Abstract

Opportunity as a construct has been widely examined in for-profit entrepreneurship research, but it is scarcely studied in the context of social entrepreneurship. It is being observed that many entrepreneurs venture into social enterprise because they perceive it as an opportunity. This study aims to address this phenomenon by extensively identifying the opportunity indicators that promote entrepreneurs to pursue social entrepreneurship.

We accomplish this by employing a mixed-methods approach wherein we used both quantitative and qualitative data from experts and analysed it using a hybrid approach of Delphi rounds and the best-worst method. We identified 13 opportunity indicators from the literature, and in the first round of Delphi, four new indicators were added to the list by a panel of 24 experts drawn from industry and academia across India. In the second round of the Delphi method, 18 of the 24 experts took part and rated the importance of each indicator on a 5-point Likert scale. Depending on the availability of the experts, both rounds of Delphi were held in person and virtually. Based on the cut-off levels for standard deviation, interquartile range, and probability of occurrence, experts agreed on 16 indicators. Furthermore, a best-worst method approach was used to prioritise these indicators based on the opinions of industry and academic experts.

The study used a theoretical lens of entrepreneurial opportunity and its two different views: objectively discovered and subjectively perceived. The results revealed a consensus among academicians and practitioners for objectively discovered opportunity indicators, which gave the highest priority to “institutional support” and “funding opportunities.“

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Without opportunity, there is no entrepreneurship.

(Short et al., 2010)

Opportunity, or “entrepreneurial opportunity” (McMullen et al., 2007; Wood & McKinley, 2010; Nair et al., 2022), is one of the central concepts in entrepreneurship research (Busenit et al., 2003). Entrepreneurial opportunity has been variously conceptualised in the entrepreneurship literature as a “set of objective external conditions vs. individual cognitions vs. social constructions” (Davidsson, 2015). Entrepreneurial opportunity is a profitable or favourable condition for entrepreneurs (Nair et al., 2022), which has been extensively studied, and the context of opportunity in entrepreneurship is ubiquitous.

Despite the vast literature that consolidates our understanding of “entrepreneurial opportunity” in for-profit entrepreneurship research, the literature on social entrepreneurship (SE) is still nascent (Corner & Ho, 2010). SE represents a distinctive space in the broader realm of entrepreneurship, and the SE opportunities are bound to be different from commercial for-profit entrepreneurial opportunities (Mair & Marti, 2006; Robinson, 2006), as SEs combine entrepreneurial creativity with a social mission (Corner & Ho, 2010; Nicholls & Cho, 2006). Hence, it will be only logical to posit that given the difference between a for-profit venture and a social enterprise, the objective and subjective events and ideas that represent the set of opportunities might vary across these two fields.

This study took the view of social entrepreneurs, according to which the complex dual mission characteristics of SE are difficult to handle by a novice entrepreneur without external support. So, to venture into a social enterprise, entrepreneurs seek entrepreneurial opportunities that provide the basic building blocks to start or scale-up the social enterprises. It has been established that perceived opportunity enhances sustainable development (Mas-Tur et al., 2021). During our discussions with social entrepreneurs, it has come to our knowledge that perceived opportunities endorse SE. The underlying importance of opportunity indicators, which foster SE, necessitates this research study. Therefore, we took an in-depth and expansive view by assessing the factors that elicit or drive opportunity in the SE context.

Although, existing research has identified the drivers that promote SE, viz., social development through social change (Mair & Marti, 2006; Peredo & McLean, 2006; Weerawardena & Mort, 2006; Lumpkin et al., 2018), helping marginalized sectors of society (Santos, 2012; Chandra, 2017; Gidron, 2017; Hockerts, 2018; Maseno & Wanyoike, 2020), meeting social needs (Mair & Marti, 2006), and sustainability (Weerawardena & Mort, 2006); individual characteristics like risk-taking & proactiveness (Sullivan Mort et al., 2003; Weerawardena & Mort, 2006), creativity (Erro-Garcés, 2020), and high sense of accountability (Dees, 1998); Emotional attitudes (Miller et al., 2012; Erro-Garcés, 2020) like altruism (Ruskin et al., 2016), compassion (Miller et al., 2012), and empathy (Ruskin et al., 2016; Bacq & Alt, 2018; Tucker et al., 2019; Tiwari et al., 2020). But there are few studies in the SE domain from the perspective of the opportunities that are perceived by social entrepreneurs. Therefore, to fill this void, it is important to list the opportunity indicators from the existing literature and also identify those that do not exist but are inevitable. Moreover, it is also necessary to assess which indicators are more important so that different stakeholders can focus on them to advance them in research and practice.

This study is best suited for a mixed-methods approach because both qualitative and quantitative information are vital to fulfilling the objectives of this study. Only a quantitative approach had not been sufficient because the study was not designed to only quantify the existing indicators; we used the experts’ opinions to identify new indicators, which is an important objective of this study. Conversely, a qualitative approach alone has not been sufficient to get insights in a more generalised way from the quantifiable data given by the experts for the opportunity indicators in SE. Therefore, to accomplish our objectives we employ the Delphi survey and best-worst method (BWM) approach. Integrated Delphi-BWM approach has already been used in the past to answer queries which involve a mix of qualitative and quantitative feedback from the experts (Aydin & Seker, 2021; Kumar et al., 2021; Sahebi et al., 2020). Delphi is an iterative, anonymous technique that solicits expert viewpoints and aggregates group consensus in a systematic and phase-wise manner (Dalkey & Helmer, 1963; Hasson et al., 2000; Rowe & Wright, 2011). The BWM approach uses a comparison system for vectors to obtain expert quantitative opinions, to arrive at weight and consistency ratio (CR) through an optimization model (Rezaei, 2015). Such mixed-method approach combines the use of qualitative and quantitative techniques so as to maximize the learning from different sources of information (narrative and numerical) and arrive at more concrete results, which we could not get just by following anyone of these approaches (Sale et al., 2002). Therefore, both the qualitative and quantitative elements, which are the prerequisites for the mixed method (Johnson & Onwuegbuzie, 2004; Plano Clark et al., 2008), have been used in this study.

The purpose of this comprehensive study is to explore the list of existing indicators, identify new indicators based on experts’ opinions, reach consensus on the final indicators, and finally prioritise those indicators according to different stakeholder views. The following objectives have been fulfilled in this study.

-

1

Identify the opportunity indicators for entrepreneurs that promote SE, based on the extensive literature review and experts’ opinions.

-

2

Categorize the identified indicators according to different views of opportunity—an objectively discovered view and a subjectively perceived view.

-

3

Prioritize objectively discovered indicators of opportunity in SE based on experts from academia and practice, separately.

-

4

Prioritize subjectively perceived indicators of opportunity in SE based on experts from academia and practice, separately.

Overall, our study offers a much-needed boost to SE research by delineating the concept of opportunity as perceived by social entrepreneurs. We identify 16 opportunity indicators in the SE space and categorise these indicators into “subjectively perceived” and “objectively discovered,“ and thus provide a much-needed refinement to the existing SE research by borrowing these conceptualizations of opportunity from existing for-profit entrepreneurship research. Finally, we also prioritise these subjective and objective indicators to identify the most relevant among them for SEs and find that “institutional support” and “funding opportunities” are more prominent among “objectively perceived indicators,“ whereas “competitive advantages of hybrid organizations” and “perceived feasibility of social enterprises” are valued more among “subjectively perceived” ones. This finding has implications for policymakers in emerging economies. In emerging economies like India, access to financial resources and institutional support is very limited (Garcia & Orsato, 2020; Khanna & Palepu, 2000); hence, factors like institutional support, funding opportunities, the perceived feasibility of SE, and competitive advantage find high support. Thus, governments in emerging economies should ensure institutional support, access to finance and other resources, and favourable policies for social enterprises to flourish.

2 Research in Social Entrepreneurship (SE) and Entrepreneurial Opportunity

2.1 Social Entrepreneurship in Emerging Economies

While for-profit entrepreneurship is driven by economic purpose (Bygrave & Minniti, 2000), a SE’s primary goal is to create social benefit rather than private economic gain (Mair et al., 2012). Social entrepreneurs contribute to society not only by producing products and services that are beneficial to society but also by employing policies and procedures that drive social development, for example, by providing employment to people with physical or mental handicaps (Gidron, 2017), providing financial services to the poor and marginalized, or funding social ventures (Mair & Marti, 2006).

In resource-constrained emerging economies with a huge population, poor infrastructure, and numerous institutional voids (Khanna & Palepu, 2010), it is very difficult for the government to achieve large-scale social and economic transformation alone. SE, hence, is considered a strong weapon to fight against unemployment, poverty, gender discrimination, poor education, and poor health standards in emerging economies (Yiu et al., 2014; Sengupta et al., 2018). Social entrepreneurs and innovators are considered partners in socio-economic development and receive both economic and other support from the government, a fact that has not gone unnoticed by many budding entrepreneurs in emerging economies, leading to the incubation of many social enterprises in recent times.

