Abstract

Episodes of extraordinary turbulence in global financial markets are examined during nine crises ranging from the Asian crisis in 1997–98 to the recent European debt crisis of 2010–13. After dating each crisis using a regime switching model, the analysis focuses on changes in the dependence structures of equity markets through correlation, coskewness and covolatility to address a range of hypotheses regarding contagion transmission. The results show that the great recession is a true global financial crisis. Finance linkages are more likely to result in crisis transmission than trade and emerging market crises transmit unexpectedly, particularly to developed markets.

Similar content being viewed by others

Notes

For example, the collapse of Lehman Brothers marks the start of the great recession.

During financial crises, countries worry that they will be affected in unexpected ways. For example, speculation during the Asian crisis in the US was that a recession was imminent and that American workers would lose their jobs (Galbraith 1998). The Russian and LTCM crisis was concluded to be the “worst crisis ever” (Committee on the Global Financial System 1999), and in the recent great recession it was expected that emerging countries would experience “sudden stops” (Blanchard 2008).

GARCH type models are another alternative method to that adopted here (Susmel and Engle 1994).

Future work should analyze the links between each crisis as policy responses to a crisis may sow the seeds of the next crisis.

Beliefs about the likelihood of crisis episodes occurring are incorporated formally via the prior probabilities p t = Pr(s t = 1) = 1 − Pr(s t = 0). The probability of being in a crisis is set to Pr(s t = 1) = 0. 9999 from the likely trigger date of each crisis running to a logical end date of each crisis. These dates are chosen based on the discussion in Section 3.2. When it is less likely that the regime is a non-crisis period, Pr(s t = 0) = 0. 0001.

A Monte Carlo study of the first three tests of this paper are included in Dungey et al. (2013) and the sampling properties of the fourth test are examined in Hsiao (2012). The results show that the tests perform reliably, particularly once the correction in the correlation tests included here included in the formula. Size adjusted critical values determined in these works are used.

The adjusted correlation coefficient

$$\widehat{\nu}_{y\left\vert x_{i}\right.}=\frac{\widehat{\rho}_{y}}{\sqrt{ 1+\delta \left( 1-\widehat{\rho}_{y}^{2}\right) }},$$removes the bias caused by increasing volatility in asset returns in the source market during crises. The term \(\delta =\frac {s_{y,i}^{2}-s_{x,i}^{2}}{s_{x,i}^{2}}\) is the proportionate change in the volatility of returns in the source equity market i, where \(s_{x,i}^{2}\) and \(s_{y,i}^{2}\) are the sample variances of equity returns in market i during the non-crisis and crisis periods. The correlation test is different to that of Forbes and Rigobon (2002) as the test statistic constructed in Fry et al. (2010) uses non-overlapping data.

All data are collected from Datastream

Forbes and Rigobon include Singapore in their sample which we don’t, as the current equity index for Singapore (The Straits Times Index) is only available from 1999 and the interest rate which constitutes a control in Forbes and Rigobon is also incomplete for the sample period.

Note the use of the finite sample critical values determined in Fry et al. (2011).

The five countries are different in each case.

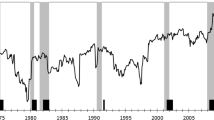

The figure of the rolling test statistics for the remaining crises are not presented to conserve space.

Usually n = 5 but may be fewer depending on the description given in Section 4.2

References

Ang A, Bekaert G (2002) International asset allocation with regime shifts. Rev Financ Stud 15(4):1137–1187

Arghyrou M, Kontonikas A (2012) The EMU Sovereign-debt crisis: fundamentals, expectations and contagion. J Int Financ Mark Inst Money 22:658–677

AuYong HH, Gan C, Treepongkaruna S (2004) Cointegration and causality in the asian and emerging foreign exchange markets: evidence from the 1990s financial crises. Int Rev Financ Anal 13:479–515

Baig T, Goldfajn I (2000) The Russian default and the contagion to Brazil. NBER working paper no 160

Baur D (2003) Testing for contagion- mean and volatility contagion. J Multinatl Financ Manag 13:405–422

