optimization of the supplier credit system of the CBEC platform. By introducing the decision matrix algorithm of the difference matrix and cloud model evaluation method, a multi-objective joint decision model for supplier selection and order allocation was established. The purpose was to analyze the relationship between financial transactions according to the joint decision-making model [9]. Zhu constructed the CBEC improved payment mode based on the secure electronic transaction protocol and compared the efficiency and security performance of the improved payment mode with the traditional face payment mode through simulation experiments [10]. Barbosa studied the current CBEC scenario, main challenges, and aspects that could be improved with the help of the proposed exclusive financial network and put forward some necessary suggestions [11]. The above studies all describe the financial management of CBEC, but there are still some deficiencies in financial risk prevention.

Although the CBEC platform has achieved high sales through the Internet, it also faces serious financial management problems of the platform. The internal management model of the platform has also been transformed into the CBEC business model, which realizes cross-border business marketing and changes the traditional business model, thus greatly increasing sales through the joint sales of online e-commerce platforms and third-party platforms. The cost-effectiveness of the platform from the CBEC model has been continuously improved. However, at the same time, they also have expressed concern about financial supervision issues, which should also be significantly affected the operation and development of the platform. Therefore, the standardized financial management of the CBEC platform would also contribute to the healthy and sustainable development of the platform.

Through the comparative analysis of experiments, this paper finds that the CBEC financial platform model can effectively improve the information security of financial transactions and the accuracy of financial data accounting. The financial platform under machine learning can also ensure financial data security from foreign enterprises. In addition, the CBEC financial platform model can also reduce the financial financing and operational risk of enterprises, reducing the error rate of enterprise managers in decision-making. The financial model also monitors the flow of financial transaction information very accurately, which is very helpful for platform managers to conduct capital accounting.

2 Evaluation of financial risks and problems of the CBEC platform

2.1 Characteristics of financial management of the CBEC platform

In the CBEC platform, financial management gradually introduces network and remote control mechanisms to ensure fast and dynamic financial reporting of financial transactions. There are four main characteristics of financial management, as shown in Fig. 1. The first is the financial management network. The traditional process of establishing a financial platform is not enough to share resources, which hinders the smooth exchange of information and a lot of financial work. Under the Internet, CBEC connects different departments and staff, which makes the specific financial management work very convenient, thus greatly improving the quality and efficiency of transactions. The second is financial transaction interworking. In CBEC, information technology solves this problem to some extent, which enables enterprises to establish a good interaction between business processes, capital flows, information flows and logistics. This n innovation of financial management mode promotes the significant improvement of financial management efficiency because financial transaction intercommunication can speed up the circulation of financial data information. The third is remote financial control. Establishing the platform financial management information system effectively solves the problem of remote financial management, which is very convenient and simple, and also reduces the management cost. This has greatly promoted the overall management and operation of the CBEC platform and new innovative forms of the financial model. The fourth is the introduction of dynamic financial accounting. In traditional circumstances, it is difficult for the platform to provide dynamic financial accounting, which reduces the frequency of updating financial statements and makes it difficult to change information on time. In terms of CBEC, these difficulties have been greatly improved in the past, which is conducive to adopting dynamic financial accounting for the financial management of the platform. Therefore, the CBEC platform can timely update a large amount of financial information and timely feedback about the platform’s operation, financial situation, etc.

