Abstract

Government programs designed to provide income safety nets often restrict eligibility to families with children, creating an unintended fertility incentive. This paper considers whether dramatically changing incentives in the earned income tax credit affect fertility rates in the USA. We use birth certificate data spanning the period 1990 to 1999 to test whether expansions in the credit influenced birthrate among targeted families. While economic theory would predict a positive fertility effect of the program for many eligible women, our results indicate that expanding the credit produced only extremely small reductions in higher order fertility among white women.

Similar content being viewed by others

1 Introduction

Historically, government programs designed to provide income safety nets tend to restrict eligibility to families with children in an attempt to target benefits toward those perceived to have the greatest need. Typically, benefits increase with a recipient’s number of children, implicitly acknowledging that despite some economies of scale, cost of living increases with family size. This is true of welfare programs like Temporary Assistance for Needy Families (TANF), and is also true of the earned income tax credit (EITC), a tax-based income support that grew enormously during the 1990s. The moral hazard associated with this program design is that it has the potential encourage childbearing. This issue has received a great deal of attention in the welfare policy literature, but has, thus far, gone relatively unexplored in the context of the EITC.

This analysis will expand upon an existing literature of economic incentives and fertility. Findings in the welfare literature are inconclusive (Moffitt 1998), and the income tax literature typically finds statistically significant effects of the income tax system on fertility decisions (Whittington 1992; Whittington et al. 1990). Expansions in the EITC provide exogenous variation in the price of childbearing that may shed light on fertility responses to economic incentives.

Additionally, by considering the link between the EITC and fertility, this paper tests a common assumption in the literature on the EITC and the labor supply of single parents. The framework used to estimate changes in the labor supply of single parents identifies the effect of the EITC by assuming that the presence of a child is exogenous to the value of the EITC (Dickert et al. 1995; Eissa and Liebman 1996; Hotz et al. 2006; Meyer and Rosenbaum 2000). To our knowledge, no previous studies consider the validity of this assumption.

Finally, declining fertility rates in many western counties raise the more general issue of whether the tax system can be used as a social policy tool for encouraging fertility. Pro-natalist policies in Canada and Western Europe have received considerable attention during the past decade (see, for example, Gauthier and Hatzius 1997). This research has the potential to shed light on the ability of taxes to influence fertility.

To directly investigate whether incentives for childbearing in the EITC do, in fact, affect fertility rates, we use birth certificate data from the National Center for Health Statistics spanning the period 1990 to 1999. We focus on whether expansions in the credit at the state and federal levels led to increases in the birthrate among targeted low-skill families. Our results suggest that EITC expansions over the course of the 1990s produced, if anything, small reductions in the higher order birthrate for white women.

The paper proceeds as follows. The following section reviews relevant literature on economic policy and fertility. Section 3 discusses the structure of the EITC and its implicit incentives for childbearing. Section 4 describes the data and empirical methods used to estimate fertility rate models and Section 5 presents these results. Section 6 concludes.

2 Literature review

A large literature in economics suggests that economic policies have the potential to affect fertility behavior. Becker (1991) lays out theoretical foundations that underpin most modern economic models of fertility. A basic form of this model would suggest that children are normal goods and that increases in family income would, all else equal, tend to promote higher fertility levels, particularly over short time periods in which the cost of human capital does not change dramatically. However, the effects of income on fertility have historically been difficult to identify empirically because of the correlation between a primary source of household income (parental wages) and the opportunity cost of time devoted to child-rearing (Schultz 1973). Several studies have estimated the effects of husband’s income (sometimes interpreted as an income effect) on family size, but reported effects have been both negative (Willis 1973) and positive (Hotz and Miller 1988).

A basic economic model of fertility would also predict that the opportunity cost of bearing and raising children affects parental decisions about starting and expanding families. A number of studies find negative correlations between female wages (sometimes instrumented using education) and fertility. More recently, researchers use variation in taxes and transfer programs to identify exogenous shifts in the costs of bearing and raising children.

2.1 Transfer programs

The largest literature on the fertility impacts of income support programs focuses on Aid to Families with Dependent Children (AFDC). Eligibility for AFDC was historically contingent upon single parenthood, providing a strong incentive for an unmarried woman to have her first child. Much of the work in the welfare and fertility literature relies on cross-state variation in the generosity of welfare benefits paid to families with children. Early cross-sectional work suggests that welfare benefits have a positive effect on the fertility of unmarried women. Hoynes (1997) finds that those effects largely disappear in a panel model that controls for unobservable state characteristics. Moffitt (1998) summarizes the vast welfare and fertility literature and notes that although there appears to be a significant correlation between welfare benefit generosity and fertility, results are extremely sensitive to methodology. One of the only consistent findings is that welfare seems to have a larger effect on fertility for white women than black women—a result that has never been well explained in the literature.

Beyond the eligibility for AFDC that came with the birth of the first child, welfare benefits typically increased with the birth of each additional child. Several papers find that these incremental benefits have no effect on the probability of additional births, conditional on having at least one child (Acs 1996; Fairlie and London 1997). Grogger and Bronars (2001) find no relationship between incremental welfare benefits and the timing of subsequent births. However, they find a positive relationship between base welfare generosity and subsequent fertility for initially unwed black mothers.

During the welfare reform process of the 1990s, a number of states implemented family caps, lowering the incremental benefit for a child born while on welfare to zero. Kearney (2004) and Levine (2002) find that the caps do not decrease national birthrates but are curiously positively correlated with fertility among those most likely to be eligible for welfare. Dyer and Fairlie (2004) and Joyce et al. (2004) also find no evidence that eliminating the incremental benefit for additional children in welfare programs affects fertility. Using smaller more select samples of female welfare recipients (Jagannathan et al. 2004; Camasso et al. 2003) and unmarried women (Horvath-Rose and Peters 2002), these authors find that the cap is associated with lower fertility.

A smaller literature considers the effect of in-kind transfer programs on fertility. Results from the RAND health insurance experiment indicate that fertility is quite responsive to changes in the price of health insurance (Liebowitz 1990), and a handful of studies exist that examine the fertility impact of recent expansion in public health insurance programs for children during the 1990s. Joyce et al. (1998) look at quarterly birthrates of unmarried women ages 19 to 27 between 1987 and 1991 for a subset of US states and find a 5% increase in births for white women but no changes in fertility in response to Medicaid expansions for non-white women. Yelowitz (1994) uses microdata from the Current Population Survey between 1989 and 1992 and finds that a $1,000 increase in the value of Medicaid coverage increases the probability of a birth to a woman in the sample by 0.33% on average. Bitler and Zavodny (2000) estimate using birthrate data that Medicaid expansions between 1983 and 1996 led to a 10% increase in the birthrate.

