Abstract

We provide additional evidence on the relationship between uncertainty and economic activity. For this purpose, we gather and construct a wide range of proxy indicators of economic and economic policy uncertainty from Spain. We distinguish between the relative merits of different types of measures based on (i) the volatility of financial markets; (ii) economic analysts’ disagreement; and (iii) economic policy uncertainty. We show that the first and the third block of measures are the most relevant to grasp the negative effects of unexpected changes in uncertainty on aggregate economic developments, as measured by real GDP. In addition, we find that economic policy uncertainty and financial uncertainty shocks produce visible negative effects on private consumption. The negative responses on capital goods investments are initially bigger in magnitude but vanish more quickly.

Similar content being viewed by others

Notes

See also Castelnuovo et al. (2017) for a short review of the most recent literature.

The latter refers to a situation in which the future outcome of an event is unknown, and in addition, one cannot extract from past experience information in order to set up a probability distribution function that assigns probabilities to future potential states of the world. Hence, one cannot compute the odds of an event. By contrast, risk refers to a situation in which it is possible to construct a probability distribution function that assigns probabilities to potential outcomes. That is, the future outcome of an event is unknown but the odds of this event can be computed based on current information.

FUNCAS is a private sector institute that has been compiling forecasters’ views of the Spanish economy since 1999. For more information on the panel, see https://www.funcas.es/Indicadores/Index.aspx. In the Spanish case, the use of this panel of experts instead of the one elaborated by Consensus Economics is warranted, given the longer sample size available, the fact that it covers more variables of interest and also that it is publicly available.

Note that we focus on measures that proxy disagreement about the economic outlook, as it is standard in the literature. In equilibrium, these measures might capture not only uncertainty about real economic developments, but also uncertainty about the evolution of prices. Alternatively, one could also add indicators that measure directly the nominal side of the economy.

For details about the new EPU index for Spain and its comparison with the original one, see Ghirelli et al. (2019).

Fernández-Villaverde et al. (2015) develop an alternative measure of uncertainty related to fiscal policy and study how it affects the business cycle. On the ability of economic agents to learn how to anticipate future fiscal policy stances based on government policy announcements, see Paredes et al. (2015).

The I3E indicator reflects the variation in the daily growth rate of these underlying components. It is published monthly on the second Tuesday of the month or on the first available working day if this Tuesday is a holiday (see https://blog.iese.edu/icdm/que-es-el-i3e/).

See Footnote 3.

The CIS survey targets each month’s representative samples of the Spanish society. Both indexes are calculated as weighted averages of the shares of responses.

For details on the methodology, see http://www.prsgroup.com/wp-content/uploads/2012/11/icrgmethodology.eps.

Which is available for Spain at http://www.policyuncertainty.com/europe_monthly.html. See, also Davis (2016).

We start from January 1997 since most of our individual indicators are available at this date (in particular, the IBEX-35 volatility and the new EPU index are available from 1997 onwards).

Additional details on the PCA approach, like factor loadings, are available from the authors upon request.

Note, economic policy uncertainty does not necessarily have to increase during each electoral campaign. This depends on citizens’ expectations about future policies.

By contrast, in case of the global synthetic indicator, one would need to consider the first three components in order to cover a similar percentage of the variance of all inputs (the first three components represent around 60% of the overall variance).

We use the seasonally adjusted Consumer Price Index (CPI) excluding unprocessed food and energy, regulated prices and VAT.

Own calculation, based on opinion-based surveys of the European Commission for the EU as a whole. The index is a combination of uncertainty about expectations of unemployment, industry order-book levels, and industry production at the EU level.

The results are robust, in qualitative terms, to the exclusion of the exogenous variables.

Unfortunately, with the data at hand, we cannot study heterogeneous uncertainty effects along the cycle. We leave this for future research.

In case of economic policy uncertainty, also the other direction of causality could be possible. It would suggest that, for instance, politicians may take advantage of business cycle conditions to put forward populistic agendas, which may generate policy instability.

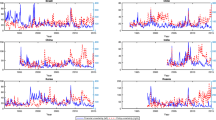

In the figures we show the responses along with their 10% confidence intervals. The responses to uncertainty measures of different types are not statistically different between each other.

Even if this prediction results from a partial equilibrium model, Bloom (2009) shows that it also holds in a general equilibrium setting.

By contrast, competitive models with flexible prices are not able to reproduce this macroeconomic comovement. In particular, in competitive models, uncertainty reduces consumption but increases total output, hours worked, and investment, as opposed to what the evidence suggests. Hence, if hours worked also drop as a response to an uncertainty shock, models with nominal price rigidity offer an alternative explanation to the one proposed by the real option models for the negative investment response to an uncertainty shock.

Note, the uncertainty proxy of Basile and Girardi (2017) captures the degree of disagreement between agents’ expectations about future economic prospects, as represented by a rich—yet heterogeneous—set of dimensions: i.e. firms’ expectations about selling prices and employment in industry, services, retail trade, and construction; export orders and production in industry; demand in services; orders and sales in retail trade; consumers’ expectations about their own economic situation, and about the general economic one.

Note, Meinen and Roehe (2017) find larger responses of investment to shocks in uncertainty measures based on the unpredictable components of a set of macroeconomic variables. These results are not comparable to ours.

Since September 2014, the policy rates of the European Central Bank (ECB) stand at around minus 10 basis points. For more information, see the following speech: https://www.ecb.europa.eu/press/key/date/2015/html/sp150519.en.html.

The results of the forecast error variance decomposition on the pre-ELB sample are not shown for brevity and are available upon request.

