Abstract

This paper analyzes the effect of a fiscal equalization system on the composition of government expenditures of subnational governments. We incorporate vertical equalization transfers with optimal choice of the composition of government expenditures in an endogenous growth model and show that such transfers reduce the incentives of recipient subnational governments to undertake productive expenditures. Using data for Canadian provinces, we find evidence that, after controlling for a number of determinants of government expenditures, the ratio of productive expenditures to total government expenditures was lower in equalization-receiving than non-receiving provinces.

Similar content being viewed by others

Notes

“Among the worlds federations, the USA is an extreme outlier with regard to the efforts undertaken by the national government to equalize the taxing capacity of subnational jurisdictions.” (Stark 2010, p. 3). Transfers from the US federal government to the states take the form of block grants or project-based transfers (Fisman and Gatti 2002). Even though the USA does not have a formal equalization system, there is redistribution between regions within the USA. Bayoumi and Masson (1995) analyze federal taxes and transfers within the USA and find that “redistributive flows from all federal sources amount to around 22 cents in a dollar” (p. 269).

See Blöchliger and Charbit (2008) for a detailed overview of the types of equalization systems used by national governments.

The intuition for the argument is that the transfers effectively compensate subnational governments for a portion of the dead weight loss associated with distortionary taxes, thus tending to increase the level of such taxes in recipient provinces.

Most of the literature takes an optimal tax approach in which the government chooses tax rates to minimize the deadweight loss from taxation subject to a revenue or government expenditure constraint.

Dahlby (2002) reviews a number of incentive effects of fiscal equalization payments and provides a simple framework to analyze whether subnational governments would under- or over-provide government investment services.

A number of studies have used the Barro (1990) model to examine how different types of government spending might affect the long-run growth of an economy. For a recent survey of the different extensions to the Barro model, see Irmen and Kuehnel (2009). Also, see Kneller et al. (1999) and Bleaney et al. (2001) for empirical studies examining the predictions of the Barro model.

The equalization function we use captures the “claw-back” feature present in the Canadian equalization system. For further details, see the discussion in Sect. 2.

We follow the literature examining the size of governments to determine the control variables for our regressions. See Sect. 4 for details.

See Fatás et al. (1998) for a discussion of this issue.

In a recent study, Albouy (2012) evaluates the equity and efficiency of the equalization system in Canada and finds that the Canadian equalization system is neither efficient nor equitable.

(Boadway (2004), p. 213) uses the term gross transfer scheme for the latter and net transfer scheme for the former.

In general, there are two approaches to determine the amount of the transfer: using a representative tax base system (for example Canada, Italy, Finland, and Norway) or using actual tax revenues (for example Greece, Portugal, Switzerland, and the UK). The two approaches are used for both vertical and horizontal transfer systems. See (Blöchliger and Charbit (2008), p. 10) for details.

For a discussion of the disincentive effect of this claw-back or base tax-back, see (Boadway (2004), p. 240). Boadway argues that the base tax-back effect is a potentially more powerful disincentive and occurs when regions can directly control the size of the tax base.

The “standard” is based on the provinces of Quebec, Ontario, Manitoba, Saskatchewan, and British Columbia.

An alternative approach to analyze this issue would be to consider the decentralized equilibrium in our framework. In a decentralized equilibrium, the representative consumer and producer do not take into account the externality from the publicly provided investment services when making their decisions. Though the growth rate in the BGP is different in the two approaches, the mechanism for deciding between the consumption and productive services provided by the government in the decentralized equilibrium would be similar to that of the planner’s problem.

For a further discussion of equalization formulas, see Dafflon and Vaillancourt (2003).

For tractability, a number of studies that use an endogenous growth model to examine the composition of government expenditure assume linearity of government expenditures with respect to output per worker (see Barro 1990; Chen 2006; Chatterjee et al. 2012, among others). Further, given the claw-back feature of equalization revenues, allowing allocation of these revenues for current expenditures would not alter the main finding of the model.

