Abstract

We report results from a comparison of numerically calibrated game theoretic integrated assessment models that explore the stability and performance of international coalitions for climate change mitigation. We identify robust results concerning the incentives of different nations to commit themselves to a climate agreement and estimate the extent of greenhouse gas mitigation that can be achieved by stable agreements. We also assess the potential of transfers that redistribute the surplus of cooperation to foster the stability of climate coalitions. In contrast to much of the existing analytical game theoretical literature, we find substantial scope for self-enforcing climate coalitions in most models that close much of the abatement and welfare gap between complete absence of cooperation and full cooperation. This more positive message follows from the use of appropriate transfer schemes that are designed to counteract free riding incentives.

Similar content being viewed by others

Notes

Most models implement Pareto-efficiency through maximization of the utilitarian sum of individual welfare per region. MICA computes Pareto-efficient strategies by solving a competitive equilibrium on international commodity markets with full internalization of the climate change externality.

The strategy set in stage 2 depends on the specific features of the models. These range from choosing abatement directly to the indirect approach of choosing to invest in a broad variety of capital stocks (including energy and abatement technologies). See the appendix for details.

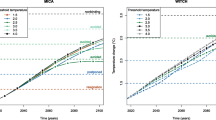

We apply the procedure thus outlined for the models MICA, WITCH and RICE, for details see Kornek et al. (2014).

To be precise, the pure rates of time preference are constant in RICE and MICA, but diminish in WITCH from an initial 3–2 % over the course of a century.

Technically, the STACO model only considers benefits from abatement, and payoffs do not depend on the level of damages.

Since marginal damages are not entirely flat in any of the models but STACO, this procedure is just an approximation of the decomposition of the cooperative carbon price but since the abatement of the OECD coalition is unambitious and leakage is small, the error is negligible.

Specifically, we will refer to model regions EUR, EU, and OLDEURO as “Europe”.

Some models use a weighted sum in the social welfare function, see model factsheets in the Appendix.

In MICA, the largest share falls onto the rest-of-the-world (ROW) region, which includes several non-OECD countries.

Model regions Middle East and North Africa (MENA), Non-EU Eastern Europe (TE), and Sub Saharan Africa (SSA).

These are the most commonly used concepts for this set of models in previous studies. The analysis could be extended to include blocking power (or core stability) which, for the sake of brevity, we leave for future work.

Technically, this is because the STACO model is characterized by superadditivity, which means that the total worth of a group of players involved in a merger does not decrease, see Eyckmans et al. (2013) for details.

In two models, there is no single carbon price within the coalition (WITCH and RICE) because maximization of social welfare for the coalition balances marginal value of emissions in terms of utility but not monetary units. This is different in MICA (where international trade balances marginal utility of consumption) and CWS (which uses a linear utility function). In WITCH and RICE, we instead use the social cost of carbon for the conversion (computed as the marginal utility of carbon inside the coalition divided by the marginal utility of average per-capita consumption inside the coalition).

References

Altamirano-Cabrera J, Finus M (2006) Permit trading and stability of international climate agreements. J Appl Econ 9(1):19–47

Barrett S (1994) Self-enforcing international environmental agreements. Oxf Econ Pap 46:878–894

Barrett S (2001) International cooperation for sale. Eur Econ Rev 45(10):1835–1850

Benchekroun H, Long N (2012) Collaborative environmental management: a review of the literature. Int Game Theory Rev 14(4):1240,002

Bosetti V, De Cian E (2013) A good opening: the key to make the most of unilateral climate action. Environ Resour Econ 55:44–56

Bosetti V, Carraro C, Galeotti M, Massetti E, Tavoni M (2006) WITCH: a world induced technical change hybrid Energy J 27(Special Issue 2):13–38

Bosetti V, Carraro C, Massetti E, Tavoni M (eds) (2014) Climate change mitigation. Edward Elgar Publishing, Cheltenham, Technological Innovation And Adaptation, A New Perspective on Climate Policy

Bréchet T, Gerard F, Tulkens H (2011) Efficiency versus stability in climate coalitions: a conceptual and computational appraisal. Energy J 32(1):49

Carraro C, Siniscalco D (1993) Strategies for the international protection of the environment. J Pub Econ 52(3):309–328

