Abstract

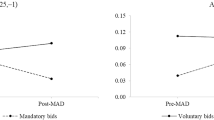

With the passage of the Insider Trading Sanctions Act (ITSA) of 1984, regulators have attempted to reduce insider trading activities through their increased power to impose stiffer penalties on violators. In their study of trading activity associated with tender offers, Arshadi and Eyssell (1991) find that insiders went from being heavy net purchasers of their own firms' stock prior to tender offer announcements to being weak net sellers. The special status of bank holding companies suggests that the trading patterns of insiders would differ between bank holding companies and non-bank holding companies. The results in this paper indicate this to be the case as there is no change in the trading patterns for insiders of bank holding companies between the two regulatory periods.

Similar content being viewed by others

References

Arshadi, Nasser, andThomas H. Eyssell, “Regulatory Deterrence and Registered Insider Trading: The Case of Tender Offers.”Financial Management 20, no. 2 (Summer 1991): 30–39.

Cornett, Marcia Millon, andSankar De. “Common Stock Returns to Corporate Takeover Bids: Evidence From Interstate Bank Mergers.”Journal of Banking and Finance 15, no. 2 (April 1991): 273–295.

Demsetz, Harold. “Corporate Control, Insider Trading, and Rates of Return.”American Economic Review 76, no. 2 (May 1986): 313–316.

Desai, Anand S. andRoger D. Stover. “Bank Holding Company Acquisitions, Stockholder Returns, and Regulatory Uncertainty.”Journal of Financial Research 8, no. 2 (Summer 1985): 145–156.

Eyssell, Thomas H. “Corporate Insiders, Toehold Acquisitions, and Information Leakage: Do Insiders Tip Their Hands?”Akron Business and Economic Review 21, no. 2 (Spring 1990): 90–103.

Eyssell, Thomas H. andJames P. Reburn. “The Effects of Insider Trading Sanctions Act of 1984: The Case of Seasoned Equity Offerings.”Journal of Financial Research 16, no. 2 (Summer 1993): 161–170.

Hirschey, Mark, Myron B. Slovin, andJanis K. Zaima. “Bank Debt, Insider Trading, and the Return to Corporate Selloffs.”Journal of Banking and Finance 14, no. 1 (March 1990): 85–98.

Houston, Joel F. andMichael Ryngaert. “The Overall Gains from Large Bank Mergers.”Journal of Banking and Finance 18, no. 6 (December 1994): 1155–1176.

Jarrell, Gregg A. andAnnette B. Poulsen. “Stock Trading Before the Announcement of Tender Offers: Insider Trading or Market Anticipation?”Journal of Law, Economics, and Organization 5, no. 2 (Fall 1989): 225–248.

Karpoff, Jonathan M. andDaniel Lee. “Insider Trading Before New Issue Announcements.”Financial Management 20, no. 1 (Spring 1991): 18–26.

Keown, Arthur J., andJohn M. Pinkerton. “Merger Announcements and Insider Trading Activity: An Empirical Investigation.”Journal of Finance 36, no. 4 (September 1981): 855–869.

Keown, Arthur J., John M. Pinkerton, Lewis Young, andRobert S. Hansen. “Recent SEC Prosecution and Insider Trading on Forthcoming Merger Announcements.”Journal of Business Research 13, no. 4 (August 1985): 329–338.

Meulbroek, Lisa K. “An Empirical Analysis of Illegal Insider Trading.”Journal of Finance 47, no. 5 (December 1992): 1661–1699.

Neely, Walter P..“Banking Acquisitions: Acquirer and Target Shareholder Returns.”Financial Management 16, no. 4 (Winter 1987): 66–74.

Penman, Stephen H. “A Comparison of the Information Content of Insider Trading and Management Earnings Forecasts.”Journal of Financial and Quantitative Analysis 20, no. 1 (March 1985): 1–18.

Pound, John, andRichard J. Zeckhauser. “Clearly Heard on the Street: The Effect of Takeover Rumors on Stock Prices.”Journal of Business 63, no. 3 (July 1990): 291–308.

Schooley, Diane K. andL. Dwayne Barney, Jr. “Using Dividend Policy and Managerial Ownership to Reduce Agency Costs.”Journal of Financial Research 17, no. 3 (Fall 1994): 363–374.

Seyhun, H. Nejat. “Insiders' Profits, Costs of Trading, and Market Efficiency.”Journal of Financial Economics 16, no. 2 (June 1986): 189–212.

Seyhun, H. Nejat. “The Information Content of Aggregate Insider Trading.”Journal of Business 61, no. 1 (January 1988): 1–24.

Wu, Hsiu Kwang. “Corporate Insider Trading in the Stock Market, 1957–61.”The National Banking Review 2, no. 3 (March 1965): 373–385.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Filbeck, G., Mullineaux, D.J. Insider Trading and regulation: A look at bank holding companies. J Econ Finan 19, 71–84 (1995). https://doi.org/10.1007/BF02920615

Issue Date:

DOI: https://doi.org/10.1007/BF02920615