Baur D (2012) Financial contagion and the real economy. J Bank Financ 36(10):2680–2692

Baur DG, Fry RA (2009) Multivariate contagion and interdependence. J Asian Econ 20:353–366

Bekaert G, Ehrmann M, Fratzscher M, Mehl A (2011) Global crises and equity market contagion. NBER working paper w17121

Beirne J, Caporale GM, Schulze-Ghattas M, Spagnolo N (2009) Volatility spillovers and contagion from mature to emerging stock markets. European central bank working paper no 113

Billio M, Caporin M (2005) Multivariate Markov switching dynamic conditional correlation GARCH representations for contagion analysis. JISS 14(2):145–161

Billio M, Pelizzon L (2003) Contagion and interdependence in stock markets: have they been misdiagnosed? J Econ Bus 55:405–426

Blanchard O (2008) Transcript of a press conference on the world economic outlook. Washington, DC 8 Oct 2008

Briere M, Chapelle A, Szafarz A (2012) No contagion, only globalization and flight to quality. J Int Money Financ 31:1729–1744

Boschi M (2005) International financial contagion: evidence from the Argentine crisis of 2001–2002. Appl Financ Econ 15:153–163

Calvo GA, Mendoza EG (2000) Rational contagion and the globalization of securities markets. J Int Econ 51:79–113

Caporale GM, Cipollini A, Spagnolo N (2005) Testing for contagion: a conditional correlation analysis. J Empir Finan 12:476–489

Caprio G, Klingebiel D, Laeven L, Noguera G (2005) Appendix: banking crisis database. In: Honohan P, Laeven L (eds) Systemic financial crises: containment and resolution. Cambridge University Press, UK

Caramazza F, Ricci L (2003) International financial contagion in currency crises. J Int Money Financ 23:51–70

Celik S (2012) The more contagion effect on emerging markets: the evidence of DCC-GARCH model. Econ Model 29:1946–1959

Chan JCC, Fry-McKibbin RA, Hsiao CY (2013) A regime switching skew-normal model for financial market crises and contagion. CAMA working paper no 15

Chiang TC, Jeon BN, Li H (2007) Dynamic correlation analysis of financial contagion: evidence from asian markets. J Int Money Financ 26:1206–1228

Choe K, Choi P, Nam K, Vahid F (2012) Testing financial contagion on Heteroskedastic asset returns in time-varying conditional correlation. Pac Basin Financ J 20:271–291

Chudik A, Fratzscher M (2011) Identifying the global transmission of the 2007–09 financial crisis in a GVAR model. European central bank working paper no 1285/January

Cifarelli G, Paladino G (2004) The impact of the Argentine default on volatility co-movements in emerging bond markets. Emerg Mark Rev 5:427–446

Cocozza E, Piselli P (2011) Testing for east-west contagion in the European banking sector during the financial crisis. Temi di discussione working paper no 790

Collins D, Gavron S (2005) Measuring equity market contagion in multiple financial events. Appl Financ Econ 15:531–538

Committee on the Global Financial System (1999) A review of financial market events in autumn 1998. Bank for international settlements. Basel, Switzerland

Corsetti G, Pesenti P (2005) The simple geometry of transmission and stabilization in closed and open economies. NBER working paper no 11341

de Haas R, van Horen N (2013) Running for the exit? international bank lending during a financial crisis. Rev Financ Stud 26:244–285

Diebold FX, Yilmaz K (2009) Measuring financial asset return and volatility spillovers, with application to global equity markets. Econ J 119:158–171

Dungey M, Fry RA, Martin VL (2002) Equity transmission mechanisms from Asia to Australia: interdependence or contagion? Aust J Manag 28(2):157–182

Dungey M, Fry RA, Martin VL (2006) Correlation, contagion and Asian evidence. Asian Econ Pap 5:32–72

Dungey M, Fry RA, González-Hermosillo B, Martin VL (2007) Contagion in global equity markets in 1998: the effects of the russian and LTCM crises. N Am J Econ Financ 18:155–174

