Summary

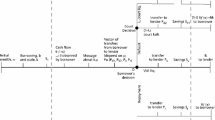

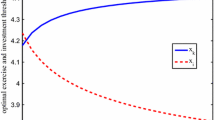

The article focuses on conflicts of interest between senior and junior debt. When the senior creditor faces a default risk and a coalition among the entrepreneur and the senior creditor is possible, the may jointly choose a less risky, but inefficient investment policy, at the cost of the remaining creditor. The junior creditor may anticipate this problem and rations credit then. Projects with a positive net present value may not be undertaken (underinvestment). If the junior creditor can seize some private wealth from the entrepreneur (external collateral), the problems is mitigated. The coalition problems depends on the type of senior and junior debt. When there is a me-first-rule or when there is unsecured and subordinated debt with even lower priority, coalition problems may be more severe than in the case of secured and unsecured debt. Note however, that there also may be a coalition’s incentive to decrease risk when priority is due to the maturity rather than to the rank of claims.

Similar content being viewed by others

Literaturverzeichnis

Adler, Barry (1995), A Re-Examination for Near-Bankruptcy Investment Incentives, in: University of Chicago Law Review, Vol. 62, 1995, S. 575–666.

Bebchuk, Lucian/ Fried, Jesse (1996), The Uneasy Case for the Priority of Secured Claims in Bankruptcy, in: Yale Law Journal, Vol. 105, 1996, S. 857–934.

Bebchuk, Lucian/Kraakman, Reinier/Triantis, George (1997), Stock Pyramids, Cross-Ownership and Dual Class: The Creation and Agency Costs of Separation between Control and Cash Flow Rights, NBER working paper No. 6951.

Berglöf, Erik/ von Thadden, Ernst-Ludwig (1994), Short-Term versus Long-Term Interests: Capital Structure with Multiple Investors, in: Quarterly Journal of Economics, Vol. 108, S. 1055–1084.

Bester, Helmut (1985), Information Asymmetries and Equilibrium Credit Rationing, in: American Economic Review, Vol. 75, S. 850–855.

Bester, Helmut/Hellwig, Martin F. (1987), Moral Hazard and Equilibrium Credit Rationing: An Overview of the Issues, in: Bamberg, Günter/Spremann, Klaus (Hrsg.), Agency Theory, Information, and Incentives, S. 135–166.

Bigus, Jochen (1999), Risikoanreizproblem und nicht gleichrangige Gläubigeransprüche.

Bitz, Michael/Hemmerde, Wilhelm/Rausch, Werner (1986), Gesetzliche Regelungen und Reformvorschläge zum Gläubigerschutz: Eine ökonomische Analyse.

Black, Fischer/ Scholes, Myron (1973), The Pricing of Options and Corporate Liabilities, in: Journal of Political Economy, Vol. 81, S. 637–654.

Bulow, Jeremy/ Shoven, John B. (1978), The Bankruptcy Decision, in: The Bell Journal of Economics, Vol. 9, S. 437–456.

Dubofsky, David A. (1992), Options and Financial Futures, Valuation and Uses.

Euromoney (2000), Can Subordinated Debt Call all the Shots? Euromoney, April 2000, S. 144–146.

European Shadow Financial Regualtory Committee (1999), Statement No. 7: Internal Ratings, Capital Standards and Subordinated Debt, in: Finanzmarkt und Portfolio Management, 14. Jg., S. 78–80.

Ewert, Ralf (1984), Zur Beziehung zwischen Investitionsvolumen, Fremdfinanzierung und Bilanzkennzahlen, in: zfbf, 36. Jg., S. 825–841.

Fama, Eugene/Miller, Merton (1972), The Theory of Finance.

Fischer, Edwin/ Zechner, Josef (1990), Die Lösung des Risikoanreizproblems durch Ausgabe von Optionsanleihen, in: zfbf, 42. Jg., S. 334–342.

Galai, Dan/Masulis, Ronald W. (1976), The Option Pricing Model and the Risk Factor of Stock, in: Journal of Financial Economics, Vol. 3, S. 53–81.

Gavish, Bezabel/ Kalay, Avner (1983), On the Asset Substitution Problem, in: Journal of Financial and Quantitative Analysis, Vol. 18, S. 21–30.

Gertner, Robert/ Scharfstein, Daniel (1991), A Theory of Workouts and the Effects of Reorganization Law, in: Journal of Finance, Vol. 46, 1991, S. 1189–1222.

Gillenkirch, Robert (1997), Gestaltung optimaler Anreizverträge.