2.2 Taxes

Empirical work finds that taxes are another economic policy that can influence the fertility decision. Tax policies considered in the literature include both implicitly pro-natalist personal exemptions for dependents, which allows tax filers to deduct an amount from taxable income for each member of the tax unit (including children), and the more obvious child tax credits, which allow deductions from tax liability for each child.

Whittington et al. (1990) analyze the impact of the personal exemption in the US tax code. They estimate a time series fertility equation using aggregate data for the USA from 1913 to 1984 by regressing the fertility rate on demographic and economic variables believed to affect fertility, including the tax value of the personal exemption: the personal exemption multiplied by the average marginal tax rate. Their estimates suggest that the elasticity with respect to the tax value is between 0.127 and 0.248. Whittington (1992) explores the same issue with microdata. Using the Panel Study of Income Dynamics, she estimates that the federal tax value of the personal exemption is positively and significantly related to the likelihood of having a birth. She finds that a 1% increase in the exemption value would result in an increase in the probability of an additional birth between 0.23 and 1.31%.

In a recent dissertation related to our work, Duchovny (2001) estimates the fertility effect of the EITC expansion that provided an incremental benefit to families with two or more children. Employing a difference-in-difference technique, she uses the Current Population Survey and women who already have two children as a control group for women who have only one child. She finds that the policy increased the fertility rate of white married mothers with only one child by up to 15%.

Several authors consider the effects of Canada’s more explicitly targeted child tax policy. Zhang et al. (1994) estimate an aggregate fertility equation for Canada from 1921 to 1988. They include the personal tax exemption, family allowance, and child tax credit from the Canadian tax system as independent variables and find that the estimated elasticity of fertility with respect to total tax benefits is 0.05, about half the size of the elasticities estimated by Whittington et al. (1990). Milligan (2005) uses the Quebec Allowance for Newborn Children (ANC) to identify an exogenous change in the cost of children. These benefits, paid only in the province of Quebec between 1988 and 1997, were typically $500 for the first child, $1,000 for the second, and up to $8,000 for third order or higher children and paid in one or more installments. Using Canadian Census data, he estimates dramatic effects of the ANC on fertility rates. For example, a one-time $500 transfer increases the probability of having a child by 9.8%. He hypothesizes that timing at least partially explains the size of these effects, as women shift planned fertility to earlier ages to benefit from the temporary ANC benefit.

2.3 The EITC and labor supply

Finally, because the EITC may theoretically affect fertility through changes in opportunity cost, as discussed in detail in Section 3, it is worth pointing out that there is substantial evidence that the EITC influences women’s labor supply. The literature shows that expansions in the EITC increased participation in the labor market for single mothers (Eissa and Liebman 1996; Hotz et al. 2006; Meyer and Rosenbaum 2000; Dickert et al. 1995) and decreased the labor supply of married women (Eissa and Hoynes 2004; Dickert et al. 1995).

3 The EITC and fertility

3.1 History and structure of the credit

The EITC is a particularly relevant part of the income tax system with respect to children; although presumably unintentional, its design makes it one of the most pro-natalist features of the United States personal income tax code. The credit was implemented for the first time in 1975 as an alternative to traditional welfare and, for both political and budgetary reasons, initially covered only low-income workers who had children (Ventry 2000). For almost 20 years, the credit exclusively benefited those with children, until a very small credit for childless filers was introduced in 1993.

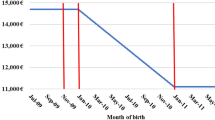

The income tax code bases EITC eligibility on the earned income of a tax-filing unit. Both married and single filers are eligible to take the credit as long as their income is low enough. The structure of the credit, which is illustrated for 2001 in Fig. 1, is such that it increases with a tax unit’s earned income until it reaches a maximum. This is commonly called the phase-in range. Over a range of income, referred to as the flat range, taxpayers receive the maximum annual credit and then the credit is phased out with additional income above a certain amount over the phase-out range. Unlike other tax credits, the EITC is refundable so that if a tax unit’s credit is greater than its tax liability, the Treasury refunds the difference. It follows that even tax units with income below the tax threshold (sum of the standard deduction and personal exemptions) can be eligible for the EITC. Most taxpayers receive their credit as a lump sum when they file, which implies that refundable EITC benefits are usually received in the months after the end of tax year in which they are accrued. Although the EITC can be paid in monthly installments, the GAO (1992) estimates that only 0.5% of recipients receive the credit this way.

Eligibility for and value of the federal credit have both changed a great deal in the past decade. Initially, the credit was only available to tax units with qualifying children, but its value did not differ by number of children.Footnote 1 The basic parameters of the federal EITC are shown in Table 1. The Tax Reform Act of 1986 legislated that the EITC be indexed for inflation, so some of the changes in federal credit over time reflect solely changes in the cost of living. The 1991 enactment of the 1990 Omnibus Budget Reconciliation Act (OBRA) set the maximum EITC value for families with families with two or more children higher than for those with just one child. In 1991, the federal maximum incremental EITC benefit for a second child was $43. In addition, OBRA 1990 increased maximum benefit levels (from $1,192 in 1991 to $1,434 in 1993 for a family with one child).Footnote 2 OBRA 1993 authorized a much larger EITC expansion that phased in over the tax years 1994 to 1996. This expansion extended eligibility for a small benefit to childless tax units with particularly low earnings. As is illustrated in Table 1, there were large increases in the maximum credit for families with children and in the incremental benefit for a second child. Between 1993 and 1996, the maximum value of the credit for a family with two children increased by $2,045 and the value of the incremental benefit for a second child increased by $1,327.

By 2001, the maximum credit was $4,008 for a family with two or more children, $2,428 for a family with one child, and $364 for a childless family. The maximum annual income for a family with two children was $32,121 in 2000, an amount well above the poverty line for a typical family. The Joint Committee on Taxation estimates that more than 19.3 million tax units will receive the EITC with credits totaling more than $34.0 billion in 2003, an increase from 12.5 million families receiving credits totaling only $7.5 billion in 1990 (United States Congress 2004).

Implementation and expansion of EITC programs in many states accompanied the expansion of the federal EITC. In the 1999 tax year, the District of Columbia and the following 11 states had an EITC: Colorado, Iowa, Kansas, Massachusetts, Maryland, Minnesota, New York, Oregon, Rhode Island, Vermont, and Wisconsin. Table 2 presents the parameters for the state EITCs for the period we analyze. In 1990, only five states had EITCs, and four of the five states with a credit in 1990 changed it during this 10-year period. The credit rates vary widely across states. For example, in 1993, Iowa’s EITC was 6.5% of the federal EITC, and Wisconsin’s EITC varied with the number of children and was 75% of the federal EITC for families with three or more children (Wisconsin is the only state with an incremental benefit for a third child). The state EITC is non-refundable in five of these states, making it less well targeted toward low-income families than a refundable EITC. All states calculate their EITCs as some percentage of the federal EITC,Footnote 3 so the state credits provide the same fertility incentives as the federal EITC. Additionally, changes in the federal EITC introduce additional variation in state EITCs.

