Abstract

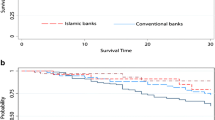

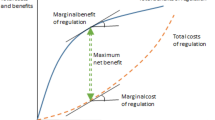

While it is widely recognized that bank regulators choose the policy of forbearance because of an undercapitalized bank insurance fund, a key policy question centers on what were the effects of forbearance. This study uses a survival model to track capital deficient banks from December 1986 to December 1989, a period in which regulators explicitly used forbearance in managing troubled banks. Despite the contention that forbearance returns banks to safe-and-sound practices, this study concludes that forbearance did not enable troubled banks to return to viability. Furthermore, the evidence from the survival analysis provides negligible support, if any, for the interrelationship between forbearance and too-big-to-fail doctrine.

Similar content being viewed by others

References

Barth, James R., R. Dan Brumbaugh, Jr., andRobert E. Litan.The Banking Industry in Turmoil: A Report on the Condition of the U. S. Banking Industry and the Bank Insurance Fund. Washington: United States Government Printing Office, 1990.

Bartholomew, Philip F. “The Cost of Forbearance during the Thrift Crisis.” Congressional Budget Office Staff Memorandum, June 1991.

Benston, George J., and Mark Carhill. “FSLIC Forbearance and the Thrift Debacle.”Proceedings of a Conference on Bank Structure and Competition, Federal Reserve Bank of Chicago, 1992, 121–144.

Cobos, Dean F. “Forbearance: Practices and Proposed Standards.”FDIC Banking Review 2 (Spring/Summer 1989): 20–28.

Cox, David R., andDavid Oakes.Analysis of Survival Data. New York: Chapman and Hall, 1984.

Kane, Edward J. “The High Cost of Incompletely Funding the FSLIC Shortage of Explicit Capital.”Journal of Economic Perspectives 3 (Fall 1989): 31–47.

Kiefer, Nicholas M. “Economic Duration Data and Hazard Functions.”Journal of Economic Literature 26 (June 1988): 646–679.

Posner, Richard A. “Theories of Economic Regulation.”Bell Journal of Economics and Management Science 5 (1974): 335–358.

Whalen, Gary. “A Proportional Hazard Model of Bank Failure: An Examination of Its Usefulness as an Early Warning Toll.”Economic Review, Federal Reserve Bank of Cleveland 27, no. 1 (1991): 21–31.

Woodward, Thomas J. “The Return of Forbearance.”Budget and Economic Analysis 2 (October 9, 1992).

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Leggett, K.J. The consequences of a policy of necessity: Bank regulatory forbearance, 1986–1989. J Econ Finan 18, 1–12 (1994). https://doi.org/10.1007/BF02920218

Issue Date:

DOI: https://doi.org/10.1007/BF02920218