2.2 Entrepreneurial Opportunity

The phenomenon of opportunity in entrepreneurship context is studied as entrepreneurial opportunity. The research on entrepreneurial opportunity has been debated since the introduction of the concept by Kirzner (1973), who exhibited that entrepreneurs are risk-takers and capitalize on the opportunities available to them in dynamic market conditions. entrepreneurial opportunity is the result of entrepreneurial activities to seek new profit opportunities. Entrepreneurial opportunity is a profitable or favourable condition for the entrepreneurs that aid them to incubate a new venture or scale up an existing venture.

Different phenomena explain opportunity in the entrepreneurial context, for example, actualization, creation, effectuation, and discovery (Ramoglou et al., 2021). Also, there are multiple definitions of entrepreneurial opportunity that imply it as profitable intentions, innovativeness, favourable future situations, and economic gains by the entrepreneur itself, due to which the term “opportunity” has been found to have inconsistency in its meaning (Davidsson, 2015). These different opinions hampered the exactness of the concept, and many studies have discussed the elusiveness of the entrepreneurial opportunity concept (Zahra, 2008; Dimov, 2011; Davidsson, 2015).

But there are two predominant views of entrepreneurial opportunity that are adopted in this study: objectively discovered and subjectively perceived (McMullen et al., 2007; McBride & Wuebker, 2022). “Entrepreneurial opportunity encompasses both objectively discovered as well as subjectively perceived elements because both aspects of opportunity matter for entrepreneurial outcomes” (Renko et al., 2012).

2.2.1 Objectively Discovered View

Shane and Venkataraman (2000), and Shane (2012) disseminated the objective view of entrepreneurial opportunities, which is based on the disruption of market equilibrium that led to situations in which new services, processes, and goods could be sold for an amount greater than the cost of their production. Entrepreneurial opportunity has also been discussed from an economic perspective, which asserts that competitive imperfections arise in the market and, to balance them, the opportunity exists (Alvarez & Barney, 2013), and there are courses of action that are taken to level the difference between demand and supply (Gregoire et al., 2010) that are objective. Thus, the objective view of entrepreneurial opportunities is promoted by discrete exogenous phenomena discovered in the market. In this study, seven objectively discovered indicators of opportunity have been identified based on the available literature and experts’ opinions, which are labelled “objective” and described in Table 1.

2.2.2 Subjectively Perceived View

This view of entrepreneurial opportunity is associated with the cognition of the entrepreneur, which focuses on the desirable future state of growth and feasibility (Gartner et al., 2008; Wood & McKinley, 2010). Subjective perceptions of entrepreneurial opportunity are subjectively perceived ideas, along with the action that triggers entrepreneurial actions and potentially lucrative options that may lead to economic gain over time (Short et al., 2010; Dimov, 2007) stated that entrepreneurial opportunity is progress along a continuum ranging from an idea to a fully developed, actionable plan for a new business to function. This view promotes. Our study has identified ten subjectively perceived indicators of opportunity in SE, based on the available literature and experts’ opinions, labelled as subjective and shown in Table 1.

3 Research Methodology

This study compiled a list of indicators from the existing literature, which has been further improved based on the feedback of experts using the Delphi approach. Further, the resulting indicators were analysed using a best-worst method (BWM) approach, which is helpful in multi-criteria decision making (MCDM) problems. The detailed methodological approach has been discussed as follows:

3.1 Research Framework

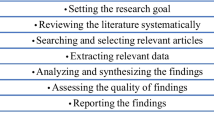

This study enumerates the opportunity indicators that foster SE in four steps as shown in the flow diagram, Fig. 1. In the first step, drawing from extant research, the authors prepare a list of opportunity indicators. In the second step, it is observed that there is a high possibility of missing other indicators due to the limited literature on this phenomenon; therefore, a Delphi survey (round 1) consisting of experts from the industry and academia has been conducted to identify indicators other than those in the literature of SE. The intervention of experts can bring a fresh perspective based on industry and practise that may not have been discussed in the existing literature. Moreover, this study will use the Delphi approach to intervene with the experts, which aggregates group consensus in a systematic and phase-wise manner and avoids any bias (Rowe & Wright, 2001). In the third step, Delphi round 2 is undertaken to finalise the list of indicators based on the consensus of the experts. Finally in the fourth step, we prioritize the opportunity indicators using a BWM approach.

3.2 MCDM Approach in Management and Entrepreneurship Research

Research questions that involve decision-making complexities due to multiple criteria, goal conflicting factors, and difficult to assess relationships can be answered using the MCDM approach because the MCDM method handles quantitative and qualitative data simultaneously, which supports the viewpoint of decision-makers in both the subjective and objective manner (Cinelli et al., 2020; Barton, 1981).

The framework of multi-criteria decision analysis (MCDA) has been used in management research. Barton (1981) introduced the MCDA approach for goals conflicting in management by objectives, which was published in the Academy of Management Review. Ruf et al. (1998) measured corporate social performance using an MCDA framework known as the analytic hierarchy process (AHP) and published the process and results in the Journal of Management.

There are a few studies that discuss the application of MCDA methods in entrepreneurship and strategy research. Murcia et al. (2022) adopted the MCDA approach to propose a “quantified VRIO” (value, rarity, imitability, and organization) framework that can be used as a tool for strategic planning based on qualitative and quantitative information provided by decision-makers. Raghuvanshi et al. (2017) identified 14 barriers to women’s entrepreneurship and used the Decision-Making Trail and Evaluation Laboratory (DEMATEL) approach to identify the causal relationship among those. Carayannis et al. (2021) gave a review about the increasing Operation Research approaches (using MCDA) in the entrepreneurial ecosystem studies, though such research is still at a very nascent stage. In another application of MCDA, Beim and Lévesque (2006) suggested an approach to identifying a country in which one can venture to establish a new business using multi-attribute value theory (MAVT), which is mostly used in practical applications for developing scales. Moreover, in a study related to entrepreneurial orientation, Ferreira et al. (2015) measured individual entrepreneurial orientation using a MCDA framework, Measuring Attractiveness by a Categorical-Based Evaluation Technique (MACBETH), which provided a framework to classify an individual as per their entrepreneurial profiles. Furthermore, Jafari-Sadeghi et al. (2022) explored the knowledge-hiding phenomenon in international entrepreneurial firms and used MCDA’s DEMATEL approach to unveil the causal relationships among the key indicators of knowledge-hiding within entrepreneurial firms.

This shows that the MCDM approach has been previously used in the domain of entrepreneurship research and that it is capable of revealing research queries that use both quantitative and qualitative information simultaneously.

3.3 The Delphi Method

This study used the Delphi approach, which is a well-established method that aids in analysing the indicators based on an expert’s consensus through a series of structured multiple-round opinion feedback (Dalkey & Helmer, 1963). This method is much more suitable for exploratory studies where the domain of enquiry is new or there is scarce and incomplete knowledge (Giannarou & Zervas, 2014). Delphi also tries to get opinions from a wide range of anonymous experts based on iterative survey instruments, which always have an advantage over other qualitative approaches because the results are not biased, the external validity is better, and the participants are more comfortable (Kennedy, 2004; Perveen et al., 2017).

The number of Delphi rounds depends upon the stability of the responses and can be assessed through the coefficient of variation (CV) (English & Kernan, 1976). Also, the iterative nature of Delphi enables participants to examine how their evaluations of indicators correspond with those of others and permits opinion shifts (Bolger & Wright, 2011).

3.4 The Best-Worst Method

BWM is an MCDM technique that is utilized in complex decision-making problems of the prioritization. The validity and usefulness of the BWM method has already been established in the previous research (Wang & Fu, 2020). Although AHP has been extensively used in prioritisation studies, it lacks practical applicability. This is because AHP involves a complex pairwise comparison of criteria that induces recurring inconsistencies and the need to repeat the process until consistency is achieved (Herman & Koczkodaj, 1996; Rezaei, 2015). Hence, BWM approach is preferred over AHP. In the BWM approach, all the criteria are compared with those of the best and worst criteria thereby requiring less expert intervention. Overall, it is more convenient to get a quantitative opinion from the experts in less time using BWM approach (Rezaei, 2015). The process of analysis is done through a comparison system that consists of two comparison vectors. This methodology aims to identify the weight and consistency ratio (CR) by using an optimization model developed through a comparison system. This method was developed by Rezaei (2015). Since then, it has been extensively used in the wide application of management research. Examples, the sustainable circular supply chain for SDGs (Sustainable Development Goals) (Kayikci et al., 2022); lean and agile practices for sustainability goals (Mathiyazhagan et al., 2021); product return issues (Kaushik et al., 2020); technological innovation in Indian MSMEs (Gupta & Barua, 2016), and others. The detailed steps for the application of BWM are discussed as follows:

Step 1

Identify the opportunity indicators that fosters SE based on literature and experts’ opinions.

