Abstract

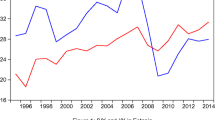

We use time series methods to analyse the long- and short-run dynamics and inter-relationships between government savings, private savings, investment, and the current account balance in the USA for the period 1947Q1–2017Q3. We control for the impact of the nonlinear dynamics of GDP growth over the business cycle on the evolution of these variables. A few important results stand out. The relationships among the variables are time varying as we find three structural periods: (I) 1947Q1–1984Q3, (II) 1984Q4–1999Q4, and (III) 2000Q1–2017Q3. The impact of nonlinearities in GDP growth matters in each period, but the twin deficit hypothesis is supported only in the first period. Generally, we also find no evidence to conclude that the Ricardian equivalence hypothesis holds over the full sample period. Finally, we cannot conclude that the Feldstein–Horioka puzzle with respect to private or government savings holds over the three structural periods.

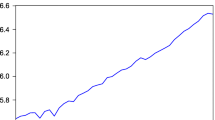

Source US Bureau of Economic Analysis (2018)

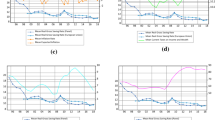

Source Authors’ calculation using data from the US Bureau of Economic Analysis (2018)

Similar content being viewed by others

Notes

We follow and modify the final set of equations presented in Olivei (2000).

See Mann (2002) for a discussion on the sustainably of the US current account deficit and if it should matter.

The discussion of the first three of these shocks is based on the discussion in McKibbin and Stoeckel (2005).

The correlation between saving and investment has been one of the interesting themes in international economics since Feldstein and Horioka (1980). We calculated the correlation between saving and investment as a share of GDP for the three periods as follows: 0.739 (1947Q1–1984Q3), 0.714 (1984Q4–1999Q4) and 0.636 (2000Q1–2017Q3).

We also conducted the Augment Dickey Fuller (ADF) tests. The conclusions were the same as the PP test.

The inference drawn from the unit root tests were invariant to the inclusion or exclusion of the intercept and trend.

The long run coefficients can be estimated using the autoregressive distributed lag (ARDL) technique (proposed by Pesaran and Shin (1999) and Pesaran et al. (2001) while imposing appropriate restrictions). We recognize the importance of long run coefficients; however, this is beyond the scope of this paper, and hence, left for future research.

We also ran the VECM without the CDR effect term, but the results were basically unchanged.

References

Altissimo F, Violante GL (2001) The nonlinear dynamics of output and unemployment in the U.S. J Appl Econom 16(4):461–486

Apergis N, Tsoumas C (2009) A survey on the Feldstein–Horioka puzzle: What has been done and where we stand. Res Econ 63(2):64–76

Bachman D (1992) Why is the US current account so large? Evidence from vector autoregressions. South Econ J 59(2):232–240

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66(January):47–78

Bartolini L, Lahiri A (2006) Twin deficits: twenty years later. Federal Reserve Bank of New York. Curr Issues Econ Finance 12(7):1–7

Baxter M, Crucini MJ (1993) Explaining saving-investment correlations. Am Econ Rev 83(3):416–436

Beaudry P, Koop G (1993) Do recessions permanently change output? J Monet Econ 31(2):149–163

Bernanke BS (2005) The global saving glut and the U.S. current account deficit. In: Speech delivered at the Sandridge Lecture, Virginia Association of Economists, Richmond, Va., March 10

Bernanke BS (2007). Global imbalances: recent developments and prospects. In: Speech delivered at the Bundesbank lecture, Berlin, Germany

Bernheim BD (1988) Budget deficits and the balance of trade. In: Summers LH (ed) Tax policy and the economy, vol 2. MIT Press. Cambridge, MA, pp 1–32

Blanchard O, Giavazzi F (2002) Current account deficits in the euro area: The end of the Feldstein–Horioka puzzle? Brook Pap Econ Act 2:147–209

Buiter WH (1981) Time preference and international lending and borrowing in an overlapping generations model. J Polit Econ 89:769–797

Bussière M, Fratzscher M, Müller G (2005) Productivity shocks, budget deficits and the current account. ECB Working Paper 509

Coakley J, Kulasi F (1997) Cointegration of long run saving and investment. Econ Lett 54:1–6

Coakley J, Kulasi F, Smith R (1996) Current account solvency and the Feldstein–Horioka puzzle. Econ J 106:620–627

Coakley J, Smith F, Smith RP (1998) The Feldstein–Horioka puzzle and capital mobility: a review. Int J Finance Econ 3:169–188

Coakley J, Fuertes A-M, Spagnolo F (2004) Is the Feldstein–Horioka puzzle history? Manch Sch 72:569

Corsetti G, Müller G (2006) Twin deficits: squaring theory, evidence and common sense. Econ Policy 48:597–638

Darrat AF (1988) Have large deficits caused rising trade deficits? South Econ J 54:879–887