Dungey M, Fry RA, González-Hermosillo B, Martin VL, Tang C (2009) Are financial crises alike? IMF working paper no WP/10/14

Dungey M, Fry-McKibbin RA, Martin VL, Xiaokang W (2013) Finite sample properties of contagion tests, manuscript. ANU, Canberra, Australia

Essaadi E, Jouini J, Khallouli W (2009) The Asian crisis contagion: a dynamic correlation approach analysis. Panoeconomicus 56:241–260

Fong TPW, Wong AY (2012) Gauging potential sovereign risk contagion in Europe. Econ Lett 115:496–499

Forbes KJ (2001) Are trade linkages important determinants of country vulnerability to crises? NBER working paper no 8194

Forbes KJ (2012) The Big C: identifying contagion. NBER Working Paper No 18465

Forbes KJ, Rigobon R (2002) No contagion, only interdependence: measuring stock market co-movements. J Financ 57:2223–2261

Fry RA, Martin VL, Tang C (2010) A new class of tests of contagion with applications. J Bus Econ Stat 28:423–437

Fry R, Hsiao CY, Tang C (2011) Actually this time is different. CAMA Working Paper 2011(12)

Galbraith JK (1998) Bracing for the Asian shock wave. The New York times, New York, US. 2 February 1998

Gallegati (2012) A wavelet-based approach to test for financial market contagion. Comput Stat Data Anal 56:3491–3497

Gelos RG, Sahay R (2001) Financial market spillovers in transition economies. Econ Transit 9:53–86

Glick R, Rose A (1999) Contagion and trade: why are currency crises regional? J Int Money Financ 18:1–38

Goldstein M (1998) The Asian financial crisis: causes, cures and systemic implications, policy analysis in international economics. Institute for International Economics, Washington DC

Goldstein I, Razin A (2013) Review of theories of financial crises. NBER working paper no 18670

Goldstein M, Kaminsky GL, Reinhart CM (2000) Assessing financial vulnerability: an early warning system for emerging markets. Institute for international economics, Washington DC

Gravelle T, Kichian M, Morley J (2006) Detecting shift-contagion in currency and bond markets. J Int Econ 68:409–423

Guidolin M, Timmerman A (2009) International asset allocation under regime switching, skew and kurtosis preferences. Rev Financ Stud 21:889–935

Hamilton JD (1989) A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57(2):357–384

Harvey CR, Siddique A (2000) Conditional skewness in asset pricing tests. J Financ 55:1263–1295

Hatemi-J A, Roca E (2011) How globally contagious was the recent us real estate market crisis? Evidence based on a new contagion test. Econ Model 28:2560–2565

Hon MT, Strauss JK, Yong SK (2007) Deconstructing the Nasdaq bubble: a look at contagion across international stock markets. J Int Financ Mark Inst Money 17:213–230

Horta P, Mendes C, Vieira I (2010) Contagion effects of the subprime crisis in the European NYSE Euronext markets. Port Econ J 9:115–140

Hsiao CY (2012) A new test of financial contagion with application to the US banking sector, manuscript, CAMA. The Australian National University, Canberra, Australia

Hui C, Chung T (2011) Crash risk of the Euro in the sovereign debt crisis of 2009–10. J Bank Financ 35:2945–2955

International Monetary Fund (2003) Lessons from the crisis in Argentina, policy development and review department. International Monetary Fund, Washington DC

Jang H, Sul W (2002) The Asian financial crisis and the co-movement of Asian stock markets. J Asian Econ 13:94–104

Kabir MH, Hassan MK (2005) The near-collapse of LTCM, US financial stock returns, and the fed. J Bank Financ 29:441–460

Kalbaska A, Gatkowski M (2012) Eurozone sovereign contagion: evidence from the CSD market (20052010). J Econ Behav Organ 2012

Kali R, Reyes J (2010) Financial contagion on the international trade network. Econ Inq 48:1072–1101

Kaminsky GL, Reinhart CM (2003) The center and the periphery: the globalization of financial turmoil. NBER working paper no 9479

