Abstract

At the heart of technology transitions lie complex processes of social and industrial dynamics. The quantitative study of sustainability transitions requires modelling work, which necessitates a theory of technology substitution. Many, if not most, contemporary modelling approaches for future technology pathways overlook most aspects of transitions theory, for instance dimensions of heterogenous investor choices, dynamic rates of diffusion and the profile of transitions. A significant body of literature however exists that demonstrates how transitions follow S-shaped diffusion curves or Lotka-Volterra systems of equations. This framework is used ex-post since timescales can only be reliably obtained in cases where the transitions have already occurred, precluding its use for studying cases of interest where nascent innovations in protective niches await favourable conditions for their diffusion. In principle, scaling parameters of transitions can, however, be derived from knowledge of industrial dynamics, technology turnover rates and technology characteristics. In this context, this paper presents a theory framework for evaluating the parameterisation of S-shaped diffusion curves for use in simulation models of technology transitions without the involvement of historical data fitting, making use of standard demography theory applied to technology at the unit level. The classic Lotka-Volterra competition system emerges from first principles from demography theory, its timescales explained in terms of technology lifetimes and industrial dynamics. The theory is placed in the context of the multi-level perspective on technology transitions, where innovation and the diffusion of new socio-technical regimes take a prominent place, as well as discrete choice theory, the primary theoretical framework for introducing agent diversity.

Similar content being viewed by others

Notes

Observing for instance the stark contrast between approaches by Nordhaus (2010) (exogenous technology trends), (Messner and Strubegger 1995) (cost-optimisation), (De Vries et al. 2001) (elasticities of substitution), (Johansen 1959; Boucekkine et al. 2011) (neoclassical vintage capital theory), (Grübler 1998) (empirical technology dynamics), (Safarzynska and van den Bergh 2012) (evolutionary dynamics), (Silverberg 1988) (self-organised systems), (Malerba et al. 1999) (innovation dynamics within firms), (Geels 2002) (socio-technical regimes).

No evidence points to cost-optimisation behaviour by agents, i.e. firms (Nelson and Winter 1982) or consumers (Douglas 1979), including at an aggregate level (Keen 2011), and no theory satisfactorily proves that an ‘average’ representative agent can correctly reproduce the aggregate behaviour of an underlying diverse set of agents, including neoclassical theory (Keen 2011).

E.g. fitting logistic curves requires data that spans at least beyond the inflexion point.

The perverse effect of using quantities relative to the total is that this method can easily lead to overlooking other competing technologies that only hold small market shares.

The relative signs of the elements in α i j when permuting i and j determine the nature of the interaction, i.e. competition or predator-prey.

E.g. how long does a car survive for on roads? How many cars of a particular type can be produced in a year?

The existence of sunk costs, investments in exchange for which technology is expected to operate for a certain amount of time, imply the existence of a non-zero life expectancy. This is particularly true if money is borrowed for the purchase of a unit and repaid during its operating lifetime.

E.g. the number of 2003 Citroen C3 currently 11 years old.

Note that in contrast to the birth function that I shall define further, ℓ i (a) must be a strictly decreasing function of age otherwise dead units would come back to life.

We consider here repairs as investments in new production capital, in order to correctly keep track of the amount of depreciation.

R i is in units of production capital purchased per unit of technology sold.

Whether the capital is fully used or whether there is spare capacity.

It almost never happens that a rate of production growth determined solely by the supply side persists for a long time. For example in the transport sector, if sales in developed nations were to increase faster than the population, this would mean that households eventually own 3-4-5 cars and so on, rather unlikely. In this case, the rate of growth of sales is limited by the rate of growth of the demand, not the rate at which production could hypothetically be scaled up given its profitability. Supply-led growth however could arise in special circumstances such as in wartime policies of rapid up-scaling.

i.e. they most likely do not choose something they know nothing of, and they gather reliable information predominantly through observations of their peers

i.e. accidents, breakdowns or economic scrapping decisions, following the survival function. The nature of ownership of these technology units, and whether they change ownership, is not relevant, which enables to make abstraction of second-hand markets.

The production capital produces a finite amount of goods in its lifetime.

