Summary

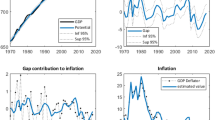

The output gap plays an important role in the assessment and conduct of monetary policy. Most of the current literature, however, relies on filtering procedures which use ad hoc smoothness arguments for identification. Furthermore, they are subject to end-of-sample problems and do not provide estimates of the output gap based on economic theory. In contrast, our model-based approach relies on a precise definition of the natural level of output and consequently of the output gap. This paper provides, for the first time, an estimate of the output gap based on a DSGE small open economy model for Switzerland. We use Bayesian econometrics to derive an estimate of the output gap, which is then compared to some alternatives. Except for the last years, our measure of the output gap is close to zero most of the time. This suggests that price rigidities play a minor role in the propagation of the Swiss business cycle. We show that our estimate produces sensible and robust results which encourage further research.

Article PDF

Similar content being viewed by others

References

An, S., and F. Schorfheide (2007), “Bayesian analysis of DSGE models”, Econometric Reviews, 26, pp. 113–172.

Andrés, J., D. López-Salido, and E. Nelson (2005), “Sticky-Price Models and the Natural Rate Hypothesis”, Journal of Monetary Economics, 52, pp. 1025–1053.

Assenmacher-Wesche, K., and S. Gerlach (2008), “Money Growth, Output Gaps and Inflation at Low and High Frequency: Spectral Estimates for Switzerland”, Journal of Economic Dynamics and Control, 32, pp. 411–435.

Bäurle, G., and T. Menz (2008), Monetary Policy in a Small Open Economy Model: A DSGE-VAR Approach for Switzerland, Ph.D. dissertation, Department of Economics, University of Bern, Bern, Switzerland.

Beltran, D. O., and D. Draper (2008), “Estimating the Parameters of a Small Open Economy DSGE Model: Identifiability and Inferential Validity”, International Finance Discussion Paper 955, Board of Governors of the Federal Reserve System.

Bignasca, F., and E. Rossi (2007), “Applying the Hirose-Kamada Filter to Swiss Data: Output Gap and Exchange Rate Pass-Through Estimates”, Swiss National Bank Working Papers 2007-10, Swiss National Bank, Zürich.

Canova, F., and L. Sala (2009), “Back to Square One: Identification Issues in DSGE Models”, Journal of Monetary Economics, 56, pp. 431–449.

Cavaliere, M. (2007), Exchange Rate Pass-Through to Process: Characteristics and Implications, Dissertation Series 8, Study Center Gerzensee.

DeJong, D. N., and C. Dave (2007), Structural Macroecometrics, Princeton University Press, Princeton and Oxford.

Del Negro, M., and F. Schorfheide (2008), “Inflation Dynamics in a Small Open Economy Model under Inflation Targeting— Some Evidence from Chile, in: K. Schmidt-Hebbel and C. Walsh (eds), Monetary Policy under Uncertainty and Learning, Central Bank of Chile, Santiago, Chile.

Edge, R. M., M. T. Kiley, and J.-P. Laforte (2008), “Natural Rate Measures in an Estimated DSGE Model of the U.S. Economy”, Journal of Economic Dynamics and Control, 32, pp. 2512–2535.

Fernández-Villaverde, J. (2009), “The Econometrics of DSGE Models”, PIER Working Paper 09-008, Penn Institute for Economic Research, Philadelphia, 2009.

Friedman, M. (1968), “The Role of Monetary Policy”, American Economic Review, 58, pp. 1–17.

Galí, J., and T. Monacelli (2005), “Monetary Policy and Exchange Rate Volatility in a Small Open Economy”, Review of Economic Studies, 72, pp. 707–734.

Gerlach; S.; and F. Smets; (1999), “Output Gaps and Monetary Policy in the EMU Area”, European Economic Review, 43; pp. 801–812.

Geweke, J. (2005), Contemporary Bayesian Econometrics and Statistics, Wiley-Interscience, Hoboken, New Jersey.

Goodfriend, M. (2007), “How the World Achieved Consensus on Monetary Policy”, Journal of Economic Perspectives, 21, pp. 47–68.

Goodfriend, M., and R. G. King (1997), “The New Neoclassical Synthesis and the Role of Monetary Policy”, in: B. S. Bernanke and J. J. Rotemberg (eds), Macroeconomics Annual 1997, volume 12, National Bureau of Economic Research, MIT Press, Cambridge, Massachusetts, pp. 231–283.

