Abstract

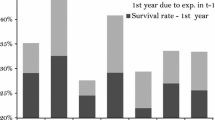

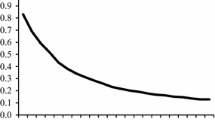

In endeavouring to explain the empirical puzzle that the sunk costs of exporting are important, but that, at the same time, trade flows do not, on average, survive for very long, this paper explores the concepts of core and peripheral markets. First, it illustrates that if the importance of sunk costs as well as the expected future returns from exporting are different, depending on whether the export decision refers to a core or a peripheral market, it is plausible that while firms will tend to stay on the core market for a long time, they will enter and exit the peripheral market much more frequently. Second, using firm-product-destination-specific export data for all firms in the Swedish food chain for the period 1997–2007, an empirical test is carried out to ascertain whether there is support for the hypothesis that trade duration will be longer for core markets. Employing two variables that capture different aspects of the core/periphery dimension, it is found that firms will indeed tend to stay longer in their core markets, while export decisions regarding peripheral markets are much less long-term. The conclusion, therefore, is that the empirical puzzle can be explained by taking into account the fact that the trade hysteresis literature builds on data on the core market decision to export or not, while the trade survival literature also includes data on decisions to stay in or exit peripheral markets.

Similar content being viewed by others

Notes

See the empirical section below for a more thorough discussion of how to define core and peripheral markets.

We want to stress from the start that we aim to offer one plausible explanation for the seemingly contradictory results in the two literatures, but we cannot rule out that there may be other explanations.

Note that Ilmakunnas and Nurmi (2010) have applied this approach in order to investigate export market entry and exit.

Note that \( \tilde{Y}_{i,t - j} = (Y_{i,t - j} \prod\nolimits_{k}^{j - 1} {(1 - Y_{i,t - k} )} ) \) takes the value one if the firm exported j years ago and zero otherwise.

See also Sutton (1991), who discusses sunk costs of advertising as well as the importance of advertising for food and beverage.

See Das et al. (2007) for an exception when it comes to a structural model in order to model the export decision.

Noting that observations on trade duration are typically discrete (since they are grouped into yearly intervals), Hess and Persson (2012) outline three major problem with the popular Cox model when applied to the typically very large trade data sets. First, when there are many so-called ties, i.e. observations with the same spell length, the Cox model can lead to biased coefficients and standard errors. Due to the fact that we usually only observe trade values once a year, or possibly once a month, this is a serious problem when dealing with trade durations. Second, it is difficult to control properly for unobserved heterogeneity, even though not doing so can bring about spurious duration dependence. Third, the Cox model makes a restrictive assumption about proportional hazards, which is unlikely to hold empirically.

The papers that do not use the Cox model tend to use a discrete-time complementary log log (cloglog) model instead. Hess and Persson (2012) note that this is not a good solution, because the cloglog model makes the same questionable assumption of proportional hazards.

The product codes of the Combined Nomenclature have been used and we employ keys between years to make all codes consistent over time. Note that a firm is only obliged to hand in export information to Statistics Sweden when its collected annual exports to the EU exceed 4.5 million Swedish krona.

Since it could be argued that such multiple spells are not independent, we include dummy variables in the regression model to capture whether the firm has exported the same product to the same destination once, twice or three times before.

As presented below, our data sample relates to exports from Swedish firms in the food chain. While it may seem counterintuitive for food chain firms to export capital goods, some firms have many plants that cover many different types of industries.

African, Caribbean and Pacific (ACP) countries have enjoyed preferential market access to Sweden since its EU membership in 1995, while other developing countries are offered less advantageous preferential market access under the Generalized System of Preferences (GSP). It may seem counter-intuitive to control for these preferential arrangements, since they are one-way preferences and thereby (directly) lower trade barriers for Swedish imports rather than exports. However, these preferential programs have rather restrictive rules of origin—and in particular regarding cumulation of origin—and this could force the exporters to import intermediate products from EU countries such as Sweden in order to be able to apply for preferential tariff treatment. In other words, it is reasonable to expect an indirect effect on Swedish firms’ exports.

In addition to the main TFP measure which is presented above, we have also used an alternative TFP based on Olley and Pakes (1996), and the results are the same.

Unfortunately, the ownership data is firm-specific and does not vary by product or export destination. This implies that one should be cautious not to make too strong interpretations of these results.