Adding here a factor F i j can be done but is secondary: even if new units are not chosen exchanges can occur through the exchange term.

Thus improvements could be made using stochastic population growth theory, where for instance the probability of extinction at low population numbers would be better represented.

i.e. a ‘low-pass’ filter.

In this case both m(b) and d ℓ(a)/d a; the wider the kernel, the lower the frequency cutoff and the more smoothing occurs.

This results from the convolution theorem.

The production of goods using existing capital generates more wealth than just what is required to maintain itself.

Given, say, a different set of possibilities available to investors.

LVE systems can be applied at other levels, e.g. firms. This may provide ways to deal with cases excluded here, requiring further research.

E.g. the mobile phone industry, in which phones have very short lifetimes, or infrastructure industries where the capital, e.g. houses, roads and bridges, have much longer lifetimes than the firms building them, potentially maintained forever.

This model does not apply at the firm level, as was done in Atkeson and Kehoe (2007).

Note however that knowledge of the absolute value of \(\overline {\tau }\), the absolute time scaling factor, appears on its own in the equation and is thus necessary.

In which case we would need to subdivide such a technology category into two.

\(\overline {C}\) is the weighted average, while \(\overline {\sigma }^{2}\) is the weighted sum of the square of the standard deviations.

Producing faster (smaller t i ) increases competitiveness and therefore the fitness, while surviving for longer (larger τ i ) decreases vulnerability to changes and thus also improves the fitness.

Replacing all alternatives by a single ‘representative’ alternative.

References

Andersen ES (1994) Evolutionary Economics, Post-Schumpeterian Contributions. Pinter Publishers

Anderson PW (1972) More is different. Science 177(4047):393–396

Arrow K, Bolin B, Costanza R, Dasgupta P, Folke C, Holling C, Jansson B, Levin S, Maler K, Perrings C, Pimentel D (1995) Economic-growth, carrying-capacity, and the environment. Science 268(5210):520–521

Arthur W B (1989) Competing technologies, increasing returns, and lock-in by historical events. Econ J 99(394):116–131

Atkeson A, Kehoe PJ (2007) Modeling the transition to a new economy: Lessons from two technological revolutions. Am Econ Rev 97(1):64–88

Ben-Akiva ME, Lerman SR (1985) Discrete choice analysis: theory and application to travel demand. MIT press

Boucekkine R, Croix DDL, Licandro O (2004) Modelling vintage structures with DDEs: principles and applications. Math Popul Stud 11(3-4):151–179

Boucekkine R, De la Croix D, Licandro O (2011) Vintage capital growth theory: Three breakthroughs. UFAE and IAE Working Papers 875.11, Unitat de Fonaments de l’Anlisi Econmica (UAB) and Institut d’Anlisi Econmica (CSIC)

Cambridge Econometrics (2014) Cambridge Econometrics E3ME Manual. http://www.e3me.com

Domencich TA, McFadden D (1975) Urban travel demand - A behavioural analysis. North-Holland Publishing

Douglas M (1979) The world of goods. Towards an anthropology of consumption. Routledge

Farrell CJ (1993) A theory of technological progress. Technol Forecast Soc Chang 44(2):161–178

Fisher JC, Pry RH (1971) A simple substitution model of technological change. Technol Forecast Soc Chang 3(1):75–88

Geels FW (2002) Technological transitions as evolutionary reconfiguration processes: a multi-level perspective and a case-study. Res Policy 31(8-9):1257–1274

Geels FW (2005) The dynamics of transitions in socio-technical systems: A multi-level analysis of the transition pathway from horse-drawn carriages to automobiles (1860 - 1930). Technol Anal Strateg Manag 17(4):445–476

Grübler A (1998) Technology and Global Change. Cambridge University Press, Cambridge, UK

Grübler A, Nakicenovic N, Victor D (1999) Dynamics of energy technologies and global change. Energy Policy 27(5):247–280

Hodgson G, Huang K (2012) Evolutionary game theory and evolutionary economics: Are they different species J Evol Econ 22(2):345–366

Hofbauer J, Sigmund K (1998) Evolutionary Games and Population Dynamics. Cambridge University Press, Cambridge, UK

