Summary

The theory of indifference maps is a static theory for consumer’s behaviour. As an illustration of this theory we examine in this note the demand reactions of an individual consumer in three situations. Given the pricesp 1 …,p n and his income μ, let Q=(q 1, …,q n) be the consumer’s optimal budget. Now in the first place, if one price is allowed to vary, sayp i, while the income and the other prices are held fixed, the optimal budget will describe a curve known as aprice-consumption curve. Makingi=1, …,n we obtainn such curves passing through Q, say A1, …, An. Second, consider an inflatory situation where all prices vary in proportion, while income μ is constant. In the staic theory of indifference maps this is equivalent to allowing μ to vary while all prices are held fixed. Thus the optimal budget will describe what is known as theincome-consumption curve which passes through Q, say C. Third, suppose in the inflatory situation that one of the prices, say pi, is held fixed. The optimal budget will then describe a certain curve, say B1; this will be called aprice-consumption curve of type B. There aren such curves which pass through Q, say B1, …, Bn.

The price-consumption curves A1 and Bi and the income-consumption curve C form a convenient geometric representation of the demand functions of the consumer.

The equations of the curves Ai, Bi, C are given in no. 1. Certain simple interrelations between these curves are pointed out in no. 2. In no. 3, finally, we examine the orientation of the curves Ai; anaiogous results are obtained for the curves Bi.

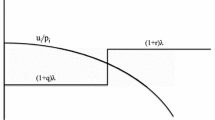

The results of no. 2 are as follows. In the case of two goods,n=2, theprice-consumption curves A1 and B2 will coincide, and likewise A2 and B1. Considering the passage through Q for falling (rising) prices, the three curves A1=B2, A2=B1 and C will pass through the budget linep 1qr+p2q2=μ from below (above). In this passage, C is intermediate between A1=B2 and A2=B1. In the case ofn goods, all of the2n curves Ai, Bi will in general be different. It is a rather typical situation that a curve Ai will be more or less perpendicular to the corresponding curve Bi. In the passage through Q for falling (rising) prices, the 2n+1 curves Ai, Bi, C will pass through the budget plane σp iqi=μ from below (above). On the upper side of the budget plane, the curves Ai will form the edges of a corner at Q, say Λ. Considering the passage of the curve C through the point Q. it is shown that this passage will always take place within the corner Λ. A similar theorem holds for the curves Bi and C.

In no. 3 the geometric interpratation of demand functions is carried further; this leads to a theorem on what is known as the substitution effect. As an immediate corollary, the theorem implies that there is the following similarity between the corner Λ and the corner which the positive coordinate axesq 1 form at the origin: The consecutive order of the edges Ai at Λ is the same as the order of the axesq i at the origin; moreover, if we use the direction of the curve C at Q to project the curves Ai into the budget plane, the projection of Ai will form a smaller angle with theq i-axis than with any other coordinate axes. Again, statements of the same type hold true for the curves Bi. The theorem in question is proved by an intuitive argument. An alternative, purely analytic proof of the theorem, ends the paper.

Similar content being viewed by others

References

R. G. D. Allen:Mathematical analysis for economists, London 1938.

E. Cansado:Vector interpretation of the Slutsky’s equation, This volume.

J. Mosak:On the interpretation of the fundamental equation of value theory. Studies in mathematical economics and econometrics; In memory of Henry Schultz. Chicago (1942).

E. Slutsky: Sulla teoria del bilancio del consumatore. Giornale degli economisti, 51 (1915).

H. Wold:A synthesis of pure demand analysis. Skandinavisk Aktuarietidskrift, 26–27 (1943–44).

H. Wold:On Giffen’s paradox. Nordisk Tidskrift for Teknisk Ökonomi (1948).

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Cansado, E., Wold, H. Some properties of price-consumption curves and income-consumption curves. Trabajos de Estadistica 1, 37–48 (1950). https://doi.org/10.1007/BF03025200

Issue Date:

DOI: https://doi.org/10.1007/BF03025200