Abstract

This paper proposes an alternative and potentially novel approach to analyzing the law of one price in a nonlinear fashion. Copula-based models that consider the joint distribution of prices separated by space are developed and applied to weekly prices for lumber products. The copulas capture nonlinearities that arise in the extremes of the joint distributions of price differentials and suggest faster equilibrating adjustments when deviations from parity are extreme.

Similar content being viewed by others

Notes

Distinctions between tests of LOP and spatial market integration are not especially meaningful. In both cases, the economic phenomena being evaluated (spatial market arbitrage) is identical. A survey of both strands of literature can be found in Fackler and Goodwin (2001).

Patton (2006) allowed for time variation in the conditional joint distribution of the returns on the Deutsche mark/US dollar and Japanese Yen/US dollar exchange rates by allowing the parameter(s) of a given copula to vary through time. Smith et al. (2011) examined linkages among logarithmic prices in regional Australian electricity markets but do not explicitly model the nonlinear error correction adjustment process that is standard in spatial arbitrage models and that we consider here. Reboredo (2011) also examined the comovement of crude oil prices using copulas, though his approach is also fundamentally different from that considered here in that it does not directly consider the error correction process commonly applied in models of spatial price linkages.

We are agnostic as to the specific linkage among prices within any transactions cost band and allow this relationship to be determined within the context of the overall joint distribution function. Alternative nonlinear dependencies across the span of the marginals can be accommodated within the range of copula functions that we consider. That said, we expect to see a stronger “error correction” type of relationship for bigger deviations from parity.

See, for example, Taylor (2001), who applies regime switching, time series models of this form to empirical tests of purchasing power parity—an aggregate version of the LOP.

A note of explanation regarding our nomenclature may be helpful in avoiding confusion. Here and below, we refer to values of \((p^i_{t}-p^j_{t})\) as the “price differential” and values of \(\Delta (p^i_{t}-p^j_{t})\) as the “differenced price differential.”.

A specification that is often referred to as an “iceberg” model, reflecting the fact that the value of the commodity melts away via a proportionally lower price as it is shipped.

The behavior underlying spatial price linkages is likely to be discrete—representing the two states of trade/no trade. However, in that empirical evaluations of such models almost always involve some degree of aggregation, the patterns of adjustment may be of a more smooth nature and therefore may favor the STAR-type models.

For details on construction and properties of copulas, see, among others, Joe (1997) and Nelsen (2006). Much of the work on copulas has been motivated by their applicability to the issues in risk management, insurance and financial economics (see, among others, Rodriguez (2003), Cherubini et al. (2004), Hu (2006), Patton (2006), and Jondeau and Rockinger (2006)). Extensive surveys on the use of copulas in economics and finance are provided by Patton (2009, 2012) and Patton and Fan (2014).

Specifically, we consider goodness of fit for the following eighteen parametric copulas: the Gaussian, t, Clayton, Gumbel, Frank, Joe, Clayton–Gumbel, Joe–Gumbel, Joe–Clayton, and the Joe–Frank copulas. We also consider 180-degree rotations of the asymmetric copulas, which include all of the preceding except for the Gaussian and t copulas.

A copula is rotated \(180^{\circ }\) by using \(1-u^x_i\) in place of \(u^x_i\), where \(u^x_i\) is the quantile corresponding to the marginal distribution for \(x_i\). Such rotations (by \(90^{\circ }\) or \(270^{\circ }\)) can accommodate inverse correlations in copulas that can only represent positive correlation in the unrotated form. Likewise, tail dependencies can be reversed by rotating the copula \(180^{\circ }\).

As a reviewer has noted, comparisons of goodness-of-fit criteria across alternative specifications provide a heuristic basis for comparing alternative specifications. Our approach is reinforced by a consideration of Cramér von Mises (CvM) and Kolmogorov–Smirnov (KS) tests of the specifications.

Estimation and inferences were accomplished using the “COPULA” and “NLP” procedures of SAS and the “copula” and “VineCopula” packages of the R language. Details are available in Chvosta et al. (2011), Schepsmeier et al. (2015), and Yan (2012). Excellent overviews of the R packages and implementation issues are presented by Yan (2007) and Czado (2011).

OSB is engineered by using waterproof and heat-cured resins and waxes and consists of rectangular-shaped wood strands that are arranged in oriented layers. OSB is produced in long, continuous mats which are then cut into panels of varying sizes. In this regard, OSB is similar to plywood, although OSB is generally considered to have more uniformity than plywood and is, moreover, cheaper to produce.

