Abstract

Do married couples make joint labor supply decisions in response to each other’s wage shocks? The study on this question aids in understanding the link between the rising income instability and household insurance. Existing studies on household insurance either focus on consumption smoothing and take labor supply as a given, or only focus on wife’s labor responses to husband’s unemployment shocks. This article develops an intra-household insurance model that allows for insurance against permanent and transitory wage shocks from both partners. Estimation using the Survey of Income and Program Participation shows that wife increases labor supply in response to husband’s adverse wage shocks when both of them are working, and wife gets more nonlabor income when she is out of work. This intra-household insurance reduces earnings instability by about 2 to 9 %. These results suggest that joint labor supply decisions provide an extra smoothing effect on income instability.

Similar content being viewed by others

Notes

Permanent shocks are defined as shocks that are expected to persist into the future. Transitory shocks are caused by temporary and random influences. Permanent shocks are not mean-reverting and transitory shocks are mean reverting.

The basic assumptions include household allocations are Pareto efficient, and preferences are either egoistic or caring.

Among empirical studies using collective labor supply models with non-participation, Blundell et al. (2007) use Great Britain data, Bloemen (2010) uses Dutch data, Hourriez (2005) uses French data, Vermeulen (2006) uses Belgian data, Lacroix and Radtchenko (2011) use Russian data, and Zamora (2011) uses Spanish data.

Transitory variances are calculated as \(\frac {1}{N}\sum \nolimits _{i=1}^{N} {\frac {1}{(T_{i} -1)}} \sum \nolimits _{i}^{T_{i} } {(y_{it} -\Bar {{y}}_{i} )^{2}}\). First, we calculate variances for either each household or each individual over an entire sample period and then take the average across these households or individuals.

We randomly match single males and single females by merging the sample of single males and sample of single female as it is in the original order in the SIPP data, by time period.

This may be due to the marriage choice itself, such as individuals with higher wage or work-hour fluctuations are less likely to get married. However, we further compute transitory variance in hourly wage rate and work-hour and show that, on the contrary, singles do not have significant higher wage and work-hour fluctuations than married individuals.

We examine wage shocks instead of income shocks because the main component of income is labor earnings, which are endogenous to labor supply.

Chiappori (1992) shows that the main results for egoistic preference also hold in a more general case of “caring” individuals, preferences of whom are represented by utility functions that depend on both their egoistic utility and their spouses’. We focus on egoistic preferences only. Each individual may care about the overall welfare of their partner, but not by the way in which this welfare is generated. Some studies incorporate household production in empirical collective models, for example, Aronsson et al. (2001) and Rapoport et al. (2011).

Interest income r t A it is included in y it , by definition.

We do not explicitly introduce shocks to nonlabor income. This model assumes that couples pool nonlabor income and decide how to allocate it according to the sharing rule. This is also the assumption that existing studies using collective models usually make. Given this assumption of nonlabor income pooling, shocks to nonlabor income and the nonstochastic nonlabor income enter the decision weight and the sharing rule in the same manner. Therefore, people share risks to nonlabor income in the exact same way as they share nonlabor income.

An example would be, when the husband gets an unexpected injury, both he and his wife know whether the injury is going to persist for a long time or to recover very soon.

The outcome that comes from this sharing rule could be larger than the total amount of nonlabor income, in which case the husband not only transfers all the nonlabor income, but also transfers part of his earnings to the wife. This sharing rule can also be a negative value, in which case the wife transfers some of her earnings to the husband.

Derivation is available upon request.

Note that this is a key difference between the collective model and the alternative unitary model: in the unitary model, a household can be viewed as a single decision maker, and the weight does not depend on prices such as wage. When a household member is not working, changes in his or her “potential” wage, or expected wage, do not matter. However, in the collective setting, the expected wage of a nonworking member could affect bargaining positions, such as the threat point.