Kaminsky GL, Schmukler SL (1999) What triggers market jitters? A chronicle of the asian crisis. J Int Money Financ 18:537–560

Kaminsky GL, Reinhart CM, Vegh CA (2003) The unholy trinity of financial contagion. NBER working paper no 10061

Kasch M, Caporin M (2013) Volatility threshold dynamic conditional correlations: an international analysis. J Financ Econ 0(0):1–37

Kenourgios D, Padhi P (2012) Emerging markets and financial crises: regional, global or isolated shocks? J Multinatl Financ Manag 22:24–38

Kim DH, Loretan M, Remolona EM (2010) Contagion and risk premia in the amplification of crisis: evidence from Asian names in the global CDS market. J Asian Econ 21:314–326

King M, Wadhwani S (1990) Transmission of volatility between stock market. Rev Financ Stud 3:5–33

Kose MA (2011) Review of this time is different: eight centuries of financial folly by Carmen M. Reinhart and Kenneth S. Rogoff. J Int Econ 84:132–134

Krugman P (1998) What happened to Asia? Mimeo. Massachusetts Institute of Technology, Cambridge

Kyle A, Xiong W (2001) Contagion as a wealth effect. J Financ 56:1401–1440

Laeven L, Valencia F (2008) Systemic banking crises: a new database. IMF working paper no WP/08/224

Lane PR (2013) Financial globalization and the crisis. Open Econ Rev 24:555–580

Loisel O, Martin P (2001) Coordination, cooperation, contagion and currency crises. J Int Econ 53:399–419

Longstaff FA (2010) The subprime credit crisis and contagion in financial markets. J Financ Econ 97:436–450

Lucas A, Schwaab B, Zhang X (2011) Conditional probabilities for euro area sovereign default risk, manuscript. Tinbergen Institute Discussion Paper no TI 11-176/2/DSF29

Masson P (1999) Contagion: monsoonal effects, spillovers, and jumps between multiple equilibria. In: Agenor PR, Miller M, Vines D, Weber A (eds) The Asian financial crisis: causes, contagion and consequences. Cambridge University Press, Cambridge, pp 265–283

Matsuyama K (2007) Credit traps and credit cycles. Am Econ Rev 97:503–516

Metiu N (2012) Sovereign risk contagion in the Eurozone. Econ Lett 117:35–38

Miller V, Vallée L (2011) Central bank balance sheets and the transmission of financial crises. Open Econ Rev 22:355–363

Mink M, Haan JD (2013) Contagion during the Greek sovereign debt crisis. J Int Money Financ 34:102–113

Missio S, Watzka S (2011) Financial contagion and the European debt crisis. CESifo working paper no 3554

Munoz MP, Marquez MD, Chulia H (2010) Contagion between markets during financial crises, manuscript. University of Barcelona, Barcelona, Spain

Naoui K, Liouane N, Brahim S (2010) A dynamic conditional correlation analysis of financial contagion: the case of the subprime credit crisis. Int J Econ Financ 2:85–96

Pais A, Stork P (2011) Contagion risk in the Australian banking and property sectors. J Bank Financ 35:681–697

Pappas V, Ingham H, Izzeldin M (2013) Financial market synchronization and contagion. Evidence from CCE and Eurozone, paper presented at INFINITI 2013

Pelletier D (2006) Regime switching for dynamic correlations. J Econ 131(1-2):445–473

Reinhart C (2010) This time is different chartbook: country histories on debt, default, and financial crises. NBER working paper no 15815

Reinhart C, Rogoff KS (2008a) Is the 2007 US sub-prime financial crisis so different? An international historical comparison. Am Econ Rev 98:339–333

Reinhart C, Rogoff KS (2008b) This time is different: eight centuries of financial folly. Princeton University Press, Princeton and Oxford

Rigobon R (2003) On the measurement of the international propagation of shocks: is the transmission stable? J Int Econ 61:261–283

Saleem K (2009) International linkage of the russian market and the Russian financial crisis: a multivariate GARCH analysis. Res Int Bus Financ 23:243–256