Green, Richard (1984) Investment Incentives, Debt, and Warrants, in: Journal of Financial Economics, Vol. 13, S. 115–136.

Green, Richard/ Talmor, Eli (1986), Asset Substitution and the Agency Costs of Debt Financing, in: Journal of Banking and Finance, Vol. 10, S. 391–399.

Hart, Oliver/ Moore, John (1995), Debt and Seniority: An Analysis of the Role of Hard Claims in Constraining Management, in: American Economic Review, Vol. 85, S. 567–585.

Ingersoll, Jonathan E. (1987), Theory of Financial Decision Making.

Jensen, Michael C./ Meckling, William H. (1976), Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure, in: Journal of Financial Economics, Vol. 3, S. 305–360.

Jurgeit, Ludwig (1989), Bewertung von Optionen und bonitätsrisikobehafteten Finanztiteln: Anleihen, Kredite und Fremdfinanzierungsfazilitäten.

Keeton, William R. (1979), Equilibrium Credit Rationing.

Kürsten, Wolfgang (1994), Finanzkontrakte und Risikoanreizproblem — Missverständnisse im informationsökonomischen Ansatz der Finanztheorie.

Kürsten, Wolfgang (1995), Risky Debt, Managerial Ownership and Capital Structure: New Fundamental Doubts on the Classical Agency Approach, in: Journal of Institutional and Theoretical Economics, Vol. 151, S. 526–555.

Kürsten, Wolfgang (1997), Zur Anreizkompatibilität von Kreditsicherheiten, oder: Insuffizienz des Stiglitz/Weiss-Modells der Agency-Theorie, in: zfbf, 39. Jg., S. 819–856.

Kürsten, Wolfgang (1998), Klassische Kreditrationierung unter Moral Hazard — Zur Bedeutung der Opportunitätsmenge risiko- und ertragsdifferenzierter Investitionsprojekte, in: Zeitschrift für Wirtschaftsund Sozialwissenschaften, 118. Jg., S. 425–461.

Long, John B. (1974), Discussion, in: Journal of Finance, Vol. 29, S. 485–488.

Merton, Robert C. (1973), The Theory of Rational Option Pricing, in: Bell Journal of Economics and Management Science, Vol. 4, S. 141–183.

Neus, Werner (1995), Zur Theorie der Finanzierung kleinerer Unternehmungen.

Neus, Werner (1998), Kreditsicherheiten und Modelle der Kreditfinanzierung, in: Franke, Günter/Laux, Helmut (Hrsg.): Unternehmensführung und Kapitalmarkt: Festschrift für Herbert Hax, S. 211–251.

Peters, Horst (1995), Kreditvergabe und Verschuldung — eine risikotheoretische Untersuchung.

Rothschild, Michael/ Stiglitz, Joseph E. (1970), Increasing Risk: a Definition, in: Journal of Economic Theory, Vol. 2, S. 225–243.

Rudolph, Bernd (1984), Kreditsicherheiten als Instrument zur Umverteilung und Begrenzung von Kreditrisiken, in: zfbf, 36. Jg., S. 16–43.

Smith, Clifford W. (1979), Applications of Option Pricing Analysis, in: Bicksler, James (Hrsg.): Handbook of Financial Economics, S. 79–121.

Stiglitz, Joseph E./ Weiss, Andrew (1981): Credit Rationing in Markets with Imperfect Information, in: American Economic Review, Vol. 71, S. 383–410.

Terberger, Eva (1987), Der Kreditvertrag als Instrument zur Lösung von Anreizproblemen.

Terstege, Udo (1995), Optionsbewertung: Möglichkeiten und Grenzen eines präferenz- und verteilungsfreien Ansatzes.

White, Michelle (1980), Public Policy toward Bankruptcy: Me-first and other Priority rules, in: The Bell Journal of Economics, Vol. 11, S. 550–564.

Author information

Authors and Affiliations

Additional information

Für wertvolle Diskussionen, Anregungen und Verbesserungsvorschläge danke ich Barry Adler, Michael Bitz, Jürgen Blum, Dominique Demougin, Jesse Fried, Charles Grant, Hayne Leland, Hans-Bernd Schäfer, Ria Steiger, Eva Terberger-Stoy, Marliese Uhrig-Homburg, Lars Wellejus und Stefanie Wettberg. Zudem danke ich einem anonymen Gutachter für zahlreiche wertvolle Anmerkungen. Teile dieser Arbeit entstanden während eines Forschungsaufenthalts an der University of California, Berkeley. Ich danke der Deutschen Forschungsgemeinschaft, die dies ermöglichte.