IEA/ETSAP (2012) Energy technology systems analysis program. http://www.iea-etsap.org/

Johansen L (1959) Substitution versus fixed production coefficients in the theory of economic growth: A synthesis. Econometrica 27(2):157–176

Keen S (2011) Debunking Economics - Revised and expanded edition. Zed Books

Keyfitz N (1967) The integral equation of population analysis. Revue de l’Institut International de Statistique / Review of the International Statistical Institute 35(3):213–246

Keyfitz N (1977) Introduction to the Mathematics of Population. Addison-Wesley

Kot M (2001) Elements of Mathematical Ecology. Cambridge University Press

Lakka S, Michalakelis C, Varoutas D, Martakos D (2013) Competitive dynamics in the operating systems market: Modeling and policy implications. Technol Forecast Soc Chang 80 (1):88–105

Lotka AJ (1911) A problem in age-distribution. Philos Magazine 21:435–438

Malerba F, Nelson R, Orsenigo L, Winter S (1999) ‘history-friendly’ models of industry evolution: The computer industry. Indust Corp Chang 8(1):3–40

Mansfield E (1961) Technical change and the rate of imitation. Econometrica 29(4):741–766

Marchetti C, Nakicenovic N (1978) The dynamics of energy systems and the logistic substitution model. Technical Report, IIASA, http://www.iiasa.ac.at/Research/TNT/WEB/PUB/RR/rr-79-13.pdf

McDonald A, Schrattenholzer L (2001) Learning rates for energy technologies. Energy Policy 29(4):255–261

McFadden D (1973) Conditional logit analysis of qualitative choice behavior, Frontiers in Econometrics

McShane BB, Bradlow ET, Berger J (2012) Visual influence and social groups. J Mark Res 49(6):854–871

Mercure JF (2012) Ftt:power : A global model of the power sector with induced technological change and natural resource depletion. Energy Policy 48(0):799–811. doi:10.1016/j.enpol.2012.06.025

Mercure JF, Pollitt H, Chewpreecha U, Salas P, Foley A, Holden P, Edwards N (2014) The dynamics of technology diffusion and the impacts of climate policy instruments in the decarbonisation of the global electricity sector. Energy Policy 73(0):686–700. doi:10.1016/j.enpol.2014.06.029

Messner S, Strubegger M (1995) User’s guide for MESSAGE III. Technical Report, IIASA, http://www.iiasa.ac.at/Admin/PUB/Documents/WP-95-069.pdf

Metcalfe J (2008) Accounting for economic evolution: Fitness and the population method. J Bioecon 10(1):23–49

Metcalfe JS (2004) Ed mansfield and the diffusion of innovation: An evolutionary connection. J Technol Trans 30:171–181

Nakicenovic N (1986) The automobile road to technological-change - Diffusion of the automobile as a process of technological substitution. Technol Forecast Soc Chang 29(4):309–340

Nelson RR, Winter SG (1982) An Evolutionary Theory of Economic Change. Harvard University Press, Cambridge, USA

Nordhaus WD (2010) Economic aspects of global warming in a post-Copenhagen environment, Proceedings of the National Academy of Sciences

ORNL (2012) Transportation energy data book, 31st edn. Technical Report, Oak Ridge National Laboratory

Rogers EM (2010) Diffusion of innovations. Simon and Schuster

Safarzynska K, Van den Bergh JCJM (2010) Evolutionary models in economics: a survey of methods and building blocks. J Evol Econ 20(3):329–373

Safarzynska K, van den Bergh JCJM (2012) An evolutionary model of energy transitions with interactive innovation-selection dynamics. Journal of Evolutionary Economics, pp 1–23

Saviotti P, Mani G (1995) Competition, variety and technological evolution: A replicator dynamics model. J Evol Econ 5(4):369–392

Schumpeter JA (1934) The Theory of Economic Development - An inquiry into Profits, Capital, Credit, Interest and the Business Cycle. Harvard University Press, Cambridge, USA

Schumpeter JA (1939) Business Cycles. McGraw-Hill

Schumpeter JA (1942) Capitalism, Socialism and Democracy. Martino Publishing, Eastford, USA

