Abstract

This paper studies how the risk of divorce affects the human capital decisions of a young couple. We consider a setting where complete specialization is optimal with no divorce risk. Couples can self-insure through savings which offers some protection to the uneducated spouse, but at the expense of a distortion. Alternatively, for large divorce probabilities, symmetry in education, where both spouses receive an equal amount of education, may be optimal. This eliminates the risk associated with the lack of education, but reduces the efficiency of education choices. We show that the symmetric allocation will become more attractive as the probability of divorce increases, if risk aversion is high and/or labor supply elasticity is low. However, it is only a “second-best” solution as insurance protection is achieved at the expense of an efficiency loss. Finally, we study how the (economic) use of marriage is affected by the possibility of divorce.

Similar content being viewed by others

Notes

This is well-summarized in Browning et al. (2012).

In other words, we have a cooperative bargaining solution in which spouses receive equal weight. An alternative would be to study a non-cooperative Nash equilibrium with couples playing a one shot game; see for instance Konrad and Lommerud (1995). Though interesting, this approach cannot be readily combined with ours in a single paper. To achieve a comprehensive understanding of couples’ behavior, the two approaches provide insights from different but complementary perspectives.

Besides Becker (1991), see his Treatise on the Family, models of the household do not distinguish between decision-making agents. The alternatives to this unitary model are models assuming that multiperson households include individual decision-makers. Such models have been described as “individual models” (Apps and Rees 2009) or “collective models” (Bourguignon et al. 1995; Browning et al. 2012).

There is no human capital investment per se but the learning-by-doing associated with market work plays a similar role.

Konrad and Lommerud (2000) also study the couple’s education, but they do not consider the effect of divorce. Their main finding is that non-cooperation leads to overinvestments in education. Borenstein and Courant (1989) is also somewhat related to our paper. They analyze human capital investments of spouses who can finance these investments either by borrowing on the financial market or from their partner’s wealth. They argue that spouses are only willing to extend “credit” to their partners if they can expect to remain married later in life and thereby to profit from their investments. Consequently, investments in human capital are inefficiently low when there is a divorce risk and no marriage contract.

Throughout this paper, we assume that the couple consists of one women and one man. We make this assumption only for expositional convenience.

This presumes that a judge is able to observe the couple’s accumulated wealth.

See Cremer et al. (2011).

The assumption that the education budget is fixed is made for simplicity but has no impact on the results. This follows directly from Cremer et al. (2011) who show that the specialization result continues to apply with an endogenous budget as long as the education technology does not exhibit a significant degree of decreasing returns.

Except for the assumption that human capital investments are made (once and for all) at the beginning of married life and thus before it is known if the couple will effectively divorce or not. Formally, this implies that the levels of w m and w f are unique (i.e., there is no period/state of nature superscript).

The simplification arises because preferences are quasi-linear. They make our argument clearer but are not essential for our results. In particular, our results do not depend on the property that labor supply increases with wage; see Appendix.

In reality, couples may save for various nondivorce-related reasons, including retirement preparation. To account for this, we could introduce a third period during which people retire. This would complicate the analysis without affecting the results.

c ∗ and ℓ ∗ are vectors and are short for optimal consumption/labor supply of male and female in both periods and states.

Where \(\ell _{i}^{\ast }\) for w i = 2 and w −i = 0 is equal to \(\ell _{-i}^{\ast }\) for w i = 0 and w −i = 2.

Recall that when π = 0, unequal wages are alwaysoptimal (irrespective of labor supply elasticity and risk-aversion).

Since the amount the better educated spouse has to pay in case of divorce is fixed from the second period’s perspective, there is no moral hazard in the paying spouse’s labor force participation.

Cigno (2012) shows that the decision to marry also depends on the choice of game after marriage. He finds that a couple will marry only if marriage serves as a commitment device for cooperation.

One can easily show that as long as both rates are equal, labor supply and savings (for given wages) are unaffected. In particular, savings continue to play no role other than providing self-insurance.

Differentiating the Lagrangian expression, ℒ, associated with this problem (after substituting w −i by 1−w i , one easily shows that at w i = 2 and w −i = 0 we have ∂ℒ/∂ w i > 0 so that a local deviation from maximum differentiation decreases welfare irrespective of π and σ even with general utilties. However, unlike in the quasi-linear setting the problem cannot be reduced to a single dimension so that this property is no longer very meaningful.

References

Apps P, Rees R (2009) Public economics and the household. Cambridge University Press, Cambridge

Barthez A, Laferrère A (1996) Contrats de Mariage et Régimes Matrimoniaux. Economie et Statistique:296–297

Becker GS (1973) A theory of marriage: part I. J Polit Econ 81:813–846

Becker GS (1974) A theory of marriage: part II. J Polit Econ 82:11–26

Becker GS (1991) A treatise on the family. Harvard University Press

Becker GS, Landes E, Michael R (1977) An economic analysis of marital instability. J Polit Econ 85(6):1141–1187

Borenstein S, Courant PN (1989) How to carve a medical degree: human capital assets in divorce settlements. Am Econ Rev 79(5):992–1009

Bourguignon FJ, Browning M, Chiappori P (1995) The collective approach to household behaviour. DELTA working papers

Browning M, Chiappori P, Weiss Y (2012) Family economics, unpublished

Cigno A (2011) The economics of marriage. Perspektiven der Wirtschaftspolitik,Verein für Socialpolitik 12:28–41

