Abstract

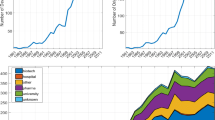

The paper investigates the co-evolutionary patterns of the dynamics of technological alliances and of the structure of the knowledge base in the pharmaceutical sector. The main hypothesis under scrutiny is that technological alliances represent a key resource for firms in knowledge intensive sectors to cope with dramatic changes in the knowledge base, marked by the introduction of discontinuities opening up new technological trajectories. Using patent information and data on technological alliances drawn from the CATI-MERIT database, we compare the evidence concerning the so-called triad regions, i.e. United States, Europe and Japan. The empirical results support the existence of a life cycle in biotechnology affecting the pharmaceutical industry. Furthermore, the dynamics of alliances is found to depend on (i) the phase of the biotechnology life cycle, (ii) the strength of the region in biotechnology and (iii) the general features of the economic environment of the region.

Similar content being viewed by others

Notes

The limits of patent statistics as indicators of technological activities are well known. The main drawbacks can be summarized in their sector-specificity, the existence of non patentable innovations and the fact that they are not the only protecting tool. Moreover the propensity to patent tends to vary over time as a function of the cost of patenting, and it is more likely to feature large firms (Pavitt 1985; Griliches 1990). Nevertheless, previous studies highlighted the usefulness of patents as measures of production of new knowledge (Acs et al. 2002). Besides the debate about patents as an output rather than an input of innovation activities, empirical analyses showed that patents and R&D are dominated by a contemporaneous relationship, providing further support to the use of patents as a good proxy of technological activities (Hall et al. 1986). Moreover, it is worth stressing that our analysis focuses on the dynamics of technological alliances, wherein the use of patent to proxy innovation has been found less noisy than any other indicator (Ahuja and Katila 2001; Cloodt et al. 2006).

As is common in empirical analyses based on patent data, in order to avoid right- and left-censoring problems, we limited the analyses to a subset of the available data which leaves out the first two and the last two years.

It must be stressed that to compensate for intrinsic volatility of patenting behaviour, each patent application is made last five years.

A finer grained territorial disaggregation would have been even better, but unfortunately our data on alliances did not allow for this.

References

Abernathy WJ, Utterback JM (1978) Patterns of industrial innovation. Technol Rev 80:41–47

Acs ZJ, Anselin L, Varga A (2002) Patents and innovation counts as measures of regional production of new knowledge. Res Policy 31:1069–1085

Antonelli C, Krafft J, Quatraro F (2010) Recombinant knowledge and growth: the case of ICTs. Struct Chang Econ Dyn 21:50–69

Ahuja G, Katila R (2001) Technological acquisitions and the innovation performance of acquiring firms: a longitudinal study. Strateg Manag J 22:197–220

Breschi S, Lissoni F, Malerba F (2003) Knowledge-relatedness in firm technological diversification. Res Policy 32:69–87

Brusoni S, Prencipe A, Pavitt K (2001) Knowledge specialization, organizational coupling, and the boundaries of the firm: why do firms know more than they make? Adm Sci Q 46:597–621

Castaldi C, Frenken K, Los B (2013) Related variety, unrelated variety and technological breakthroughs: an analysis of US state-level patenting. ECIS Working Paper 13.03, Eindhoven University of Technology, The Netherlands

Cloodt M, Hagedoorn J, Van Kranenburg H (2006) Mergers and acquisitions: their effect on the innovative performance of companies in high-tech industries. Res Policy 35:642–654

Colombelli A, Quatraro F (2014) The persistence of firms’ knowledge base: a quantile approach to Italian data. Econ Innov New Technol, forthcoming. doi:10.1080/10438599.2013.871164

Colombelli A, Krafft J, Quatraro F (2013) Properties of knowledge base and firm survival: evidence from a sample of French manufacturing firms. Technol Forecast Soc Chang 80:1469–1483

Colombelli A, Krafft J, Quatraro F (2014) High growth firms and technological knowledge: do gazelles follow exploration or exploitation strategies? Ind Corp Chang, forthcoming

Dosi G (1982) Technological paradigms and technological trajectories: a suggested interpretation of the determinants and directions of technical change. Res Policy 11:147–162

Duysters G (2001) Partner or perish: surviving the network economy. Inaugural lecture 22 June. Eindhoven University of Technology

Duysters G, de Man AP (2003) Transitory alliances: an instrument for surviving turbulent industries? R&D Manag 33:49–58

Escourrou N (1992) Les sociétés de biotechnologie européennes, un réseau très imbriqué, Biofutur July–August 40–42

Foray D (2004) The economics of knowledge. MIT Press, Cambridge

Frenken K, Nuvolari A (2004) Entropy statistics as a framework to analyse technological evolution. Applied evolutionary economics and complex systems. Edward Elgar Publishing, Cheltenham, UK and Northampton, MA, pp 95–132