Carraro C, Eyckmans J, Finus M (2006) Optimal transfers and participation decisions in international environmental agreements. Rev Int Organ 1(4):379–396

Chander P, Tulkens H (1995) A core-theoretic solution for the design of cooperative agreements on transfrontier pollution. Int Tax Pub Finance 2:279–293

d’Aspremont C, Gabszewicz JJ (1986) New developments in the analysis of market structures. Macmillan, New York, chap On the stability of collusion, pp 243–264

Dellink R, de Bruin K, Nagashima M, van Ierland EC, Urbina-Alonso Y, Weikard HP, Yu S (2015) STACO technical document 3: model description and calibration of STACO-3, WASS Working Paper 2015–11, Wageningen University

Eyckmans J (2012) Review of applications of game theory to global climate agreements. Rev Bus Econ Lit 57(2):122–142

Eyckmans J, Finus M (2006) Coalition formation in a global warming game: how the design of protocols affects the success of environmental treaty-making. Nat Resour Model 19(3):323–358

Eyckmans J, Finus M (2007) Measures to enhance the success of global climate treaties. Int Environ Agreem: Politics Law Econ 7(1):73–97

Eyckmans J, Tulkens H (2003) Simulating coalitionally stable burden sharing agreements for the climate change problem. Resour Energy Econ 25:299–327

Eyckmans J, Finus M, Mallozzi L (2013) A new class of welfare maximizing stable sharing rules for partition function form games, working paper

Fankhauser S (1995) Valuing climate change: the economics of the greenhouse. Routledge, London

Finus M (2008) Game theoretic research on the design of international environmental agreements: insights, critical remarks, and future challenges. Int Rev Environ Resour Econ 2:29–67

Finus M, Pintassilgo P (2013) The role of uncertainty and learning for the success of international climate agreements. J Pub Econ 103:29–43

Finus M, van Ierland E, Dellink R (2006) Stability of climate coalitions in a cartel formation game. Econ Gov 7:271–291

Fuentes-Albero C, Rubio SJ (2010) Can international environmental cooperation be bought? Eur J Oper Res 202(1):255–264

Hoel M (1992) International environment conventions: the case of uniform reductions of emissions. Environ Resour Econ 2(2):141–159

Karp L, Simon L (2013) Participation games and international environmental agreements: a non-parametric model. J Environ Econ Manag 65(2):326–344

Kolstad C, Ulph A (2008) Learning and international environmental agreements. Clim Change 89:125–141

Kolstad C, Ulph A (2011) Uncertainty, learning and heterogeneity in international environmental agreements. Environ Resour Econ 50:389–403

Kornek U, Steckel J, Edenhofer O, Lessmann K (2013) The climate rent curse: new challenges for burden sharing, presented at 20th annual conference of the European Association of Environmental and Resource Economists, 26–29 June 2013, Toulouse, France, available at http://www.webmeets.com/EAERE/2013/prog/viewpaper.asp?pid=757

Kornek U, Lessmann K, Tulkens H (2014) Transferable and non transferable utility implementations of coalitional stability in integrated assessment models, CORE Discussion Paper nb 35

Lessmann K, Edenhofer O (2011) Research cooperation and international standards in a model of coalition stability. Resour Energy Econ 33(1):36–54

Lessmann K, Marschinski R, Edenhofer O (2009) The effects of tariffs on coalition formation in a dynamic global warming game. Econ Model 26(3):641–649

Luderer G, Pietzcker RC, Bertram C, Kriegler E, Meinshausen M, Edenhofer O (2013) Economic mitigation challenges: how further delay closes the door for achieving climate targets. Environ Res Lett 8(3):034033

McGinty M (2007) International environmental agreements among asymmetric nations. Oxf Econ Pap 59(1):45–62

Metz B, Davidson O, Bosch P, Dave R, Meyer L (eds) (2007) Contribution of working group III to the fourth assessment report of the intergovernmental panel on climate change. Cambridge University Press, Cambridge, and New York

Morris J, Paltsev S, Reilly J (2008) Marginal abatement costs and marginal welfare costs for greenhouse gas emissions reductions: results from the EPPA model, MIT Joint Program on the Science and Policy of Global Change. Report 164, Cambridge, MIT

