Abstract

Output effects of currency crises are often estimated to be negative and persistent. A new banking crisis database allows us to construct pure currency collapses that are not associated with banking crises. The estimates show that countries facing a pure currency crisis have full recovery of output in the long-run while twin crisis leads to larger output losses. Allowing for long lags is a critical element in understanding the recovery dynamics. Further analysis reveals that there is a similar lag in the association between export growth and recovery dynamics.

Similar content being viewed by others

Notes

Studies on currency crisis use a variety of definitions to measure crisis episodes that includes exchange rate depreciations/devaluations, foreign reserve losses and interest rate changes as outlined in Flood et al. (2010). Given the focus of our study, we mostly follow the Frankel and Rose (1996) method of using exchange rate depreciation to define the crises episodes. In this paper, we use the terms ‘large depreciation’, ‘large devaluation’, ‘currency crises’ and ‘currency collapse’ interchangeably.

Lizondo and Montiel (1989) stress that it is hard to analytically argue that devaluations are always costly.

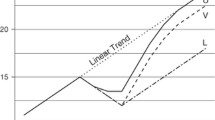

A related study by Radelet and Sachs (1998) distinguishes between U shaped and V shaped recoveries. Lee and Park (2002) argue that real GDP growth in South Korea following the Asian crisis represents a V shaped recovery. However, as stressed by Hong and Tornell (2005), the recovery in just the growth rates will still result in a permanent output loss.

Out of the 159 countries, 41 countries never experienced any currency crisis thereby forming our ‘control group’.

This specification is based on panel unit root test on real GDP data The Im et al. (2003) W statistics that relaxes the assumption of common unit root was 9.13. This implies we cannot reject the null hypothesis of unit root for GDP. Based on these results, we use growth rates of GDP when estimating our Eq. (1) and use cumulative impulse responses to examine dynamic level effects.

This approach assumes that there is no anticipation of currency crisis effect on real GDP. However, in the tax and government spending context, Yang (2005) and Ramey (2011) show significant anticipation effect. Theoretically, anticipation effect in the currency crisis context can have positive or negative effects depending on the channel of transmission. However, as Krugman (1979) elaborates, arbitrage opportunities should limit the difference in timing between anticipation and actual event.

We also estimated models with wider definitions of pure currency crisis by isolating banking crisis dates within 1 year of large depreciations. The results are very similar. The results are also robust to using private GDP as our output indicator as used in King et al. (1991). These estimates are available upon request.

We have also experimented with a limited sample based on timing restriction of currency crisis episodes. We selected 49 currency crisis episodes that happened in either January or February. The possibility of reverse causality in these episodes were smaller since most of the current year growth in data happened after these episodes. The results are very similar to the full sample no contemporaneous feedback results. Cerra and Saxena (2008) also examined the role of endogeneity in detail using Probit models and bivariate equations. They found lower current growth can increase the chance of a crisis in the same year. This should make the possibility of upward bias in our results unlikely.

References

Aghion P, Bacchetta P, Banerjee A (2001) Currency crises and monetary policy in an economy with credit constraints. Eur Econ Rev 45:1121–1150

Bernanke BS, Gertler M, Watson M (1997) Systematic monetary policy and the effects of oil price shocks. Brook Pap Econ Act 1:91–142

Bordo M, Eichengreen B, Klingebiel D, Martinez-Peria MS (2001) Is crisis problem growing more severe? Econ Policy 16:53–82

Bussiere M, Saxena SC, Tavor CE (2012) Chronicle of currency collapses: re-examining the effects on output. J Int Money Financ 31:680–708

Caprio G, Klingebiel D (1996). Bank insolvencies: cross-country experience. World Bank Policy Research Paper No. 1620

Cerra V, Saxena SC (2008) Growth dynamics: the myth of economic recovery. Am Econ Rev 98(1):439–457

Chang R, Velasco A (2001) A model of financial crises in emerging markets. Q J Econ 116:489–517

Cooper RN (1971) Currency devaluation in developing countries. In: Ranis G (ed) Government and economic development. Yale University Press, New Haven

Diaz-Alejandro C (1985) Good-bye financial repression, hello financial crash. J Dev Econ 19:1–24

Edwards S (1989) Real exchange rates, devaluation, and adjustment. MIT Press, Cambridge