2.2 Financial risk analysis of the CBEC platform

The financial risks in the CBEC platform are reflected in four aspects, as shown in Fig. 2. The first is the difficulty of accounting. Most CBEC transactions are conducted in real-time. Therefore, for convenience, many CBECs tend to collect financial accounting, but this does not meet the requirements of current accounting standards. In addition, many CBEC enterprises have multiple accounts to operate, and the price and sales costs vary from platform to platform. International logistics is a more complex and uncertain industry. This unique business feature of CBEC requires providing resources for the platform to meet its business needs. The second is an incomplete financial report. In addition to traditional financial statements and related instructions, indicators such as financial-related exchange rate, average customer retention time, and attendance rate often significantly impact the financial status and long-term development prospects of multinational e-commerce enterprises when measuring CBEC’s financial operations. Moreover, the concealment of these financial information reports is not conducive to the platform making corresponding economic decisions. The third is excessive dependence on the third platform. Most CBEC enterprises rely on Amazon and other external third-party platforms for trade, but most small and medium-sized CBEC enterprises only operate on one platform. If the platform system or policy is suddenly wrong, or the enterprise goes bankrupt, these enterprises would face greater financial and operational difficulties and may even face the problem of financial chain rupture. The fourth is financial foreign exchange risk. The main activities of CBEC enterprises are usually import and export and foreign exchange trade [12]. Therefore, to solve the platform's financial risk problem, it is necessary to deal with more complex exchange rate problems. At the same time, considering the exchange rate fluctuations in different periods, the dynamic change of foreign exchange risk is also one of the main system risks of the platform.

2.3 Financial problems of the CBEC platform

The financial problems of the CBEC platform are shown in Fig. 3. First, the laws and regulations of the platform are not perfect. Various factors and time constraints largely constrain the development of CBEC. As a key factor in the development of CBEC, the supervision of the financial department directly affects the future of CBEC. At the same time, enterprises must strengthen the quality of financial management and prevent the disclosure of personal information on the CBEC platform. Second, financial information is not safe. Financial information security directly determines the impact of CBEC platform control measures on the platform’s financial foreign exchange and income. Regarding CBEC platform, financial information is usually processed by computers, which greatly improves the processing speed and brings additional security risks. The network environment of the platform is weak, and the risk of obtaining financial information is large. Some financial information is easy to be stolen, and the CBEC platform is seriously affected during operation. Third, the foundation of personnel management is weak. The network has become an important tool for CBEC platform information collection. In this process, the quality and availability of personnel significantly impact the platform's financial management. The platform may encounter problems in the procurement, transaction and other processes, and the main problem is that the amount of traded goods are not received in time, which has brought serious problems to the financial security of the platform. Fourth, financial accounting is not standardized. Some CBEC platforms perform poorly in financial accounting and lack a scientific basis. The platform management personnel know little about financial accounting, and the accounting standards of the platform financial personnel are inconsistent, making it impossible to reasonably prepare financial statements, thus seriously affecting the platform financial management.

2.4 Analysis of the causes of financial problems of the CBEC platform

There are three main reasons for the financial problems of the CBEC platform. First, the platform accounting system is not perfect. Many CBEC platforms have not yet established a sound accounting system, and there is no clear standard for capital accounting. In addition, there is no clear standard for policy selection, which depends on the specific situation. Moreover, the accounting method is very arbitrary, which cannot ensure the rationality and integrity of the accounting account, nor can it ensure the true reflection of the transaction amount. Due to the lack of an audit control system consistent with the authenticity and objectivity of accounting data, accounting results are biased. Secondly, the financial planning of the platform is not perfect. The use and purchase of funds an important issue in the operation of the CBEC platform. In general, the utilization rate of financial accounting has declined due to the imperfect system, inconsistency with the comprehensive budget and expenditure management plan, and lack of standardized and systematic management in budget management, income accounting and recording, resource sharing and other fields. In general, the CBEC platform is small in scale, with a relatively weak ability to deal with risks and insufficient financial advantages. Weak platform risk response capability would lead to poor financial operation. Financing must have a high platform credit rating or appropriate guarantee, while some CBEC platforms lack effective financial management. In addition, it takes a lot of time to provide logistical support for transnational transportation, and the repatriation of funds is slow [13]. The platform lacks financial talent. Some accountants working on the CBEC platform are unwilling to accept new things. Although they are familiar with traditional financial theories, they cannot fully integrate theories and new technologies into the platform, which may also lead to problems in the operation of the financial system. At the same time, the CBEC platform lacks financial management information system, which leads to the decline of all informatization levels in the platform.

