Abstract

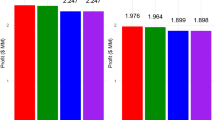

Downscaled climate change projections for California, when translated into changes in irrigation water delivery and then into profit from agriculture in the Central Valley, show an increase in conventional measures of variability such as the variance. However, these increases are modest and mask a more pronounced increase in downside risk, defined as the probability of unfavorable outcomes of water supply or profit. This paper describes the concept of downside risk and measures it as it applies to outcomes for Central Valley agriculture projected under four climate change scenarios. We compare the effect of downside risk aversion versus conventional risk aversion or risk neutrality when assessing the impact of climate change on the profitability of Central Valley agriculture. We find that, when downside risk is considered, the assessment of losses due to climate change increases substantially.

Similar content being viewed by others

Notes

Downside risk was first modeled by Roy (1952), who noted that investors frequently put the conservation of their principal as their first goal and set some minimum acceptable return that will conserve the principal.

Kiparsky (2010) interviewed water managers on the eastside of the San Joaquin Valley, part of our study area, to elicit their utility functions for water supply risk and found strong evidence of downside risk aversion on their part.

Connell-Buck et al. (2011) employ the same approach.

CALSIM output includes stream flow for the main rivers in the Central Valley, reservoir inflows, storage, and releases, and water deliveries to Central Valley Project (CVP) and State Water Project (SWP) contractors throughout the Central Valley. The CALSIM projections under climate change are in Chung et al. (2009). There are also projections for mid-century (2035–2064); our analysis of those projections is presented in an online Appendix. These deliveries were converted from monthly flow levels to annual deliveries based on the time in each month and matched to CVPM regions using CVPM files that match delivery nodes to CVPM regions. We modified historical non-project water deliveries by the same percentage as average changes in project water deliveries.

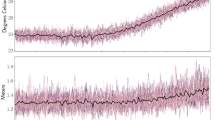

In principle, some of the downside risk apparent in Fig. 1 could be mitigated with additional storage capacity. The Sacramento-San Joaquin River system has only about 1 year’s storage compared, say, to 3 years’ storage on the Colorado River. The need for additional storage has been discussed in California for over 25 years. So far, little progress has occurred because of disagreements about who should pay for new storage. Moreover, the over-riding concern currently is for major new investment in conveyance infrastructure to replace existing conveyance facilities highly vulnerable to seismic risks.

CVPM includes twenty crops, some of which are aggregates of several specific crops. The twenty crops are: grains (includes wheat, barley & oats), rice, cotton, sugarbeets, corn & corn silage, dry & lima beans, safflower, alfalfa (includes alfalfa hay, alfalfa seed, and clover), pasture, field crops (includes sudan grass, sunflower, other misc. field crops), process tomatoes, fresh tomatoes, onions & garlic, potatoes, almonds & pistachios, other deciduous (includes peaches, walnuts, nectarines, pears, cherries, apples, misc), subtropical (includes citrus, avocados, olives, figs, misc), vines (includes raisins, wine, and table grapes), truck crops (includes carrots, cauliflower, lettuce, peas, spinach, broccoli, asparagus, peppers, sweet potatoes, misc), and cucurb (includes cantelope, honeydew, watermelon, squash, and cucumbers).

Output from other regions is implicitly held constant. To the extent that climate change reduces (increases) production worldwide, the price responses in the paper are under (over) estimates.

The model does not consider the option of deficit irrigation resulting in reduced yields.

However, adaptation can be costly, slow to occur or imperfect. Moreover, there can be some trends, such as population growth, that will increase the pressure on California’s water supply as the century progresses.

By contrast, Medellín-Azuara et al. (2011), who simulate just the GFDL-A2 scenario, use the change in gross revenue from agriculture as their economic metric. Gross revenue exceeds net revenue by an order of magnitude and is not generally accepted as an appropriate metric of value in economics.

To measure skewness, we report the Fisher-Pearson coefficient and also the probability that aggregate annual profit falls below the mean value, $549.3 million.

The p-values are 0.00 for the GFDL scenarios, 0.010 for PCM-A2, and 0.202 for PCM-B1. In some sub-regions, the PCM-B1 results are also statistically different from the baseline (see online Appendix).

The p-values are 0.0000 for the GFDL scenarios, 0.0182 for PCM-A2, and 0.1996 for PCM-B1.

The certainty equivalent of a gamble is the outcome which, if it occurred for sure, would yield the same expected utility as the gamble itself.

It is an exact measure of the certainty equivalent if the gamble involves normally distributed outcomes (which is not the case here) and the decision maker has a negative exponential utility function.

Their first formulation in Kahneman and Tversky (1979), known as prospect theory, also assumes that the utility function for downside outcomes is risk seeking, while that for upside outcomes is risk averse.

For a further generalization, see Zakamouline (2014).

In an online Appendix, we also assess the impact of a lower level of downside risk aversion, α = 2.

Many of the individual irrigation districts have their own surface water rights and/or pump groundwater in addition to receiving water from wholesale agencies.

In an online Appendix, we perform a sensitivity analysis using values of λ = 0.5 and λ = 1.5.

References

Bawa VS (1975) Optimal rules for ordering uncertain prospects. J Financ Econ 2:95–121

BECS (Berkeley Economic Consulting). November 2008a. Economic impacts in the Central Valley. Prepared for the San Luis Delta Mendota Water Authority

BECS (Berkeley Economic Consulting). December 2008b. Economic impacts of the wanger interim order for delta smelt

Cayan D, Tyree M, Dettinger M, Hidalgo M, Das T, Maurer E, Bromirski P, Graham N, Flick R. 2009. Climate change scenarios and sea level rise estimates for the California 2009 climate change scenarios Assessment. California Energy Commission, Sacramento, CEC-500-2009-014-F.