In our empirical analysis, we highlight groups that are likely to be affected by changes in the EITC. One component of identifying these groups is whether those eligible for the EITC actually claim it. Participation in the EITC is relatively high compared to other cash or near-cash transfer programs, with most researchers concluding that at least three quarters of eligible households claim the credit. Scholz (1994) estimated that between 80 and 86% of eligible households received the EITC in 1990. Using more recent data, Holtzblatt and McCubbin (2004) estimate that between 64 and 80% of those are eligible for the EITC filed taxes in 1996, and the General Accounting Office (2001) estimates participation rates of 75%. Participation in state EITCs appears to be high as well, although there is much less evidence on this topic (Hitsurana and Stinson 2004).

3.2 Incentive effects

The design of the EITC creates both price and income effects that have the potential to influence fertility behavior. The most straightforward of these is the income effect. The income effect of this earnings subsidy increases demand for all normal goods. If we assume that children are normal goods, then higher net income as a result of the EITC should promote fertility.

The price (or substitution) effects are slightly more complicated. The simplest price incentive is that before 1994, childless women in the EITC income range benefited by having a first child because the credit was only available to families with children. Therefore, taking into account both income and price effects, the EITC provided an unambiguously positive incentive for a first birth for all income-eligible women. The introduction of the EITC’s incremental benefit for having a second child, in place since 1991, provides a positive price effect incentive for a second child by reducing the cost of a second child relative to other decisions. Likewise, the enactment of the federal EITC for low-income childless taxpayers in 1994 slightly reduces the relative benefit of a first birth. However, it should be noted that the EITC for childless taxpayers is small in absolute dollars, is phased out at low-income ranges, and is not part of Wisconsin’s or Maryland’s EITC.

The previous price and income effect analysis is too simple because it ignores the potentially confounding labor supply incentives of the EITC. Because the EITC works as an earnings subsidy, the full incentive for having an additional child will depend upon where the tax unit falls in the income distribution. Specifically, if a tax unit’s income is in the phase-in range of the EITC, the EITC increases a woman’s net wages and raises the opportunity cost of childbearing (Hotz et al. 1997). Assuming that quantity of children is a normal good, the EITC creates an ambiguous incentive for childbearing for women in this range. If a tax unit’s income is in the flat range of the EITC, the EITC provides a pure income effect, and the EITC would be predicted to increase fertility. Finally, if a family’s income is in the phase-out range of the EITC, the substitution effect should lower net wages, lower hours worked, and simultaneously encourage childbearing, and the income effect should increase fertility.Footnote 4 In summary, if we assume children are normal goods, mothers with income in the phase-in range of the EITC face an ambiguous incentive for additional children. However, mothers with income in the flat and phase-out range face an unambiguously positive incentive to have a second (but not a third or higher order) birth.

As an alternative explanation for the link between the EITC and fertility, Fraser (2001) presents a theoretical model that suggests that income risk is negatively associated with the demand for children (again, assuming that children are normal goods). Kneisner and Ziliak (2002) suggest that the EITC plays a large role in providing consumption insurance to low-income households. To the extent that per-child tax benefits provide insurance against negative income shocks, this may provide another reason why the EITC would promote fertility.

Changes in the EITC may also affect timing decisions. Slemrod (1990) suggests that the largest responses to tax incentives are in the timing of economic transactions, not in real behavioral changes such as whether or not to have a child. There is some evidence to support this timing effect with respect to fertility: Dickert-Conlin and Chandra (1999) find that the timing of childbirth around the end of a tax year responds to tax incentives. It is possible that the EITC’s primary effect is on the timing of when people have children, either within a tax year or within their lifetimes, rather than whether or not to have a child.

4 Data and empirical approach

To test the hypothesis that the EITC influences the decision to have children, we examine birthrates over the course of the 1990s, controlling for state and demographic characteristics and exploiting variation in state EITC programs over time to identify the effect of the credit on fertility. We have chosen to use birthrates constructed using birth certificates as the dependent variable in our analysis because they provide the most complete picture of the fertility rate in the USA. The likely reason is that new mothers, particularly those who are young and low-income, are disproportionately likely to drop out of nationally representative survey data sets like the Census, Current Population Survey, or Survey of Income and Program Participation (SIPP). For example, Daponte and Wolfson (2003) document a substantial undercount of infants in the US Census.

To construct birthrates for the model, we use data from US birth certificates between 1990 and 1999. The Natality Detail File, maintained by the National Center for Health Statistics (NCHS), records the information collected on state birth certificates and provides documentation of each the approximately 40 million births in the USA over these 10 years. These data are particularly well-suited to studying fertility patterns because they document virtually every live birth in the USA with accompanying demographic information about the mother and child.

Each birth certificate record contains the following basic information:Footnote 5

-

Birth year;

-

Birth month;

-

Mother’s state of residence;

-

Age, race, education level, and marital status of mother;

-

Age and race of father (when one is identified);

-

Number of births mother has had (living children);

-

Birth order of this child (among living children).

Birth certificate records do not include information about family income, so we do not know which families are eligible for or receive the EITC. Because we cannot observe income (and because we do not want to condition upon potentially endogenous eligibility or participation), we use education as a proxy for income and participation in the EITC, a technique adopted frequently in the welfare literature. Using monthly data covering the 1997 tax year from the SIPP, we find that approximately 23% of all women between the ages of 25 and 44 are eligible for the EITC. These results are presented in Table 8 in Appendix 1. Eligibility is highest for those with less than a high school degree (45%) and, while more than 22% of women with some college are eligible for the EITC, the percentage drops precipitously for those with a college degree or more (8%).Footnote 6 This illustrates an important difference in the demographic characteristics of EITC recipients, who must be working to receive benefits, as compared to a recipient population for a more traditional welfare program. Given these estimates, we select a sample of women with less than a college degree as those most likely to be affected by changes in the EITC.

Recall that some of our theoretical predictions are based upon where an EITC-eligible family falls in the EITC schedule. Given the small credit value and income range of the EITC for childless individuals, we predict that the EITC is likely to have a positive effect on the decision to have a first birth for all women. However, when considering higher order births, we predict an unambiguous increase in fertility for only women in the flat or phase-out ranges of the credit. As we cannot directly observe where families fall in the income distribution in birth certificate data, our SIPP estimates of EITC eligibility may provide some insight into the expected effect of the EITC on fertility. The estimates of eligibility provided in Table 8 in Appendix 1 show that conditional upon being eligible for the EITC at all, approximately 81% of women with a high school or more degree and 71% of women with less than a high school degree fall into the flat or phase-out ranges.Footnote 7 If location on the EITC schedule matters, we might predict an overall positive effect of the EITC on higher order births.