Sharif MN, Kabir C (1976) Generalized model for forecasting technological substitution. Technol Forecast Soc Chang 8(4):353–364

Silverberg G (1988) Modelling economic dynamics and technical change: mathematical approaches to self-organisation and evolution. In: Dosi G, Freeman C, Nelson R, Silverberg G, Soete L (eds) Technical change and economic theory. Pinter Publishers, pp 560–607

Solow RM, Tobin J, von Weizscker C C, Yaari M (1966) Neoclassical growth with fixed factor proportions. Rev Econ Stud 33(2):79–115

De Vries BJ, van Vuuren DP, Den Elzen MG, Janssen MA (2001) The Targets IMage Energy Regional (TIMER) Model. Technical Report, National Institute of Public Health and the Environment (RIVM)

Weiss M, Patel MK, Junginger M, Perujo A, Bonnel P, Van Grootveld G (2012) On the electrification of road transport - learning rates and price forecasts for hybrid-electric and battery-electric vehicles. Energy Policy 48(0):374–393

Wilson C (2009) Meta-analysis of unit and industry level scaling dynamics in energy technologies and climate change mitigation scenarios. Technical Report IR-09-029, IIASA, http://webarchive.iiasa.ac.at/Admin/PUB/Documents/IR-09-029.pdf

Wilson C (2012) Up-scaling, formative phases, and learning in the historical diffusion of energy technologies. Energy Policy 50:81–94

Acknowledgments

I would like to acknowledge the students who have been attending the Energy Systems Modelling seminars held at 4CMR in 2013, in particular A. Lam, P. Salas and E. Oughton, with whom the discussions on technology and evolutionary economics led to the development and enhancement of this theory. I would furthermore like to thank participants to the International Conference on Sustainability Transition 2013 for providing valuable feedback, in particular K. Safarzynska for critical comments, as well as two anonymous referees for their recommendations. This research was funded by the UK Engineering and Physical Sciences Research Council, fellowship number EP/K007254/1.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Growth under full employment

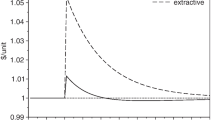

In a situation where an innovation was to follow a path free of competitors and grow as fast as its industry can produce it, it would follow the fastest possible rate \(t_{i}^{-1}\) of exponential growth determined by:

This is a transcendental equation that can only be solved numerically. As demonstrated by Lotka (1911) (see Kot 2001 for a clearer derivation), it has only one real solution, all others being complex of the form u±i v which give rise to oscillatory behaviour in the real part. The non-oscillatory real solution, an exponential, can be approximated if simple forms are taken for ℓ(b) and P(b) (see Fig. 3, right)

where b 0 is the time between investment and construction, P i is a production rate and therefore (R i P i )−1 is the rate of expansion of production capacity (in inverse years), and \({\tau _{i}^{K}}\) is the timescale of capital depreciation, its life expectancy (and therefore we always have \({\tau _{i}^{K}} >> b_{0}\)). To first order, one can find which is the dominant of these timescales in particular situations, using limits for the dimensionless parameter R i P i b 0 (which determines the slope of the linear left hand side of the equation, see graph).

Case 1

(R i P i b 0)is small ⇒λ b 0 is small

We perform a Taylor expansion around λ b 0 = 0,

Since R i P i cannot be a very small quantity, it is most likely that b 0<<(R i P i )−1, for instance with small technologies that are ready to use as they come out of the factory (e.g. vehicles). And since \(R_{i}P_{i} >> 1/{\tau _{i}^{K}}\), then t i ≃(R i P i )−1. In this case the rate of production is constrained by the rate of re-investment into production capacity, which depends on the rate of production of technology units but not on the time of construction of production capacity. For large systems (e.g. power plants, wind turbines, infrastructure), the time of construction may be long (i.e. several years), constraining money flows used for firm expansions. For small modular technologies (e.g. electronics), the time of production is short and other timescales dominate the time ‘bottleneck’.