Random Lengths is an independent, privately owned price reporting service, providing information on commonly produced and consumed wood products in the USA, Canada, and other countries since 1944. Reported open-market sales prices are based on hundreds of weekly telephone interviews with producers, wholesalers, distributors, secondary manufacturers, buying groups, treaters, and some large retailers. The regional OSB price data used are FOB mill price averages

Nonstationarity tests for the individual prices are not presented here but are available on request. The cointegration relationship is evaluated using the residuals from \(ln(P^{i}_{t}) = \alpha + \beta ln(P^{j}_{t}) + \epsilon _t\). Note that a test of stationarity of the price differentials is equivalent to restricting \(\alpha =0\) and \(\beta =1\).

Deviation half-lives are given by \(ln(0.5)/ln(1-\beta )\).

In the interest of space and in light of the BIC values, we do not present estimates of the STAR model. These estimates are available from the authors on request.

Standard normal marginals are used only to illustrate the dependencies in the joint distributions. We use the empirical marginals to evaluate the nature of price adjustment below.

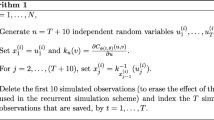

Mean relationships were estimated by simulating data from the estimated copula and the nonparametric marginal densities. Splines and high-ordered polynomial expressions were then fit to the simulated data. Note that simulation of the joint distributions using nonparametric density estimates involved generating random, dependent draws from the univariate values and then using a nonparametric estimate of the inverse cdf. A fine grid was defined for the kernel density estimates of the density, and then, quantiles were matched to the randomly drawn uniform variates to generate values of the two dependent variables \((\Delta (p^i_{t}-p^j_{t}),(p^j_{t-1}-p^i_{t-1}))\).

Derivatives are derived by solving the bivariate relationship suggested by the copula for one variable in terms of the other. Splines and high-ordered polynomials were then used to parameterize this relationship, and derivatives are obtained by differentiating this polynomial. This provides an accurate approximation of the patterns of price responses that can be compared to conventional linear models.

References

Balcombe K, Bailey A, Brooks J (2007) Threshold effects in price transmission: the case of Brazilian wheat, maize, and soya prices. Am J Agric Econ 89:308–323

Benninga S, Protopapadakis A (1988) The equilibrium pricing of exchange rates and assets when trade takes time. J Int Money Financ 7:129–149

Berg D, Bakken H (2007) A copula goodness-of-fit approach based on the probability integral transform, unpublished working paper. http://www.danielberg.no/publications/gofcomp

Bessler DA, Fuller SW (1993) Cointegration between U.S. wheat markets. J Reg Sci 33:485–501

Buongiorno J, Uusivuori J (1992) The law of one price in the trade of forest products: co-integration tests for U.S. exports of pulp and paper. For Sci 38:539–553

Cherubini U, Luciano E, Vecchiato W (2004) Copula methods in finance. John Wiley and Sons, Chichester

Chvosta J, Erdman DJ, Little M (2011) Modeling financial risk factor correlation with the COPULA rocedure, SAS Global Forum, Paper 340–2011. SAS Institute Inc., Cary

Czado C (2011) The world of vines. In: 4th Workshop on Vine Copula Distributions and Applications, Technische Universität München, Munich, Germany, May 2011. https://www.statistics.ma.tum.de/fileadmin/w00bdb/www/veranstaltungen/vine_world.pdf. Accessed 31 March 2017

Deheuvels P (1979) La Fonction de Dépendance Empirique et ses Propriétés: Un Test Non–Paramétrique d Indépendance. Académie Royale de Belgique. Bulletin de la Classe des Sciences, 5e Série 65:274–292

De Lira Salvatierra I, Patton AJ (2015) Dynamic copula models and high frequency data. J Empir Financ 30:120–135

Demarta S, McNeil AJ (2005) The t copula and related copulas. Int Stat Rev 73:111–129

Dumas B (1992) Dynamic equilibrium and the real exchange rate in a spatially separated world. Rev Financ Stud 5:153–180

Embrechts P, McNeil A, Straumann D (2002) Correlation and dependence in risk management: properties and pitfalls. In: Dempster MAH (ed) Risk management: value at risk and beyond. Cambridge University Press, Cambridge, pp 176–223

Engle Robert F, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55(2):251–276

Fackler PL, Goodwin BK (2001) Spatial Price Analysis. In: Rausser GC, Garnder BL (eds) Handbook of agricultural economics. Elsevier Science, New York

Fang HB, Fang KT, Kotz S (2002) The meta-elliptical distributions with given marginals. J Multivar Anal 82:1–16

Genest C, Rivest L-P (1993) Statistical inference procedures for bivariate Archimedean copulas. J Am Stat Assoc 88(423):1034–1043

Genest C, Rémillard R, Beaudoin D (2009) Goodness of fit tests for copulas: a review and power study. Insur Math Econ 44:199–213

Giovannini A (1988) Exchange rates and traded goods prices. J Int Econ 24:45–68

Glasserman P (2004) Monte-Carlo methods in financial engineering. Springer-Verlag, New York

Goodwin BK, Grennes TJ, Wohlgenant MK (1990) Testing the law of one price when trade takes time. J Int Money Financ 9:21–40