Frenken K, van Oort FG, Verburg T (2007) Related variety, unrelated variety and regional economic growth. Reg Stud 41:685–697

Frenken K, van Oort FG, Verburg T (2007) Related variety, unrelated variety and regional economic growth. Reg Stud 41:685–697

Galambos L, Sturchio JJ (1996) The pharmaceutical industry in the twentieth century: a reappraisal of the sources of innovation. Hist Technol 13(2):83–100

Galambos L, Sturchio JJ (1998) Pharmaceutical firms and the transition to biotechnology: a study in strategic innovation. Bus Hist Rev 72:250–278

Gambardella A (1995) Science and innovation in the US pharmaceutical industry. Cambridge University Press, Cambridge

Gottinger HW, Umqli CL (2008) The evolution of the pharmaceutical-biotechnology industry. Bus Hist 50:583–601

Griliches Z (1990) Patent statistics as economic indicators: a survey. J Econ Lit 28:1661–1707

Hagerdoorn J (1993) Understanding the rationale of strategic technology partnering: interorganizational modes of cooperation and sectoral diferences. Strateg Manag J 14:371–386

Hagerdoorn J (1996) Trends and patterns in strategic technology partnering since the early seventies. Rev Ind Organ 11:601–616

Hagerdoorn J, Duysters G (2002) External sources of innovative capabilities: the preference for strategic alliances or mergers and acquisitions. J Manag Stud 39:167–188

Hagerdoorn J, Schakenraad J (1994) The effect of strategic technology alliances on company performance. Strateg Manag J 15:291–309

Hall BH, Griliches Z, Hausman JA (1986) Patents and R and D: is there a lag? Int Econ Rev 27:265–283

Henderson R, Pisano GP, Orsenigo L (1999) The pharmaceutical industry and the revolution in molecular biology: interactions among scientific, institutional, and organizational change. In: Mowery D, Nelson R (eds) Sources of industrial leadership: studies of seven industries. Cambridge University Press, Cambridge

Jaffe AB (1986) Technological opportunity and spillovers of R&D: evidence from firms’ patents, profits, and market value. Am Econ Rev 76:984–1001

Jaffe AB (1989) Characterizing the “technological position” of firms, with application to quantifying technological opportunity and research spillovers. Res Policy 18:87–97

Kauffman (1993) Origins of order: self-organization and selection in evolution. Oxford University Press, Oxford

Klepper S (1997) Industry life cycles. Ind Corp Chang 6:145–182

Krafft J, Quatraro F, Saviotti PP (2009) Evolution of the knowledge base in knowledge intensive sectors. Ind Corp Chang, revised and resubmitted

Kuznets S (1930) Secular movements in production and prices. Houghton Mifflin, Boston

Langlois RN (2003) Cognitive comparative advantage and the organization of work: lessons from Herbert Simon’s vision of the future. J Econ Psychol 24:187–207

Langlois RN, Robertson PL (1995) Innovation, networks, and vertical integration. Res Policy 24:543–562

Lee J (2003) Innovation and strategic divergence: an empirical study of the U.S. pharmaceutical industry from 1920 to 1960. Manag Sci 49:143–159

Lipton M (2006) Merger waves in the 19th, 20th and 21st centuries. York University, School

Lundvall BA (ed) (1992) National systems of innovation. Pinters, London

Malerba F (2007) Innovation and the dynamics and evolution of industries: progress and challenges. Int J Ind Organ 25:675–699

Malerba F, Orsenigo L (1995) Schumpeterian patterns of innovation. Camb J Econ 19:47–65

Malerba F, Orsenigo L (1997) Technological regimes and sectoral patterns of innovative activities. Ind Corp Chang 6:83–118

Malerba F, Orsenigo L (2006) A history-friendly model of innovation, market structure and regulation in the age of random screening in the pharmaceutical industry. In: Antonelli C, Foray D, Hall BH, Steinmuller WE (eds) New frontiers in the economics of innovation and new technology new frontiers in the economics of innovation and new technology. Edward Elgar, Cheltenham

March J (1991) Exploration and exploitation in organizational learning. Organ Sci 2:71–87

Mitchell P (2007) Price controls seen as key to Europe’s drug innovation lag. Nat Rev Drug Discov 6:257–258

Moeller S, Brady C (2007) Intelligent M&A. Navigating the mergers and acquisitions. Wiley, Chichester

Nesta L (2008) Knowledge and productivity in the world’s largest manufacturing corporations. J Econ Behav Organ 67:886–902