Eichengreen B, Rose A, Wyplosz C (1997) Contagious currency crises. Scand J Econ 98:463–484

Fischer S (1999) The Asian crisis: the return of growth. International Monetary Fund, Speech

Flood RP, Marion NP, Yepez J (2010) A perspective on predicting currency crises. IMF Working Paper, WP/10/227

Frankel JA, Rose AK (1996) Currency crashes in emerging markets: an empirical treatment. J Int Econ 72(2):351–366

Gupta P, Mishra D, Sahay R (2007) Behavior of output during currency crises. J Int Econ 72(2):428–450

Hamilton JD, Herrera AM (2004) Oil shocks and aggregate macroeconomic behavior: the role of monetary policy. J Money Credit Bank 36:265–286

Hong K, Tornell A (2005) Recovery from a currency crisis: some stylized facts. J Dev Econ 76(1):71–96

Hutchison MM, Glick R (2001) Banking and currency crises: how common are twins? In: Glick R, Moreno R, Spiegel M (eds) Financial crises in emerging markets. Cambridge University Press, Cambridge

Hutchison MM, Noy I (2002) Output costs of currency crisis and balance of payment crises in emerging markets. Comp Econ Stud 44:27

Hutchison MM, Noy I (2005) How bad are twins? Output costs of currency and banking crises. J Money Credit Bank 37(4):725–752

Im KS, Peseran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115:53–74

Kamin SB, Rogers JH (2000) Output and real exchange rate in developing countries: an application to Mexico. J Dev Econ 61:85–109

Kaminsky G (2008) Currency crises. In: Durlauf SN, Blume LE (eds) The New Palgrave dictionary of economics, 2nd Edition. Palgrave Macmillan

Kaminsky G, Reinhart C (1999) The twin crises: the causes of banking and balance-of-payments problems. Am Econ Rev 89(3):473–500

Kappler M, Reisen H, Schularick M, Turkisch E (2012) The macroeconomic effects of large exchange rate appreciations. Open Econ Rev. doi:10.1007/s11079-012-9246-4

King R, Plosser C, Stock J, Watson M (1991) Stochastic trends and economic fluctuations. Am Econ Rev 81(4):819–840

Krugman P (1979) A model of balance-of-payments crises. J Money Credit Bank 11(3):311–325

Krugman P, Taylor L (1978) Contractionary effects of devaluation. J Int Econ 8(3):445–456

Laeven LA, Valencia F (2008) Systematic banking crises: a new database. IMF Working Paper No. 08/224

Laeven LA, Valencia FV (2010) Resolution of banking crises: the good, the bad, and the ugly. IMF Working Paper No.10/146

Lee JW, Park YC (2002) Recovery and sustainability in East Asia. World Econ 25:539–562

Lizondo S, Montiel PJ (1989) Contractionary devaluation in developing countries: an analytical overview. IMF Staff Pap 36:182–227

Mckinnon RI, Pill H (1997) Credible economic liberalization and overborrowing. Am Econ Rev 87(2):189–193

Morley SA (1992) On the effect of devaluation during stabilization programs in LDCs. Rev Econ Stat 74:21–27

Obstfeld M (1994) The logic of currency crises. Cah Economiques Monetaires 43:189–213

Radelet S, Sachs JD (1998) The onset of the East Asian financial crisis: diagnosis, remedies, prospects. Brook Pap Econ Act 1:1–74

Ramey V (2011) Identifying government spending shocks: it’s all in the timing. Q J Econ 126:1–50

Romer C, Romer D (1989) Does monetary policy matter? A new test in the spirit of Friedman and Schwartz. NBER Macroecon Annu 4:121–170

Velasco A (1987) Financial and balance of payments crisis. J Dev Econ 27:263–283

Von Hagen J, Ho T-K (2007) Money market pressure and the determinants of banking crises. J Money Credit Bank 39:1037–1066

Yang S-CS (2005) Quantifying tax effects under policy foresight. J Monet Econ 52(8):1557–1568

Acknowledgments

The authors would like to thank the two anonymous referees, the editor George S. Tavlas, Ronald Balvers, Stratford Douglas and Andrew Young for comments and suggestions. Usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Basistha, A., Teimouri, S. Currency Crises and Output Dynamics. Open Econ Rev 26, 139–153 (2015). https://doi.org/10.1007/s11079-014-9323-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-014-9323-y