Nagashima M, Dellink R, Van Ierland E, Weikard HP (2009) Stability of international climate coalitions–a comparison of transfer schemes. Ecol Econ 68(5):1476–1487

Nagashima M, Weikard HP, de Bruin K, Dellink R (2011) International climate agreements under induced technological change. Metroeconomica 62(4):612–634

Nordhaus W (2008) A question of balance: economic modelling of global warming. Yale University Press, New Haven

Nordhaus WD, Yang Z (1996) A regional dynamic general-equilibrium model of alternative climate-change strategies. Am Econ Rev 86(4):741–765

Paltsev S (2010) Baseline projections for the EPPA-5 model, personal communication

Paltsev S, Reilly J, Jacoby HD, Eckaus RS, McFarland J, Sarofim M, Asadoorian M, Babiker M (2005) The MIT emissions prediction and policy analysis (EPPA) model: version 4, MIT Joint Program on the Science and Policy of Global Change. Report 125, Cambridge, MIT

Ramsey F (1928) A mathematical theory of saving. Econ J 38(152):543–559

Tol R (2009) The economic effects of climate change. J Econ Perspect 23(2):29–51

Weikard HP (2009) Cartel stability under an optimal sharing rule. Manch Sch 77(5):575–593

Weikard HP, Finus M, Altamirano-Cabrera J (2006) The impact of surplus sharing on the stability of international climate agreements. Oxf Econ Pap 58(2):209–232

Yang Z (2008) Strategic bargaining and cooperation in greenhouse gas mitigations: an integrated assessment modeling approach. MIT Press, Cambridge

Acknowledgments

We would like to thank all participants of the two workshops that led to this model comparison (Potsdam 8–9th of February, 2012, and Venice, 24–25th of January, 2013), and two anonymus reviewers for their helpful comments. We also benefited from feedback to presentations of the manuscript at Grantham Institute, LSE, at IGIER, Bocconi, and at the EAERE2013 conference, which is gratefully acknowledged. Ingram Jackard contributed to the review of numerical coalition models an preparation of the initial workshop, and we are grateful to Patrick Doupe, who helped us improve our style and presentation. Kai Lessmann received funding from the German Federal Ministry for Education and Research (BMBF promotion references 01LA1121A). The research work of Bosetti and Emmerling was supported by the Italian Ministry of Education, University and Research and the Italian Ministry of Environment, Land and Sea under the GEMINA project. The research work of Nagashima was supported by Grants-in-Aid for Scientific Research from the Japan Society for the Promotion of Science, Grant Number 23730265.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix: Model Factsheets

Appendix: Model Factsheets

Model: MICA (Model of International Climate Agreements), PIK, Germany | |

Model description: Kornek et al. (2013) | |

Model concept | Solution method |

Multi-region optimal growth model with climate externality and international trade | Competitive equilibrium, full internalization of climate change damage within the coalition; implemented as non-linear optimization problem solved with a modified Negishi algorithm |

Welfare concept | Parametric specification |

Discounted utilitarianism in each region, joint welfare maximization with constant Negishi weights for the coalition | Pure rate of time preference \(\rho = 3\)%, elasticity of marginal utility \(\eta = 1\) |

Markets and Trade | Model anticipation |

Consumption good | Perfect foresight |

Number of region: 11 | |

AFR Sub-Saharan Africa without South Africa | |

CHN China | |

EUR EU-27 | |

IND India | |

JPN Japan | |

LAM All American countries except Canada and the United States | |

MEA North Africa, Middle Eastern and Arab Gulf countries, resource exporting countries within the former Soviet Union, and Pakistan | |

OAS South East Asia, North Korea, South Korea, Mongolia, Nepal, Afghanistan | |

ROW Australia, Canada, New Zealand, South Africa and non-EU27 European states except Russia | |

RUS Russia | |

USA United States of America | |

Base year | Time horizon and step |

2005 | 2005–2195, 10 years |

Climate | Climate change |

Greenhouse Gases: CO\(_2\) | Temperature response model |

Carbon dioxide concentration (ppm) | |

Temperature change (\(^{\circ }\hbox {C}\)) | |

Mitigation options | Climate impacts |

Abatement cost function for CO\(_2\) based on mitigation cost information from the REMIND model (Luderer et al. 2013) | Region-specific quadratic damage function in temperature increase |