3 Financial application evaluation and model optimization of the CBEC platform

3.1 Application of AI in CBEC finance

AI can be used to establish a CBEC credit system and evaluate the credit rating of the CBEC platform. It can also accelerate the establishment of an open and transparent credit database. Enterprises with low skills must comply with relevant laws and advise consumers on cross-border consumption issues. In addition, information exchange can also be accelerated by establishing coordination and monitoring mechanisms among relevant agencies, as well as mechanisms for monitoring CBEC payments at borders and in relevant legal systems. Moreover, relevant national institutions should actively participate in international negotiations. A dispute settlement mechanism should be established to determine the scope of the application of laws and regulations. It mainly includes financial transaction data and rules and regulations for financial risk assessment. At the same time, information resources can be incorporated into the CBEC platform. Resource integration means different combinations and optimization of internal and external resources of the platform, and finding innovative resource allocation models suitable for the development of the platform. Resource management under AI becomes more open, with an easy integration and unified interface. Using data analysis technology, a modular, normative and systematic resource library is established for the CBEC platform. The new business process based on data analysis optimizes the combination of information resources, customer resources, professional resources and other internal and external resources, and highlights the central competitiveness of the platform, thus proposing a better service model according to the actual needs of customers [14, 15]. In a word, the impact of AI on resource portfolio is complex and systematic.

3.2 Significance of CBEC financial regulations

In order to rapidly develop the CBEC platform, attention must be paid to financial management. The digital revolution has strongly promoted the development of the CBEC platform. CBEC platform is based on the modern financial industry and realizes transaction settlement and financial settlement through AI. Normative financial management can improve transparency and facilitate the financing of CBEC platform. In order to simplify financial transactions, the CBEC platform must strengthen financial management and related comprehensive financial transactions, and optimize internal financial management. In addition, comprehensive financing contributes to the financial standardization of the CBEC platform and the financial optimization of CBEC artificial intelligence, which also contributes to the long-term development of CBEC. Therefore, studying the financial standardization of CBEC platform is of positive significance.

3.3 CBEC financial platform model construction

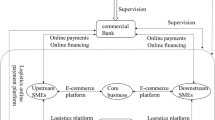

In view of the platform financial problems mentioned above and the causes of the platform financial problems, this paper optimizes and analyzes the financial model of CBEC through new technologies, so as to improve the platform operation and financial information security. This forms a dynamic platform business management mode, which is shown in Fig. 4.

3.3.1 Regulatory financial platform system

CBEC platform should optimize the financial management system and establish an accounting system that keeps pace with the times. It is necessary to formulate a series of accounting standards and financial systems, and thoroughly overcome the systematic limitations of the traditional model, to adjust and improve the accounting system. In addition, it can expand the scope of audit firms and reconsider the basic assumptions that constitute effective, institutionalized and standardized management measures, which are efficient and standardized management measures. The CBEC platform should significantly adjust and expand the management elements of the financial management system to institutionalize the management content. By limiting the implementation process, the platform can help promote financial management and ensure effective financial management. By scientifically constructing laws and regulations regarding the financial security of the platform, awareness of the protection of the rights of CBEC platform workers can be raised and used to safeguard the financial security of the platform.

3.3.2 Effective control of financial data

It is suggested that CBEC institutions should be established. Whether through a third-party payment platform or not, a foreign currency current account should be opened, and a special seal should be affixed to the RMB, foreign currency and CBEC payment data, which is conducive to the statistics and control of CBEC transactions and payments. At the same time, if the personal currency exchange system does not provide an interface with the electronic payment institution, the payment institution shall first use the foreign exchange purchase method, and then record the foreign exchange sales information. The State Administration of Foreign Exchange shall strengthen the statistics, control, and management of CBEC’s foreign exchange income and conduct regular on-site inspections. By combining the management purpose of on-site and off-site inspection, the control and management efficiency can be improved.