Suppose not: if the wife is indifferent between working or not, but her participation yields a positive gain for her spouse, then she will choose to participate; otherwise, the decision is not Pareto optimal.

Since the sharing rule does not depend on the husband’s transitory shocks, female labor supply as a function of the sharing rule does not depend on the husband’s transitory shocks either.

Some studies examine the consequence of job loss on marriage. For example, Eliason (2012) finds that husband’s job loss increases risk of divorce by 13 % using Swedish data. Doiron and Mendolia (2012) also find that couples are more likely to divorce when the husband experiences a job loss, using the British Household Panel Survey.

There are some other studies that examine how external insurance affects labor supply. For example, Cullen and Gruber 2000 show that a generous unemployment benefit has a crowding out effect on spousal labor supply.

Our model incorporates both male nonworking and female nonworking cases. There are 23.6 % of the sample in which wife does not work and husband works. Most of these cases are likely to be a participation choice rather than involuntary unemployment.

SIPP also contains monthly data on wage and labor supply. However, monthly data have the well-documented seam bias problem (Gottschalk 2005, among others). Respondents are more likely to report a wage change between interviews instead of within an interview period.

We do not have a balanced panel due to sample attrition, and people who are over 64 years old at any point in the panel are also dropped out of our sample. The SIPP documentation suggests that the loss rate for SIPP 2004 Panel is 36.6 % by the end of wave 12. The rate of sample loss in SIPP is usually high in wave 2 and then with a lower rate of attrition at each subsequent wave. (http://www.census.gov/sipp/usrguide/ch2_nov20.pdf)

We use the deflator from http://www.census.gov/hhes/www/income/income05/cpiurs.html.

We thank Peter Gottschalk for generously providing SIPP wage data with his correction of measurement error.

The intuition of identification is that differences in the preferences and the sharing rule, across education group, remain constant over time. The identification of labor supply relies on the assumption that the returns to education have changed over time, but such changes do not affect labor supply decisions. This assumption is consistent with empirical studies on income inequality, such as the increasing wage premium between college and high school degree (Katz and Autor 1999, among others).

There is also a debate in empirical research on returns to education and wage inequality that whether the movements reflect changes in skill prices (such as price differential between college and high school), or changes in the composition of college and high school graduates (such as from increasing enrollment in college and people self-selected to college). Some studies decompose these two effects (Carneiro and Lee 2009). In this article, we are not trying to distinguish or decompose these effects. Rather, we simply allow aggregate movements to differ from individual movements and distinguish shocks to male and females, so that a couple can insure for this aggregate risk.

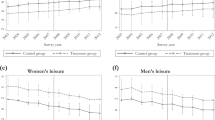

The variance for transitory shocks is comparable with existing studies. For example, in Moffitt and Gottschalk (2012), the variance of transitory shocks is between 0.15 and 0.2 for male log annual (their Figure 3), for male aged 30–59 in the early 2000s using the PSID. The variation in permanent shocks is a bit larger than existing studies, and the main reason is that the estimates of permanent shocks come from individual regressions of up to 12 observations. The small sample size could cause a larger variation.

Excluding savings from nonlabor income is consistent with a two-step budgeting process such as in Blundell and Walker (1986). In our model, at the beginning of a marriage, a couple optimally allocate life-cycle wealth for each period according to expected wage shocks; in the second stage, when shocks are realized in each period, a couple allocate nonlabor income, net of savings, according to the sharing rule.

Lise and Seitz (2011) use similar instruments. The housing price index quarterly data by state can be found at http://www.ofheo.gov/hpi_download.aspx.

Due to large variation in savings data, we run regression by trimming the top and bottom 5 %, but predict savings for the entire sample.

We acknowledge that using predicted regressors in the FIML may yield biased estimates due to measurement error. Therefore, our estimates serve as a lower bound of the true estimates. The advantage of using FIML versus alternative estimation method such as nonlinear GMM is that FIML allows for full distribution assumption of error terms. Other empirical studies on collective labor supply with nonparticipation also use FIML (for example, Blundell et al. 2007; Bloemen 2010).