Damage as [%] of GDP based on Fankhauser (1995) following Finus et al. (2006) | |

Land use | Resources considered |

— | — |

Model: STACO-3 (Stability of Coalitions), Wageningen University, The Netherlands | |

Model description: Nagashima et al. (2011), Dellink et al. (2015) | |

Model concept | Solution method |

Combined game-theoretic and integrated assessment model with regional benefits (avoided damages) and abatement costs of greenhouse gas emissions | Partial agreement Nash equilibrium between signatories and singletons |

Welfare concept: Discounted net present value of regional payoff in each region, joint payoff maximization within coalitions; no full welfare evaluation but the Keynes–Ramsey rule used for discounting payoffs is consistent with a logarithmic utility function. | Parametric specification: Pure rate of time preference \(\rho =1.5\)%; implicitly \(\eta =1\) |

Markets and Trade | Model anticipation |

Carbon Trade is modelled as transfers between coalition members | Perfect foresight |

Number of region: 12 | |

BRA Brazil | |

CHN China | |

EUR EU and EFTA (EU-27, Iceland, Liechtenstein, Norway, Switzerland) | |

HIA High-income Asia (Indonesia, Malaysia, Philippines, Singapore, South Korea, Taiwan, and Thailand) | |

IND India | |

JPN Japan | |

MES Middle Eastern countries | |

OHI Other high income countries (including for example, Australia, Canada and New Zealand) | |

ROE Rest of Europe | |

ROW Rest of the world | |

RUS Russia | |

USA United States of America | |

Base year | Time horizon and step |

2011 | 2011–2106, 5 years |

Climate | Climate change |

Greenhouse Gases: CO\(_2\), CH\(_4\), N\(_2\)O, PFCs, HFCs, SF\(_6\), based on EPPA-5 model to calibrate the regional GHGs BAU emission paths | CO\(_2\)-e concentration (ppm) Radiative Forcing (W/m\(^2\))Temperature change (\({^{\circ }\hbox {C}}\)) |

Mitigation options: Regional abatement cost functions for GHGs are based on regional cost parameters from the EPPA model (Morris et al. 2008) | |

Climate impacts: Benefits are calculated as the net present value of the stream of future avoided damages from a unit of abatement in the current period, taking regional GDP growth and inertia in the climate system into account (Nagashima et al. 2011). This function is calibrated to a simple climate module, based on the DICE model (Nordhaus 2008), but calibrated on the EPPA-5 model (Paltsev et al. 2005; Paltsev 2010). The linear global benefit function is based on estimates of climate damage by Tol (2009). Benefits are allocated across regions with a share for each region (Finus et al. 2006). | |

Land use | Resources considered |

— | — |

Model: CWS (ClimNeg World Simulation model, Version 2.0), KU Leuven, Belgium | |

Model description: Bréchet et al. (2011) | |

Model concept | Solution method |

Multi-region optimal growth model with climate externality, maximization of coalition welfare, internalization of climate externality for coalition members | Nash equilibrium of carbon emission game solved by tatonnement algorithm between coalition and non-members |

Welfare concept | Parametric specification |

Discounted utilitarianism in each region, coalition’s welfare maximization with equal welfare weights for all members | \(\rho = 1.5\)% (constant), \(\eta = 0\) (linear in consumption) |

Markets and Trade | Model anticipation |

no trade in goods, trade in carbon emission permits (optional) | Perfect foresight |

Number of region: 6 | |

USA: United States of America | |

JAP: Japan | |

EU: South East Asia | |

China: China | |

FSU: Former Soviet Union | |

ROW: Rest of the World | |

Base year | Time horizon and step |

2000 | 2000–2310, 10 years |

Climate | Climate change |

Greenhouse Gases: CO\(_2\) | 3-box model of carbon cycle (atmosphere, lower and upper ocean) |

CO\(_{2}\)-e concentration (ppm) | |

Radiative Forcing (W/m\(^2\) ) | |

Atmospheric and ocean temperature change (\(^{\circ }\hbox {C}\)) | |

Mitigation options | Climate impacts |

Exogenous emission efficiency improvement over time plus region-specific abatement cost functions (power functions, exponent 2.887) | Region-specific damage function, power function of atmospheric temperature change (exponent 3.0), damage as [%] of GDP |

