Summary

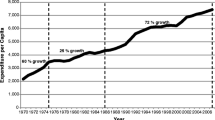

The gains in life expectancy are expected to double the dependency ratio and increase population by 10% in Switzerland until 2050. To quantify the effects on social security and public finances, we use an overlapping generations model with five margins of labor supply: labor market participation, hours worked, job search, retirement, and on-the-job training. A passive fiscal strategy would be very costly. A comprehensive reform, including an increase in the retirement age to 68 years, may limit the tax increases to 4 percentage points of value added tax and reduce the decline of per capita income to less than 6%.

Article PDF

Similar content being viewed by others

References

Abrahamsen, Yngve, and Jochen Hartwig (2003), Volkswirtschaftliche Auswirkungen verschiedener Demographieszenarien und Varianten zur langfristigen Finanzierung der Alterssicherung in der Schweiz, Forschungsbericht Nr. 12/03.

Altig, David, and Charles T. Carlstrom (1999), “Marginal Tax Rates and Income Inequality in a Life-Cycle Model”, American Economic Review, 89, pp. 1197–1215.

Altig, David, Alan J. Auerbach, Laurence J. Kotlikoff, Kent A. Smetters and Jan Walliser (2001), “Simulating Fundamental Tax Reform in the United States”, American Economic Review, 91, pp. 574–595.

Atkinson, Anthony, and John Micklewright (1991), “Unemployment Compensation and Labor Market Transitions: A Critical Review”, Journal of Economic Literature, 29, pp. 1679–1727.

Belot, Michele, and Jan van Ours (2001), “Unemployment and Labor Market Institutions: An Empirical Analysis”, Journal of the Japanese and International Economies, 15, pp. 403–418.

Blanchard, Olivier J. (1985), “Debt, Deficits and Finite Horizons”, Journal of Political Economy, 93, pp. 223–247.

Blanchard, Olivier J., and Justin Wolfers (2000), “The Role of Shocks and Institutions in the Rise of European Unemployment: The Aggregate Evidence”, Economic Journal, 110, pp. 1–33.

Blundell, Richard (1995), “The Impact of Taxation on Labor Force Participation and Labor Supply”, in: OECD Job Study: Taxation, Employment, and Unemployment, Paris.

Blundell, Richard, and Thomas MaCurdy (1999), “Labor Supply: A Review of Alternative Approaches”, in: O. Ashenfelter and D. Card (eds), Handbook of Labor Economics, Vol. 3A, New York.

Börsch-Supan, Axel (2000), “Incentive Effects of Social Security on Labor Force Participation: Evidence in Germany and Across Europe”, Journal of Public Economics, 78, pp. 25–49.

Börsch-Supan, Axel, and Joachim K. Winter (2001), “Population Aging, Savings Behavior, and Capital Markets”, NBER Working Paper 8561.

Bovenberg, Lans A. (2003), “Financing Retirement in the European Union”, International Tax and Public Finance, 10, pp. 713–734.

Bovenberg, Lans A., and Thijs Knaap (2005), “Ageing, Funded Pensions and the Dutch Economy”, CESifo Working Paper 1403.

Bundesamt für Statistik (2006), Szenarien zur Bevölkerungsentwicklung in der Schweiz.

Bundesrat (2008), Bericht des Bundesrats über seine Geschäftsführung 2007.

Bütler, Monika (2009), “Switzerland: High Replacement Rates and Generous Subsistence as a Barrier to Work in Old Age”, Geneva Papers on Risk and Insurance, 34, pp. 561–577.

Bütler, Monika, Olivia Huguenin and Federica Teppa (2004), “What Triggers Early Retirement? Results from Swiss Pension Funds”, CEPR Discussion Paper 4394.

Crémer, Helmuth, and Pierre Pestieau (2003), “The Double Dividend of Postponing Retirement”, International Tax and Public Finance, 10, pp. 419–434.

Diamond, Peter A. (2004), “Social Security”, American Economic Review, 94, pp. 1–24.

Diamond, Peter A., and Peter R. Orszag (2005), “Saving Social Security”, Journal of Economic Perspectives, 19, pp. 11–32.

Disney, Richard (2004), “Are Contributions to Public Pension Programmes a Tax on Employment?”, Economic Policy, 39, pp. 269–311.