Samitas A, Tsakalos I (2013) How can a small country affect the European economy? The Greek contagion phenomenon. J Int Financ Mark Inst Money 25:18–32

Serwa D, Bohl MT (2005) Financial contagion vulnerability and resistance: a comparison of European stock markets. Econ Syst 29:344–362

Sojli E (2007) Contagion in emerging markets: the Russian crisis. Appl Financ Econ 17:197– 213

Susmel R, Engle RF (1994) Hourly volatility spillovers between international equity markets. J Int Money Financ 13:3–25

Syllignakis MN, Kouretas GP (2011) Dynamic correlation analysis of financial contagion: evidence from the central and eastern european markets. Int Rev Econ Financ 20:717–732

Van Rijckeghem C, Weder B (2001) Sources of contagion: is it finance or trade. J Int Econ 54:293– 308

Wälti S, Weder G (2008) Recovering from bond market distress: good luck and good policy. Emerg Mark Rev 10:36–50

Wen X, Wei Y, Huang D (2012) Measuring contagion between the energy market and stock market during financial crisis: a copula approach. Energy Econ 34:1435–1446

Yuan K (2005) Asymmetric price movements and borrowing constraints: a rational expectations equilibrium model of crises, contagion and confusion. J Financ 60:379–411

Acknowledgments

The authors thank two anonymous referees for their substantial comments which helped us immensely in putting together this paper. We would also like to thank Vance Martin, Marcel Fratzcher, Timo Henckel, Jan Jacobs, Ayhan Kose, Craig Orme, John Randal, Warwick McKibbin, James Yetman and George Tavlas for helpful comments. Fry-McKibbin and Tang acknowledge funding from ARC project DP0985783

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Estimation of the Regime Switching Model

The regime switching model is used to estimate the crisis dates using knowledge of trigger events. Prior distributions are combined with the likelihood function to obtain the joint posterior distribution via the Bayes rule in a Bayesian estimation framework. The Gibbs sampler is then used to obtain draws from the joint posterior distribution required for the analysis.

The (complete-data) likelihood function of the model in Eqs. 1 to 2 is

where \(\Theta =\left ( \mu _{0},\mu _{1},\sigma _{0}^{2},\sigma _{1}^{2}\right )\) and s t ∈ {0, 1}. Here, y = (y 1, … , y T )′ and s = (s 1, … , s T )′.

The prior for the model parameters are specified as

where \(IW\left ( \underline {\tau }_{\sigma ^{2}},\underline {S}_{\sigma ^{2}}\right ) \) denotes the inverse-Wishart distribution with degree of freedom \(\underline {\tau }_{\sigma ^{2}}\) and scale matrix \(\underline {S}_{\sigma ^{2}}\). The prior mean and variance for \(\mu _{s_{t}}\) are set to \(\underline {\mu }\) and \(\underline {V}_{\mu }=\phi _{\mu }\).

The joint posterior distribution is calculated by multiplying the prior distributions with the likelihood function via Bayes rule. Then, posterior draws from the joint posterior distribution are obtained via the Gibbs sampler:

-

Step1:

Specify starting values for \(\Theta ^{(0)}=\left (\mu _{l}^{(0)},\left (\sigma _{l}^{2}\right )^{(0)}\right )\) with l = 0, 1. Set counter loop = 1, … , n.

-

Steps2:

Generate s (loop)from π (s| y, Θ(loop − 1)).

-

Step3:

Generate \(\mu _{l}^{(loop)}\) from \(\pi \left (\mu _{l}|y,\left (\sigma _{l}^{2}\right )^{(loop-1)},s^{\left (loop\right )}\right )\).

-

Step4:

Generate \(\left (\sigma _{l}^{2}\right )^{(loop)}\) from \(\pi \left (\sigma _{l}^{2}|y,\mu _{l}^{\left (loop-1\right )},s^{(loop)}\right )\).

-

Step5:

Set loop = loop + 1 and go to Step 2.

The number of iterations set for Steps 2 to 4 is n. The first n 0 of these are discarded as burn-in draws, and the remaining n 1draws are retained to compute the parameter estimates. The full conditional distributions are given below and their derivations are available on request.