3.3.3 Improvement of financial accounting system

The first is to improve the accounting management system, and to establish accounting management standards and systems that conform to the reality of the CBEC platform. It is necessary to emphasize the authenticity and standardization of accounting, and strictly supervise the implementation of accounting through access to financial data on the platform and the number of daily bills. In order to effectively improve the quality of accounting information, the adoption of accounting policies needs to be analyzed in many aspects. It needs to adjust the existing accounting standards and prudently include non-financial indicators reflecting the characteristics of the CBEC industry in the financial statements. In terms of the CBEC platform, the number of product views and purchases in the financial statements can be increased, which enables internal financial managers to monitor the platform performance comprehensively. This can effectively predict and evaluate the economic prospects of the platform, and help the platform achieve the long-term goal of sustainable development.

3.3.4 Development of financial information management system

A stable financial information system is a reliable basis for ensuring the authenticity, objectivity and accuracy of the financial data of the CBEC platform. First, during the transition period, a financial management system should be established to support multinational and multi-mode management systems, which should have good financial accounting functions, and can update the financial conversion data of income and expenditure accounts in real-time. Second, to meet the actual needs of the CBEC platform, it should be optimized from the perspective of the content of the financial management system. As a key component of the new financial management system, logistics management can provide more effective marketing and cost control functions. In addition, to ensure the rapid synchronization and sharing of inventory data, the platform financial management system must have specific inventory management and data analysis capabilities. Moreover, the system must establish a security mechanism to ensure the security and operation of financial data, and the security and continuity of financial data.

4 Application of ML algorithm in the construction of CBEC financial platform

In order to study the specific flow of CBEC financial transactions, the financial management system of the CBEC platform is analyzed and studied through the ML algorithm. The corresponding management system is optimized according to the deficiencies in the platform, so as to improve the normal transaction payment of CBEC platform. Among them, machine learning is an algorithm that studies financial data sets and classifiers through clustering centers, and finally obtains financial safety factors. First, the financial category of the samples in the platform is calculated:

Among them, \(a_{(n)}\) is the training sample within the platform, and \(b_{i}\) is the cluster centroid of the platform financial data. Secondly, the financial data categories are classified accordingly, and the optimized financial data clustering center can be obtained as:

After that, the training samples of financial data in the platform are classified into data sets, and the classified financial data sets are:

Among them, C and D are the inflow data and outflow data of financial data, respectively. The probability distribution of the financial data set is:

Among them, \(t_{1i}\) is the probability coefficient of financial data. By using probability distribution to promote the learning of financial data sets, the classification indicators of the financial platform model can be obtained:

According to the classification indicators of the platform model, the error rate of the platform financial model is calculated as:

The error rate of the financial model can measure the financial calculation effect of machine learning in the CBEC platform. According to the error rate and classification index, the data coefficient of the classification index can be obtained as:

The combination of financial linear models of CBEC platform is:

The classifier of the final financial model is:

Finally, the safety factor of the platform’s financial model can be obtained as:

Among them, \(o_{1} ,o_{2}\) are the weight coefficients of the platform financial model, respectively, and the sum of the two is 1; \(y_{i}\) is the classification index of the platform’s classified data. The safety factor of the financial model is used to measure the management and processing effect of the CBEC platform for financial data under machine learning.

5 Experimental evaluation of cross-border e-commerce financial model

In order to study the financial model management effect of the CBEC platform, this paper constructed a corresponding financial model of CBEC platform by analyzing the management mode and financial operation risk of CBEC finance. By improving the financial fund accounting system and optimizing the financial accounting ability of the internal staff of the platform, the financial operation ability of the CBEC platform was improved. Therefore, this paper first investigated the satisfaction effect of three large financial enterprises of the CBEC platform on the financial model of the platform, in which 100 people were surveyed in each financial enterprise. The specific satisfaction effects are shown in Table 1.