We found that the number of products exported to a country increased with 0.04 % as the size of the country increased with 1 % (based on a linear model with firm-country fixed effects). In addition, a logit regression on a firm-country, instead of a firm-country-product level as in Table 4, resulted in an expected negative coefficient of the GDP variable, which indicates that the size of the country is more valid for the firm’s decision when it comes to export or not to a particular country but less important when it comes to the decision at product level.

We note, however, that some interesting patterns may be observed. The location in Sweden is important and firms located in the county of Scania stand out as those with the longest duration of export flows, which is in line with the fact that we find a cluster of food processors in this region. The regional destination dummies are not as diverse as the location dummies but export flows to sub-Saharan Africa survive for a shorter period compared to export flows to the other regions (keeping all other variables equal, which may explain the positive coefficient of ACP). In addition, export of processed food, the lion’s share of the total exports in this value chain, seems to have longer survival, which is in line with Arkolakis and Muendler (2011) since processed foods constitute the top products of the food chain. When it comes to industry belonging, we note that the survival of exports from upstream firms (i.e. the agricultural sector) is much lower compared to all others.

References

Antràs, P. (2003). Firms, contracts, and trade structure. Quarterly Journal of Economics, 118(4), 1375–1418.

Arkolakis, C. (2010). Market penetration costs and the new consumers margin in international trade. Journal of Political Economy, 118(6), 1151–1199.

Arkolakis, C., & Muendler, M.-A. (2011). The extensive margin of exporting products: A firm-level analysis. (NBER Working Paper 16641). Cambridge, MA: National Bureau of Economic Research.

Aw, B. Y., Chung, S., & Roberts, M. J. (2003). Productivity, output, and failure: A comparison of Taiwanese and Korean manufactures. Economic Journal, 113(November), 485–510.

Békés, G., & Muraközy, B. (2012). Temporary trade and heterogeneous firms. Journal of International Economics, 87(2), 232–246.

Bernard, A. B., Eaton, J. E., Bradford Jensen, J., & Kortum, S. (2003). Plants and productivity in international trade. American Economic Review, 93(4), 1268–1290.

Bernard, A. B., & Jensen, J. B. (2004). Why some firms export. Review of Economics and Statistics, 86(2), 561–569.

Bernard, A. B., Redding, S. J., & Schott, P. K. (2010). Multi-product firms and product switching. American Economic Review, 100(1), 70–97.

Besedeš, T. (2008). A search cost perspective on formation and duration of trade. Review of International Economics, 16(5), 835–849.

Besedeš, T. (2011). Export differentiation in transition economies. Economic Systems, 35(1), 25–44.

Besedeš, T., & Prusa, T. J. (2006a). Ins, outs and the duration of trade. Canadian Journal of Economics, 39(1), 266–295.

Besedeš, T., & Prusa, T. J. (2006b). Product differentiation and duration of US import trade. Journal of International Economics, 70(2), 339–358.

Besedeš, T., & Prusa, T. J. (2011). The role of extensive and intensive margins and export growth. Journal of Development Economics, 96(2), 371–379.

Brenton, P., Saborowski, C., & von Uexküll, E. (2010). What explains the low survival rate of developing country export flows. World Bank Economic Review, 24(3), 474–499.

Cadot, O., Iacovone, L., Pierola, D., & Rauch, F. (2011). Success and failure of African exporters. (Policy Research Working Paper No. 5657). Washington, DC: World Bank.

Cameron, A. C., & Trivedi, P. K. (2010). Microeconometrics using stata: Revised edition. Stata Press, Texas.

Creusen, H., & Lejour, A. (2011). Uncertainty and the export decision of Dutch firms. (CPB Discussion Paper No. 183). The Hague: Netherlands Bureau for Economic Policy Analysis.

Das, S., Roberts, M. J., & Tybout, J. R. (2007). Market entry costs, producer heterogeneity, and export dynamics. Econometrica, 75(3), 837–873.

Dixit, A. (1989a). Entry and exit decisions under uncertainty. Journal of Political Economy, 97(3), 620–638.

Dixit, A. (1989b). Hysteresis, import penetration, and exchange rate pass-through. Quarterly Journal of Economics, 104(2), 205–228.

Dixit, A. (1992). Investment and hysteresis. Journal of Economic Perspective, 6(1), 107–132.