Step 2

Determine the best (most significant) driver and worst (least significant) driver among the identified indicators based on experts from academia and industry.

Step 3

Determine the preference ranking for the best driver over other indicators on a 9-point rating scale to construct (best-to-other) a vector as shown in Eq. (1), as below.

Where \({x}_{Bj}\) denotes the preferences of the best-selected driver B over any other driver j.

Step 4

Determine the preference for each of the other criteria j over the worst criterion on a 9-point rating scale to construct (other-to-worst) a vector as shown in Eq. (2), as below.

Where \({x}_{jWB}\) denotes the preference of other driver j over the worst driver, W.

Step 5

Evaluate the optimal with of each driver (, .

The objective is to identify the optimal weights of the indicators so that the maximum absolute differences for all j can be minimized for | \(\frac{{W}_{B}}{{W}_{j}}\) - \({x}_{Bj}\)| and | \(\frac{{W}_{j}}{{W}_{w}}\) - \({x}_{jW}\)|. This min-max model will be represented in Eq. (3), as below.

Subject to

\(\sum _{j}{W}_{j}\) =1

\({W}_{j}\ge 0,\) for all j.

The model from Eq. (3) is then transformed into a linear model as shown below in Eq. (4)

Subject to

\(\left|\frac{{W}_{B}}{{W}_{j}}- {x}_{Bj}\right| \le\) for all j.

\(\left|\frac{{W}_{j}}{{W}_{B}}- {x}_{jB}\right| \le\) for all j.

\(\sum _{j}{W}_{j}\) =1

\({W}_{j}\ge 0,\) for all j.

The optimal weights (\({W}_{1}^{*}\), \({W}_{2}^{*}, \dots .,{W}_{n}^{*})\) and \({ }^{*}\)are identified by solving the linear programming model which is shown in Eq. (4).

The value of consistency of comparison for indicators (\({ }^{*}\)) must be near zero and has been recommended. However, there is no threshold mentioned in BWM (Rezaei, 2016). To elicit the weight in a group MCDM, there are two main approaches: aggregation of individual judgement (AIJ) and aggregation of individual priorities (AIP) (Ishizaka & Nemery, 2013). This study has used the more common AIP approach to evaluate the weight vector, in which the weights proposed by each expert are combined to gain the weight of all experts for each indicator.

4 Application of Proposed Research Framework: Case of Social Entrepreneurship in India

4.1 Application of Delphi Survey

The Delphi procedure was used because it is a well-established and well-recognised method for obtaining expert opinion and is preferred in those studies where the field is still evolving and lacks empirical proof (Powell, 2003; Linstone & Turoff, 1975) Delphi is performed in multiple rounds, where the first round is usually designed qualitatively to gain the breadth of expert opinion, and subsequent rounds use a quantitative approach by assessing the descriptive statistics to establish the strength of opinion and gain group consensus. The duration of the survey is nine months, from September 2021 until May 2022. The anonymity of experts has been given high priority by self-administering the study, as it reduces normative social influence and brings out opinions based on merit alone (Bolger & Wright, 2011). To maintain the anonymity of the study, the details of individual experts and their opinions were kept confidential, and only the final results of one complete round were shared with the experts before proceeding for the next round. We have self-administered the questionnaire with individual experts through virtual and in-person meetings.

4.1.1 Delphi Round 1

Based on the extensive literature review a list of 13 opportunity indicators has been identified by the authors. But there might be high possibility of missing indicators that are not given in the literature due to the scarcity of the research in this domain. Therefore, it became important to recruit experts that can assist in the identification of opportunity indicators. Such exploration where the field is not mature enough and the knowledge is still assimilating can be easily handled by Delphi approach (Williams & Webb, 1994).

One of the key objectives of a Delphi study is to obtain an unbiased panel of experts with sufficient breadth, depth, and objectivity in the field of study (Devaney & Henchion, 2018). The literature on who constitutes an expert is equivocal, as researchers (Hallowell & Gambatese, 2010; Devaney & Henchion, 2018) employ their own set of criteria to choose their panel of experts. Overall, the expert should meet a few (2–3) of the following criteria in the field of study for which he or she serves as an expert: A representative but not exhaustive list of these criteria includes significant corporate work experience, participation in conferences or professional forums, membership in professional bodies, authorship in peer-reviewed journal articles, writing or editing of books, book chapters, or industry reports, teaching experience in accredited institutions of higher learning, and a holder of advanced degrees in the field of study.

While most of the experts chosen for such studies are industry professionals or those serving in academia or policy-making bodies, many studies have also used students as experts (Rowe and Wright, 1999). However, inclusion of students in the expert panels has invited criticism from many quarters (Rowe & Wright, 2001, 2011); hence, in our study, we have been circumspect in our choice of students as panel members and only selected doctoral-level students when they have met at least three of the above-mentioned criteria and thus demonstrated substantial depth in the field of study to be considered as a member of the expert panel. Additionally, we also focused on the heterogeneity among the panel of experts (Rowe & Wright, 2001; Hallowell & Gambatese, 2010; Devaney & Henchion, 2018) to obtain a diverse range of responses and a combined knowledge that reflects all aspects of the problem for a higher quality of decision-making. Thus, our expert panel had a good mix of domain knowledge and diversity.

A purposeful sampling technique (Patton, 2002) has been used to identify the experts for this study. Thirty-six experts from the social entrepreneurship domain were contacted on social media. This comprised a heterogeneous sample of experts from academia, experts from industry, including social enterprises and investors in these ventures, and government officials and officials from policy-making bodies. Among them, government officials and policymakers were reluctant to participate in our research. Even though anonymity was ensured, they declined to participate as this was not permissible under their work norms. Therefore, we were only left with experts from industry and academia to conduct this study.

Our choice of experts was based on the criteria followed in the field, as discussed above. Anyone meeting at least three of the aforesaid seven criteria was selected as an expert. Accordingly, any expert in the industry must possess extensive experience as a manager, founder, or leader for a minimum of 4 years. Additionally, they were members of professional bodies and participated in conferences. Many among them possessed advanced degrees too. Likewise, experts from academia were those researchers who have published at least two Scopus-indexed research papers in the domain of social entrepreneurship or written or edited two books or book chapters. Most of these candidates were also enrolled as faculty at a university or institute and were teaching social entrepreneurship. They also regularly participated in conferences and held advanced degrees in their fields of study. We also included two doctoral scholars in the final stages of their dissertations as experts in our study. This was because the profiles of these scholars met the acceptable criteria quite well. They had the requisite Scopus-indexed publications and had participated in conferences as presenters. They also had teaching experience and were working alongside their professors to teach a social entrepreneurship course at the university level. One of them had also worked in the industry in a relevant domain before joining the PhD programme. Thus, these doctoral students were pursuing rigorous research at some of the best universities and institutes globally and substantially met the criteria for being experts. The inclusion of these doctoral students also added to the heterogeneity of our expert panel.

Based on the set criteria for experts, 36 experts were contacted through social media, and the objectives of the study were explained to them. Out of these, 24 agreed to participate in a brainstorming session in the first round. Each expert was given a list of 13 opportunity indicators that have been identified by the authors from the existing literature. Experts were then asked to give at least two indicators that are not on this list but that they consider important. There was no upper limit to the number of indicators that experts could suggest. Experts were also asked for their opinion about the removal of any existing indicators. The survey was conducted in a controlled manner by giving feedback, where each expert was clearly informed before administering the questionnaire that this study is not assessing the indicators that are due to individual characteristics, emotions, or prosocial motives but those indicators that social entrepreneurs realise from an “opportunity” perspective.

All the indicators suggested by 24 experts were noted during the online and in-person interactions. After the removal of duplicates, those synonymous with the existing 13 indicators from the literature, and those not related to the objective of the study, four new indicators have been identified based on experts’ opinions in the first round of Delphi. Table 1 shows a list of 17 indicators, including the four new indicators of opportunities that foster SE found in this round based on the opinions of experts.

4.1.2 Delphi Round 2

In the second stage of Delphi, the feedback from the first round was shared with the panel of experts. A list of all the 17 indicators, which including four new indicators suggested by experts in the first round, were shared with a panel of experts that participated in the first round of Delphi. In this second round, the author’s focus is to gain an preference rating for each of the 17 indicators identified in the previous round. To obtain the preference rating, a 5-point Likert scale questionnaire was constructed so that experts could rate the significance of each indicator, with 1 being the least important and 5 being the most important (Heiko, 2012). All the experts that participated in round 1 were contacted again, and 18 experts responded and participated in the 2nd round. The experts were requested to rate their preference for each indicator on a 5-point Likert scale (1 = of little importance to 5 = most important). An opportunity indicator is considered significant if it gets an expert rating of 4 or 5 on the Likert scale (1–5). The summary statistics that follow from the Delphi 2nd round are shown in Table 2.

