Abstract

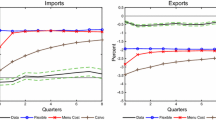

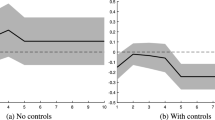

Errors-in-Variables, Supply Side Effects, and Price Elasticities in Foreign Trade.—Previous estimates of price elasticities in foreign trade are likely to be biased upward due to errors-in-variables, omission of supply side influences, aggregation, bad measurement of price competitiveness, and misspecification of the estimation equations. This paper incorporates the supply side into the traditional demand for export equation and uses a panel data approach for OECD manufacturing to provide unbiased estimates of price elasticities. The estimates indicate that the sum of the absolute import and export price elasticities is close to one and that currency depreciations are likely to adversely affect trade balances in the long run due to supply side influences. JEL no. E3, F1, F4

Zusammenfassung

Variablenfehler, Wirkungen der Angebotsseite und Preiselastizitäten im Außenhandel.—Frühere Schätzungen von Preiselastizitäten im Außenhandel sind wahrscheinlich nach oben verzerrt aufgrund von Variablenfehlern, der Vernachlässigung von Einflüssen der Angebotsseite, der Aggregation, der schlechten Messung der preislichen Wettbewerbsfähigkeit und der fehlerhaften Spezifizierung der Schätzgleichungen. Der Verfasser fügt die Angebotsseite in die traditionelle Gleichung der Exportnachfrage ein und verwendet einen Paneldaten-Ansatz für die verarbeitende Industrie in der OECD, um unverzerrte Schätzungen von Preiselastizitäten zu ermitteln. Die Schätzungen ergeben, daß die Summe der absoluten Import- und Exportpreiselastizitäten nahe eins liegt und daß sich Währungsabwertungen wegen der Einflüsse der Angebotsseite wahrscheinlich langfristig auf die Handelsbilanzen nachteilig auswirken.

Similar content being viewed by others

References

Anderson, T. W., and C. Hsiao (1982). Formulation and Estimation of Dynamic Models Using Panel Data.Journal of Econometrics 18 (1): 47–82.

Athukorala, P., and J. Riedel (1991). The Small Country Assumption: A Reassessment with Evidence from Korea.Weltwirtschaftliches Archiv 126 (1): 138–151.

Bhargava, A., L. Franzini, and W. Narendranthan (1982). Serial Correlation and the Fixed Effects Model.Review of Economic Studies 49 (4): 533–549.

Blanchard, O. J., and L. H. Summers (1986). Hysteresis and the European Unemployment Problem.NBER Macroeconomics Annual (1): 15–78.

Bruno, M. (1986). Aggregate Supply and Demand Factors in OECD Unemployment: An Update.Economica 53 (Supplement): S35-S52.

Bruno, M., and J. D. Sachs (1985).Economics of Worldwide Stagflation. Cambridge, Mass.: Harvard University Press.

Deutsche Bundesbank (1985). New Calculation of the External Value of the Deutsche Mark and Foreign Currencies.Monthly Report of the Deutsche Bundesbank 37 (1):38–43.

Dornbusch, R. (1987). Exchange Rates and Prices.American Economic Review 77 (1): 93–106.

Durand, M. (1986). Method of Calculating Effective Exchange Rates and Indicators of Competitiveness. OECD Working Papers 29. Paris.

Durand, M., J. Simon, and C. Webb (1992). OECD’s Indicators of International Trade and Competitiveness. OECD Working Papers 120. Paris.

Fitoussi, J.-P., and E. S. Phelps (1988).The Slump in Europe: Open Economy Macroeconomics Reconstructed. Oxford: Basil Blackwell.

Funke, M., and S. Holly (1992). The Determinants of West German Exports of Manufactures: An Integrated Demand and Supply Approach.Weltwirtschaftliches Archiv 128 (3): 498–512.

Goldstein, M., and M. S. Khan (1978). The Supply and Demand for Exports: A Simultaneous Approach.Review of Economics and Statistics 6 (2): 275–286.

— (1985). Income and Price Effects in Foreign Trade. In R. W. Jones and P. B. Kenen (eds.),Handbook of International Economics, Vol. 2. Amsterdam: Elsevier Science Publishers.

Griliches, Z., and J. A. Hausman (1986). Errors in Variables in Panel Data.Journal of Econometrics 31 (1): 93–118.

Holly, S., and K. Wade (1991). UK Exports of Manufactures: The Role of Supply Side Factors.Scottish Journal of Political Economy 38 (1): 1–18.

Hooper, P., and J. Marquez (1995). Exchange Rates, Prices, and External Adjustment in the United States and Japan. In P. Kenen (ed.),Understanding Interdependence: The Macroeconomics of the Open Economy. Princeton, NJ: Princeton University Press.