Case 2

(R i P i b 0) is of order 1 ⇒λ b 0≃1

We perform a Taylor expansion around λ b 0=1,

If \(b_{0} << R_{i}^{-1}P_{i}^{-1}\) then t=e R i P i and the limiting timescale is again the re-investment rate. However, if \(b_{0} >> R_{i}^{-1}P_{i}^{-1}\) then t=b 0 and the rate of growth is limited by the rate of completion of capital installation. For example, for technologies with complex production capital structures with a long time of for installation with no income constrains the rate of return, the dominant bottleneck timescale is b 0, a situation where a firm must wait for expansion projects to come to completion and income to be brought in before launching itself into further expansions.

Case 3

(R i P i b 0) is large ⇒λ b 0 is large

No Taylor expansion is possible. However if \(R_{i}P_{i} e^{-\lambda b_{0}} \rightarrow 1/{\tau _{i}^{K}}\), then

and the timescale of expansion diverges. This corresponds to a case where a firm struggles with its cash flows to maintain its production capacity. Beyond this the timescale can also become negative, where a firm scales down its activities.

Thus in many cases one of the three timescales dominates, the bottleneck timescale. In other cases, if two timescales are similar, t i must be calculated numerically using Eq. 44.

These three cases however only occur if consumers are ready to buy all that this particular industry is able to produce, and consequently its growth is limited by its ability to expand. If, however, the demand grows more slowly than these maximal rates, then the demand constrains the rate of growth, a demand-led case. Furthermore, if consumers have a choice of products and competition occurs, then the rate of growth is further constrained and a model of competition must be derived, as done in Section 4.

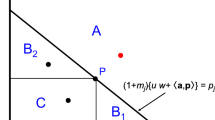

Appendix B: A binary logit choice model

A model of choice is constructed here using a pairwise comparison, which will be performed for all possible pairs in order to rank exhaustively consumer preferences, the latter being distributed. I use for this generalised cost distribution of sales obtained from recent sales data. This calculation is the basis of discrete choice theory adapted to the purposes of this work, and more information can be obtained in Ben-Akiva and Lerman (1985) and Domencich and McFadden (1975).

I assume two distributions for the relative numbers of situations where agents, stating their individual preference between technologies i and j, face different situations and state different choices. By counting how many agents prefer which technology in each pair, one can determine what the probabilities of preferences between these two technologies are for future situations where choices are to be made (e.g. 70 % of agents choose i and 30 % j). It does not mean however that when the time comes to invest or purchase, these are the choices that would be made, since depending on the state of diffusion of these technologies, they might not necessarily be available to every agent. By going through an exhaustive list of pairwise preferences, final choices can be determined.

I denote these (normalised) distributions f(C,C i ,σ i )d C=f i (C−C i )d C and f(C,C j ,σ j )d C=f j (C−C j )d C, where C i ,C j are the means and σ i ,σ j are the standard deviations for technologies i and j. These distributions can be of any kind, but they require to have a single well defined maximum and variance (e.g. they cannot have two maximaFootnote 29). I can then evaluate the probability of choosing i over j using the following. First, I calculate the probability of choosing i in all cases where j has an arbitrary cost C. The central assumption here is that the fraction of agents for whom the generalised cost of j is C and for whom the cost for i is lower than C will choose technology i over j if given a choice, and this fraction is equal to the cumulative probability distribution F i (C−C i ). But this situation occurs a fraction f j (C−C j ) of the time, giving a total probability

while the converse is

In order to evaluate how often the cost of technology i is lower than that of technology j, and the converse, a sum over all possible values of C must be taken. For simplicity, I use as variables C ′=C−C j and C ″=C−C i , with the mean cost difference ΔC=C i −C j :

This appears difficult without further knowledge of the distribution type, however it is possible to take a derivative with respect to ΔC, which makes the integral a convolution of the two distributions

This convolution yields a new distribution f i j (ΔC)dΔC of which the standard deviation is \(\sigma _{ij} = \sqrt {{\sigma _{i}^{2}} + {\sigma _{j}^{2}}}\). This is the probability distribution of technology switching in terms of ΔC. The convolution having been computed, this distribution can be integrated again as a function of ΔC to yield a cumulative probability distribution that the cost of technology i is less than that of j (and conversely):

Thus given a choice between technologies i and j, the fraction F i j of agents tends to choose technology i and the fraction F j i chooses j, these fractions being functions of the generalised cost difference, and this cumulative choice function has a width that follows the sum of the squares \(\sigma _{ij} = \sqrt {{\sigma _{i}^{2}} + {\sigma _{j}^{2}}}\). Note that this calculation is independent of probability distribution type; however F i j (ΔC) should have roughly the shape of a ‘smooth’ step function, its ‘smoothness’ determined roughly by the widths of both cost distributions.