Based on the assessment of importance ratings, different summary statistics have been used to derive the consensus. Mode is used to assess the highest frequency ratings being given by experts. Standard Deviation (SD) is used to assess the level of agreement; a high value of SD shows a large distribution of scores near the mean, which depicts weaker agreement, and a low value of SD shows a stronger agreement as the outcomes are closer to the mean. For consensus, a standard deviation of less than 1.0 has been considered (Williams & Webb, 1994; Perveen et al., 2017). The interquartile range (IQR), which is the difference between the 75th and 25th percentile, and the IQR value of one or less than one, recommend a low dispersion level (von der Gracht, 2012; Barrios et al., 2021), which has also been used for this study.

Consensus can be assessed based on the level of agreement; the expected probability of occurrence (EP) helps to understand the level of agreement among the experts based on the frequency of the response; a score of at least 50% has been taken as the standard for the consensus level (Heiko, 2012). An indicator in this study will indicate consensus if at least 50% of the experts rate the importance as 4 or 5 on the Likert scale (1–5). Therefore, for this study, there are three criteria for reaching consensus: SD < 1, IQR < = 1, and EP > 50%.

It can be observed from the results in Table 2 that the indicator “effective cause branding” (S2) could not meet the consensus criteria with an EP value less than 50% and has been dropped for further analysis. All the other 16 indicators have gained consensus. Moreover, the CV values for all the indicators are less than 0.5, which indicates that there is no need for additional Delphi rounds for building consensus (English & Kernan, 1976).

4.2 Application of BWM Approach

Based on the consensus in 2nd round of Delphi survey, this study has identified a list of 16 opportunity indicators that promote SE. However, Delphi method falls short when it comes to prioritizing these indicators (Powell, 2003; Allen et al., 2019) and hence, we use the BWM approach. Such prioritization is important for different stakeholders like policy makers, social entrepreneurs, venture capitalists (VCs) among others. A ranking of these opportunity indicators provides an idea to policy makers that which macro conditions will foster higher SE, what kind of support is expected by social entrepreneurs and core perceptions or ideas that represent SE opportunities. Also, it is interesting to note that the indicators identified in this study serve as criteria for entrepreneurs to venture into social enterprise. As a result, the indicators in this study are regarded as criteria for BWM application.

The result of Delphi 2nd round was shared with all the 18 experts and they were requested to participate in the last round of enquiry. 13 out of 18 from the 2nd stage of Delphi survey agreed to participate in the final phase. The details of the experts participated in this round are given in Table 3. We presented the subjectively perceived and objectively discovered indicators separately to the group of experts from industry and academia. This is done because industry and academia represent two separate stakeholders in the entrepreneurship domain and are driven by competing or differing logics (Kieser & Leiner, 2009) such that their assumptions, frame of references, enquiry process and the way they define and tackle problems is significantly different (Beech et al., 2010; Briner & Denyer, 2012).

4.2.1 Subjectively Perceived Indicators

The subjectively perceived indicators have been assessed based on expert opinion following the methodology discussed in Sect. 3.4, Step 2, and Step 3. The experts were enquired for the most preferred indicator over other indicators, and other indicators for the least preferred indicator. The inputs of the experts for both of these steps are shown in Table 4a and Table 4b. Further, the global weight of the indicators is computed as outlined in Step 5. The weights of subjectively perceived indicators and priority ranking by the expert panel have been shown in Table 4c. S5 > S7 > S1 > S3 > S8 > S6 > S10 > S4 > S9. We further divided the experts into industry and academic experts and calculated the global weight and ranking of the indicators (Table A1 and Table A2 in the Appendix) as follows: academic experts: S1 > S7 > S8 > S5 > S6 > S3 > S10 > S9 > S4; industry experts: S5 > S3 > S7 > S1 > S6 > S10 > S4 > S8 > S9. The industry experts and academic experts accorded the highest ratings to different opportunity indicators.

4.2.2 Objectively Discovered Indicators

Similarly, we assessed the weights of objectively discovered indicators based on experts’ suggestions using the BWM approach as mentioned in Sect. 3.4, Step 2, and Step 3. The experts were enquired for the most preferred indicator over other indicators, and other indicators for the least preferred indicator. Table 5a and Table 5b highlight the experts’ ratings. Based on the opinions of the experts, global weight and global ranking were determined for objectively discovered opportunity indicators in Table 5c: O5 > O6 > O7 > O2 > O1 > O4 > O3. We further divided the experts into industry and academic experts and calculated the global weight and ranking (Table A3 and Table A4 in the Appendix) as follows: Academic experts: O5 > O6 > O7 > O1 > O2 > O4 > O3; industry experts: O6 > O5 > O2 > O4 > O7 > O1 > O3. Both the industry experts and academic experts accorded the highest ratings to “institutional support” and “funding opportunities by impact investors.“ This shows the consistency in ratings between the panel of all experts, and when divided into academic and industry experts, separately.

5 Discussion

We obtain valuable insights based on our Delphi and BWM analyses and forge our findings into meaningful propositions that could be studied quantitatively. Our analysis revealed 16 opportunity indicators that hold significance in the context of emerging economies given the presence of institutional voids. Voids in the capital markets make capital scarce for firms operating in emerging economies, leading to decreased investment in discretionary activities like corporate social responsibility (CSR) (Julian & Ofori-dankwa, 2013). Further, the government in emerging economies is also resource constrained, and it heavily relies on corporates to assist in achieving its social development goals. Consequently, NPOs that rely on such corporate funding or donations for their functioning are compelled to explore alternative means of raising money for their pro-social activities. This leads to commercialization/marketization by the NPOs, which is proposed as a new opportunity indicator by experts during our research. Thus, we propose:

Proposition 1

In emerging economies where, financial resources are scarce, the commercialization/marketization intent of not-for-profit (NPO) organisations drives SE.

Voids in labour market lead to poor availability of skilled and qualified manpower in emerging economies. Tilak and Choudhury (2021) exhibited that only 10–40% of the engineering graduates entering the job market every year are employable in India (i.e., most don’t possess the requisite set of skills to do their job well). The absence of good manpower hampers creativity and growth in organizations. High demand and poor supply of specialised human capital mean that social enterprises would have the poorest access to manpower, which would impact their creativity and growth. However, volunteerism in social causes by specialized manpower would increase the welfare and upgradation to the society that drive SE. In our research, volunteerism in social work has emerged as a new opportunity indicator that fosters SE. Hence, we propose:

Proposition 2

In emerging economies where skilled human resources are scarce, volunteerism by skilled individuals for social causes drives SE.

As previously stated, institutional voids in the capital market limit firms’ overall access to capital. While large, diversified conglomerates could rely on their group companies for supplier and buyer networks, managerial talent, technology, financial resources, reputation, information, and political connections (Mahmood & Mitchell, 2004; Gao et al., 2017), the same is not available to social entrepreneurs who are small, localized, and poorly networked. Hence, institutional support and funding opportunities, as evidenced in this study, emerged as the top indicators of SE. Hence, we propose:

Proposition 3

In emerging economies with institutional voids and poor access to finance, objective indicators like “institutional support” and “funding opportunities” are more important predictors of SE.

Established institutions, corporations, and NGOs partner with universities to encourage self-sufficiency, creativity, and vocational education as a way to bring social development to emerging economies (Mirvis & Googins, 2018). Also, policy makers firmly believe that to accelerate national level awareness for SE education programmes can be designed. Furthermore, multinational corporations took an active role in addressing social issues through technological innovations and strategic shifts (Lind et al., 2022). In our study, the indicators of institutional support (O5) gain a high priority ranking, and thus we propose:

Proposition 4

Established institutions and corporations in emerging economies foster SE as a means to bridge social developments.

SEs are hybrid organisations with the dual mission of achieving both social impact and economic sustainability (Cheah et al., 2019). Projects creating a social impact provide legitimacy and increased government support to firms in emerging economies (Jamali & Mirshak, 2007). The social mission in SE is in fact a source of advantage for firms in emerging economies and increases their access to resources and institutional support from government. Such support from government and policymakers also increases the feasibility of these SEs, so firms pursuing them are motivated by these subjective indicators, i.e., “competitive advantages of hybrid organizations” and “perceived feasibility of social enterprises,“ which also comprise a finding from our research. Thus, we propose:

Proposition 5

In resource constrained emerging economies subjective indicators like ‘competitive advantages of hybrid organizations’ and ‘perceived feasibility of social enterprises’ are valuable drivers of SE.