We acknowledge that our test statistics for the unitary and the collective model could be underestimated due to the potential measurement error by using predicted regressors in the FIML.

Note that our exercise in this section is based on estimates with dual earner couples only. The estimates of the sharing rule and labor supply functions are available upon request.

References

Altonji J, Hayashi F, Kotlikoff L (1992) Is the extended family altruistically linked? Direct tests using micro data. Am Econ Rev 82(3):1177–1198

Aronsson T, Daunfeldt S, Wikstrom M (2001) Estimating intrahousehold allocation in a collective model with household production. J Popul Econ 14(4):569–584

Attanasio O, Pavoni N (2011) Risk sharing in private information models with asset accumulation: explaining the excess smoothness of consumption. Econometrica 79(4):1027–1068

Bloemen HG (2010) An empirical model of collective household labour supply with non-participation. Econ J 543(3):183–214

Blundell R, Chiappori PA, Magnac T, Meghir C (2007) Collective labor supply: heterogeneity and nonparticipation. Rev Econ Stud 74(2):417–445

Blundell R, Pistaferri L, Preston I (2008) Consumption inequality and partial insurance. Am Econ Rev 98(5):1887–1921

Blundell R, Walker I (1986) A life-cycle consistent empirical model of family labour supply using cross-section data. Rev Econ Stud 53(4):539–558

Bingley P, Walker I (2001) Household unemployment and the labour supply of married woman. Economica 68(270):157–185

Carneiro P, Lee S (2009) Estimating distributions of potential outcomes using local instrumental variables with an application to changes in college enrollment and wage inequality. J Econometrics 149(2):191–208

Chiappori PA (1988) Rational household labor supply. Econometrica 56(1):63–89

Chiappori PA (1992) Collective labor supply and welfare. J Polit Econ 100(3):437–467

Chiappori PA, Fortin B, Lacroix G (2002) Marriage market, divorce legislation and household labor supply. J Polit Econ 110(1):37–72

Cochrane JH (1991) A simple test of consumption insurance. J Polit Econ 99(5):957–976

Cullen JB, Gruber J (2000) Does unemployment insurance crowd out spousal labor supply? J Labor Econ 18(3):546–572

Dahl M, Schwabish JA, DeLeire T (2011) Estimates of year-to-year volatility in earnings and in household income from administrative, survey, and matched data. J Hum Resour 46(4):750–774

Donni O (2003) Collective household labor supply: nonparticipation and income taxation. J Public Econ 87(5–6):1179–1198

Doiron D, Mendolia S (2012) The impact of job loss on family dissolution. J Popul Econ 25(1):367– 398

Dynan K, Elmendorf D, Sichel D (2012) The evolution of household income volatility. BE J Econ Anal Poli 12(2):1–42

Eliason M (2012) Lost jobs, broken marriages. J Popul Econ 25(4):1365–1397

Elrod LD, Spector RG (2003) A review of the year in family law: charts. Fam L Q 36(4):559–566

Elrod LD, Spector RG (2004) A review of the year in family law: charts. Fam L Q 37(4):577–584

Elrod LD, Spector RG (2005) A review of the year in family law: charts. Fam L Q 38(4):811–818

Gottschalk P (2005) Downward nominal wage flexibility—real or measurement error? Rev Econ Stat 87(3):556–568

Gottschalk P, Moffitt R (1994) The growth of earnings instability in the U.S. labor market. Brookings Pap Eco Ac 25(2):217–272

Gottschalk P, Moffitt R (2009) The rising instability of U.S. earnings. J Econ Perspect 23(4):3–24

Haider S (2001) Earnings instability and earnings inequality of males in the United States: 1967–1991. J Labor Econ 19(4):799–836

Hourriez JM (2005) Estimation of a collective model of labor supply with female nonparticipation. Mimeo. CREST-INSEE, France