Im, K. S., M. H. Pesaran, and Y. Shin (1997). Testing for Unit Roots in Heterogeneous Panels. Manuscript, Department of Applied Economics, University of Cambridge.

Kemp, M. C. (1962). Errors of Measurement and Bias in Estimates of Import Demand Parameters.Economic Record 38 (September): 369–372.

Klepper, S., and E. E. Leamer (1984). Consistent Set of Estimates for Regressions with Errors in all Variables.Econometrica 52 (1): 163–183.

Kmenta, J. (1986).Elements of Econometrics. New York: Macmillan.

Kravis, I. B., and R. E. Lipsey (1974). International Trade Prices and Price Proxies. In: N. Ruggles (ed.),The Role of the Computer in Economic and Social Research in Latin America. New York: National Bureau of Economic Research.

Krugman, P. (1980). Scale Economies, Product Differentiation, and the Pattern of Trade.American Economic Review 70 (5): 950–959.

— (1989). Differences in Income Elasticities and Trends in Real Exchange Rates.European Economic Review 33 (5): 1031–1054.

Layard, R., S. Nickell, and R. Jackman (1991).Unemployment: Macroeconomic Performance and the Labour Market. Oxford: Oxford University Press.

Leamer, E. E. (1978).Specification Searches: Ad Hoc Inference with Nonexperimental Data. New York: John Wiley.

Madsen, J. B. (1997). Pricing to Market and the Efficiency of Macroeconomic Policies in Open Economies with Floating Exchange Rates.Journal of Post Keynesian Economics 19 (2):225–242.

Madsen, J. B., and D. Damania (1994). Accounting for Supply, Integration and Income in Foreign Trade.Applied Economics 26 (1):53–63.

Marston, R. C. (1990). Pricing to Market in Japanese Manufacturing.Journal of International Economics 29 (3/4):217–236.

Menon, J. (1995). Exchange Rate Pass-Through.Journal of Economic Surveys 9 (2): 197–231.

Muscatelli, V. A., T. G. Srinivasan, and D. Vines (1994). The Empirical Modelling of NIE Exports: An Evaluation of Different Approaches.Journal of Development Studies 30 (2):279–302.

Muscatelli, V. A., A. A. Stevenson, and C. Montagna (1995). Modelling Aggregate Manufactured Exports for Some Asian Newly Industrialized Economies.Review of Economics and Statistics 77 (1):147–155.

Nguyen, D. T. (1989). The Demand for LDC Exports of Manufactures: Estimates from Hong Kong. A Comment.Economic Journal 99 (June):461–466.

OECD (1987).OECD Leading Indicators and Business Cycles. Sources and Methods No. 39. Paris.

Orcutt, G. (1950). Measurement of Price Elasticities in International Trade.Review of Economics and Statistics 32 (May):117–132.

Oulton, N., and G. Young (1996). How High is the Social Rate of Return to Investment?Oxford Review of Economic Policy 12 (2):48–69.

Pesaran, M. H., and R. Smith (1995). Estimating Long-Run Relationships from Dynamic Heterogeneous Panels.Journal of Econometrics 68 (1):79–113.

Phelps, E. S. (1994).Structural Slumps: The Modern Equilibrium Theory of Unemployment, Interest, and Assets. Cambridge, Mass.: Harvard University Press.

Riedel, J. (1988). The Demand for LDC Exports of Manufactures: Estimates from Hong Kong.Economic Journal 98 (March):138–148.

Rose, A. K. (1991). The Role of Exchange Rates in a Popular Model of International Trade: Does the “Marshall-Lerner” Condition Hold?Journal of International Economics 30 (3/4):301–316.

Rose, A. K., and J. L. Yellen (1989). Is There a J-Curve?Journal of Monetary Economics 24 (1):53–68.

Rotemberg, J. J., and M. Woodford (1991). Mark-Ups and the Business Cycle.NBER Macroeconomics Annual (6):63–129.

Sachs, J. D., and H. J. Shatz (1994). Trade and Jobs in U.S. Manufacturing.Brookings Papers on Economic Activity (1):1–80.

Additional information

Remark: Comments and suggestions from participants at seminars at University of Southampton, University of Adelaide and University of Western Australia, and particularly of an anonymous referee, are gratefully acknowledged. Paula Madsen and Wana Yang provided excellent research assistance.

About this article

Cite this article

Madsen, J.B. Errors-in-variables, supply side effects, and price elasticities in foreign trade. Weltwirtschaftliches Archiv 134, 612–637 (1998). https://doi.org/10.1007/BF02773290

Issue Date:

DOI: https://doi.org/10.1007/BF02773290