It was observed in our research that academic and industry experts were unanimous in their choice of the topmost objectively discovered indicators: institutional support (O5) and funding opportunities by impact investors (O6). However, the choice was divergent in the case of subjectively discovered indicators. This could be because, although industry and academia rely on different logics, time dimensions, communication practices, rigour and relevance norms, and interests and incentives (Bartunek & Rynes, 2014), they tend to agree on aspects that are interesting and justified (Baldridge et al., 2004), that is, those corroborated by compelling evidence. The evidence for institutional support and funding opportunities in fostering SE is overwhelming in the context of emerging economies (Stephan et al., 2015). Thus, we see convergence for objectively discovered indicators and not for subjectively perceived ones among industry and academic experts. Hence the proposition:

Proposition 6

Competing logics in academia and industry converge on factors that are objectively discovered rather than subjectively perceived.

6 Conclusion and Implications

Our research is exploratory in nature and makes several valuable contributions to the nascent literature on social entrepreneurship and opportunity indicators. Previous research has focused on indicators of SE that flow from individual characteristics, emotions, and intent for social change, but our research takes a deep dive into the extant SE literature to identify, categorize, and prioritise opportunity indicators for SE. Using a mix-method approach, we identified 16 opportunity indicators that foster SE and ranked them according to their importance level for different stakeholders. Drawing from for-profit entrepreneurship literature, these indicators are also classified into “subjectively perceived” and “objectively discovered.“ Based on our analysis, we further prioritise these indicators and identify the topmost drivers of SE. We proposed six testable hypotheses to guide future opportunity indicator research.

While the extant body of literature on SE has addressed a wide array of themes (Kaushik et al., 2023), scant attention has been devoted to the examination of opportunity indicators. Identification of such opportunity indicators in emerging economies would allow governments to design policies that would increase SE. Given the vast population, poverty, and poor social development, the government needs more social ventures for equitable growth and development. Our research reveals that “institutional support” and “funding opportunities” are more prominent among “objectively perceived indicators,“ whereas “competitive advantages of hybrid organizations” and “perceived feasibility of social enterprises” are valued more among “subjectively perceived indicators.“ A consensus of all experts from academia and industry on the topmost objectively discovered parameters of “institutional support” and “funding opportunities” establishes the importance of these indicators in fostering SE in emerging economies. Thus, governments in emerging economies should focus more on policies related to creating institutional support and funding to foster SE.

In the case of SE, the industry and academia are very collaborative, as entrepreneurship is a practise-based phenomenon. Most academics who study social enterprise work in some way to help it. Moreover, the result of our study also shows that objectively discovered drivers are ranked almost similarly by academia and practitioners while subjectively perceived drivers are taken differently (Proposition 2) by academicians and practitioners. Therefore, this study highlights the thought processes of both academicians and practitioners for subjectively perceived indicators, where the academicians give high preference to the long-term sustainability of the social enterprise, whereas the practitioners focus on in-hand resource availability. This distinction may enable both stakeholders to learn from one another and apply the learning to their practise and research.

Methodologically, previous research has identified indicators for SE using qualitative interview approaches (Stirzaker et al., 2021), case-studies (Erro-Garcés, 2020), and quantitative approaches (Halberstadt et al., 2021). This is among the first studies to use mixed methods (qualitative and quantitative) for understanding the indicators in the SE domain. Although there is little research in the entrepreneurship domain that has used the MCDM approach, to the best of our knowledge, this is the first extensive study that has used the Delphi-BWM approach in SE research. This provides direction to the SE researchers on the use of hybrid approaches to unveil insights from less studied domains.

The results of this study will benefit social entrepreneurs as it provides a direction to government to implement policy changes in areas critical to drive SE. It will also benefit policymakers and venture capitalists who seek to incubate more SE ventures as they know in which areas they should prioritize.

7 Limitations and Future Research

Exploratory research has its limitations, which also apply to this study. Delphi-based research uses preferential approaches for data collection, which are not free from assumptions and thus raise some doubt on the response received from the purposive sample of experts in this study. Despite this, given the developing nature of the opportunity indicator research in the SE domain, full-fledged quantitative research could not be conducted. Moreover, there are chances of missing some indicators that have not been included in earlier research. Hence, the choice of a mixed-method approach to gain preliminary insights is quite apt in our research. We develop six testable propositions in our research, which could guide a lot of future research in the SE space. Additionally, boundary conditions for the opportunity indicators and SE relationship could be explored, such as the impact of entrepreneurial opportunity on this relationship. On the methodological side, we aggregate weight in BWM using AIP, which can lead to information loss as it uses the centrality feature and ignores dispersion. This can be overcome by future researchers using an advanced Bayesian BWM approach (Mohammadi & Rezaei, 2020). Future researchers could also explore a scale for the opportunity indicators and conduct econometric analyses.

References

Agafonow, A. (2014). Toward a positive theory of social entrepreneurship. On maximizing versus satisficing value capture. Journal of Business Ethics, 125(4), 709–713.

Agafonow, A. (2015). Value creation, value capture, and value devolution: Where do social enterprises stand? Administration & Society, 47(8), 1038–1060.

Allen, T., Prosperi, P., Cogill, B., Padilla, M., & Peri, I. (2019). A Delphi Approach to develop sustainable Food System Metrics. Social Indicators Research, 141(3), 1307–1339. https://doi.org/10.1007/s11205-018-1865-8

Alvarez, S. A., & Barney, J. B. (2013). Epistemology, opportunities, and entrepreneurship: Comments on Venkataraman et al.(2012) and Shane (2012). Academy of Management Review, 38(1), 154–157.

Aydin, N., & Seker, S. (2021). Determining the location of isolation hospitals for COVID-19 via Delphi-based MCDM method. International Journal of Intelligent Systems, 36(6), 3011–3034.

Bacq, S., & Alt, E. (2018). Feeling capable and valued: A prosocial perspective on the link between empathy and social entrepreneurial intentions. Journal of Business Venturing, 33(3), 333–350.

Bacq, S., & Lumpkin, G. T. (2020). Social entrepreneurship and COVID-19. Journal of Management Studies.

Bacq, S., Geoghegan, W., Josefy, M., Stevenson, R., & Williams, T. A. (2020). The COVID-19 virtual idea blitz: Marshaling social entrepreneurship to rapidly respond to urgent grand challenges. Business Horizons, 63(6), 705–723. https://doi.org/10.1016/j.bushor.2020.05.002. Scopus.

Baldridge, D. C., Floyd, S. W., & Markóczy, L. (2004). Are managers from Mars and academicians from venus? Toward an understanding of the relationship between academic quality and practical relevance. Strategic Management Journal, 25(11), 1063–1074. https://doi.org/10.1002/smj.406

Barrios, M., Guilera, G., Nuño, L., & Gómez-Benito, J. (2021). Consensus in the delphi method: What makes a decision change? Technological Forecasting and Social Change, 163, 120484. https://doi.org/10.1016/j.techfore.2020.120484

Barton, R. F. (1981). An MCDM approach for resolving goal conflict in MBO. Academy of Management Review, 6(2), 231–241.

Bartunek, J. M., & Rynes, S. L. (2014). Academics and practitioners are alike and unlike: The paradoxes of academic–practitioner relationships. In Journal of Management (Vol. 40, Issue 5, pp. 1181–1201). Sage Publications Sage CA: Los Angeles, CA.

Beech, N., MacIntosh, R., & MacLean, D. (2010). Dialogues between academics and practitioners: The role of generative dialogic encounters. Organization Studies, 31(9–10), 1341–1367.

Beim, G., & Lévesque, M. (2006). Country selection for New Business venturing: A multiple criteria decision analysis. Long Range Planning, 39(3), 265–293. https://doi.org/10.1016/j.lrp.2006.06.001

Block, J. H., Hirschmann, M., & Fisch, C. (2021). Which criteria matter when impact investors screen social enterprises? Journal of Corporate Finance, 66, 101813.

Bolger, F., & Wright, G. (2011). Improving the Delphi process: Lessons from social psychological research. Technological Forecasting and Social Change, 78(9), 1500–1513. https://doi.org/10.1016/j.techfore.2011.07.007

Bozhikin, I., Macke, J., & da Costa, L. F. (2019). The role of government and key non-state actors in social entrepreneurship: A systematic literature review. Journal of Cleaner Production, 226, 730–747. https://doi.org/10.1016/j.jclepro.2019.04.076

Bradford, A., Luke, B., & Furneaux, C. (2020). Exploring accountability in Social Enterprise: Priorities, Practicalities, and legitimacy. Voluntas: International Journal Of Voluntary And Nonprofit Organizations, 31(3), 614–626. https://doi.org/10.1007/s11266-020-00215-8. Scopus.