Hyslop DR (2001) Rising U.S. earnings inequality and family labor supply: the covariance structure of intrafamily earnings. Am Econ Rev 91(4):755–777

Juhn C, Potter S (2007) Is there still an added worker effect? Federal Reserve Bank of New York Staff Report No. 310

Katz LF, Autor DH (1999) Changes in the wage structure and earnings inequality. In: Ashenfelter O C, Card D (eds) Handbook of labor economics, vol 3, Part A. Elsevier Science, New York, pp 1463–1555

Kohara M (2010) The response of Japanese wives’ labor supply to husbands’ job loss. J Popul Econ 23(4):1133–1149

Lacroix G, Radtchenko N (2011) The changing intra-household resource allocation in Russia. J Popul Econ 24(1):85–106

Lise J, Seitz S (2011) Consumption inequality and intra-household allocations. Rev Econ Stud 78(1):328–355

Lundberg S (1985) The added worker effect. J Labor Econ 3(1):11–37

Mazzocco M (2004) Saving, risk sharing, and preferences for risk. Am Econ Rev 94(4): 1169–1182

Mazzocco M (2007) Household inter-temporal behavior: a collective characterization and a test of commitment. Rev Econ Stud 74(3):857–895

Mazzocco M, Ruiz C, Yamaguchi S (2007) Labor supply, wealth dynamics, and marriage decisions. California Center for Population Research Working Paper CCPR-065-06

Moffitt R, Gottschalk P (2002) Trends in the transitory variance of earnings in the United States. Econ J 112(478):C68–C73

Moffitt R, Gottschalk P (2012) Trends in the transitory variance of male earnings: methods and evidence. J Hum Resour 47(3):204–236

Rapoport B, Sofer C, Solaz A (2011) Household production in a collective model: some new results. J Popul Econ 24(1):23–45

Shin D, Solon G (2011) Trends inmen’s earnings volatility: what does the panel study of income dynamics show? J Public Econ 95(7–8):973–982

Townsend RM (1994) Risk and insurance in village India. Econometrica 62(3):539–591

Vermeulen F (2006) A collective model for female labour supply with non-participation and taxation. J Popul Econ 19(1):99–118

Zamora B (2011) Does female participation affect the sharing rule? J Popul Econ 24(1):47–83

Acknowledgments

The author is indebted to Peter Gottschalk and Shannon Seitz for their invaluable advice. She also thanks Arthur Lewbel, Susanto Basu, Christopher Baum, Hans Bloemen, Katharine Bradbury, Donald Cox, John Knowles, Jeffery Smith, two anonymous referees, and participants on several conferences and workshops for their helpful suggestions and comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Erdal Tekin

Appendix

Appendix

Derivation of Eq. 16

Based on the equation of Donni (2003) in his Section 3.2.3 and our functional form, a partial differential equation that identifies the nonparticipation set gives

From Eq. 14, we have A 1 = a 1 + s f b 1, and A 3 = a 3 + s f b 3. From Eq. 15, we have K 3 = k 3 + q f b 3, and K 1 = k 1 + q f b 1. Plug these into the above Eq. 24 together with the expression of k 3 and k 1 derived from Eq. 9, and we have:

This can be further simplified to Eq. 16: \(q_{f} =\frac {s_{f} b_{8} }{\Delta }\).

1.1 Derivation of likelihood function

This section derives log-likelihood function for male and female labor supply when both partners are working and female labor supply when husband is out of work. Assume that preference shocks \(u_{it}^{f}\) and \(u_{it}^{m}\) in labor supply function (Eq. 22) follow a joint normal distribution with zero mean and the following covariance matrix:

The log-likelihood function takes the following form:

The likelihood function when both partners are working follows a joint normal distribution:

where φ is the density function of standard normal distribution.