In discrete choice theory, the Gumbel distribution is often used, \(f_{i} = e^{-e^{-(C-C_{i})/\sigma _{i}}}\), and the result of the convolution of two Gumbel distributions is a logistic distribution of the average cost difference ΔC i j relative to the root mean square width σ i j :

Appendix C: From the binary to the multinomial logit in the replicator equation

The derivation of the binary logit in Appendix B gives a relationship between the cost probability distributions and the cumulative distribution of choice between two options f i and f j (with parameters C i ,σ i and C j ,σ j ), as a convolution, consistent with Domencich and McFadden (1975). The probability of cost of option i being less than the cost of option j is

the star denoting a convolution. The binary form of the replicator dynamics equation requires summing the result of binary choices, however distributions can be first grouped and afterwards convolved:

In this picture, each cost distribution of possible alternatives f j is weighted by the factor A i j S j which involves shares and changeover timescales. This weighted sum of distributions results in a composite distribution with new mean and standard deviation parameters \(\overline {C}\) and \(\overline {\sigma }\).Footnote 30, which cannot be expressed analytically in any simpler form. The convolution corresponds roughly to the probability that the cost of option i is less than the cost of the ‘average’ alternative (with average cost \(\overline {C}\)) weighted by the frequency of occurrence of these choices, \(P(C < \overline {C} | C_{i} = C)\).

As an approximation, I replace this ‘average’ probability distribution with that of an arbitrary cost value C being lower than the minimum of all available alternatives simultaneously. This corresponds to the product of the individual distributions,

When the weighting of these choices is equal, if each of these probability functions are Gumbel, then the result of this is also a Gumbel distribution, of cost parameter proportional to \( \ln {\sum }_{j} e^{-C_{j} / \sigma _{j}}\), a classic result of discrete choice theory when deriving the multinomial logit (Ben-Akiva and Lerman 1985, p. 105). Equal weighting in the multinomial logit corresponds to perfect access to information and technology options by all agents. In the theory presented here, each agent has access to a different set of choices, which, when correctly weighted, is

The weighted (representative alternative) cost parameter is instead

This unequal weighting of alternatives is generally overlooked in discrete choice theory, but crucial when exploring the diffusion of technology since part of the dynamics stem from restricted access to options in early states of diffusion. Following Appendix B, the convolution becomes

This is the multinomial logit weighted by A i j S j , i.e. adjusted for restricted access to alternatives. I now define the fitness in the evolutionary theory sense,

This is the fitness of a technology to capture the market, a growth minus a survival term.Footnote 31 The average fitness is then

Thus the replicator dynamics (37) can in fact be written as

This is the classical replicator dynamics equation in general evolutionary theory (e.g. Hofbauer and Sigmund 1998), where the ability of a proponent option or biological specie to capture market or space is proportional to the difference of its fitness to the average fitness.

This transformation however has required an approximation which is a simplification of the distribution of alternatives. This is a useful simplification for the sake of exposition, but leads to a less accurate form of the replicator equation and associated market response. This is due to leaving out, at Eq. 57, some of the details of the restricted access to technology and information, as well as the complexity emerging from interactions.Footnote 32 The binary form essentially maintains the information as to which options are seen by which agent in aggregate. It is however heavier computationally since it involves pairwise comparisons, which scales as n 2/2−n for the binary form, compared to n for the multinomial form (n the number of options).

Rights and permissions

About this article

Cite this article

Mercure, JF. An age structured demographic theory of technological change. J Evol Econ 25, 787–820 (2015). https://doi.org/10.1007/s00191-015-0413-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-015-0413-9