Dolado J, Jenkinson T, Sosvilla-Rivero S (1990) Cointegration and unit roots: a survey. J Econ Surv 4(3):249–273

Dooley M, Frankel JA, Mathieson DJ (1987) International capital mobility: What do saving-investment correlations tell us? Int Monet Fund Staff Pap 34:503–530

Engle RF, Granger CWJ (1987) Cointegration and error correction representation: estimation and testing. Econometrica 55:251–276

Feldstein MS, Bachetta P (1991) National saving and international investment. In: Berheim D, Shoven J (eds) National saving and economic performance. University of Chicago Press, Chicago, pp 201–226

Feldstein MS, Horioka C (1980) Domestic saving and international capital flows. Econ J 90:314–329

Ghosh A, Uma R (2006) Do current account deficit matter? Finance Dev 43(4). IMF. http://www.imf.org/external/pubs/ft/fandd/2006/12/basics.htm#author. Accessed 15 Feb 2018

Gulley OD (1992) Are saving and investment cointegrated? Another look at the data. Econ Lett 39:55–58

Husted S (1992) The emerging U.S. current account deficit in the 1980s: a cointegration analysis. Rev Econ Stat 74:159–166

Hutchison MM, Pigott C (1984) Budget deficits, exchange rates and the current account: theory and U.S. evidence. Federal Reserve Bank of San Francisco. Econ Rev pp 5–25

Jansen WJ (1996) Estimating saving-investment correlations: evidence for OECD countries based on an error correction model. J Int Money Finance 15:749–781

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with applications to money demand. Oxford Bull Econ Stat 52:169–210

Katsimi M, Zoega G (2016) European Integration and the Feldstein–Horioka Puzzle. Oxf Bull Econ Stat 78(6):834–852

Kim S, Roubini N (2008) Twin deficit or twin divergence? Fiscal policy, current account, and real exchange rate in the US. J Int Econ 74:362–387

Kraay A, Ventura J (2000) Current accounts in debtor and creditor countries. Q J Econ 115(4):1137–1166

Kraay A, Ventura J (2003) Current accounts in the long and short run. Natl Bur Econ Res Macroecon Annu 2002(17):65–112

Mann CL (2002) Perspectives on the U.S. Current account deficit and sustainability. J Econ Perspect 16(3):131–152

McKibbin W, Stoeckel A (2005) The United States current account deficit and world markets. Econ Scenar 10:2–9. Retrieved from: https://www.brookings.edu/wp-content/uploads/2016/06/200502.pdf. Accessed 15 Feb 2018

Miller SM (1988) Are saving and investment cointegrated? Econ Lett 27:31–34

Obstfeld M (1986) Capital mobility in the world economy: Theory and measurement. In: Carnegie-rochester conference series on public policy, vol 24(Spring) pp 55–10

Obstfeld M, Rogoff K (1995) The intertemporal approach to the current account. In: Grossman G, Rogoff K (eds) Handbook of international economics, vol 3. North-Holland, Amsterdam, pp 1731–1799

Olivei GP (2000) The role of saving and investment in balancing the current account: some—empirical evidence from the United States. N Engl Econ Rev pp 3–14. Retrieved from https://www.bostonfed.org/economic/neer/neer2000/neer400a.pdf. Accessed 15 Feb 2018

Penati A, Dooley M (1984) Current account imbalances and capital formation in industrial countries, 1949–1981. IMF Staff Pap 31:1–24

Pesaran MH, Shin Y (1999) An autoregressive distributed-lag modelling approach to cointegration analysis. In: Strøm S (ed) Econometrics and economic theory in the 20th century: the Ragnar Frisch centennial symposium. Cambridge University Press, Cambridge, pp 371–413

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(3):289–326

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346

Pindyck R, Rubinfeld D (1998) Econometric models and economic forecasts, 4th edn. McGraw-Hill-Irwin, New York

Sachs J (1981) The current account and macroeconomic adjustment in the 1970s. Brook Pap Econ Act 12:1089–1092

Summer LN (1988) Tax policy and international competitiveness. In: Frenkel JA (ed) International aspects of fiscal policies, NBER conference report. Chicago University Press, Chicago, pp 349–375

Tesar LL (1991) Saving, investment and international capital flows. J Int Econ 31:55–78

US Bureau of Economic Analysis (2018) U.S. economic accounts. Retrieved on 28 July 2018 from https://www.bea.gov/

Ventura J (2003) Towards a theory of current accounts. World Econ 26(4):483–512

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Young Cheol Jung declares that he has no conflict of interest. Adian McFarlane declares that he has no conflict of interest. Anupam Das declares that he has no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Rights and permissions

About this article

Cite this article

McFarlane, A., Jung, Y.C. & Das, A. The dynamics among domestic saving, investment, and the current account balance in the USA: a long-run perspective. Empir Econ 58, 1659–1680 (2020). https://doi.org/10.1007/s00181-018-1566-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1566-9