Dorn, David, and Alfonso Sousa-Poza (2010), “Voluntary and Involuntary Early Retirement: An International Analysis”, Applied Economics, 42, pp. 427–438.

Eissa, Nada, and Hilary W. Hoynes (2004), “Taxes and the Labor Market Participation of Married Couples: the Earned Income Tax Credit”, Journal of Public Economics, 88, pp. 1931–1958.

Farmer, Roger E.A. (1990), “Rince Preferences”, Quarterly Journal of Economics, 105, pp. 43–60.

Feldstein, Martin (2005a), “Rethinking Social Insurance”, American Economic Review, 95, pp. 1–24.

Feldstein, Martin (2005b), “Structural Reform of Social Security”, Journal of Economic Perspectives, 19, pp. 33–55.

Feldstein, Martin and Jeffrey B. Liebman (2002), “Social Security”, in: A. J. Auerbach, M. Feldstein (ed.), Handbook of Public Economics, Vol. 4, Amsterdam, pp. 2245–2324.

Feldstein, Martin, and Andrew Samwick (1992), “Social Security Rules and Marginal Tax Rates”, National Tax Journal, 45, pp. 1–22.

Feldstein, Martin, and Andrew Samwick (2002), Potential Paths of Social Security Reform, Cambridge, pp. 181–224.

Fence, Robert, and Pierre Pestieau (2005), Social Security and Early Retirement, Cambridge.

Fisher, Walter. H., and Christian Keuschnigg (2010), “Pension Reform and Labor Market Incentives”, Journal of Population Economics, 23, pp. 769–803.

Fouarge, Didier, and Trudie Schils (2009), “The Effect of Early Retirement Incentives on the Training Participation of Older Workers”, LABOUR, 23, pp. 85–109.

Gerfin, Michael, and Michael Lechner (2002), “A Microeconometric Evaluation of the Active Labour Market Policy in Switzerland”, Economic Journal, 112, pp. 854–893.

Gerfin, Michael, Michael Lechner and Heidi Steiger (2005), “Does Subsidised Temporary Employment Get the Unemployed Back to Work? An Econometric Analysis of Two Different Schemes”, Labour Economics, 12, pp. 807–835.

Gertler, Mark (1999), “Government Debt and Social Security in a Life-Cycle Economy”, Carnegie-Rochester Conference Series on Public Policy, 50, pp. 61–110.

Görlitz, Katja (2009), “The Effect of Subsidizing Continuous Training Investments - Evidence from German Establishment Data”, Ruhr Economic Papers 144.

Grafenhofer, Dominik, Christian Jaag, Christian Keuschnigg and Mírela Keuschnigg (2007), “Economic Ageing and Demographic Change”. Vienna Yearbook of Population Research 2007, pp. 133–165.

Gruber, Jonathan, and David A. Wise (1999), Social Security and Retirement Around the World, Chicago.

Gruber, Jonathan, and David A. Wise (2004) (ed.), Social Security Programs and Retirement around the World: Micro-Estimation, Chicago.

Gruber, Jonathan, and David A. Wise (2007), Social Security Programs and Retirement Around the World: Fiscal Implications, Chicago.

Immervoll, Herwig, Henrik J. Kleven, Claus T Kreiner and Emmanuel Saez (2007), “Welfare Reform in European Countries: A Microsimulation Analysis”, Economic Journal, 117, pp. 1–44.

Jaag, Christian (2009), “Education, Demographics, and the Economy”, Journal of Pension Economics and Finance, 8, pp. 189–223.

Jaag, Christian, Christian Keuschnigg and Mírela Keuschnigg (2010), “Pension Reform, Retirement and Life-Cycle Unemployment”, International Tax and Public Finance, 17 (5), pp. 556–585.

Kalemli-Ozcan, Sebnem (2002), “Does the Mortality Decline Promote Economic Growth?”, Journal of Economic Growth, 7, pp. 411–439.

Kane, Thomas (2006), “Public Intervention and Post-Secondary Education”, in: E. Hanushek and F. Welch (ed.), Handbook of the Economics of Education, Amsterdam.