References

Angelini G, Bacchiocchi E, Caggiano G, Fanelli L (2019) Uncertainty across volatility regimes. J Appl Econom 34(3):437–455

Arslan Y, Atabek A, Hulagu T, Şahinöz S (2015) Expectation errors, uncertainty, and economic activity. Oxf Econ Pap 67(3):634–660

Bachmann R, Elstner S, Sims ER (2013) Uncertainty and economic activity: evidence from business survey data. Am Econ J Macroecon 5(2):217–249

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty*. Q J Econ 131(4):1593–1636

Basile R, Girardi A (2017) Uncertainty and business cycle: a review of the literature and some evidence from the Spanish economy. Estud Econ Apl 36(1):235–250

Basu S, Bundick B (2017) Uncertainty shocks in a model of effective demand. Econometrica 85(3):937–958

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77(3):623–685

Bloom N (2014) Fluctuations in uncertainty. J Econ Perspect 28(2):153–76

Caggiano G, Castelnuovo E, Groshenny N (2014) Uncertainty shocks and unemployment dynamics in US recessions. J Monetary Econ 67:78–92

Caggiano G, Castelnuovo E, Figueres JM (2017a) Economic policy uncertainty and unemployment in the United States: a nonlinear approach. Econ Lett 51:31–34

Caggiano G, Castelnuovo E, Pellegrino G (2017b) Estimating the real effects of uncertainty shocks at the zero lower bound. Eur Econ Rev 100:257–272

Caggiano G, Castelnuovo E, Figueres J (2018) Economic policy uncertainty spillovers in booms and busts. Working paper series 27/2018, CAMA working paper

Caggiano G, Castelnuovo E, Nodari G (2017) Uncertainty and monetary policy in good and bad times. Research discussion paper series 2017-06, Reserve Bank of Australia

Camacho M, Perez Quiros G (2011) Spain-sting: Spain short-term indicator of growth. Manch Sch 79:594–616

Carriero A, Todd EC, Marcellino M (2018) Endogenous uncertainty. Working paper series 18-05, Federal Reserve Bank of Cleveland

Castelnuovo E, Tran TD (2017) Google It Up! A Google trends-based uncertainty index for the United States and Australia. Econ Lett 161:149–153

Castelnuovo E, Lim G, Pellegrino G (2017) A short review of the recent literature on uncertainty. Aust Econ Rev 50(1):68–78

Charles A, Darné O, Tripier F (2018) Uncertainty and the macroeconomy: evidence from an uncertainty composite indicator. Appl Econ 50(10):1093–1107

Christiano LJ, Motto R, Rostagno M (2014) Risk shocks. Am Econ Rev 104(1):27–65

Colombo V (2013) Economic policy uncertainty in the US: Does it matter for the Euro area? Econ Lett 121:39–42

Davis SJ (Oct 2016) An index of global economic policy uncertainty. Working paper 22740, National Bureau of Economic Research

Denis S, Kannan P (Mar 2013) The impact of uncertainty shocks on the UK economy. IMF working paper no. 13/66

Dovern J, Fritsche U, Slacalek J (2012) Disagreement among forecasters in G7 countries. Rev Econ Stat 94(4):1081–1096

Fernández-Villaverde J, Guerrón-Quintana P, Kuester K, Rubio-Ramírez J (2015) Fiscal volatility shocks and economic activity. Am Econ Rev 105(11):3352–3384

Ghirelli C, Pérez JJ, Urtasun A (2019) A new economic policy uncertainty index for Spain. Econ Lett 182:64–67

Guiso L, Parigi G (1999) Investment and demand uncertainty. Q J Econ 114(1):185–227

Haddow A, Hare C, Hooley J, Shakir T (2013) Macroeconomic uncertainty: What is it, how can we measure it and why does it matter? Bank Engl Q Bull 53(2):100–109

Jurado K, Ludvigson SC, Ng S (2015) Measuring uncertainty. Am Econ Rev 105(3):1177–1216

Ludvigson SC, Ma S, Ng S (May 2019). Uncertainty and business cycles: Exogenous impulse or endogenous response? Am Econ J Macroecon, forthcoming

Mariano RS, Murasawa Y (2003) A new coincident index of business cycles based on monthly and quarterly series. J Appl Econom 18(4):427–443

Meinen P, Roehe O (2017) On measuring uncertainty and its impact on investment: cross-country evidence from the Euro area. Eur Econ Rev 92:161–179

Moore A (2017) Measuring economic uncertainty and its effects. Econ Rec 93(303):550–575

Mumtaz H, Zanetti F (2013) The impact of the volatility of monetary policy shocks. J Money Credit Bank 45(4):535–558

Paredes J, Perez-Quiros G, Perez JJ (Aug 2015) Fiscal targets. A guide to forecasters? ECB working paper (1834)

Posada D, Urtasun A, Mínguez JG (June 2014) Un análisis del comportamiento reciente de la inversión en equipo y de sus determinantes. Boletín Económico del Banco de España, pp 41–50

Rossi B, Sekhposyan T (2015) Macroeconomic uncertainty indices based on nowcast and forecast error distributions. Am Econ Rev 105(5):650–55

Stock JH, Watson MW (2002) Forecasting using principal components from a large number of predictors. J Am Stat Assoc 97(460):1167–1179

Zalla R (2017) Economic policy uncertainty in Ireland. Atl Econ J 45(2):269–271

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The views expressed in this paper are the authors’ and do not necessarily reflect those of the Bank of Spain or the Eurosystem. We thank participants at the Banco de España seminar and Eurosystem’s Working Group on Forecasting, in particular, Javier Vallés and Gabriel Pérez-Quirós.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Ghirelli, C., Gil, M., Pérez, J.J. et al. Measuring economic and economic policy uncertainty and their macroeconomic effects: the case of Spain. Empir Econ 60, 869–892 (2021). https://doi.org/10.1007/s00181-019-01772-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01772-8