Dobson, P., Waterson, M., Konrad, K., & Matutes, C. C. (1999). Retailer power: Recent developments and policy implications. Economic Policy, 14(28), 135–164.

Esteve-Pérez, S., Requena-Silvente, F., & Pallardó-López, V. (2012). The duration of firm-destination export relationships: Evidence from Spain, 1997–2006. Economic Inquiry, 51(1), 159–180.

Fishman, A., & Rob, R. (2003). Consumer inertia, firm growth and industry dynamics. Journal of Economic Theory, 109(1), 24–38.

Freund, C., & Pierola, M. D. (2010). Export entrepreneurs. Evidence from Peru. (Policy Research Working Paper 5407). Washington, DC: World Bank.

Fugazza, M., & Molina, A. C. (2009). The determinants of trade survival. (HEID Working Paper No 05/2009). Economics Section, The Graduate Institute of International Studies.

Görg, H., Kneller, R., & Muraközy, M. (2007). What makes a successful export? (CEPR Discussion Paper 6614). London: Centre for Economic Policy Research.

Greenaway, D., & Kneller, R. (2007). Exporting, productivity and agglomeration. European Economic Review, 52(5), 919–939.

Gullstrand, J. (2011). Firm and destination-specific export costs: The case of the Swedish food sector. Food Policy, 36(2), 204–213.

Hess, W., & Persson, M. (2011). Exploring the duration of EU imports. Review of World Economics/Weltwirtschaftliches Archiv, 147(4), 665–692.

Hess, W., & Persson, M. (2012). The duration of trade revisited. Continuous-time vs. discrete-time hazards. Empirical Economics, 43(3), 1083–1107.

Ilmakunnas, P., & Nurmi, S. (2010). Dynamics of export market entry and exit. Scandinavian Journal of Economics, 112(1), 101–126.

Jaud, M., & Kukenova, M. (2011). Financial development and survival of African agri-food exports. (Policy Research Working Paper 5649). Washington, DC: World Bank.

Melitz, M. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Melitz, M., & Ottaviano, G. I. P. (2008). Market size, trade, and productivity. Review of Economic Studies, 75(1), 295–316.

Nitsch, V. (2009). Die another day: Duration in German import trade. Review of World Economics/Weltwirtschaftliches Archiv, 145(1), 133–154.

Olley, G. S., & Pakes, A. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica, 64(4), 1263–1297.

Roberts, M. J., & Tybout, J. R. (1997). The decision to export in Colombia: An empirical model of entry with sunk costs. American Economic Review, 87(4), 545–564.

Sabuhoro, J. B., Larue, B., & Gervais, Y. (2006). Factors determining the success or failure of Canadian establishments on foreign markets: A survival analysis approach. International Trade Journal, 20(1), 33–73.

Sutton, J. (1991). Sunk costs and market structure. Cambridge, MA: MIT Press.

Tovar, J., & Martínez, L. R. (2011). Diversification, networks and the survival of exporting firms. Serie Documentos CEDE, 2011-08, Universidad de Los Andes.

Volpe-Martincus, C., & Carballo, J. (2008). Survival of new exporters in developing countries: Does it matter how they diversify? Globalization, Competitiveness and Governability, 2(3), 30–49.

Wagner, J. (2007). Exports and productivity: A survey of the evidence from firm-level data. World Economy, 30(1), 60–82.

Acknowledgments

The authors are grateful for helpful comments and suggestions from seminar participants at Örebro University, the European Trade Study Group (ETSG) 13th Annual Conference in Copenhagen, Denmark, Ratio in Stockholm, University of Tennessee and Georgia Tech. We gratefully acknowledge financial support from the Jan Wallander and Tom Hedelius Foundation under Grant Nos. P2009-0118:1 and W2009-0352:1, and thank AgriFood Economics Centre in Lund for providing us with data. The paper has previously been circulated under the title “The Survival of Swedish Food Exports”.

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Gullstrand, J., Persson, M. How to combine high sunk costs of exporting and low export survival. Rev World Econ 151, 23–51 (2015). https://doi.org/10.1007/s10290-014-0204-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-014-0204-7

Keywords

- Sunk costs

- Trade duration

- Survival

- Core versus peripheral markets

- Sweden

- Firm-level data

- Discrete-time hazard models