To account for the at-risk set of parents who did not give birth to a child, and because it would be inappropriate to compare birth counts across states without accounting for population differences, we group the data into cells and normalize them by a measure of the at-risk population. We create cells by state and year, the critical units for policy analysis, and by demographic characteristics associated with childbirth: age, education, race, and parity.

To calculate the denominators for the birthrates in each cell, we estimate cell sizes in 1990 and 2000 using weighted data from the Decennial Census 5% PUMS Files and linearly interpolate the values for the rest of the years in our sample. The birthrate for cell with characteristics i, the dependent variable in this analysis, is:Footnote 8

We break birthrates into cells according the following demographic categories of the mother:

-

Age group (5): 15–24, 25–29, 30–34, 35–39, 40–44;

-

Race group (2): White, non-white;

-

Education group (2): Fewer than 12 years, 12–15 years;

-

Birth parity (3): First birth, second birth, higher order birth;Footnote 9

-

State (50): and

-

Year (10): 1990–1999.

This sample selection and creation of cells based upon education level creates a second data issue: birth certificates do not contain mother’s education for approximately 1.2 million births in our 10-year sample. This data problem exists for Washington and Connecticut in all years and in New York and New Jersey in 1990, and so we drop Washington and Connecticut entirely from our analysis and exclude New York and New Jersey for 1990.Footnote 10 This procedure results in approximately 2,800 cell observations per year or 28,000 observations overall. Less than 1% of these cells contain no births. Zero births are most likely in the non-white race category and in smaller states. Each cell observation in the data file contains a birthrate and dummy variables that mark the six demographic/state/year categories listed above.

We identify the effect of the EITC on fertility behavior based upon variation in state EITCs (Neumark and Wascher 2001; Meyer and Rosenbaum 2000; Dickert-Conlin and Houser 2002). We analyze birthrates within states, as state supplemental EITC credits changed over time, holding constant observable demographic characteristics. Following is the empirical model:

where i indexes cell groups 1 through n, α s is a state fixed effect, α t is a year effect that is constant across all states and ɛ it is an error term. We include state fixed effects to control for unobservable time-invariant state characteristics such as religious affiliation, urbanicity, and cultural factors. The year effects control for the declining national trend in fertility for women with low levels of education. Standard errors in this model are clustered at the state level.

Our policy variables of interest are Base EITCs,t−2 and Incremental EITC s,t−2. The Base EITC s−2 is the maximum federal plus state EITC for the number of children before the birth (that is, the base EITC value attached to first birth cells is the credit for childless taxpayers and the value for second birth cells is the one-child credit). Increases in the generosity of the base are expected to produce both an income effect and a change in the opportunity cost of working. The Incremental EITC s−2 is the difference between the maximum federal plus state EITC associated with the birth of an additional child and the base EITC value. For example, as Table 1 shows, in 1994, the federal incremental benefit to having a first child (in terms of maximum benefits for each family size) is the difference between the no-child benefit ($306) and the one-child benefit ($2,038) or $1,732. One exception is that childless individuals under the age of 25 are not eligible for the EITC; therefore, the base EITC for this group is 0. Similarly, the incremental benefit for having a second child would be the difference between the one-child benefit ($2,038) and the 2+ children benefit ($2,528) or $490. The incremental benefit to any children beyond two is zero, except in the state of Wisconsin, which gives an additional subsidy to families with three children in certain years. In theory, we expect the incremental EITC to be positively correlated with fertility because individuals only receive the incremental benefit if they have the additional child. The EITC values vary over time and across states due to changes in federal and state EITC parameters; including the generosity of the credit and whether taxpayers without qualifying children are eligible for the EITC.

Tables 3 and 4 show the base and incremental values in 1989 dollars by state and number of children. These values are lagged by 2 years because the EITC is paid in the calendar year following the tax year, and it takes at least 9 months to alter fertility decisions. Therefore, in the baseline model, the Colorado state EITC is not included because it was not implemented until 1999. In our specification checks, we test the sensitivity of our results to the lag structure.

Because the model includes state fixed effects, year effects, and a comprehensive set of control variables for factors that change within states over time (described below), the effect of the EITC on fertility can be attributed to changes in the real value of credits within states over time.

The vector X consists of a set of dummy variables identifying demographic characteristics of the cells—age, race, education, and number of children. The vector Z contains a set of time-varying policy and economic variables that may influence the birthrate for the EITC-eligible population (and may also be correlated with EITC generosity). Each of these control variables is lagged 1 year. To control for changes in low-skill labor market conditions that could change the opportunity cost of a parent’s time, we include the state unemployment rate, employment growth rate, and the percentage of employment in the manufacturing and services sectors.

These state-level policy variables include characteristics of the AFDC/TANF and public health insurance programs. To capture AFDC/TANF characteristics, we use four variables from the Council of Economic Advisers (1999) data set on welfare reform: (1) the maximum AFDC/TANF benefit for a three-person family; (2) a dummy variable indicator for a pre-TANF welfare waiver in a state; (3) a dummy variable that captures TANF implementation; and (4) an indicator for the presence of a state family cap after welfare reform. We expect welfare benefits to be positively correlated with fertility and caps on family size, which prevent incremental benefits for children born while the mother is on welfare, to be negatively correlated with fertility.

We also include a control variable to account for changes in health insurance eligibility of children due to the state-level Medicaid expansions of the early 1990s. Using a 1990 national sample, we calculate for each state and each year the percent of children under age 19 who would be eligible for Medicaid or state Child Health Insurance Programs. This varies within and across states over time by legislative generosity, but not by differences in the demographic characteristics of an actual state population that might have independent effects for fertility trends. Our measure is similar to the one developed by Currie and Gruber (1996).

The last set of state-level control variables in the analysis captures features of the state income tax system that might be expected to influence fertility decisions. We include the minimum marginal income tax rate in a state’s personal income tax system, which is zero if there is no personal income tax, and a dummy variable for the existence of a state child tax credit or supplementary deductions, beyond the personal exemption, for children or child care expenses.

Finally, because we group the data into cells and calculate within-cell birthrates for demographic subpopulations of dramatically different sizes, we weight cell observations by the inverse of variance of the birthrate. This is a particularly important because some US states have very small non-white populations. Intuitively, this weighting scheme places the most importance on cell observations for which the birthrate has been estimated most precisely—large cells. Mechanically, the procedure controls for possible heteroskedasticity in the error terms. Additionally, because the key variation our models comes from changes in policy within states over time, all standard errors in all regressions are clustered at the state level.