According to the data surveyed in Table 1, the employees of the three financial enterprises were highly satisfied with the CBEC platform. The number of satisfied employees of financial enterprise 1 was 86, accounting for 86% of the total employees of the enterprise. The average number of people was 9, accounting for 9% of the total number of the enterprise. The number of dissatisfied people was 5, accounting for 5% of the total number of the enterprise. The number of satisfied employees of financial enterprise 2 was 85, accounting for 85% of the enterprise's total employees. The average number of people was 8, accounting for 8% of the total number of the enterprise. The number of dissatisfied people was 7, accounting for 7% of the total number of the enterprise. The number of satisfied employees of financial enterprise 3 was 88, accounting for 88% of the total employees of the enterprise. The average number of people was 4, accounting for 4% of the total number of the enterprise. The number of dissatisfied people was 8, accounting for 8% of the total number of the enterprise. Overall, 86.3% of employees in financial enterprises were satisfied with the financial model. The average number of employees of the financial enterprise for the financial model accounted for 7% of the total number. The number of employees in financial enterprises who were dissatisfied with the financial model accounted for 6.7% of the total. Satisfied financial enterprise employees believed that implementing the financial model on the platform could improve the accounting of the platform funds and the management effect of financial information, and also could collect the transaction information of the platform in real-time. The dissatisfied employees thought that the financial model was not as accurate as manual accounting, because they believed that the machine learning and big data algorithms that financial models rely on were not mature enough. The main reason for dissatisfaction is that they feel that the appearance of the financial model may replace their position in future, and the data calculation and processing speed of the financial model is faster. After that, the financing risk and operational risk of the CBEC platform under the financial model were analyzed. The specific changes are shown in Fig. 5.

According to the data investigated in Fig. 5, the financing risk and operating risk of the platform were gradually decreasing under the operation of the financial model of CBEC platform. The average financing risk was about 0.53, and the average operating risk was about 0.66. Overall, the initial value of platform financing risk was 0.85, which decreased to 0.25 on the seventh day, and the whole process decreased by 0.60. The initial value of the platform’s operational risk was 0.88, which decreased to 0.48 on the seventh day, with a decrease of 0.40 in the whole process. The overall financing and operating risks of the CBEC platform financial model declined with the improvement of the financial management system. The main reason is that the financial data of the CBEC platform cannot be tampered with, and the encryption of the data is relatively good. Users can only access it with permission, and the risk prediction is more accurate after improving the financial management system. The financial model also monitors the flow of financial transaction information very accurately, which is very helpful for the platform managers to conduct capital accounting. The accuracy of financial model monitoring affects the speed and efficiency of manual capital accounting. The ML algorithm was used to analyze the classifier value and safety factor of the platform’s financial model, and the change in their data within a week was studied. The specific changes are shown in Fig. 6.

According to the data investigated in Fig. 6, the classifier value and safety factor of the CBEC platform financial model were gradually increased under the ML algorithm. The mean value of the classifier value was about 1.14, and the mean value of the safety factor was about 1.37. On the whole, the initial value of the classifier value of the platform financial model was 0.85, which increased to 1.41 on the seventh day, and the whole process increased by 0.56. The initial value of the safety factor of the platform’s financial model was 1.10, which increased to 1.64 on the seventh day, and the whole process increased by 0.54. The increase in classifier value showed that the CBEC platform’s financial security system was more perfect, and the financial management methods were more diversified. The rise of the safety factor showed that the financial model of the platform was more complex and unified in terms of capital accounting standards, and relevant financial personnel paid more attention to financial data, which to some extent ensured the safe operation of the CBEC platform. Finally, the transaction information security and financial accounting accuracy of the CBEC platform financial model were analyzed and compared with the original financial model of the CBEC platform. The specific comparison is shown in Fig. 7.

According to the data in Fig. 7, the transaction information security and financial accounting accuracy of the CBEC platform financial model was better than the original financial model. The security of transaction information was 10.4% higher than the original financial model, and the accuracy of financial accounting was 10% higher than the original financial model. The financial management system and capital operation system standards under the CBEC platform were clearer, and the financial statements related to transactions were clearer. For the import and export transaction volume records of the platform, data analysis, recording, and comparison can also be conducted through the financial information database, which would improve the data accuracy and data security of the platform’s finance to a certain extent. In addition, the construction of the financial model of the CBEC platform is of great significance to the improvement of the fund accounting ability and resource integration ability of the platform, because the financial model can improve the financial management system by standardizing the financial data monitoring and calculation of the platform.

