Summary

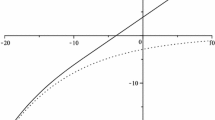

A model of stochastic processes is being developed which is suitable for dealing with problems of the collective theory of risk. The capital of an insurance company is represented as a stochastic process. With the help of this model an optimum payment of dividends can be found, that is the one for which with due consideration of the probability of ruin the expected rate of all dividend payments becomes a maximum.

Similar content being viewed by others

References

VergleicheWolff, “Versicherungsmathematik”, Springer-Verlag Wien, 1970 u. die dort angegebene Literatur.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Wolff, KH. Optimale Dividendenzahlungen. Blätter DGVFM 9, 445–447 (1970). https://doi.org/10.1007/BF02809016

Received:

Issue Date:

DOI: https://doi.org/10.1007/BF02809016