Briner, R. B., & Denyer, D. (2012). Systematic review and evidence synthesis as a practice and scholarship tool. Handbook of Evidence-Based Management: Companies, Classrooms and Research, 112–129.

Busenitz, L., West, G. P. I., Shepherd, D. A., Nelson, T., Chandler, G. N., & Zacharakis, A. (2003). Entrepreneurship in emergence: Fourteen years of entrepreneurship research in management journals. Journal of Management, 29(3), 285–308.

Bygrave, W., & Minniti, M. (2000). The social dynamics of entrepreneurship. Entrepreneurship Theory and Practice, 24(3), 25–36.

Carayannis, E., Grigoroudis, E., & Wurth, B. (2021). OR for Entrepreneurial Ecosystems: A problem-oriented review and agenda. European Journal of Operational Research. https://doi.org/10.1016/j.ejor.2021.10.030

Chandra, Y. (2017). Social entrepreneurship as institutional-change work: A corpus linguistics analysis. Journal of Social Entrepreneurship, 8(1), 14–46.

Cheah, J., Amran, A., & Yahya, S. (2019). Internal oriented resources and social enterprises’ performance: How can social enterprises help themselves before helping others? Journal of Cleaner Production, 211, 607–619. https://doi.org/10.1016/j.jclepro.2018.11.203. Scopus.

Cinelli, M., Kadziński, M., Gonzalez, M., & Słowiński, R. (2020). How to support the application of multiple criteria decision analysis? Let us start with a comprehensive taxonomy. Omega, 96, 102261. https://doi.org/10.1016/j.omega.2020.102261

Clarkin, J. E., & Cangioni, C. L. (2016). Impact investing: A primer and review of the literature. Entrepreneurship Research Journal, 6(2), 135–173.

Corner, P. D., & Ho, M. (2010). How opportunities develop in social entrepreneurship. Entrepreneurship Theory and Practice, 34(4), 635–659.

Dalkey, N., & Helmer, O. (1963). An experimental application of the Delphi method to the use of experts. Management Science, 9(3), 458–467.

Dart, R. (2004). The legitimacy of social enterprise. Nonprofit Management and Leadership, 14(4), 411–424.

Davidsson, P. (2015). Entrepreneurial opportunities and the entrepreneurship nexus: A re-conceptualization. Journal of Business Venturing, 30(5), 674–695. https://doi.org/10.1016/j.jbusvent.2015.01.002

Dees, J. (1998). The meaning of social entrepreneurship, revised may 2001, original draft available at www.Fuqua.Duke.Edu/centers/case/documents. Dees_SEdef. Pdf.

Devaney, L., & Henchion, M. (2018). Who is a Delphi ‘expert’? Reflections on a bioeconomy expert selection procedure from Ireland. Futures, 99, 45–55.

Dimov, D. (2007). Beyond the single-person, single-insight attribution in understanding entrepreneurial opportunities. Entrepreneurship Theory and Practice, 31(5), 713–731.

Dimov, D. (2011). Grappling with the unbearable elusiveness of entrepreneurial opportunities. Entrepreneurship Theory and Practice, 35(1), 57–81.

English, J. M., & Kernan, G. L. (1976). The prediction of air travel and aircraft technology to the year 2000 using the Delphi method. Transportation Research, 10(1), 1–8.

Erro-Garcés, A. (2020). Creativity and Emotions as Drivers for Social Entrepreneurship. Journal of Social Entrepreneurship, 11(3), 300–316.

Evans, P. (1996). Government action, social capital and development: Reviewing the evidence on synergy. World Development, 24(6), 1119–1132.

Ferreira, F. A. F., Marques, C. S. E., Bento, P., Ferreira, J. J. M., & Jalali, M. S. (2015). Operationalizing and measuring individual entrepreneurial orientation using cognitive mapping and MCDA techniques. Journal of Business Research, 68(12), 2691–2702. https://doi.org/10.1016/j.jbusres.2015.04.002

Gao, C., Zuzul, T., Jones, G., & Khanna, T. (2017). Overcoming institutional voids: A reputation-based view of long-run survival. Strategic Management Journal, 38(11), 2147–2167.

Garcia, A. S., & Orsato, R. J. (2020). Testing the institutional difference hypothesis: A study about environmental, social, governance, and financial performance. Business Strategy and the Environment, 29(8), 3261–3272.

Gartner, W. B., Shaver, K. G., & Liao, J. (2008). Opportunities as attributions: Categorizing strategic issues from an attributional perspective. Strategic Entrepreneurship Journal, 2(4), 301–315.

Giannarou, L., & Zervas, E. (2014). Using Delphi technique to build consensus in practice. International Journal of Business Science & Applied Management (IJBSAM), 9(2), 65–82.

Gidron, B. (2017). The dual hybridity of social enterprises for marginalized populations. Journal of Social Entrepreneurship, 8(1), 1–13.

Gregoire, D. A., Shepherd, D. A., & Schurer Lambert, L. (2010). Measuring opportunity-recognition beliefs: Illustrating and validating an experimental approach. Organizational Research Methods, 13(1), 114–145.

Günzel-Jensen, F., Siebold, N., Kroeger, A., & Korsgaard, S. (2020). Do the United Nations’ Sustainable Development Goals matter for social entrepreneurial ventures? A bottom-up perspective. Journal of Business Venturing Insights, 13, e00162.

Gupta, H., & Barua, M. K. (2016). Identifying enablers of technological innovation for indian MSMEs using best-worst multi criteria decision making method. Technological Forecasting and Social Change, 107, 69–79. https://doi.org/10.1016/j.techfore.2016.03.028. Scopus.

Halberstadt, J., Niemand, T., Kraus, S., Rexhepi, G., Jones, P., & Kailer, N. (2021). Social entrepreneurship orientation: Drivers of success for start-ups and established industrial firms. Industrial Marketing Management, 94, 137–149.

Hallowell, M. R., & Gambatese, J. A. (2010). Qualitative research: Application of the Delphi method to CEM research. Journal of Construction Engineering and Management, 136(1), 99.

Hasson, F., Keeney, S., & McKenna, H. (2000). Research guidelines for the Delphi survey technique. Journal of Advanced Nursing, 32(4), 1008–1015.

Heiko, A. (2012). Consensus measurement in Delphi studies: Review and implications for future quality assurance. Technological Forecasting and Social Change, 79(8), 1525–1536.

Herman, M. W., & Koczkodaj, W. W. (1996). A Monte Carlo Study of Parwise comparison. Inf Process Lett, 57(1), 25–29.

Hockerts, K. (2015). The social entrepreneurial antecedents scale (SEAS): A validation study. Social Enterprise Journal.

Hockerts, K. (2017). Determinants of social entrepreneurial intentions. Entrepreneurship Theory and Practice, 41(1), 105–130.

Hockerts, K. (2018). The effect of experiential social entrepreneurship education on intention formation in students. Journal of Social Entrepreneurship, 9(3), 234–256.

Huybrechts, B., & Nicholls, A. (2013). The role of legitimacy in social enterprise-corporate collaboration. Social Enterprise Journal.

Ishizaka, A., & Nemery, P. (2013). Multi-criteria decision analysis: Methods and software. John Wiley & Sons.

Jafari-Sadeghi, V., Mahdiraji, A., Devalle, H., A., & Pellicelli, A. C. (2022). Somebody is hiding something: Disentangling interpersonal level drivers and consequences of knowledge hiding in international entrepreneurial firms. Journal of Business Research, 139, 383–396. https://doi.org/10.1016/j.jbusres.2021.09.068

Jamali, D., & Mirshak, R. (2007). Corporate social responsibility (CSR): Theory and practice in a developing country context. Journal of Business Ethics, 72(3), 243–262.

Johnson, R. B., & Onwuegbuzie, A. J. (2004). Mixed methods research: A research paradigm whose time has come. Educational Researcher, 33(7), 14–26.

Julian, S. D., & Ofori-dankwa, J. C. (2013). Financial resource availability and corporate social responsibility expenditures in a sub-saharan economy: The institutional difference hypothesis. Strategic Management Journal, 34(11), 1314–1330.

Kaushik, V., Kumar, A., Gupta, H., & Dixit, G. (2020). Modelling and prioritizing the factors for online apparel return using BWM approach. Electronic Commerce Research, 1–31.

Kaushik, V., Tewari, S., Sahasranamam, S., & Hota, P. K. (2023). Towards a precise understanding of social entrepreneurship: An integrated bibliometric–machine learning based review and research agenda. Technological Forecasting and Social Change, 191, 122516.

Kayikci, Y., Kazancoglu, Y., Gozacan-Chase, N., & Lafci, C. (2022). Analyzing the drivers of smart sustainable circular supply chain for sustainable development goals through stakeholder theory. Business Strategy and the Environment. https://doi.org/10.1002/bse.3087. Scopus.