A full set of descriptive statistics for the data set is given in Table 5. The mean birthrate is 6.53 births per 100 women across all cells and years.Footnote 11 There is considerable variance across cells, and the median of 4.99 is considerably lower than the mean. The birthrate is highest for 25- to 29-year-old women. White women have higher first birth (5.94) and higher order (7.60) birth rates than non-white women (4.88 and 6.24, respectively).

5 Results: fertility rates

5.1 Baseline specification

Table 6 presents weighted least-squares (WLS) results by race and parity. We split the sample by race based upon differences observed in the descriptive analysis and because differential fertility responses by race are a frequent finding in the welfare literature. We also split the sample by first births and higher order births because previous exposure to the larger EITC associated with having children may create differential responses for first births and subsequent births. More formally, a set of F tests supports the decision to split the sample in this way.

Generally, we find that the expansion of the EITC is inversely related to fertility rates among white women. The first column of Table 6 shows that an increase in the base EITC available to childless women is negatively correlated with fertility rates (coefficient = −0.0162, SE = 0.0033) at statistically significant levels. However, at the mean birthrate (5.94/100) and EITC base value ($34), this coefficient translates into an elasticity of −0.009. With an average increase in the base EITC for childless women at 2.2% over our time period, this coefficient is economically insignificant. The coefficient on the incremental value of the EITC is also negative for childless white women (coefficient = −0.0084, SE = 0.0121), but not statistically significant.

For higher order births among white women, both the base and incremental EITC have negative coefficients, and the coefficient on the incremental EITC is statistically significant at the 5% level (coefficient = −0.0132, SE = 0.0056). At the mean birthrate (7.60/100) and EITC value ($125), this coefficient translates into an elasticity of −0.022. The average annual increase in the incremental EITC over this time period for families with one child was approximately 72%. This implies an annual 0.11 percentage point decreases in fertility rates. However, this dramatic 72% increase in the EITC is driven by a few outlying years, and the median annual increase in the EITC is only about 5%. This rate of increase of the EITC implies a 0.008 annual percentage point decrease in fertility rates.

These negative, albeit very small, effects of incremental EITC benefits for white women are inconsistent with earlier studies on the US and Canadian income tax systems. However, unlike these earlier studies, we have conditioned on women with low education, among whom, we might expect fertility elasticities to be different than the general population. In fact, our results are consistent with papers in the welfare literature, such as Kearney (2004) and Levine (2002), which find that lower incremental benefits are positively correlated with fertility among those most likely to be eligible for welfare.Footnote 12 One possible explanation for these results relates to Becker’s (1991) theory of fertility, which suggests that quality is a further dimension along which economic resources may influence childbearing decisions. While the financial incentives of the EITC for the childless individuals are on the margin of whether or not to have a child, the financial benefits of an EITC expansion for those with children may also affect the quality of, or human capital investment in, existing children. That is, parents may substitute quality (that is, greater investment in education) for quantity (that is, more children) in response to increases in the EITC. This does not directly explain why the incremental value, rather than the base value, is negative, but given our identification scheme of changes in credit value over time within state, the two are highly correlated.

Turning to the non-white sample, we find quite different effects. Generally, the base EITC is positively related to fertility rates, but it is only statistically significant at the 10% level for first births (coefficient = 0.0073, SE = 0.0043). We cannot reject the hypothesis that the remaining EITC coefficients are zero. This coefficient on the base EITC for first births implies a small elasticity of 0.004. At the mean annual increase in the EITC of approximately 2.2% and an average birth rate of 4.90 for this group, this translates into an economically insignificant 0.0005 percentage point increase in fertility rates.

Among our control variables, having less than a high school diploma is associated with significantly higher fertility for white women who already have a child and significantly lower fertility for all other women. Age has the predicted effect on fertility for both race groups: birthrates are higher at younger ages and decline with age. The state unemployment rate is not statistically significantly related to fertility for any of our groups.Footnote 13

Many of the welfare policy variables in the models do not seem to have significant influences on fertility. Recall that we have selected on women with less than a college degree, which may be too broad of a population to capture effects of the welfare reforms. A notable exception is the implementation of TANF, which is associated with significantly higher fertility for white women having higher order births. While we do not see an obvious explanation for this finding, Levine (2002) also finds a positive relationship between the implementation of welfare waivers (precursors to TANF) and fertility among unmarried women with less than a high school degree.

Finally, controlling for a state’s minimum marginal tax rate and EITC, the presence of a state child (or child care) tax credit has a consistently positive effect on fertility across all race and parity groups. The coefficients imply increases in fertility of between 8 and 12% in states that implement a child tax credit.

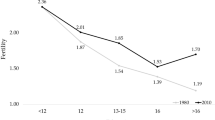

5.2 Sensitivity tests

We conduct a number of sensitively tests, and Table 7 presents the elasticities calculated from EITC coefficients of interest. For reference, the results of the baseline models in Table 6 are given in the first row (row 0). We first test the sensitivity of our results to alternative lag structures. In particular, in rows 1, 2, and 3, we show the results with a triangular weighted lag, a single-year lag, and a 3-year lag. In general, the results do not change much, with the exception that the coefficient on the incremental EITC for white higher order births is no longer statistically significant at the 5% level in the 1- and 3-year lag models.

As Table 2 shows, some states do not have refundable EITCs, making their credits less well targeted at low-income individuals. When we include only the value of refundable state credits in our EITC measure, we find results very similar to our baseline results (row 4). When we estimate models without New York and New Jersey because of possible data problems, the results (row 5) are robust in sign, significance, and magnitude. In this case, the coefficient on the base EITC is now statistically significant at the 5% level for white higher order births, and the coefficients on the base and incremental EITC values for non-white higher births are statistically significant.

The results are largely consistent when we include state trends to account for potential differences in fertility rates over time within states (row 6). The coefficient on the incremental EITC in the regression of first birth rates for white women is now statistically significant at the 5% level with an elasticity of −0.072, and the coefficient on the base EITC in the regression of first birth rates for non-white women is now statistically significant at the 5% level, although economically very small.

We show results for a semi-log specification (row 7) in which the measures of the EITC variables are in natural logs,Footnote 14 and our results are somewhat sensitive to this choice. In particular, we find a positive and statistically significant relationship between the base EITC and fertility for higher order births to white women. An implied elasticity of 0.299 and the mean (median) increase in the base EITC over this period of approximately 15 (9) percent suggests that the EITC is correlated with annual increase in the fertility rate of 0.35 to 0.20 percentage points. Although this positive elasticity is within the range of the previous literature on the US personal exemption and fertility, we are more confident in the results of our level regressions because of the large number of zero values in the EITC variables (almost two thirds in the incremental values for white higher order births).