Given that equalization payments are unpredictable, they may not feature in the allocation decision of the government in the current period.

Endogenous growth requires that there be no diminishing returns to \(k\), which implies that the production function be of the Ak form (Barro 1990).

For \(\theta =1\), the derivative is positive for \(\alpha >0.5\). For lower values of \(\theta \), the derivative would be positive for lower values of \(\alpha \). For example, if \(\theta =0.25\), then the derivative is positive for values of \(\alpha >0.2\).

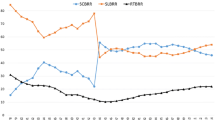

Provincial government expenditure data for Canada are only available for the period between 1989 and 2009. The data were obtained form CANSIM Table 3850001. For details on consolidated federal, provincial, territorial, and local government revenue and expenditures, see: http://www23.statcan.gc.ca/imdb/p2SV.pl?Function=ssgetSurvey&db=imdb&adm=8&dis=2&SDDS=1735&lang=en.

Kneller et al. (1999) also include defense as a productive expenditure. However, defense expenditures are only undertaken by the federal government, and hence, these are not included in our classification. Further, three expenditures categories available in CANSIM—expenditure on research establishments, employee pension plan benefits, and changes in equity and motor vehicle accident compensation—were excluded from the analysis due to very limited information.

We undertook a number sensitivity of checks for our results by redefining our classification of productive and unproductive expenditures. For example, our findings reported in this section were qualitatively similar when we reclassified Resource & industrial development and Regional planning & development as productive expenditures.

The ratio of unproductive expenditures to total expenditures \(\left( \frac{g^{u}}{g}\right) \) corresponds to the parameter \(\theta \) in the model in Sect. 3.

Even though British Columbia received equalization in a few years over the period of our analysis, it has been classified as a non-receiving province. Similarly, Ontario received equalization payments for 1 year in 2009, but has been classified as a non-receiving province.

We examined the sensitivity of our results by restricting our definition of equalization-receiving provinces to the five provinces that received equalization payments for the entire period and found that our results were qualitatively unchanged.

The dependency ratio is defined as the fraction of population younger than 18 years or older than 65 years.

The data were obtained from CANSIM Tables 320002 and 290035. For details on provincial data for Capital and Repair Expenditures, see http://www23.statcan.gc.ca/imdb/p2SV.pl?Function=getSurvey&SDDS=2803&Item_Id=881.

The variable \(govavwage\) is defined as the total public sector wage bill divided by total number of public sector employees.

Similar to the results reported in Table 4, when all control variables are included in the regression, the estimated coefficient for Eqdum for the ratio of unproductive to total expenditures \(\left( \frac{g^{u}}{g}\right) \) was negative and statistically significant.

References

Albouy, D. (2012). Evaluating the efficiency and equity of federal fiscal equalization. Journal of Public Economics, 96(9), 824–839.

Alesina, A., & Wacziarg, R. (1998). Openness, country size and government. Journal of Public Economics, 69(3), 305–321.

Barro, R. J. (1990). Government spending in a simple model of endogenous growth. Journal of Political Economy, 98(5), S103–S125.

Baskaran, T. (2012). The flypaper effect: Evidence from a natural experiment in Hesse. MPRA Paper No. 37144.

Bayoumi, T., & Masson, P. R. (1995). Fiscal flows in the United States and Canada: Lessons for monetary union in Europe. European Economic Review, 39(2), 253–274.

Bleaney, M., Gemmell, N., & Kneller, R. (2001). Testing the endogenous growth model: Public expenditure, taxation, and growth over the long run. Canadian Journal of Economics, 34(1), 36–57.

Blöchliger, H., & Charbit, C. (2008). Fiscal equalization. OECD Economic Studies No. 44, 2008/1.

Boadway, R. (2004). The theory and practice of equalization. CESifo Economic Studies, 50(1), 211–254.