The likelihood function in the male nonparticipation set is different. First, based on Eq. 14, the error term in female labor supply function when husband does not work is now \(u_{it}^{f} +s_{f} u_{it}^{m}\). This suggests that the upper left element in the covariance matrix is \(\sigma _{f}^{2} +2s_{f} \rho \sigma _{f} \sigma _{m} +s_{f}^{2} \sigma _{m}^{2}\). The covariance between \((u_{it}^{f} +s_{f} u_{it}^{m} )\) and \(u_{it}^{m}\) is \(\rho \sigma _{f} \sigma _{m} +s_{f} \sigma _{m}^{2}\). Therefore, the covariance matrix becomes

The likelihood in male nonparticipation set becomes

where Φ stands for the cumulative distribution function of standard normal distribution, \(\sigma _{\nu _{f} }\) is the abbreviation for the square root of the upper left element in covariance matrix, and r f is the correlation parameter in the nonparticipation set \(\left ( {\frac {\rho \sigma _{f} +s_{f} \sigma _{m} }{\sigma _{\nu _{f} } }} \right )\).

Similarly, the likelihood in female nonparticipation set becomes

and the likelihood in the set where neither the husband nor wife participates follows a bivariate normal distribution:

1.2 Unitary model

In this section, we derive an alternative household decision model, the unitary model, which assumes that a household as a unit, rather than two individuals, makes decision and maximizes utility. The unitary model implies a different set of testable restrictions. In Section 5.4, we test the hypothesis of both collective model and unitary model. There are two restrictions imposed on the unitary model without corner solution: income pooling restriction and the Slutsky restrictions. The income pooling restriction assumes that household members pool income together, which fully insure themselves against all shocks. The other restriction is the Slutsky symmetry of the substitution matrix and positive semi-definiteness of the substitution matrix. The unitary model generates different testable restrictions from the collective model. The unitary model becomes

Labor supply functions will be derived the same as in Eq. 8. The Slutsky symmetry of compensated cross wage effects can be expressed as follows:

where \(S_{ij} =\frac {\partial h^{i}}{\partial w^{j}}-h^{j}\frac {\partial h^{i}}{\partial y},i,j=f,m\)

Based on the Slutsky symmetry (34) and the labor supply functions (Eq. 8), we derive the following testable restrictions:

In addition, nonparticipation generates another set of restrictions for the unitary model. In the collective model, when the husband is out of work, his potential wage still affects the sharing rule, thus labor supply. In the unitary model, his potential wage no longer affects labor supply. This implies that the effect of male potential wage on female labor supply is zero, when the husband is out of work:

Similarly, when the wife is out of work, we have

1.3 Derivation of log earnings as a function of both partners’ wage shocks

In this section, we use Taylor expansions to derive earnings as a function of the partial response to both partners’ wage shocks. Based on the specification of the sharing rule in our model, the higher-order derivatives of labor supply with respect to wage shocks all become zeros. The first-order Taylor expansion for log male earnings is as follows:

where 𝜖 f and 𝜖 m are transitory components of female and male unlogged wage, respectively; thus, log𝜖 m is equivalent to v m in Eq. 21. Take the variance of Eq. 38, and the constant term on the right-hand side drops out.

where \(\frac {\partial \text {log}h^{m}}{\partial \text {log}\epsilon ^{m}}\) and \(\frac {\partial \text {log}h^{m}}{\partial \text {log}\epsilon ^{f}}\) are directly derived from labor supply functions (Eq. 5) and sharing rule (Eq. 6). All items on the right-hand side can be computed using estimates from our model.

Similarly, the Taylor expansion of log household earnings becomes

Taking the variance of Eq. 40, the variance of the constant terms becomes zero. Again substitute partial derivatives using the estimated coefficients from Eqs. 5 and 6, and the variance becomes

Rights and permissions

About this article

Cite this article

Zhang, S. Wage shocks, household labor supply, and income instability. J Popul Econ 27, 767–796 (2014). https://doi.org/10.1007/s00148-014-0507-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-014-0507-y