The posterior distribution for μ l , l = 0, 1, conditional on y, \(\sigma _{0}^{2}\), \(\sigma _{1}^{2}\) and s is an univariate normal distribution given by

where \(D_{\mu _{l}}=\left ( \underline {V}_{\mu }^{-1}+\left ( \sigma _{l}^{2}\right )^{-1}\right )^{-1}\) and \(\widehat {\mu }_{l}\,=\,D_{\mu _{l}}\left [\underline {V}_{\mu }^{-1}\underline {\mu }\,+\,\sum \limits ^{T}_{t=1}1\left (s_{t}\,=\,l\right )\left (\sigma _{s_{t}}^{2}\right )^{-1}y_{t}\right ]\).

The posterior distribution for \(\sigma _{l}^{2}\), l = 0, 1, conditional on y, μ 0, μ 1 and s is an inverse-Wishart distribution

where \(\tau _{\sigma _{l}^{2}}\,=\,\underline {\tau }_{\sigma ^{2}}\,+\,\sum \limits ^{T}_{t=1}1\left (s_{t}\,=\,l\right )\) and \(S_{\sigma _{l}^{2}}=\underline {S}_{\sigma ^{2}}+\sum \limits ^{T}_{t=1}1\left (s_{t}=l\right ) \left ( y_{t}\,-\,\mu _{s_{t}}\right ) \left ( y_{t}\,-\,\mu _{s_{t}}\right )^{\prime }\).

To generate regime variable s t , the multi-move Gibbs sampling method is used. Since the regime variable s t evolves independently of its own past values, the regimes s 1, … , s T are conditionally independent of each other given the data and other parameters:

where the success probability can be calculated as

Once the above probability is calculated, a random number from a uniform distribution between 0 and 1 is generated to compare with the calculated value of Prs t = 1|y, Θ. If the probability Prs t = 1|y, Θ is greater than the generated number, the regime variable s t = 1; otherwise, s t = 0.

Appendix B: Derivation of the Covolatility Test Statistic for Contagion

This appendix summarizes the key points in the derivation of the covolatility statistic for contagion. Further details are presented in Hsiao (2012). Consider the following generalized exponential distribution which has as its base the bivariate normal distribution, but with the addition of fourth order comoments labelled covolatility:

where \(\eta =\ln \iint \exp [ h] dr_{1}dr_{2}\), and

A test for bivariate normality in this distribution is a test of the parameter

Let the parameters of Eq. 18 be \(\Theta =\left \{ \mu _{1},\mu _{2},\sigma _{1}^{2},\sigma _{2}^{2},\rho ,\theta \right \}\). Under the null hypothesis, the maximum likelihood estimators of the unknown parameters are

The log likelihood function of the expression in Eq. 18 at time t is

where h is given by equations (19) and \(\eta =\ln \iint \exp [ h] dr_{1}dr_{2}\).

The asymptotic information matrix, derived in Fry et al. (2010), is

Using Eq. 23 and the properties of the bivariate normal distribution, the information matrix under H 0 is

Evaluating the gradient of 𝜃 under the null gives

The score function under the null is

The Lagrange multiplier statistic is obtained by substituting the expressions in Eqs. 24 and 26 into

The test statistic for contagion through the covolatility channel is

which is denoted by CV in the paper.

Appendix C: Summary of Crisis Dating Assumptions in Selected Papers for the Period of 1997 to 2013

Rights and permissions

About this article

Cite this article

Fry-McKibbin, R., Hsiao, C.YL. & Tang, C. Contagion and Global Financial Crises: Lessons from Nine Crisis Episodes. Open Econ Rev 25, 521–570 (2014). https://doi.org/10.1007/s11079-013-9289-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-013-9289-1

Keywords

- Contagion testing

- Correlation

- Coskewness

- Covolatility

- Asian crisis

- Russian crisis

- LTCM crisis

- Brazil crisis

- Dot-com crisis

- Argentinian crisis

- Sub-prime crisis

- Great recession

- European debt crisis

- Global financial crisis