Nesta L, Saviotti PP (2005) Coherence of the knowledge base and the firm’s innovative performance: evidence from the U.S. pharmaceutical industry. J Ind Econ 53:123–42

Nesta L, Saviotti PP (2006) Firm knowledge and market value in biotechnology. Ind Corp Chang 15:625–652

Nelson R (ed) (1993) National innovation systems. A comparative analysis. Oxford University Press, New York/Oxford

Nelson RR, Winter SW (1982) An evolutionary theory of economic change. Harvard University Press, Cambridge

Nooteboom B (2000) Learning by interaction: absorptive capacity, cognitive distance and governance. J Manag Gov 4:69–92

Odagiri H (2006) The economics of biotechnology. In Japanese Tokyo; Toyokeizai, cited in Okamoto Y., Paradox of Japanese Biotechnology: can the regional cluster development approach be a solution?

Orsenigo L (1989) The emergence of biotechnology. Pinter Publishers, London

Orsenigo L, Pammolli F, Riccaboni M, Bonaccorsi A, Turchetti G (1998) The evolution of knowledge and the dynamics of an industry network. J Manag Gov 1:147–175

Orsenigo L, Pammolli F, Riccaboni M (2001) Technological change and network dynamics. Lessons from the pharmaceutical industry. Res Policy 30:485–508

Oxley JE (2012) Governance of international strategic alliances: technology and transaction costs. Routledge, London and New York

Pammolli F, McKelvey M, Orsenigo L (2004) Pharmaceuticals analysed through the lens of a sectoral innovation system. In: Malerba F (ed) Sectoral systems of innovation: concepts, issues and analyses of six major sectors in Europe. Cambridge University Press, Cambridge, pp 73–120

Pavitt K (1985) Patent statistics as indicators of innovative activities: possibilities and problems. Scientometrics 7:77–99

Phillippen S, Riccaboni M (2007) Radical innovation and network evolution: the effect of the genomic revolution on the evolution of the pharmaceutical R&D network. Ann Econ Stat 87(88):325–350

Quatraro F (2010) Knowledge coherence, variety and productivity growth: manufacturing evidence from italian regions. Res Policy 39:1289–1302

Quéré M (2003) Knowledge dynamics: biotechnology’s incursions into the pharmaceutical industry. Ind Innov 10:255–273

Saviotti PP (1988) Information, variety and entropy in technoeconomic development. Res Policy 17:89–103

Saviotti PP (2004) Considerations about the production and utilization of knowledge. J Inst Theor Econ 160:100–121

Saviotti PP (2007) On the dynamics of generation and utilisation of knowledge: the local character of knowledge. Struct Chang Econ Dyn 18:387–408

Saviotti PP (2009) Knowledge networks structure and dynamics. In: Pyka A, Scharnorst A (eds) Innovation networks, new approaches in modeling and analyzing. Springer, Berlin

Saviotti PP, Catherine D (2008) Innovation networks in biotechnology. In: HolgerPatzelt TB, Audretsch DB (eds) Handbook of Bioentrepreneurship. Springer, Berlin

Saviotti PP, Frenken K (2008) Export variety and the economic performance of countries. J Evol Econ 18:201–218

Schumpeter JA (1939) Business cycles. A theoretical, historical and statistical analysis of the capitalist process. McGraw Hill, New York and London

Schumpeter JA (1942) Capitalism, socialism and democracy. Harper and Row, New York

Senker J, Sharp M (1997) Organisational learning in cooperative alliances: some case studies in biotechnology. Technol Anal Strateg Manag 9:35–51

Teece DJ, Rumelt R, Dosi G, Winter S (1994) Understanding corporate coherence: Theory and evidence. J Econ Behav Organ 23:1–30

Tether BS (2002) Who co-operates for innovation and why. An empirical analysis. Res Policy 31:947–967

Verspagen B, van Moergastel T, Slabbers M (1994) MERIT concordance table: IPC - ISIC (rev. 2). MERIT Research Memorandum 2/94–004, University of Maastricht

Walsh V, Niosi J, Mustar P (1995) Small firm formation in biotechnology: a comparison of France, Britain and Canada. Technovation 15:303–27

Weitzmann ML (1998) Recombinant growth. Q J Econ 113:331–360

Zidorn W, Wagner M (2013) The effect of alliances on innovation patterns: an analysis of the biotechnology industry. Ind Corp Chang, forthcoming. doi:10.1093/icc/dts042

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

1.1 A.1 Knowledge variety

We decided to measure technological variety by using the information entropy index. Entropy measures the degree of disorder or randomness of the system, so that systems characterized by high entropy will also be characterized by a high degree of uncertainty (Saviotti 1988). Differently from common measures of variety and concentration, the information entropy has some interesting properties (Frenken and Nuvolari 2004). An important feature of the entropy measure is its multidimensional extension. Consider a pair of events (Xl, Yj), and the probability of co-occurrence of both of them p lj . A two dimensional total variety (TV) measure can be expressed as follows:

If one considers p lj to be the probability that two technological classes l and j co-occur within the same patent, then the measure of multidimensional entropy focuses on the variety of co-occurrences of technological classes within regional patents applications.