We create an alternative measure of the EITC value (which we refer to as a “simulated instrument”) as a further specification check. We take a sample of families from the 1990 Census, with reported income from 1989 and household and demographic characteristics for 1990. Using the NBER’s TAXSIM model (Feenberg and Coutts 1993 and http://www.nber.org/~taxsim/taxsim-calc6/), we calculated the EITC that each individual would be eligible for all years between 1988 and 1999 based on their state of residence and their demographic characteristics. The variation in the EITC value within states over time comes strictly from law changes. We then calculate the mean EITC value within the demographic categories in our sample. This EITC value varies by year, state, and demographic categories. The disadvantage of this measure is that the sample sizes are very small and the mean EITC values are subject to outliers. About one quarter of the cells have fewer than ten observations. The problem is especially relevant for higher order births. Therefore, we present the results using just the average base EITC as the independent variable of interest. The results (row 8) show no statistically significant relationship between this measure of the EITC and fertility rates for white higher order births and for non-white births. However, there is a positive and statistically significant relationship between the simulated average base EITC and fertility for white first births, with an elasticity of 0.04. Given the sample sizes used to create the instrument, we are hesitant to place much weight on this estimate, but it does illustrate the sensitivity of the model to the choice of independent variable.

In terms of identification in our models, the base EITC and incremental EITC are likely to be highly correlated. We consider the results when we include each variable without the other (rows 9 and 10). Again, the results are similar to the baseline except that the elasticity with respect to the base EITC for white higher order births is statistically significant at the 5% level and relatively large (elasticity of 0.210).

In our baseline specification, we do not separate the sample in any way based on marital status because of the coding difficulties in the vital statistics and also because it is possible that the EITC influenced marital decisions.Footnote 15 The incentives for marriage in the structure of the EITC essentially encourage marriage for single earner couples and discourage marriage for dual earner couples. Previous research does not find evidence of the EITC influencing marriage (see Dickert-Conlin and Houser 2002 and Ellwood 2000), but if people are altering their marital status and fertility decisions in response to the EITC, and therefore the compositions of the samples are changing over time, we might expect to see a differential fertility effect between married women vs unmarried women.

After excluding the states that inconsistently coded marital status, we estimate our baseline models separately for married and unmarried women. The results (rows 11 and 12) suggest that perhaps the fertility responses to the EITC also reflect marital responses. In particular, first birth fertility rates are positively correlated with the base EITC white women but negatively correlated for the sample of white unmarried women. The results are generally similar for non-white first births, although the coefficient on the base EITC is not statistically significant for married women. The statistical significance is somewhat surprising given that the base EITCt-2 is non-zero only in 1996 and later years. The fact that the signs are opposite for married and unmarried women may suggest that that the marriage patterns over this time period were correlated with changes in the EITC, which is affecting the sample selections of childless married and unmarried women.Footnote 16 For example, perhaps those considering first births were more likely to marry as a result of the EITC.

We perform one final test of the validity of our results by estimating models identical to the ones for which we report our baseline results, but on a sample of births to college-educated women.Footnote 17 While income is not perfectly correlated with education, the estimates of EITC eligibility presented in Appendix 1 show that fewer than 8% of college-educated women of childbearing age are eligible for the credit. While many of the results are statistically significant, some are positive and some are negative. Because the sign pattern does not match up against our results for the lower-educated baseline sample and because most of the results are implausibly large,Footnote 18 we are not sure what, if anything, to infer from them.

Finally, it must be pointed out that the effects of the EITC on birthrates that we observe are not the same thing as the impact of the program on completed fertility or family size, which we are unable to measure with birth certificate data (rather than panel microdata). And even when lower birthrates do translate into lower completed fertility, the effect may be an indirect one that works through timing rather than the decision of whether or not to have a child at all. To test whether the EITC expansion of the 1990s had a significant effect on the timing of fertility, we estimate WLS models in which the dependent variable is the age of a mother at her first birth. The demographic control variables, policy variables, and fixed effects are the same as in our fertility rate equations.

Descriptive statistics on mother’s age at first birth are provided in Table 9 in Appendix 1, and results of the regression models are in Table 10 in Appendix 1. We find small, positive and significant elasticities with respect to the base EITC value for both white and non-white women. Measured against the actual increase in EITC benefits over this period, these elasticities translate into births between 2 and 6 weeks later, with the stronger effects for white women. This delay in childbearing is consistent with our negative fertility coefficients. For incremental EITC benefits, the only significant result is for non-white women in the linear specification of the model. This elasticity translates to first births occurring 2.5 months earlier to non-white women. We are cautious to note that these results do not conclusively imply a timing effect of the EITC policy. It is possible that sample selection of who is giving birth completely drives these results. For example, these results are consistent with fewer relatively young women giving birth.

6 Conclusion

Using state-level data on birthrates between 1990 and 1999 and exploiting the large variation in state EITC programs during this period, we have tested the hypotheses that the income support provided by the EITC, as well as eligibility criteria, encouraged births among recipients. While economic theory would predict that a positive fertility effect of the program for many eligible women, our baseline models show that expanding the credit produced only extremely small reductions in higher order fertility among white women. While our results are admittedly sensitive to model specification, of the 84 coefficients estimated in our 12 specification checks, only two are positive, significant, and of an economically meaningful magnitude. Of these, magnitudes were generally smaller than those found in the US and Canadian income tax and fertility literatures. However, our results cannot be taken to mean that tax policy has no effect on fertility because we find that state child and child care tax credits are associated with significantly higher birthrates.

Finally, we find that white women are more sensitive to the financial incentives of the EITC than non-white women. The existence of racial differences in fertility behavior is consistent with the findings in previous work on economic policy and fertility. Differing labor force attachments, earnings distributions and marriage markets for white and non-white women are possible explanations for these findings. Unlike AFDC or TANF, the EITC operates entirely through the labor market. If, for example, white women have better labor force opportunities, an increase in the EITC may be a more relevant source of income than for non-white women and, therefore, raise the opportunity cost of childbearing. Unfortunately, the vital statistics data we have do not allow us to say more on this topic, but it remains a topic for future research. As Moffitt (1998) and others have noted, there is clearly much that remains to be understood about the economic policy and fertility behavior, particularly with respect to race.

Notes

A qualified child is a natural or adopted child or stepchild of taxpayers filing joint or single head of household returns. In 1990, a parent had to provide more than half the support for the child regardless of whether he or she lived with the child. Beginning in 1991, a parent could claim the EITC only if the child lived with him or her for more than half the year. For a thorough introduction to the EITC program, its historical development and provisions, see Hoffman and Seidman (2002).