6 Conclusions

With the rapid development of CBEC, opportunities and challenges coexist. The CBEC platform needs to be a continuously optimized financial system, and financial management needs to be highly valued. The internal financial personnel of the platform need to improve their overall quality and supplement their professional knowledge, so as to continuously develop CBEC’s countermeasures to respond to market changes. AI can improve the fund accounting ability and resource integration of the platform. Through the above experimental analysis, it can be seen that the CBEC model built in this paper can mention the security of transaction information and the accuracy of financial accounting, and it can also reduce the risk of enterprise platforms. For the CBEC platform, measures can be taken to reduce some financial risks. Only by effectively controlling financial risks can the healthy development of CBEC be improved. To improve CBEC’s competitiveness and achieve greater economic benefits, it is necessary to actively study financial management measures and optimize the organizational structure of financial management. Only by constantly improving and optimizing financial management measures can the financial model become the driving force for CBEC’s development.

Data availability

Data sharing is not applicable to this article as no datasets were generated or analyzed during the current study.

References

Ma S, Chai Y, Zhang H (2018) Rise of cross-border e-commerce exports in China. China World Econ 26(3):63–87

Mou J, Zhu W, Benyoucef M (2020) Impact of product description and involvement on purchase intention in cross-border e-commerce. Ind Manag Data Syst 120(3):567–586

Yang Y (2020) Risk factors of consumer switching behaviour for cross-border e-commerce mobile platform. Int J Mob Commun 18(6):641–664

Lv Q (2018) Supply chain decision-making of cross-border e-commerce platforms. Adv Ind Eng Manag 7(1):1–8

Sun L (2021) Cross-border e-commerce data set: choosing the right fulfillment option. Manuf Serv Oper Manag 23(5):1297–1313

Hazarika BB, Mousavi R (2021) Review of cross-border e-commerce and directions for future research. J Glob Inf Manag (JGIM) 30(2):1–18

Miao Y (2019) A two-sided matching model in the context of B2B export cross-border e-commerce. Electron Commer Res 19(4):841–861

Cao Y, Shao Y, Zhang H (2022) Study on early warning of e-commerce enterprise financial risk based on deep learning algorithm. Electron Commer Res 22(1):21–36

Yang Y (2020) Research on the optimization of the supplier intelligent management system for cross-border e-commerce platforms based on machine learning. IseB 18(4):851–870

Zhu Q (2020) The optimization effect of fuzzy factional-order ordinary differential equation in block chain financial cross-border e-commerce payment mode. Alex Eng J 59(4):2839–2847

Barbosa D (2020) Impact of a BRICS integrated payment system on cross-border e-commerce. BRICS J Econ 1(4):33–41

Yu L (2021) Research on the risk and supervision system of cross-border e-commerce payment in China. Financ Eng Risk Manag 4(5):9–15

Afolayan MS (2021) Legal analysis of electronic payment system and frauds associated with e-commerce transactions in Nigeria. J Commer Prop Law 8(3):116–125

Sun Yi, Li Y (2021) The impact of risk-aware consumer trust on CB e-commerce platforms and purchase intention. J Glob Inf Manag 30(3):1–13

Zhang X (2021) New development pattern of dual circulation promoted by cross-border e-commerce: theoretical mechanism, development ideas and relevant measures. Contemp Econ Manag 43(10):59–65

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares no conflict of interest with any financial organizations regarding the material reported in this manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zhou, K. Financial model construction of a cross-border e-commerce platform based on machine learning. Neural Comput & Applic 35, 25189–25199 (2023). https://doi.org/10.1007/s00521-023-08456-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-023-08456-6