Boadway, R., & Flatters, F. (1982). Efficiency and equalization payments in a federal system of government: A synthesis and extension of recent results. Canadian Journal of Economics, 15(4), 613–633.

Boadway, R., & Hayashi, M. (2004). An evaluation of the stabilization properties of equalization in Canada. Canadian Public Policy, 30(1), 91–109.

Boadway, R. W., & Hobson, P. A. R. (1998). Equalization: Its contribution to Canada’s economic and fiscal progress (Vol. 36). Kingston, Ontario: John Deutsch Institute for the Study of Economic Policy, Queen’s University.

Buchanan, J. M. (1950). Federalism and fiscal equity. American Economic Review, 40(4), 583–599.

Buchanan, J. M. (1952). Federal grants and resource allocation. Journal of Political Economy, 60(3), 208–217.

Chatterjee, S., Paola, G., & Ilker, K. (2012). Where has all the money gone? Foreign aid and the composition of government spending. The B.E. Journal of Macroeconomics, 12(1), 1–36.

Checherita, C., Nickel, C., & Rother, P. (2009). The role of fiscal transfers for regional economic convergence in Europe. European Central Bank Working Paper No. 1029.

Chen, B.-L. (2006). Economic growth with an optimal public spending composition. Oxford Economic Papers, 58(1), 123–136.

Courchene, T. (1994). Social Canada in the millennium: Reforming imperatives and restructuring principles. Toronto: C.D. Howe Institute.

Dafflon, B., & Vaillancourt, F. (2003). Problems of equalisation in federal systems. In R. Blindenbacher, A. Koller (Eds.), Federalism in a changing world: Learning from each other (pp. 395–411). McGill-Queen’s Press-MQUP.

Dahlby, B. (2002). The incentive effects of fiscal equalization grants. Atlantic Institute for Market Studies, Paper (4).

Fatás, A., Andersen, T. M., & Martin, P. (1998). Does EMU need a fiscal federation? Economic Policy, 13(26), 163–203.

Fisman, R., & Gatti, R. (2002). Decentralization and corruption: Evidence from US federal transfer programs. Public Choice, 113(1–2), 25–35.

Hammes, D. L., & Wills, D. T. (1987). Fiscal illusion and the grantor government in Canada. Economic Inquiry, 25(4), 707–713.

Irmen, A., & Kuehnel, J. (2009). Productive government expenditure and economic growth. Journal of Economic Surveys, 23(4), 692–733.

Kneller, R., Bleaney, M. F., & Gemmell, N. (1999). Fiscal policy and growth: Evidence from OECD countries. Journal of Public Economics, 74(2), 171–190.

Logan, R. R. (1986). Fiscal illusion and the grantor government. Journal of Political Economy, 94(6), 1304–1318.

Oates, W. E. (1988). On the measurement of congestion in the provision of local public goods. Journal of Urban Economics, 24(1), 85–94.

Rodrik, D. (1998). Why do more open economies have bigger governments? Journal of Political Economy, 106(5), 997–1032.

Shelton, C. A. (2007). The size and composition of government expenditure. Journal of Public Economics, 91(11), 2230–2260.

Smart, M. (1998). Taxation and deadweight loss in a system of intergovernmental transfers. Canadian Journal of Economics, 31(1), 189–206.

Stark, K. J. (2010). Rich states, poor states: Assessing the design and effect of a US fiscal equalization regime. Tax Law Review, 63, 957–1008.

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful for helpful comments from Stefan Dodds and seminar participants at the 2012 Canadian Economics Association meetings in Calgary. We thank Edgar Cudmore for his assistance with obtaining the data for the analysis.

Rights and permissions

About this article

Cite this article

Cyrenne, P., Pandey, M. Fiscal equalization, government expenditures and endogenous growth. Int Tax Public Finance 22, 311–329 (2015). https://doi.org/10.1007/s10797-014-9310-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-014-9310-7