In 1991, 1992, and 1993, the EITC was greater for filing units with children under 1 year of age. This so-called “wee-tots” credit increased the maximum credit by $388 in 1993.

Beginning in 1998, Minnesota had a two-tiered system where there is a second flat range above the initial one.

We note that there is no evidence that the EITC causes a behavioral response on the internal margin of hours worked (see, for example, Eissa and Liebman 1996).

According to the National Center for Health Statistics, a nurse attending at the birth collects this information from both the mother and father (if present). Contacts at the NCHS have told us that they assume the mother herself to be the source of all information in the certificates, except in a small number of states that impute marital status.

These results are consistent with other similar work. In the Current Population Survey, Eissa and Hoynes (2004) find that in tax year 1996, around 60% of married couples with children where the woman has less than a high school education are eligible for the EITC, and 19% of those where the woman has exactly a high school education are eligible. Using the cohort from the National Longitudinal Survey of Youth 1979 data, Dahl and Lochner (2005) find that 39% of mothers eligible for the EITC are high school dropouts, 48% have a high school degree, and 14% have some college.

The GAO (1996) estimated that 73% of married couples and only 53% of single parent receiving the EITC in 1994 were in the phase-out range.

Note that to be able to estimate populations for cell denominators using a 5% PUMS sample, we combine black and other non-whites into a single non-white category, and we combine 15- to 19- and 20- to 24-year-olds into a single category.

Ideally, women would be assigned to birth groups based upon total completed fertility. We use the number of children living in the household as a proxy for all children born to the mother because the 2000 Census did not ask a total fertility question.

Washington State did not record education on the birth certificate until 1992. In our 10-year sample, Washington and Connecticut average approximately 8 and 37% (respectively) of birth certificates missing information on mother’s education. In 1990, New York and New Jersey average approximately 41% of birth certificates missing data on mother’s education. In most cases, the missing data results because particular geographic regions within the state did not record mother’s education. We also exclude observations without a record of birth order. This is approximately 0.3% of all birth certificates in the nation. Connecticut accounts for a large share of these. We present specification tests that address the decision to drop these missing observations later in the paper.

The mean birthrate for all women in the dataset (including those with higher education) is 6.67 per 100 women, which compares well with national estimates ranging from 70.9 per 1,000 in 1990 to 65.9 per 1,000 in 1999 (US Census Bureau 2001).

As a falsification test, we separately estimate the regressions for samples of second births and third and higher order births. We use the EITC base and incremental values for second births as the primary independent variables for both samples. Because the EITC creates no incentive for third or higher order births, a significant effect would seemingly indicate a spurious relationship between the EITC incremental value variable and fertility. We do not find any convincing evidence of such a spurious relationship. While the coefficient on the second child incremental variable is still negative (−0.092) for third or higher order births, it is not statistically significant at standard levels and is smaller than the coefficient for second births only using the appropriate EITC values (−0.115). However, because neither coefficient is precisely estimated, we cannot reject equality between the two.

Dehejia and Lleras-Muney (2004) find that the health of babies is positively related to the unemployment rate and attribute at least some of this to the selection into motherhood during economic downturns.

In the cases where the EITC variables are zero, we put in 0.00001.

The following states inferred marital status, sometimes very badly, in the vital statistics data for some or all of the years in our data Michigan (all years), New York (all years), Connecticut (before 1998), California (before 1995), Nevada (before 1997), and Texas (before 1994) (US Department of Health and Human Services 2002; Ventura and Bachrach 2000).

It does not seem likely that there are differential labor supply responses between married and unmarried women in this case. An increase in the base EITC should provide incentive for married women to drop out of the labor force, given that most eligible married women are in the phase-out range of the EITC. This should be correlated with an increase in fertility rather than the increase that we see.

The welfare literature often restricts the sample to women with less than a high school diploma, but given the earnings requirements in the EITC, this restriction is not reasonable in our case.

For example, the estimated elasticity of −0.422 combined with a mean birthrate of 6.96 per 100 for higher order births to college-educated white women would imply more than a 2 percentage point reduction in the birthrate in response to the EITC.

References

Acs G (1996) The impact of welfare on young mothers’ subsequent childbearing decisions. J Hum Resour 31(4):898–915

Becker GS (1991) A treatise on the family. Enlarged edn., Harvard University Press, Cambridge

Bitler M, Zavodny M (2000) The effect of Medicaid eligibility expansions on births. Working Paper 2000–4. Federal Reserve Bank of Atlanta

Camasso MJ, Jagannathan R, Killingsworth M, Harvey C (2003) New Jersey’s family cap and family size decisions: findings from a five-year evaluation. In: Polachek SW (ed) Research in labor economics: worker well-being and public policy. Elsevier, Amsterdam, pp 71–112

Currie J, Gruber J (1996) Saving babies: the efficacy and cost of recent changes in the Medicaid eligibility of pregnant women. J Polit Econ 104(6):1263–1296

Dahl G, Lochner L (2005) The impact of family income on child achievement: evidence from the earned income tax credit. Working Paper, University of Rochester

Daponte BO, Wolfson LJ (2003) How many American children are poor? Considering census undercount by comparing census to administrative data. Working Paper, Carnegie Mellon University

Dehejia R, Lleras-Muney A (2005) Booms, busts and babies health. Q J Econ 119(3):1091–1130

Dickert S, Houser S, Scholz JK (1995) The earned income tax credit and transfer programs: a study of labor market and program participation. In: Poterba JM (ed) Tax policy and the economy, vol. 9. MIT Press, Cambridge, pp 1–50

Dickert-Conlin S, Chandra A (1999) Taxes and the timing of birth. J Polit Econ 107(1):161–177

Dickert-Conlin S, Houser S (2002) EITC and marriage. Natl Tax J 55(1):25–40

Dyer WT, Fairlie RW (2004) Do family caps reduce out-of-wedlock births? Evidence from Arkansas, Georgia, Indiana, New Jersey and Virginia. Popul Res Policy Rev 23(5–6):441–473

Duchovny NJ (2001) The earned income tax credit and fertility. Ph.D. dissertation, University of Maryland

Eissa N, Hoynes HW (2004) Taxes and the labor market participation of married couples: the earned income tax credit. J Public Econ 88(9–10):1931–1958

Eissa N, Liebman JB (1996) Labor supply response to the earned income tax credit. Q J Econ 111(2):605–637

Ellwood D (2000) The impact of the earned income tax credit and social policy reforms on work, marriage, and living arrangements. Natl Tax J 53(4) Part 2:1063–1105

Fairlie RW, London RA (1997) The effect of incremental benefit levels on births to AFDC recipients. J Policy Anal Manag 16(4):575–597