Goodwin BK, Holt MT, Prestemon JP (2011) North American oriented strand board markets, arbitrage activity, and market price dynamics: a smooth transition approach. Am J Agric Econ 93:993–1014

Goodwin BK, Piggott NE (2001) Spatial market integration in the presence of threshold effects. Am J Agric Econ 83:302–317

Heckscher EF (1916) Vaxelkursens Grundval vid Pappersmyntfot. Ekonomisk Tidskrift 18:309–312

Hu L (2006) Dependence patterns across financial markets: a mixed copula approach. Appl Financ Econ 10:717–729

Isard P (1977) How far can we push the “Law of One Price”? Am Econ Rev 67:942–948

Joe H (1997) Multivariate models and dependence concepts. Chapman and Hall, London

Jondeau E, Rockinger M (2006) The Copula-GARCH model of conditional dependencies: an international stock-market application. J Int Money Financ 25:827–853

Jung C, Doroodian K (1994) The law of one price for U.S. softwood lumber: a multivariate cointegration test. For Sci 40:595–600

Lo MC, Zivot E (2001) Threshold cointegration and nonlinear adjustment to the law of one price. Macroecon Dyn 5:533–576

Michael P, Nobay AR, Peel D (1994) Purchasing power parity yet again: evidence from spatially separated markets. J Int Money Financ 13:637–657

Nelsen RB (2006) An introduction to copulas. Springer-Verlag, New York

Oh DH, Patton AJ (2013) Time-varying systemic risk: evidence from a dynamic copula model of CDS spreads, (May 23, 2013). Economic Research Initiatives at Duke (ERID) Working Paper No. 167

Park H, Mjelde JW, Bessler DA (2007) Time-varying threshold cointegration and the law of one price. Appl Econ 39:1091–1105

Patton AJ (2006) Modelling asymmetric exchange rate dependence. Int Econ Rev 47:527–556

Patton AJ (2009) Copula-based models for financial time series. In: Andersen TG, Davis RA, Kreiss J-P, Mikosch T (eds) Handbook of financial time series. Springer Verlag, Berlin

Patton AJ (2012) A review of copula models for economic time series. J Multivar Anal 110:4–18

Patton AJ, Fan Y (2014) Copulas in econometrics. Annu Rev Econ 6:179–200

Reboredo JC (2011) How do crude oil prices co-move?: A copula approach. Energy Econ 33:948–955

Richardson DJ (1978) Some empirical evidence on commodity arbitrage and the law of one price. J Int Econ 8:341–351

Rodriguez JC (2003) Measuring financial contagion: a copula approach. J Empir Financ 14:401–423

Schepsmeier U, Stoeber J, Brechmann EC, Graeler B, Nagler T, Erhardt T (2012) Package VineCopula \(R\)-Project CRAN Repository, July 2015

Schweizer B, Sklar A (1983) Probabilistic metric spaces. Elsevier Science, New York

Sephton PS (2003) Spatial market arbitrage and threshold cointegration. Am J Agric Econ 85:1041–1046

Sklar A (1959) Fonctions de rèpartition àn dimensions et leurs marges. Publ Inst Stat Univ Paris 8:229–231

Smith MS, Gan Q, Kohn RJ (2011) Modelling dependence using skew t copulas: Bayesian inference and applications. J Appl Econom 27:500–522

Taylor AM (2001) Potential pitfalls for the purchasing-power-parity puzzle? Sampling and specification biases in mean-reversion tests of the law of one price. Econometrica 69:473–498

Teräsvirta T (1994) Specification, estimation and evaluation of smooth transition autoregressive models. J Am Stat Assoc 89:208–218

Thursby MC, Johnson PR, Grennes TJ (1986) The law of one price and the modelling of disaggregated trade flows. Econ Model 3:293–302

Wang W, Wells MT (2000) Model selection and semiparametric inference for bivariate failure-time data. J Am Stat Assoc 95(449):62–72

Yan J (2007) Enjoy the joy of copulas: with a package copula. J Stat Softw 21(4):1–21

Yan J, Kojadinovic I (2012) Package ‘copula,’: multivariate dependence with copulas, \(R\)-Project CRAN Repository

Author information

Authors and Affiliations

Corresponding author

Additional information

The helpful comments of workshop participants at Hebrew University in Jerusalem and at the 21st Symposium of the Society for Nonlinear Dynamics and Econometrics are gratefully acknowledged. Helpful assistance and comments were provided by Alexios Galanos, Toshinao Yoshiba, Heather Anderson, and three anonymous referees. This work was supported by the US Forest Service.

Rights and permissions

About this article

Cite this article

Goodwin, B.K., Holt, M.T., Önel, G. et al. Copula-based nonlinear modeling of the law of one price for lumber products. Empir Econ 54, 1237–1265 (2018). https://doi.org/10.1007/s00181-017-1235-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1235-4