Kedmenec, I., Rebernik, M., & Tominc, P. (2016). Social Entrepreneurship Education and its Association with Perceived Desirability and Feasibility of Social Entrepreneurship among Business Students / Obrazovanje za socijalno poduzetništvo i njegova povezanost s percepcijom poželjnosti i izvodljivosti so. Croatian Journal of Education - Hrvatski Časopis Za Odgoj i Obrazovanje, 18(4), https://doi.org/10.15516/cje.v18i4.1774

Kennedy, H. P. (2004). Enhancing Delphi research: Methods and results. Journal of Advanced Nursing, 45(5), 504–511.

Khanna, T., & Palepu, K. (2000). The future of business groups in emerging markets: Long-run evidence from Chile. Academy of Management Journal, 43(3), 268–285.

Khanna, T., & Palepu, K. G. (2010). Winning in emerging markets: A road map for strategy and execution. Harvard Business Press.

Kieser, A., & Leiner, L. (2009). Why the rigour–relevance gap in management research is unbridgeable. Journal of Management Studies, 46(3), 516–533.

Kirzner, I. (1973). Competition and entrepreneurship. Chicago. Univ. Of Chicago Press.

Kollenda, P. (2021). Financial returns or social impact? What motivates impact investors’ lending to firms in low-income countries. Journal of Banking & Finance, 106224.

Korosec, R. L., & Berman, E. M. (2006). Municipal support for Social Entrepreneurship. Public Administration Review, 66(3), 448–462. https://doi.org/10.1111/j.1540-6210.2006.00601.x

Kruse, P. (2020). Can there only be one?–an empirical comparison of four models on social entrepreneurial intention formation. International Entrepreneurship and Management Journal, 16(2), 641–665.

Kumar, P., Singh, R. K., Paul, J., & Sinha, O. (2021). Analyzing challenges for sustainable supply chain of electric vehicle batteries using a hybrid approach of Delphi and best-worst method. Resources Conservation and Recycling, 175, 105879.

Laroche, M., Bergeron, J., & Barbaro-Forleo, G. (2001). Targeting consumers who are willing to pay more for environmentally friendly products. Journal of Consumer Marketing.

Lee, Y. N., Zailani, S., & Rahman, M. K. (2021). Determinants of customer intention to purchase social enterprise products: A structural model analysis. Journal of Social Entrepreneurship, 12(3), 358–379.

Lin, Y. H., Lin, F. J., & Wang, K. H. (2021). The effect of social mission on service quality and brand image. Journal of Business Research, 132, 744–752.

Lind, C. H., Kang, O., Ljung, A., & Rosenbaum, P. (2022). Involvement of multinational corporations in social innovation: Exploring an emerging phenomenon. Journal of Business Research, 151, 207–221.

Linstone, H. A., & Turoff, M. (1975). The delphi method. MA: Addison-Wesley Reading.

Littlewood, D., & Holt, D. (2018). How social enterprises can contribute to the Sustainable Development Goals (SDGs)–A conceptual framework. Entrepreneurship and the sustainable development goals. Emerald Publishing Limited.

Lumpkin, G. T., Bacq, S., & Pidduck, R. J. (2018). Where Change happens: Community-Level Phenomena in Social Entrepreneurship Research: JOURNAL OF SMALL BUSINESS MANAGEMENT. Journal of Small Business Management, 56(1), 24–50. https://doi.org/10.1111/jsbm.12379

Mahmood, I. P., & Mitchell, W. (2004). Two faces: Effects of business groups on innovation in emerging economies. Management Science, 50(10), 1348–1365.

Mair, J., & Marti, I. (2006). Social entrepreneurship research: A source of explanation, prediction, and delight. Journal of World Business, 41(1), 36–44.

Mair, J., & Noboa, E. (2006). Social entrepreneurship: How intentions to create a social venture are formed. Social entrepreneurship (pp. 121–135). Springer.

Mair, J., Battilana, J., & Cardenas, J. (2012). Organizing for society: A typology of social entrepreneuring models. Journal of Business Ethics, 111(3), 353–373.

Manolova, T. S., Brush, C. G., Edelman, L. F., & Elam, A. (2020). Covid19? Pivoting to stay the course: How women entrepreneurs take advantage of opportunities created by the COVID-19 pandemic. International Small Business Journal, 38(6), 481–491.

Margiono, A., Kariza, A., & Heriyati, P. (2019). Venture legitimacy and storytelling in social enterprises. Small Enterprise Research, 26(1), 55–77. https://doi.org/10.1080/13215906.2019.1570318. Scopus.

Mas-Tur, A., Guijarro, M., & Carrilero, A. (2021). What type of Entrepreneurship leads to Sustainable Development? A Configurational Approach. Social Indicators Research, 157(1), 29–42. https://doi.org/10.1007/s11205-020-02525-2

Maseno, M., & Wanyoike, C. (2020). Social entrepreneurship as mechanisms for social transformation and social impact in East Africa an exploratory case study perspective. Journal of Social Entrepreneurship, 1–26.

Mathiyazhagan, K., Agarwal, V., Appolloni, A., Saikouk, T., & Gnanavelbabu, A. (2021). Integrating lean and agile practices for achieving global sustainability goals in indian manufacturing industries. Technological Forecasting and Social Change, 171, https://doi.org/10.1016/j.techfore.2021.120982. Scopus.

McBride, R., & Wuebker, R. (2022). Social Objectivity and Entrepreneurial Opportunities. Academy of Management Review, 47(1), 75–92.

McMullen, J. S., Plummer, L. A., & Acs, Z. J. (2007). What is an entrepreneurial opportunity? Small Business Economics, 28(4), 273–283.

Meyskens, M., Robb-Post, C., Stamp, J. A., Carsrud, A. L., & Reynolds, P. D. (2010). Social ventures from a resource-based perspective: An exploratory study assessing global Ashoka fellows. Entrepreneurship: Theory and Practice, 34(4), 661–680. https://doi.org/10.1111/j.1540-6520.2010.00389.x. Scopus.

Miller, T. L., Grimes, M. G., McMullen, J. S., & Vogus, T. J. (2012). Venturing for others with heart and head: How compassion encourages social entrepreneurship. Academy of Management Review, 37(4), 616–640.

Mirvis, P., & Googins, B. (2018). Catalyzing social entrepreneurship in Africa: Roles for western universities, NGOs and corporations. Africa Journal of Management, 4(1), 57–83.

Mohammadi, M., & Rezaei, J. (2020). Bayesian best-worst method: A probabilistic group decision making model. Omega, 96, 102075. https://doi.org/10.1016/j.omega.2019.06.001

Molecke, G., & Pinkse, J. (2020). Justifying Social Impact as a form of Impression Management: Legitimacy judgements of Social Enterprises’ Impact Accounts. British Journal of Management, 31(2), 387–402. https://doi.org/10.1111/1467-8551.12397. Scopus.

Murcia, N. N. S., Ferreira, F. A. F., & Ferreira, J. J. M. (2022). Enhancing strategic management using a “quantified VRIO”: Adding value with the MCDA approach. Technological Forecasting and Social Change, 174, 121251. https://doi.org/10.1016/j.techfore.2021.121251

Nair, S., Gaim, M., & Dimov, D. (2022). Toward the emergence of entrepreneurial opportunities: Organizing early-phase new venture creation support systems. Academy of Management Review, 47(1), 162–183.

Nicholls, A., & Cho, A. H. (2006). Social entrepreneurship: The structuration of a field. Social Entrepreneurship: New Models of Sustainable Social Change, 34(4), 99–118.

Nicolopoulou, K. (2014). Social entrepreneurship between cross-currents: Toward a framework for theoretical restructuring of the field. Journal of Small Business Management, 52(4), 678–702. https://doi.org/10.1111/jsbm.12130. Scopus.

Nicolopoulou, K., & Karatas-Ozkan, M. (2009). CSR and social entrepreneurship: Future global opportunities and challenges in Corporate Community involvement strategies. International Journal of Business and Globalisation, 3(2), 173–187. https://doi.org/10.1504/IJBG.2009.022607. Scopus.

Nicolopoulou, K., Lucas, I., Tatli, A., Karatas-Ozkan, M., Costanzo, A., Özbilgin, L., M., & Manville, G. (2015). Questioning the legitimacy of Social Enterprises through Gramscian and bourdieusian perspectives: The case of british Social Enterprises. Journal of Social Entrepreneurship, 6(2), 161–185. https://doi.org/10.1080/19420676.2014.961095. Scopus.

Pache, A. C., & Chowdhury, I. (2012). Social entrepreneurs as institutionally embedded entrepreneurs: Toward a new model of social entrepreneurship education. Academy of Management Learning & Education, 11(3), 494–510.