Feenberg DR, Coutts E (1993) An introduction to the TAXSIM model. J Policy Anal Manag 12(1):189–194

Fraser CD (2001) Income risk, the tax-benefit system and the demand for children. Economica 68:105–125

Gauthier AH, Hatzius J (1997) Family benefits and fertility: an econometric analysis. Popul Stud 51(3):295–306

Grogger J, Bronars SG (2001) The effect of welfare payments on marriage and fertility behavior of unwed mothers: results from a twins experiment. J Polit Econ 109(3):529–545

Hitsurana DP, Stinson TF (2004) Urban and rural differences in utilization of state earned income tax credit programs: Minnesota’s experience. RPRC Working Paper No. 04-08. Rural Poverty Research Center, Columbia MO and Corvallis OR

Hoffman SD, Seidman LS (2002) Helping working families: the earned income tax credit. W.E. Upjohn Institute, Kalamazoo, MI

Holtzblatt J, McCubbin J (2004) Issues affecting low-income filers. In: Aaron HJ, Slemrod J (eds) The crisis in tax administration. Brookings Institution Press, Washington, DC, pp 148–200

Horvath-Rose A, Peters HE (2002) Welfare waivers and non-marital childbearing. In: Duncan G, Chase-Landsdale L (eds) Welfare reform: for better, for worse. Russell Sage, New York, pp 222–244

Hotz VJ, Miller R (1988) An empirical analysis of life cycle fertility and female labor supply. Econometrica 56(1):91–118

Hotz VJ, Klerman JA, Willis RJ (1997) The economics of fertility in developed countries. In: Rosenzweig MR, Stark O (eds) The handbook of population and family economics. Elsevier, Amsterdam, pp 275–347

Hotz VJ, Mullin C, Scholz JK (2006) Examining the effect of the earned income tax credit on the labor market participation of families on welfare. NBER Working Paper 11968

Hoynes HW (1997) Does welfare play any role in female headship decisions? J Public Econ 65(2):89–117

Jagannathan R, Camasso MJ, Killingsworth M (2004) New Jersey’s family cap experiment: do fertility impacts differ by racial density? J Labor Econ 22(2):431–460

Joyce T, Kaestner R, Kwan F (1998) Is Medicaid pronatalist? The effect of eligibility expansions on abortions and births. Fam Plann Perspect 30(3):108–113

Joyce T, Kaestner R, Korenman S, Henshaw S (2004) Family cap provisions and changes in births and abortions. Popul Res Policy Rev 23(5-6):475–511

Kearney MS (2004) Is there an effect of incremental welfare benefits on fertility behavior? A look at the family cap. J Hum Resour 39(2):295–325

Kniesner TJ, Ziliak J (2002) Tax reform and automatic stabilization. Am Econ Rev 92(3):590–612

Levine PB (2002) The impact of social policy and economic activity throughout the fertility decision tree. NBER Working Paper 9021

Liebowitz A (1990) The response of births to changes in health care costs. J Hum Resour 25(4):697–711

Meyer BD, Rosenbaum DT (2000) Making single mothers work: recent tax and welfare policy and its effects. Natl Tax J 53(4):1027–1062

Milligan K (2005) Subsidizing the stork: new evidence on tax incentives and fertility. Rev Econ Stat 87(3):539–555

Moffitt RA (1998) The effect of welfare on marriage and fertility: what do we know and what do we need to know? In: Moffitt R (ed) Welfare, the family and reproductive behavior: research perspectives. National Academy of Sciences Press, Washington, DC, pp 50–96

National Center for Health Statistics. Various years. Technical appendix from Vital Statistics of the United States. www.cdc.gov/nchs/births.htm#methods

National Governors Association. Various years. Maternal and child health update

Neumark D, Wascher W (2001) Using the EITC to help poor families: new evidence and a comparison with the minimum wage. Natl Tax J 54(2):281–317

Scholz JK (1994) The earned income tax credit: participation, compliance and antipoverty effectiveness. Natl Tax J 47(1):63–87

Schulz TP (1973) A preliminary survey of economic analyses of fertility. Am Econ Rev 63(2):71–78

Slemrod J (1990) Do taxes matter? The impact of the Tax Reform Act of 1986. MIT Press, Cambridge

United States Census Bureau (2001) Statistical abstract of the United States, 121st edn. Government Printing Office, Washington, DC

United States Congress (2004) Green book. Government Printing Office, Washington, DC

United States Department of Health and Human Services (2002) Technical appendix from vital statistics of United States, 2000, Natality. Hyattsville, MD

United States General Accounting Office (1992) Earned income tax credit: advance payment option is not widely known or understood by the public. Washington DC: GAO/GGD-92-26, February

United States General Accounting Office (1996) Earned income tax credit: profile of tax year 1994 credit recipients. Washington DC: GAO/GGD-96-122BR

United States Government Accounting Office (2001) Earned income tax credit eligibility and participation. GAO-02-290R. Washington, DC

Ventry DJ (2000) The collision of tax and welfare politiroffsetcs: the political history of the earned income tax credit, 1969–1999. Natl Tax J 53(4):983–1026

Ventura SJ, Bachrach CA (2000) Nonmarital childbearing in the United States, 1940–99. Natl Vital Stat Reports 48(16):1–39

Willis R (1973) A new approach to the economic theory of fertility behavi.or. J Polit Econ 81(2):S14–S64

Whittington LA (1992) Taxes and the family: the impact of the tax exemption for dependents on marital fertility. Demography 29(2):215–226

Whittington LA, Alm J, Peters E (1990) Fertility and the personal exemption: implicit pronatalist policy in the United States. Am Econ Rev 80(3):545–556

Yelowitz AS (1994) The effect of Medicaid expansions on the behavior of the poor. Ph.D. dissertation, Department of Economics, Massachusetts Institute of Technology

Zhang J, Quan J, Van Meerbergen P (1994) The effect of tax-transfer policies on fertility in Canada, 1921–88. J Hum Resour 29(1):181–201

Acknowledgment

Thanks to Gabrielle Chapman, Cristian Meghea, and Karoline Mortenson for excellent research assistance. We are also grateful to Janet Holtzblatt, Saul Hoffman, Marianne Bitler, Elizabeth Peters, Irv Garfinkel, and anonymous referees for helpful comments and suggestions. Baughman gratefully acknowledges the support of the Robert Wood Johnson Scholars in Health Policy Research Program while the project was being completed. All remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Junsen Zhang

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Baughman, R., Dickert-Conlin, S. The earned income tax credit and fertility. J Popul Econ 22, 537–563 (2009). https://doi.org/10.1007/s00148-007-0177-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-007-0177-0