Abstract

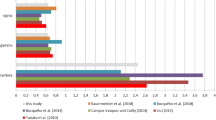

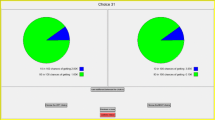

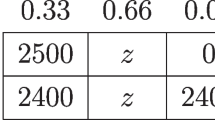

Since Holt and Laury (Am Econ Rev 92(5):1644–1655, 2002), the multiple price list (MPL) procedure has widely been used to elicit individual risk preferences. We assess the impact of varying list order and spacing, and of presentation via text or graphs. Relative to the original MPL baseline, some non-linear transformations of lottery prices systematically increase elicited risk aversion, while some graphical displays tend to reduce it.

Similar content being viewed by others

Notes

Please see Sect. 4 for an alternative view on this hypothesis.

Camerer (1989) offers a similar conjecture, but does not elaborate or test it. In his experiment, expected values are proportional to displayed areas, while in our experiment, they are proportional to the volumes of the 3-d pies.

Why is the gap in mean s between MPLe and, say, MPLa so much larger than the corresponding gap in r? We see two reasons. First, the 8 MPLe trials excluded for r exhibit higher mean values of s than the other trials. Second, the convex transform behind MPLe compresses the range of the \(\hat{r}\)’s, artificially lowering the mean (and standard deviation) of r in Table 2.

Power tests collected in online Appendix A suggest that, given the observed means and standard deviations in sequence I, a sample twice as large as ours would suffice to reject the null hypothesis at the 5% level in 90% of samples for the TF and FF treatments, but it would take a sample about ten times as large to do so for the FT and TT treatments.

Some readers might be surprised that in the prize dimension, our data suggest, if anything, ambiguity seeking and not ambiguity aversion. A literature search turned up only two previous studies, Eichberger et al. (2011) and Eliaz and Ortoleva (2011), that dealt with ambiguity in prizes. The latter study focused on correlations between prize ambiguity and the usual probability ambiguity. Eichberger et al. (2011) finds ambiguity aversion in prizes, but to a lesser degree than for ambiguity in probabilities.

References

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2006). Elicitation using multiple price list formats. Experimental Economics, 9(4), 383–405.

Benjamin, D. J., Brown, S. A., & Shapiro, J. M. (2013). Who is “behavioral” cognitive ability and anomalous preferences. Journal of the European Economic Association, 11(6), 1231–1255.

Bosch-Domènech, A., & Silvestre, J. (2013). Measuring risk aversion with lists: A new bias. Theory and Decision, 75(4), 465–496.

Camerer, C. F. (1989). An experimental test of several generalized utility theories. Journal of Risk and uncertainty, 2(1), 61–104.

Cokely, E. T., & Kelley, C. M. (2009). Cognitive abilities and superior decision making under risk: A protocol analysis and process model evaluation. Judgment and Decision Making, 4(1), 20.

Cox, J. C., Smith, V. L., & Walker, J. M. (1988). Theory and individual behavior of first-price auctions. Journal of Risk and Uncertainty, 1(1), 61–99.

Eichberger, J., Oechssler, J., & Schnedler, W. (2011). How do subjects cope with ambiguous situations when they become even more ambiguous?. Technical report, Mimeo, University of Heidelberg.

Eliaz, K., & Ortoleva, P. (2011). A variation on Ellsberg. Brown University Working Paper. doi:10.2139/ssrn.1761445.

Frederick, S. (2005). Cognitive reflection and decision making. The Journal of Economic Perspectives, 19(4), 25–42.

Friedman, D., Isaac, R. M., James, D., Sunder, S. (2014). Risky curves: On the empirical failure of expected utility. New York: Routledge.

Hey, J. D., Orme, C. (1994). Investigating generalizations of expected utility theory using experimental data. Econometrica: Journal of the Econometric Society, 62(6),1291–1326.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92(5), 1644–1655.

James, D. (2007). Stability of risk preference parameter estimates within the Becker–DeGroot–Marschak procedure. Experimental Economics, 10(2), 123–141.

Lévy-Garboua, L., Maafi, H., Masclet, D., & Terracol, A. (2012). Risk aversion and framing effects. Experimental Economics, 15(1), 128–144.

Park, J., & Brannon, E. M. (2013). Training the approximate number system improves math proficiency. Psychological Science, 24(10), 2013–2019. doi:10.1177/0956797613482944.

Schley, D. R., Peters, E. (2014). Assessing “economic value” symbolic-number mappings predict risky and riskless valuations. Psychological Science. doi:10.1177/0956797613515485.

Weller, J. A., Dieckmann, N. F., Tusler, M., Mertz, C. K., Burns, W. J., & Peters, E. (2013). Development and testing of an abbreviated numeracy scale: A Rasch analysis approach. Journal of Behavioral Decision Making, 26(2), 198–212.

Acknowledgements

We are grateful for support from the National Science Foundation under Grant SES-1357867. As usual, the NSF played no role in the design of our study, nor in the collection, analysis, and interpretation of data, nor in the writing of the report, nor in the decision to submit the article for publication. We also thank Tobias Schmidt for a helpful pointer to the previous literature, and two reviewers, and an editor of this journal for very helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Habib, S., Friedman, D., Crockett, S. et al. Payoff and presentation modulation of elicited risk preferences in MPLs. J Econ Sci Assoc 3, 183–194 (2017). https://doi.org/10.1007/s40881-016-0032-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40881-016-0032-8