CDWR (California Department of Water Resources). 2008. Economic analysis guidebook

Chung F, Anderson J, Arora S et al. 2009. Using future climate projections to support water resources decision making in California. California Energy Commission, Sacramento. CEC-500-2009-052-F

Cline WR (1992) The Economics of Global Warming. Peterson Institute for International Economics, Washington, DC

Connell-Buck C, Medellín-Azuara J, Lund J, Madani K (2011) Adapting California’s water system to warm vs. dry climates. Clim Chang 109(Suppl 1):133–149

Dale LL, Dogrul EC, Brush CF, Kadir TN, Chung FI, Miller NL, Vicuna SD (2013) Simulating the impact of drought on California's Central Valley hydrology, groundwater and cropping. Br J Environ Clim Chang 3(3):271

Draper AJ, Munévar A, Arora SK, Reyes E, Parker NL, Chung FI, Peterson LE (2004). CalSim: generalized model for reservoir system analysis. J Water Resour Plan Manag 130(6):480–489

Ebert U (2005) Measures of Downside risk. Econ Bull 4(16):1–9

Fishburn PC (1977) Mean-risk analysis with risk associated with below-Target returns. Am Econ Rev 67(2):116–126

Franco G, Cayan DR, Moser S, Hanemann M, Jones MA (2011) Second California assessment: integrated climate change impacts assessment of natural and managed systems. guest editorial. Clim Chang 109(Supp 1):1–19

Hatchett, S. 1997. Description of CVPM. In Central Valley Project Improvement Act Programmatic Environmental Impact Statement, chap. II, pp. II-1–II-23, U.S. Bur. of Reclam., Sacramento

Holthausen DM (1981) A risk-return model with risk and return measured as deviations from a target return. Am Econ Rev 71(1):182–188

Howitt RE (1995) Positive mathematical programming. Am J Agric Econ 77:329–342

IPCC 2007. Climate change 2007: the physical science basis. Contribution to the fourth assessment report by working group I. Cambridge University Press, Cambridge, UK, New York, NY. www.ipcc.ch/ipccreports/ar4-wg1.htm.IPCC 2007

Kahneman D, Tversky A (1979) Prospect theory: An analysis of decision under risk. Econometrica 47:263–291

Kiparsky (2010) Risk analysis for Water resources under climate change, population growth, and land use change. University of California Berkeley, PhD Dissertation

Lanzillotti RF (1958) Pricing objectives in large companies. Am Econ Rev 48(5):921–940

Liang X, Wood EF, Lettenmaier DP (1996) Surface soil moisture parametrization of the VIC-21 model: evaluation and modification. Glob Planet Change 13(1–4):195–206

Mao JC (1970) Models of capital budgeting, EV vs ES. J Financ Quant Anal 4(05):657–675

Markowitz HM (1952) The utility of wealth. J Polit Econ 60:151–158

Markowitz HM (1959) Portfolio Selection: Efficient Diversification of Investments. University Press, Yale New Haven Connecticut

Masson RT (1974) Utility functions with jump discontinuities: some evidence and implications from peasant agriculture. Econ Inq 12(4):559–566

Maurer EP, Hidalgo HG (2008) “Utility of daily vs. monthly large-scale climate data: An intercomparison of two statistical downscaling methods.”. Hydrol Earth Syst Sci 12:551–563

Mearns LO, Rosenzweig C, Goldberg R (1992) Effect of changes in interannual climatic variability on CERES-wheat yields: sensitivity and 2× CO2 general circulation model studies. Agric for Meteorol 62(3):159–189

Medellín-Azuara J, Howitt RE, MacEwan DJ, Lund JR (2011) Economic impacts of climate-related changes to California agriculture. Clim Chang 109(1):387–405

Menezes C, Geiss C, Tressler J (1980) Increasing downside risk. Am Econ Rev 70(5):921–932

Rayner S, Lach D, Ingram H (2005) Weather forecasts are for wimps: why water resource managers do not use climate forecasts. Clim Chang 69(2–3):197–227

Roy AD (1952) Safety first and the holding of assets. Econometrica 20:431–449

Tobin, J. 1958. “Liquidity preference as behavior towards risk.” Rev Econ Stud February 25:65–85.

Tversky A, Kahneman D (1991) Loss aversion in riskless choice: A reference dependent model. Q J Econ 106:1039–1061

Waud RN (1976) Asymmetric policymaker utility functions and optimal policy under uncertainty. Econometrica: J Econ Soc 44:53–66

Zakamouline V (2014) Portfolio performance evaluation with loss aversion. Quant Finan 14(4):699–710

Acknowledgments

Dr. Hanemann’s research was supported by NSF Award 1204774 to Arizona State University. Our research relies on modeling results provided to us by California Department of Water Resources and CVPM computer code provided by Steven Hatchett. We thank Sydny Fujita and Nathaniel Bush for research assistance. This draft has benefitted from the helpful suggestions of several anonymous reviewers and the associate editor. Any remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hanemann, M., Sayre, S.S. & Dale, L. The downside risk of climate change in California’s Central Valley agricultural sector. Climatic Change 137, 15–27 (2016). https://doi.org/10.1007/s10584-016-1651-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-016-1651-z