Keuschnigg, Christian, and Mirela Keuschnigg (2004), “Aging, Labor Markets and Pension Reform in Austria”, Finanzarchiv, 60, pp. 359–392.

Keuschnigg, Christian, and Mirela Keuschnigg (2010), “Training, Life-Cycle Unemployment, and Retirement: Technical Appendix”, Universität St. Gallen, unpublished manuscript.

Keuschnigg, Christian, Mirela Keuschnigg and Christian Jaag (2010), “Aging and the Financing of Social Security in Switzerland: An Analytical Note”, Universität St. Gallen, unpublished manuscript.

Kotlikoff, Laurence J. (1997), “Privatizing Social Security in the United States: Why and How”, in: A. J. Auerbach (ed.), Fiscal Policy. Lessons from Economic Research, Cambridge, pp. 213–248.

Krueger, Alan, and Bruce Meyer (2002), “Labor Supply Effects of Social Insurance”, in: A. Auerbach and M. Feldstein (ed.), Handbook of Public Economics, Vol. 4, Amsterdam, pp. 2327–2392.

Lau, Morten, and Panu Poutvaara (2006), “Social Security Incentives and Human Capital Investment”, Finnish Economic Papers, 19, pp. 16–24.

Layard, Richard, Stephen Nickell and Richard Jackman (1991), Unemployment, London.

Lieb, Christoph, Andre Müller and Renger van Nieuwkoop (2003), Analyse der Finanzierungsquellen für die AHVSWISSOLG — Ein Overlapping Generations Model für die Schweiz, Forschungsbericht Nr. 11/03.

Lindbeck, Assar, and Mats Persson (2003), “The Gains from Pension Reform”, Journal of Economic Literature, 41, pp. 74–112.

Meghir, Costas, and David Phillips (2008), “Labor Supply and Taxes”, IFS Working Paper 08/04.

Messer, Dolores, and Stefan Wolter (2009), “Money Matters — Evidence from a Large-Scale Randomized Field Experiment with Vouchers for Adult Training”, CESifo Working Paper 2548.

Miles, David (1999), “Modelling the Impact of Demographic Change Upon the Economy”, Economic Journal, 109, pp. 1–36.

Mitchell, Olivia S., and John W Phillips (2000), “Retirement Responses to Early Social Security Benefit Reductions”, NBER Working Paper 7963.

Nickel, Stephen (1997), “Unemployment and Labor Market Rigidities: Europe versus North America”, Journal of Economic Perspectives, 3, pp. 55–74.

Queisser, Monika, and Edward Whitehouse (2006), “Neutral or Fair? Actuarial Concepts and Pension-System Design”, OECD Social, Employment and Migration WP No. 40.

Queisser, Monika, and Dimitri Vittas (2000), “The Swiss Multi-Pillar Pension System: Triumph of Common Sense?”, Policy Research Working Paper 2416, The World Bank.

Scarpetta, Stefano (1996), “Assessing the Role of Labour Market Policies and Institutional Settings on Unemployment: A Cross-Country Study”, OECD Economic Studies, 26, pp. 43–98.

Soares, Rodrigo R. (2005), “Mortality Reductions, Educational Attainment, and Fertility Choice”, American Economic Review, 95, pp. 580–601.

Weil, Philippe (1990), “Nonexpected Utility in Macroeconomics”, The Quarterly Journal of Economics, Vol. 105, No. 1, pp. 29–42.

Weil, David N. (2006), “Population Aging”, NBER Working Paper 12147.

Author information

Authors and Affiliations

Additional information

Financial support by the Swiss State Secretariat for Economic Affairs (SECO) is gratefully acknowledged. We appreciate stimulating comments by SECO economists, seminar participants at the University of St. Gallen and Hannes Berger and Ludwig Strohner. We are particularly grateful for very constructive comments by an anonymous referee and by the editor, Klaus Neusser.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 2.0 International License ( https://creativecommons.org/licenses/by/2.0 ), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

About this article

Cite this article

Keuschnigg, C., Keuschnigg, M. & Jaag, C. Aging and the financing of social security in Switzerland. Swiss J Economics Statistics 147, 181–231 (2011). https://doi.org/10.1007/BF03399345

Published:

Issue Date:

DOI: https://doi.org/10.1007/BF03399345