Hall, R. E. (2005), “Separating the Business Cycle from other Economic Fluctuations”, in: The Greenspan Era: Lessons for the Future, Federal Reserve Bank of Kansas City, pp. 133–179.

Harvey, A. C., and A. Jäger (1993), “Detrending, Stylized Facts and the Business Cycle”, Journal of Applied Econometrics, 8, pp. 231–247.

Ireland, P. (2004), “Technology Shocks in the New Keynesian Model”, Review of Economics and Statistics, 86, pp. 923–936.

Justiniano, A., and B. Preston (2009), “Monetary Policy and Uncertainty in an Empirical Small Open Economy Model”, Journal of Applied Econometrics, forthcoming.

Justiniano, A., and G. E. Primiceri (2008), Potential and Natural Output, 2008, manuscript.

Kaufmann, D. (2009), “The Price Setting Behaviour in Switzerland— Evidence from CPI Micro Data”, Swiss Journal of Economics and Statistics, 145: forthcoming, 2009.

Leeper, E. M., and C. A. Sims (1994), “Toward a Modern Macroeconomic Model Usable for Policy Analysis”, in: S. Fischer and J. J. Rotemberg (eds), NBER Macroeconomics Annual 1994, volume 9, National Bureau of Economic Research, Inc, MIT Press, Cambridge, Massachusetts, pp. 81–118.

Lubik, T. A. and F. Schorfheide (2007), “Do Central Banks Respond to Exchange Rate Movements? A Structural Investigation”,Journal of Monetary Economics, 54, pp. 1069–1087.

McCallum, B. T. (2001), “Should Monetary Policy Respond Strongly to Output Gaps?”, American Economic Review (Papers and Proceedings), 91, pp. 258–262.

McCallum, B. T., and E. Nelson (1999), “Performance of Operational Policy Rules in an Estimated Semi-Classical Structural Model”, in: J. Taylor (ed.), Monetary Policy Rules, University of Chicago Press, Chicago, pp. 15–45.

Mills, T. C. (2003), Modelling Trends and Cycles in Economic Time Series, Palgrave Texts in Econometrics, Palgrave MacMillan, New York.

Monacelli, T. (2005), “Monetary Policy in a Low Pass-Through Environment”, Journal of Money Credit and Banking, 37, pp. 1047–1066.

Neiss, K. S., and E. Nelson (2005), “Inflation Dynamics, Marginal Cost, and the Output Gap: Evidence from Three Countries”, Journal of Money, Credit, and Banking, 37, pp. 1019–1045.

Neusser, K. (2009), Zeitreihenanalyse in den Wirtschaftswissenschaften, Vieweg +Teubner, Wiesbaden, 2nd edition.

Orphanides, A., and S. van Norden (2002), “The Unreliability of Output-Gap Estimates in Real Time”, Review of Economics and Statistics, 84, pp. 569–583.

Perruchoud, A. (2009), “Estimating a Taylor Rule with Markov Switching Regimes”, Swiss Journal of Economics and Statistics, 145, pp. 187–220.

Schorfheide, F. (2008), “DSGE Model-Based Estimation of the New Keynesian Phillips Curve”, Economic Quarterly, 94(4), pp. 397–433.

Sims, C. A. (2001), “Solving Linear Rational Expectations Models”, Computional Economics, 20, pp. 1–20.

Stalder, P. (2007), “The Changing Role of Foreign Labor and Female Participation: Impacts on Wage-Price Dynamics and Unemployment in Switzerland”, mimeo.

Watson, M. F. (2007), “How Accurate Are Real-Time Estimates of Output Trends and Gaps?”, Economic Quarterly, 2, pp. 143–161.

Woodford, M. (2003), Interest and Prices: Foundations of a Theory of Monetary Policy, Princeton University Press, Princeton, New Jersey.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank Gregor Bäurle, Harris Dellas, Marvin Goodfriend, Yvan Lengwiler and Jean-Marc Natal, as well as many conference participants, for helpful comments and constructive criticism. We are, in particular, grateful to Gregor Bäurle for letting us use his MATLAB codes.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 2.0 International License ( https://creativecommons.org/licenses/by/2.0 ), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

About this article

Cite this article

Leist, S., Neusser, K. Measuring the natural output level by DSGE models: An empirical investigation for Switzerland. Swiss J Economics Statistics 146, 275–300 (2010). https://doi.org/10.1007/BF03399307

Published:

Issue Date:

DOI: https://doi.org/10.1007/BF03399307