Cigno A (2012) Marriage as commitment device. Rev Econ Househ 10:193–213

Cremer H, Pestieau P, Racionero M (2011) Unequal wages for equal utilities. Int Tax Public Financ 18(4):383–398

Ermisch JF (2003) An economic analysis of the family. Princeton University Press

Fernández R, Wong JC (2011) The disappearing gender gap: the impact of divorce, wages, and preferences on education choices and women’s work. IZA DP No. 6046

Gonzalez L, Ozcan B (2008) The risk of divorce and household saving behavior. IZA DP No. 3726

Johnson WR, Skinner J (1986) Labor supply and marital separation. Am Econ Rev 76:455–469

King AG (1982) Human capital and the risk of divorce: an asset in search of a property right. South Econ J 49(2):536–541

Konrad K, Lommerud KE (1995) Family policy with non-cooperative families. Scand J Econ 97(4):581–601

Konrad K, Lommerud KE (2000) The Bargaining family revisited. Can J Econ 33(2):471–487

Lommerud KE (1989) Marital division of labor with risk of divorce: the role of voice enforcement of contracts. J Lab Econ 7(1):113–127

Stevenson B (2007a) The impact of divorce laws on investment in marriage-specific capital. J Lab Econ 25(1):75–94

Stevenson B (2007b) Divorce-law changes, household bargaining, and married women’s labor supply revisited, manuscript. University of Pennsylvania

Acknowledgments

Financial support from the Chaire “Marché des risques et creation de valeur” of the FdR/SCOR is gratefully acknowledged. We are grateful to the editor, Alessandro Cigno, and to the two referees for their insightful and constructive comments. We also thank Sara Meade for her prompt and effective text editing.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Appendix: General utility

Appendix: General utility

Throughout this paper, we assume quasi-linear preference (with no income effect) and a utility function given by u(c i −v(ℓ i )). This specification implies that labor supply is always increasing in wage, and one might be tempted to consider that this is crucial for our results. However, this is not the case. We use this specification for simplicity and to be able to reduce the problem to a single dimension. But this is simply a matter of exposition. Proposition 1 continues to be valid for general utility functions. This is obvious for items (iii) and (iv), but needs to be established for (i) and (ii).

The result that maximum wage differentiation is optimal for π = 0 with general utility functions follows directly from Cremer et al. (2011). The theoretical argument effectively formalizes the intuition explained in Section 3.3 above. To make this paper self-contained, we briefly sketch this main argument. Assume the general utility function u(c i ,ℓ i ), then for equal wages and π = 0 we will have c i =w i ℓ i =ℓ i and s = 0 (i.e., spouses consume their own incomes, which are equal and saving is zero). Welfare is then given as follows,

where

With unequal wages, w i = 2 and w −i = 0, the spouse with w i = 0 does not work and earns no income but he/she receives a compensation from the spouse with higher human capital, as optimally marginal utilities are equalized. Denoting this transfer T, the couple’s welfare is given as follows,

where we have ℓ −i = 0. Observe that as long as π = 0 we have s = 0, and the two periods are perfectly symmetrical. Now assume the individual with higher human capital simply gives half of his/her income to his/her spouse (\( T=\ell _{i}^{MD}\)) so that consumption levels are equalized (which is generally not the optimal level). Additionally, set \(\ell _{i}^{MD}=\ell ^{E} \), so that the individual with w i = 2 works the same number of hours with equal wages (which is also generally not optimal). With these two assumptions, we have

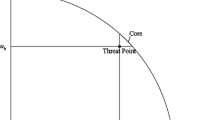

In other words, under wage differentiation the couple can achieve the same consumption levels as under wage equalization by having only a single individual work (the same amount as under wage equalization). Intuitively, this is simply a generalization of the argument discussed in Section 3.3 and represented in Fig. 1. This establishes that item (i) of Proposition 1 continues to be valid with more general utility function.

Introducing a positive π, a couple’s welfare with general utility functions is redefined as follows:

Budget constraints are unchanged and continue to be given by Eqs. (3)–(6).Footnote 20 Under equal wages, maximizing (A3) subject to Eqs. (3)–(6) yields \(c_{i}^{tj}=\ell _{i}^{tj}=\ell ^{E}\) defined by Eq. (A2) so that welfare is given by \(\mathcal {W}^{E}=4u\left (\ell ^{E},\ell ^{E}\right ) \) which does not depend on π. Under unequal wages (w i = 2 and w −i = 0), differentiating welfare with respect to π, while using the envelope theorem yields

To establish the inequality, observe that the second term in brackets is the utility of the married couple, while the first term is the utility of the divorced spouses. Since savings and productivities are the same in both cases, the utility of the married couple is always at least as large as that of the divorced spouses. This is because the (c,ℓ) bundles chosen by the divorced spouses are feasible for the married couple, while the opposite is not true. Consequently, item (ii) of the proposition stating that wage differentiation becomes less attractive as π increases, remains valid with general utility. To summarize, none of these results requires an increasing labor supply function.

Rights and permissions

About this article

Cite this article

Cremer, H., Pestieau, P. & Roeder, K. United but (un)equal: human capital, probability of divorce, and the marriage contract. J Popul Econ 28, 195–217 (2015). https://doi.org/10.1007/s00148-014-0504-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-014-0504-1