Patton, M. Q. (2002). Two decades of developments in qualitative inquiry: A personal, experiential perspective. Qualitative Social Work, 1(3), 261–283.

Peredo, A. M., & McLean, M. (2006). Social entrepreneurship: A critical review of the concept. Journal of World Business, 41(1), 56–65.

Perveen, S., Kamruzzaman, M., & Yigitcanlar, T. (2017). Developing policy scenarios for sustainable urban growth management: A Delphi Approach. Sustainability, 9(10), 1787. https://doi.org/10.3390/su9101787

Pham, L. X., Phan, L. T., Le, A. N. H., & Tuan, B. N. (2022). A. Factors Affecting Social Entrepreneurial Intention: An Application of Social Cognitive Career Theory. Entrepreneurship Research Journal. Scopus. https://doi.org/10.1515/erj-2021-0316

Plano Clark, V. L., Huddleston-Casas, C. A., Churchill, S. L., O’Neil Green, D., & Garrett, A. L. (2008). Mixed methods approaches in family science research. Journal of Family Issues, 29(11), 1543–1566.

Powell, C. (2003). The Delphi technique: Myths and realities. Journal of Advanced Nursing, 41(4), 376–382.

Raghuvanshi, J., Agrawal, R., & Ghosh, P. K. (2017). Analysis of barriers to women entrepreneurship: The DEMAâ„¡ approach. The Journal of Entrepreneurship, 26(2), 220–238.

Ramoglou, S., Zyglidopoulos, S., & Papadopoulou, F. (2021). Is there opportunity without Stakeholders? A Stakeholder Theory Critique and Development of Opportunity-Actualization. Entrepreneurship Theory and Practice, 10422587211043354. https://doi.org/10.1177/10422587211043354

Renko, M., Shrader, R. C., & Simon, M. (2012). Perception of entrepreneurial opportunity: A general framework. Management Decision.

Rezaei, J. (2015). Best-worst multi-criteria decision-making method. Omega, 53, 49–57.

Rezaei, J. (2016). Best-worst multi-criteria decision-making method: Some properties and a linear model. Omega, 64, 126–130.

Robinson, J. (2006). Navigating social and institutional barriers to markets: How social entrepreneurs identify and evaluate opportunities. Social entrepreneurship (pp. 95–120). Springer.

Rowe, G., & Wright, G. (2001). Expert opinions in forecasting: The role of the Delphi technique. In J. S. Armstrong (Ed.), Principles of forecasting (30 vol., pp. 125–144). Springer US. https://doi.org/10.1007/978-0-306-47630-3_7

Rowe, G., & Wright, G. (2011). The Delphi technique: Past, present, and future prospects—introduction to the special issue. Technological Forecasting and Social Change, 78(9), 1487–1490.

Ruf, B. M., Muralidhar, K., & Paul, K. (1998). The development of a systematic, aggregate measure of corporate social performance. Journal of Management, 24(1), 119–133.

Ruskin, J., Seymour, R. G., & Webster, C. M. (2016). Why create value for others? An exploration of social entrepreneurial motives. Journal of Small Business Management, 54(4), 1015–1037.

Sahebi, I. G., Masoomi, B., & Ghorbani, S. (2020). Expert oriented approach for analyzing the blockchain adoption barriers in humanitarian supply chain. Technology in Society, 63, 101427.

Sale, J. E., Lohfeld, L. H., & Brazil, K. (2002). Revisiting the quantitative-qualitative debate: Implications for mixed-methods research. Quality and Quantity, 36(1), 43–53.

Sansone, G., Andreotti, P., Colombelli, A., & Landoni, P. (2020). Are social incubators different from other incubators? Evidence from Italy. Technological Forecasting and Social Change, 158. Scopus. https://doi.org/10.1016/j.techfore.2020.120132

Santos, F. M. (2012). A positive theory of social entrepreneurship. Journal of Business Ethics, 111(3), 335–351.

Seelos, C., & Mair, J. (2005). Social entrepreneurship: Creating new business models to serve the poor. Business Horizons, 48(3), 241–246. https://doi.org/10.1016/j.bushor.2004.11.006

Sengupta, S., Sahay, A., & Croce, F. (2018). Conceptualizing social entrepreneurship in the context of emerging economies: An integrative review of past research from BRIICS. International Entrepreneurship and Management Journal, 14(4), 771–803.

Shane, S. (2012). Reflections on the 2010 AMR decade award: Delivering on the promise of entrepreneurship as a field of research. Academy of Management Review, 37(1), 10–20.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226.

Short, J. C., Ketchen Jr, D. J., Shook, C. L., & Ireland, R. D. (2010). The concept of “opportunity” in entrepreneurship research: Past accomplishments and future challenges. Journal of Management, 36(1), 40–65.

Singh, A., Majumdar, S., & Saini, G. K. (2017). Corporate social responsibility and Social Entrepreneurship: An indian context. Journal of Entrepreneurship and Innovation in Emerging Economies, 3(1), 71–76. https://doi.org/10.1177/2393957516684451. Scopus.

Solomon, G. T., Alabduljader, N., & Ramani, R. S. (2019). Knowledge management and social entrepreneurship education: Lessons learned from an exploratory two-country study. Journal of Knowledge Management, 23(10), 1984–2006. https://doi.org/10.1108/JKM-12-2018-0738. Scopus.

Sonne, L. (2012). Innovative initiatives supporting inclusive innovation in India: Social business incubation and micro venture capital. Technological Forecasting and Social Change, 79(4), 638–647. https://doi.org/10.1016/j.techfore.2011.06.008

Stephan, U., Uhlaner, L. M., & Stride, C. (2015). Institutions and social entrepreneurship: The role of institutional voids, institutional support, and institutional configurations. Journal of International Business Studies, 46(3), 308–331.

Stirzaker, R., Galloway, L., Muhonen, J., & Christopoulos, D. (2021). The drivers of social entrepreneurship: Agency, context, compassion and opportunism. International Journal of Entrepreneurial Behavior & Research.

Sullivan Mort, G., Weerawardena, J., & Carnegie, K. (2003). Social entrepreneurship: Towards conceptualisation. International Journal of Nonprofit and Voluntary Sector Marketing, 8(1), 76–88.

Thörnqvist, C., & Kilstam, J. (2021). Aligning corporate Social responsibility with the United Nations’ sustainability goals: Trickier than it seems? A study of Social Entrepreneurship in Sweden. Economics, 9(1), 161–177. https://doi.org/10.2478/eoik-2021-0009. Scopus.

Tilak, J. B. G., & Choudhury, P. K. (2021). Employment and employability of Engineering Graduates in India. Journal of Contemporary Educational Research, 5(3), https://doi.org/10.26689/jcer.v5i3.1825. Article 3.

Tiwari, P., Bhat, A. K., & Tikoria, J. (2020). Mediating role of prosocial motivation in predicting social entrepreneurial intentions. Journal of Social Entrepreneurship, 1–24.

Tucker, R., Croom, R. M., & Bacq, S. (2019). Feeling your pain, pursuing my gain: Assessing status-striving, empathy, and social entrepreneurship intent. Journal of Business Venturing Insights, 12(C).

Urban, B., & Kujinga, L. (2017). The institutional environment and social entrepreneurship intentions. International Journal of Entrepreneurial Behavior & Research, 23(4), 638–655. https://doi.org/10.1108/IJEBR-07-2016-0218

Virutamasen, P., Wongpreedee, K., & Kumnungwut, W. (2015). Strengthen brand association through SE: Institutional theory revisited. Procedia-Social and Behavioral Sciences, 195, 192–196.

von der Gracht, H. A. (2012). Consensus measurement in Delphi studies: Review and implications for future quality assurance. Technological Forecasting and Social Change, 79(8), 1525–1536. https://doi.org/10.1016/j.techfore.2012.04.013

Wang, T., & Fu, Y. (2020). Constructing Composite indicators with individual judgements and best–worst method: An illustration of Value measure. Social Indicators Research, 149(1), 1–14. https://doi.org/10.1007/s11205-019-02236-3

Weaver, R. L. (2020). The impact of COVID-19 on the Social Enterprise Sector. Journal of Social Entrepreneurship Scopus. https://doi.org/10.1080/19420676.2020.1861476

Weerawardena, J., & Mort, G. S. (2006). Investigating social entrepreneurship: A multidimensional model. Journal of World Business, 41(1), 21–35.

Williams, P. L., & Webb, C. (1994). The Delphi technique: A methodological discussion. Journal of Advanced Nursing, 19(1), 180–186.

Wood, M. S., & McKinley, W. (2010). The production of entrepreneurial opportunity: A constructivist perspective: The production of Entrepreneurial Opportunity. Strategic Entrepreneurship Journal, 4(1), 66–84. https://doi.org/10.1002/sej.83