Land use | Resources considered |

– | – |

Model: WITCH (World Induced Technical Change Hybrid model, version 2012), FEEM, Italy | |

Model description: Bosetti et al. (2014) | |

Model concept | Solution method |

Hybrid Optimal growth model, including a bottom-up energy sector and a simple climate model, embedded in a game theoretic setup | Regional growth models solved by non-linear optimization and game theoretic setup solved by tatonnement algorithm between coalitions and non-members (Nash equilibrium) |

Welfare concept | Parametric specification |

Discounted Utilitarianism, coalition’s welfare maximization with equal welfare weights for all members | \(\rho = 3\)% decreasing, \(\eta = 1\) (log of consumption) |

Markets and Trade | Model anticipation |

Oil | Perfect foresight |

Number of region: 13 | |

CAJAZ: Canada, Japan, New Zeland | |

CHINA: China, including Taiwan | |

EASIA: South East Asia | |

INDIA: India | |

KOSAU: South Korea, South Africa, Australia | |

LACA: Latin America, Mexico and Caribbean | |

MENA: Middle East and North Africa | |

NEWEURO: EU new countries, CHE, NOR oldeuro: EU old countries (EU-15) | |

SASIA: South Asia | |

SSA: Sub Saharan Africa | |

TE: Non-EU Eastern Europe, including Russia | |

USA: United States of America | |

Base year | Time horizon and step |

2005 | 2005–2150, 5 years |

Climate | Climate change |

Greenhouse Gases: | 3-box model of carbon cycle |

CO\(_2\), CH\(_4\), N\(_2\)O, HFCs, CFCs, SFs | CO\(_2\)-e concentration (ppm) |

Aerosols considered: yes | Radiative Forcing (W/m\(^2\) ) |

Temperature change (\(^{\circ }\hbox {C}\)) | |

Mitigation options | Climate impacts |

Abatement cost functions for non-CO2 GHGs | Region-specific damage function with linear and power function term with exponent 2.2 in the temperature increase Damage as [%] of GDP |

Land use | |

Decarbonization options in the Energy system (Renewables, Nuclear, Biomass, CCS) | |

Land use | Resources considered |

Emissions from land use change are considered | Coal, Oil, Gas, Uranium, Biomass |

Model: RICE Regional Integrated model of Climate and the Economy, SUNY Binghampton, USA | |

Model description Yang (2008) | |

Model concept | Solution method |

Multi-region Ramsey-type growth model with joint production of GHG emission that causes climate externality | the non-cooperative Nash equilibrium; cooperative solutions under various assumptions of incentive compatibilities; coalition solutions (called “hybrid” Nash equilibria in Yang (2008)) |

Welfare concept | Parametric specification |

Discounted sum of regional utility functions. | Pure rate of time preference \(\rho =3\)%, elasticity of marginal utility \(\eta =1\) |

Markets and Trade | Model anticipation |

- | Perfect foresight |

Number of region: 6 | |

CHN China | |

EEC Eastern European countries and the former Soviet Union | |

EU European Union | |

OHI Other high-income countries | |

ROW Rest of the world | |

USA United States of America | |

Base year | Time horizon and step |

2000 | 2000–2245 (5 years) |

Climate | Climate change |

CO\(_2\) emissions and other exogenously set GHG emissions | the Schneider box model |

Mitigation options | Climate impacts |

Mitigation cost functions based on Nordhaus and Yang (1996) and updated with Yang (2008) which contains updates provided by Nordhaus | Climate damage functions based on Nordhaus and Yang (1996) and updated with Yang (2008) which contains updates provided by Nordhaus |

Land use | Resources considered |

exogenously set | Availability of fossil fuel resources at global level has been checked implicitly |

Rights and permissions

About this article

Cite this article

Lessmann, K., Kornek, U., Bosetti, V. et al. The Stability and Effectiveness of Climate Coalitions. Environ Resource Econ 62, 811–836 (2015). https://doi.org/10.1007/s10640-015-9886-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-015-9886-0