Moreover, the total index can be decomposed in a “within” and a “between” part anytime the events to be investigated can be aggregated into a smaller numbers of subsets. Within-entropy measures the average degree of disorder or variety within the subsets, while between-entropy focuses on the subsets measuring the variety across them. Frenken et al. (2007) refer to between- and within- group entropy respectively as unrelated and related variety.

It can be easily shown that the decomposition theorem holds also for the multidimensional case. Hence if one allows l ∈ S g and j ∈ S z (g = 1,…,G; z = 1,…, Z), we can rewrite H(X, Y) as follows:

Where the first term of the right-hand-side is the between-entropy and the second term is the (weighted) within-entropy. In particular:

We can therefore refer to between- and within-entropy respectively as unrelated technological variety (UTV) and related technological variety (RTV), while total information entropy is referred to as general technological variety.

A.2 Knowledge coherence

Knowledge coherence measures the degree of complementarity among technologies. We expect it to provide us with an indication of the difficulty, or cost, a firm has to face to learn a new type of knowledge. Typically a firm needs to combine, or integrate, many different pieces of knowledge to produce a marketable output. Thus, in order to be competitive a firm not only needs to learn new ’external’ knowledge but it needs to learn to combine it with other, new and old, pieces of knowledge. We can say that a knowledge base in which different pieces of knowledge are well combined, or integrated, is a coherent knowledge base. The technologies contained in the knowledge base are by definition complementary in that they are jointly required to obtain a given outcome. For this reason, we turned to calculate the coherence of the knowledge base, defined as the average relatedness of any technology randomly chosen within the sector with respect to any other technology (Nesta and Saviotti 2005, 2006; Nesta 2008).

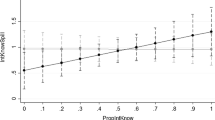

To yield the knowledge coherence index, a number of steps are required. In what follows we will describe how to obtain the index at the sector level. First of all, one should calculate the weighted average relatedness WAR l of technology l with respect to all other technologies present within the sector. Such a measure builds upon the measure of technological relatedness τ lj (see Nesta and Saviotti 2005, for details). Following Teece et al. (1994), WAR l is defined as the degree to which technology l is related to all other technologies j ∈ l in the sector, weighted by patent count P jt :

Finally the coherence of knowledge base within the sector is defined as weighted average of the WAR lt measure:

It is worth stressing that such index implemented by analysing co-occurrences of technological classes within patent applications, measures the degree to which the services rendered by the co-occurring technologies are complementary to one another. The relatedness measure τ lj indicates indeed that the utilization of technology l implies that of technology j in order to perform specific functions that are not reducible to their independent use. This makes the coherence index appropriate for the purposes of this study.

1.1 A.3 Cognitive distance

We need a measure of cognitive distance (Nooteboom 2000) able to express the dissimilarities amongst different types of knowledge. A useful index of distance can be derived from the measure of technological proximity. Originally proposed by Jaffe (1986, 1989), who investigated the proximity of firms’ technological portfolios. Subsequently Breschi et al. (2003) adapted the index in order to measure the proximity, or relatedness, between two technologies. The idea is that each firm is characterized by a vector V of the k technologies that occur in its patents. Knowledge similarity can first be calculated for a pair of technologies l and j as the angular separation or un-cented correlation of the vectors V lk and V jk . The similarity of technologies l and j can then be defined as follows:

The idea underlying the calculation of this index is that two technologies j and l are similar to the extent that they co-occur with a third technology k. The cognitive distance between j and l is the complement of their index of the similarity:

Once the index is calculated for all possible pairs, it needs to be aggregated at the industry level to obtain a synthetic index of technological distance. This can be done in two steps. First of all one can compute the weighted average distance of technology l, i.e. the average distance of l from all other technologies.

Where P j is the number of patents in which the technology j is observed. Now the average cognitive distance at time t is obtained as follows:

Rights and permissions

About this article

Cite this article

Krafft, J., Quatraro, F. & Saviotti, P.P. Knowledge characteristics and the dynamics of technological alliances in pharmaceuticals: empirical evidence from Europe, US and Japan. J Evol Econ 24, 587–622 (2014). https://doi.org/10.1007/s00191-014-0338-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-014-0338-8

Keywords

- Collective knowledge

- Technological alliances

- Knowledge variety

- Knowledge coherence

- Knowledge similarity

- Evolutionary economics